Orthopedic Joint Replacement Market Report Scope & Overview:

Get more information on Orthopedic Joint Replacement Market - Request Sample Report

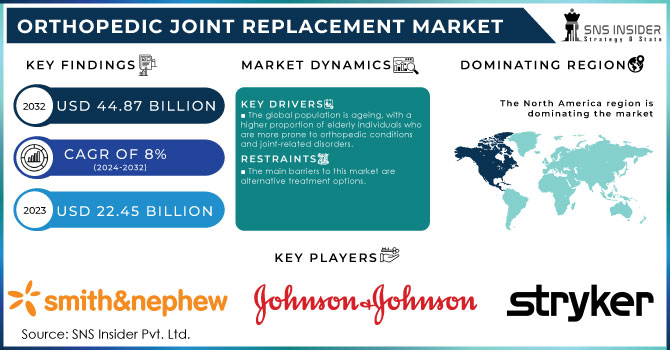

The Orthopedic Joint Replacement Market size was estimated at USD 22.45 billion in 2023 and is expected to reach USD 44.87billion by 2032 at a CAGR of 8% during the forecast period of 2024-2032.

The Orthopedic Joint Replacement Market refers to the market for medical devices and procedures used in orthopedic surgery to replace damaged or diseased joints, such as knees, hips, shoulders, and ankles. Joint replacement surgery is typically performed to relieve pain and improve mobility in patients with conditions like arthritis, joint degeneration, or joint trauma. The market encompasses a wide range of products, including implants, prosthetics, surgical instruments, and other related devices. These devices are designed to mimic the structure and function of natural joints, allowing patients to regain mobility and improve their quality of life.

The global orthopedic joint replacement market has experienced significant growth in recent years due to various factors, including an ageing population, increasing prevalence of orthopedic disorders, technological advancements in implant materials and surgical techniques, and rising patient awareness and demand for improved healthcare outcomes. It's important to note that market size and specific trends within the orthopedic joint replacement market can vary depending on factors like geographic region, type of joint replacement procedure, and regulatory environment. For the most up-to-date and detailed market information, consulting industry reports and market research studies specific to the desired region or segment are recommended.

Osteoarthritis is among the conditions that older citizens experience most often. Joint replacement is the most popular form of osteoarthritis treatment, which has increased patient acceptance of joint implants. There is a clearly rising elderly population as a result of hip fractures occurring more frequently in older people, which is aiding in the growth of the orthopaedic joint replacement industry. Technology developments, particularly in the area of extremities like the knees and hips, are increasing sales. For instance, Stryker Corporation introduced Mako Total Hip 4.0, a sophisticated robotic system, in 2020. The technology enables surgeons and medical professionals to plan a patient's implant placement while accounting for variations in pelvic tilt in the patient's standing, sitting, and supine positions. To enhance its market share in this industry, Smith+Nephew purchased Integra Lifesciences' extremities orthopaedic business in 2020.

Along with smaller, more niche producers, huge multinational corporations are important players in the orthopaedic joint replacement business. Along with Zimmer Biomet Holdings Inc., Stryker Corporation, Johnson & Johnson (DePuy Synthes), Smith & Nephew Plc, and Medtronic Plc., some significant businesses in this market.

MARKET DYNAMICS

DRIVERS:

- The global population is ageing, with a higher proportion of elderly individuals who are more prone to orthopedic conditions and joint-related disorders.

- Increasing Patient Awareness and Demand are the main drivers of this market.

Patients are becoming more and more aware of the advantages of joint replacement surgeries in terms of pain alleviation and enhanced quality of life. Patients are more inclined to choose joint replacement surgery and seek medical attention, which helps the industry expand.

RESTRAIN:

- Joint replacement surgeries and associated implants can be expensive, including the cost of preoperative assessments, surgical procedures, hospital stays, post-operative rehabilitation, and follow-up care.

- The main barriers to this market are alternative treatment options.

Although many people find joint replacement surgery to be a beneficial treatment option, other options include medication, physical therapy, lifestyle changes, and pain management approaches. Patients may decide against surgery depending on the severity of their ailment, which may influence the demand for joint replacement operations.

OPPORTUNITY:

- There is a growing demand for orthopedic joint replacement procedures in emerging markets, particularly in countries with developing healthcare infrastructure.

- In this sector, there is a large possibility for less invasive procedures.

Due to their benefits, such as smaller incisions, decreased post-operative discomfort, quicker healing, and shorter hospital stays, minimally invasive procedures for joint replacement surgeries have become more and more common. Since less intrusive procedures result in better patient outcomes and satisfaction, there is potential for market expansion.

CHALLENGES:

- Joint replacement surgeries and associated implants can be expensive. The high cost of these procedures can limit access, particularly in regions with limited healthcare resources or individuals with inadequate insurance coverage.

- Implant Longevity and Durability are the huge challenges of this market.

Although joint replacements have advanced over time, issues with implant lifetime and durability still exist. Implant deterioration over time can result in issues such as implant loosening, wear debris, and the requirement for revision procedures. For manufacturers, ensuring implant function and durability over the long term is a constant issue.

IMPACT OF RUSSIA-UKRAINE WAR

Following the start of Russia's invasion of Ukraine, the international community has intensified its response by imposing broad economic sanctions. As sanctions target both Russian banking transactions and the sale of high-tech items, the Russian market is becoming more and more cut off with every new step. Given humanitarian concerns, it is doubtful that medical technologies and gadgets would be widely targeted. Specific diagnostic and cutting-edge surgical equipment will undoubtedly be caught in export regulations pertaining to semiconductors, lasers, and other technologies. Medical equipment exports to Russia that are permitted by sanctions will continue but against stronger economic forces.

$875 million, or 1.8% of the anticipated worldwide market size for that market sector, will be accounted for by the Russian orthopaedic device market in 2023. The company Zimmer Biomet Holdings, Inc. is the market leader with an estimated 18% market share for orthopaedic devices. Although it is still too early to define upper and lower limitations with certainty, the pattern indicates that device revenue will significantly fall for the Russian market.

IMPACT OF ONGOING RECESSION

Doctors and hospitals are saying that as the recession worsens, financially strapped patients are postponing elective surgeries like knee replacements and nose jobs while others are hastening non-urgent ones out of concern that they could soon lose their jobs and health insurance. There is significant regional and surgical variance with unemployment continuing to grow. Because of this, renowned orthopaedic surgeons in Chicago may be busier than ever, but gastroenterologists in Atlanta are frantically trying to fill openings. Even still, doctors whose operating rooms are already fully booked think a downturn is coming later this year. Johnson & Johnson's sales from orthopaedics fell by 12.6% to around $8.1 billion. Organic net sales at Stryker Orthopaedics fell by 8.3% last year, with unit volume falling by 6.8% and prices falling by 1.8%. With regard to its orthopaedics and sports medicine division, Smith and Nephew reported a 12% sales decline.

KEY MARKET SEGMENTATION

By Anatomy

-

Shoulder

-

Ankle

-

Knee

-

Hip

-

Others

By Procedure

-

Partial Replacement

-

Total Replacement

By Appication

-

Ambulatory Centers

-

Hospitals

-

Clinics

-

Other

Regiona Coverage:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

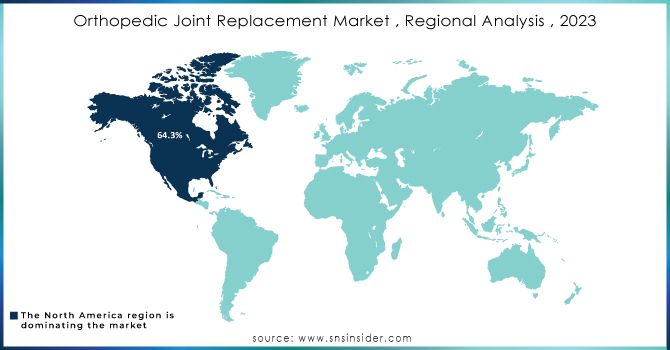

REGIONAL ANALYSIS

North America: With a revenue share of more than 64.3% in 2023, North America dominated the joint replacement market. The demand for joint replacements in North America is anticipated to rise as a result of causes like the incidence of osteoarthritis, the elderly population, the availability of insurance coverage, or a number of trauma & accident cases. For example, the American Joint Replacement Registry (AJRR) reports that around 1.8 million hip and knee arthroplasty procedures were documented in the registry in 2020. As a result, this promotes the market for joint replacements to grow. The market for joint replacement is projected to develop in the area as a result of the rising frequency of orthopaedic illnesses and the quick uptake of novel products.

Asia Pacific: The market for joint replacement is predicted to develop at the quickest rate in Asia Pacific during the forecast period because of increased healthcare spending, rapidly changing healthcare infrastructure, and expanding medical tourism in the area. According to The Asian Federation of Osteoporosis Societies (AFOS), there were 1.5 million hip fractures overall in 2020 and 3.1 million are anticipated by 2050. It is anticipated that additional factors, such as the ageing population, rising healthcare spending in developing Asian economies, & an increase in the prevalence of osteoarthritis, osteoporosis, bone injuries, diabetes, and obesity, will have an impact on the joint replacement market over the coming years.

Do You Need any Customization Research on Orthopedic Joint Replacement Market - Enquire Now

Key Players

Some major players in Orthopedic Joint Replacement Market are Stryker, Johnson & Johnson Private Limited, Zimmer Biomet, Arthrex, Inc, Smith+Nephew, Corin Group, Exactech, Inc, Beijing Chunlizhengda Medical Instruments Co., Ltd, DJO LLC, B. Braun Melsungen AG and other players.

RECENT DEVELOPMENTS

Stryker: In 2021, Mako Total Hip 4.0 has been made available by Stryker for robotic hip replacement procedures. Based on the patient's sitting, standing, and supine positions, the new software will assist the doctor in planning the patient's hip implant location.

Globus Medical: In 2020, To diversify its product line, Globus Medical purchased StelKast, a renowned producer of knee and hip implants.

| Report Attributes | Details |

| Market Size in 2023 | US$ 22.45 Bn |

| Market Size by 2032 | US$ 44.87 Bn |

| CAGR | CAGR of 8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Anatomy (Shoulder, Ankle, Knee, Hip, Others) • By Procedure (Partial Replacement, Total Replacement) • By Application (Ambulatory Centers, Hospitals, Clinics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Stryker, Johnson & Johnson Private Limited, Zimmer Biomet, Arthrex, Inc, Smith+Nephew, Corin Group, Exactech, Inc, Beijing Chunlizhengda Medical Instruments Co., Ltd, DJO LLC, B. Braun Melsungen AG |

| Key Drivers | • The global population is ageing, with a higher proportion of elderly individuals who are more prone to orthopedic conditions and joint-related disorders. • Increasing Patient Awareness and Demand are the main drivers of this market. |

| Market Restraints | • Joint replacement surgeries and associated implants can be expensive, including the cost of preoperative assessments, surgical procedures, hospital stays, post-operative rehabilitation, and follow-up care. • The main barriers to this market are alternative treatment options. |