Enterprise Governance, Risk, and Compliance (eGRC) Market Report Scope and Overview:

The Enterprise Governance, Risk, and Compliance Market Size was valued at USD 20.49 Billion in 2024 and is expected to reach USD 55.3 Billion by 2032 and grow at a CAGR of 13.22% from 2025-2032.

Get More Information on Enterprise Governance, Risk, and Compliance Market - Request Sample Report

The Enterprise Governance, Risk, and Compliance (eGRC) market is experiencing significant growth, fueled by organizations' rising need to navigate regulatory requirements, mitigate risks, and maintain corporate governance. eGRC solutions integrate various components of risk management, compliance processes, and governance frameworks into a cohesive system, offering organizations a thorough view of their risk landscape. A major driver of the eGRC market is the increasing number of regulatory mandates across diverse industries. For example, the European Union's Digital Operational Resilience Act (DORA), which took effect in 2023, requires financial firms to enhance their cybersecurity resilience and manage operational risks. This regulation has motivated organizations to adopt eGRC solutions to ensure compliance and avoid substantial penalties.

Enterprise Governance, Risk, and Compliance (eGRC) Market Highlights:

-

Increased focus on data privacy and security following high-profile breaches has escalated demand for eGRC solutions.

-

Around 60% of organizations are prioritizing investments in data governance and compliance platforms to protect sensitive information.

-

COVID-19 accelerated digital transformation, driving businesses to adopt eGRC for operational efficiency and adaptability.

-

Regulatory pressures, such as GDPR and Sarbanes-Oxley, are driving adoption of comprehensive eGRC frameworks to ensure transparency and accountability.

-

eGRC solutions are increasingly used to educate employees and enforce compliance, fostering accountability at all organizational levels.

-

Excessive reliance on automated systems may lead to overlooked compliance issues, highlighting the need for human oversight.

Furthermore, the heightened emphasis on data privacy and security-especially following several high-profile data breaches-has escalated the demand for eGRC tools. According to a 2023 report, 60% of organizations are prioritizing investments in data governance and compliance solutions to protect sensitive information. Companies like Zoom have implemented eGRC platforms to bolster their data protection efforts and adhere to global privacy regulations, including the GDPR. In addition, the COVID-19 pandemic has accelerated the trend toward digital transformation, encouraging businesses to invest in eGRC solutions to optimize their operations and improve adaptability. As organizations face a rapidly changing risk environment, the need for real-time risk assessments and compliance monitoring has become increasingly critical. A survey conducted in 2024 found that 70% of enterprises are actively seeking integrated eGRC solutions to enhance their risk management capabilities and operational efficiency.

In conclusion, the eGRC market is well-positioned for substantial growth, driven by regulatory pressures, the demand for improved data security, and ongoing digital transformation initiatives. Organizations are increasingly adopting eGRC solutions to ensure compliance, mitigate risks, and foster a culture of accountability within their operations.

Enterprise Governance, Risk, and Compliance (eGRC) Market Drivers:

-

Organizations seek to improve transparency and accountability in their operations, necessitating effective governance frameworks.

Organizations are increasingly prioritizing transparency and accountability in their operations, which is crucial within the Enterprise Governance, Risk, and Compliance (eGRC) market. Strong governance frameworks not only ensure compliance with regulations but also build trust among stakeholders, including customers, employees, and investors.

The emergence of global regulatory standards, such as the Sarbanes-Oxley Act in the U.S. and the General Data Protection Regulation (GDPR) in Europe, has prompted companies to adopt eGRC solutions that offer a comprehensive approach to governance, risk management, and compliance. These frameworks facilitate the standardization of processes, simplifying the tracking and reporting of compliance activities and thereby enhancing transparency. For instance, a multinational corporation like Unilever, which operates across various global markets, has implemented a comprehensive eGRC system to enhance transparency and accountability. This system integrates its risk management and compliance processes, enabling the company to effectively monitor compliance across different regulatory environments and ensure adherence to both local laws and international standards. By utilizing eGRC tools, Unilever can provide real-time insights into its governance practices, thus boosting stakeholder confidence.

Furthermore, fostering accountability involves ensuring that employees at all levels understand their responsibilities regarding compliance and governance. Companies are increasingly leveraging eGRC solutions to educate staff on compliance protocols and ethical standards. For instance, a financial services firm may deploy an eGRC platform that includes automated training modules on anti-money laundering (AML) practices. This approach ensures that employees are well-informed and accountable for complying with regulatory requirements, significantly reducing the risk of non-compliance.

In conclusion, as organizations aim to enhance transparency and accountability, effective governance frameworks enabled by eGRC solutions are essential. These frameworks help businesses navigate complex regulatory environments, cultivate trust with stakeholders, and promote sustainable business practices.

Enterprise Governance, Risk, and Compliance (eGRC) Market Restraints:

-

Over-reliance on automated systems may lead to complacency in manual oversight, increasing the risk of overlooking potential compliance issues.

Excessive reliance on automated systems within the Enterprise Governance, Risk, and Compliance (eGRC) market can lead to complacency in manual oversight, heightening the risk of overlooking compliance issues. While eGRC solutions are designed to enhance process efficiency, organizations must remain vigilant to ensure that these automated tools do not replace critical human judgment and oversight.

For instance, take a financial institution that implements an advanced eGRC platform to automate its compliance reporting and risk assessment functions. Although the system is capable of generating reports and flagging potential issues, the absence of human oversight can result in overlooked nuances in the data. If compliance officers depend entirely on automated alerts without conducting thorough reviews, they may miss emerging risks or misinterpret findings, potentially leading to non-compliance with regulatory requirements.

A notable example involves a large multinational bank that faced hefty penalties due to compliance failures linked to its automated monitoring systems. Despite investing heavily in eGRC technology to manage its anti-money laundering (AML) processes, the automated system generated alerts based on predetermined thresholds, causing compliance staff to become desensitized over time. As a result, genuine alerts were ignored or dismissed, ultimately leading to significant fines from regulators for failing to report suspicious activities. To mitigate these risks, organizations should pursue a balanced approach that integrates automated systems with robust human oversight. This might include ongoing training for compliance teams to foster a culture of diligence and critical thinking. Additionally, creating a feedback loop that reintegrates human insights into the automated systems can enhance their effectiveness over time.

In conclusion, while eGRC solutions play a vital role in managing governance, risk, and compliance, organizations must recognize the crucial importance of human oversight. Finding the right balance between automation and manual intervention is essential for effectively identifying and addressing compliance challenges in a complex regulatory landscape.

Enterprise Governance, Risk, and Compliance (eGRC) Market Segment Analysis:

By Component

The software segment dominated the market and represented a significant revenue share in 2024, fueled by the many players in the eGRC market offering software solutions. Moreover, the global footprint of several of these companies has enabled wider software adoption during the forecast period. For instance, as of 2023, SAP reported having over 400,000 customers in more than 180 countries, which includes 25 million users in its business software communities. This widespread adoption of SAP's solutions is expected to play a significant role in driving market growth in the eGRC sector.

The services segment is projected to see substantial growth during the forecast period. This expansion is mainly due to the benefits provided by services, such as accessibility, cost-effectiveness, scalability, analytics, data storage, enhanced security, and operational management. The rising popularity of Software as a Service (SaaS) GRC solutions from eGRC providers has also propelled the growth of this segment. For example, Archer Technologies LLC, a GRC solution provider based in the U.S., offers SaaS GRC solutions. The ongoing presence of such companies meeting market demand is likely to drive further growth throughout the forecast period.

By Organization Size

The largest enterprise segment dominated the market and represented a significant revenue share in 2024. This segment is witnessing growth during the forecast period due to the benefits offered by eGRC solutions. They offer customization, 24/7 automation, frictionless onboarding and integration, complete visibility and management, greater data security as well as real-time reporting and monitoring. As large enterprises usually have massive customer bases, complex operating mechanisms, big workforces, and larger organizational networks this segment became an area of necessity for implementing GRC which considerably grow the enterprise size subsector from 2024 to 2032

The small and medium-sized enterprises (SMEs) segment is expected to grow at a faster rate during this period. The growth is due to focus of SMEs on cloud-based advanced risk compliance solutions and affordable services. In the current competitive scenario, SMEs primarily rely on quick turnaround time and cost efficiency to strengthen their position in the market.

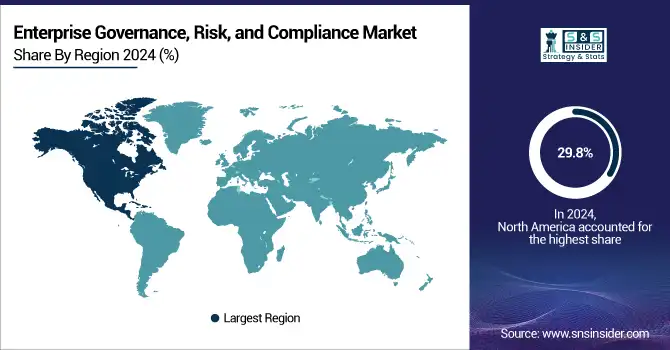

Enterprise Governance, Risk, and Compliance (eGRC) Market Regional Analysis:

North America Enterprise Governance, Risk, and Compliance (eGRC) Market Trends:

North America dominated the market and represented over 29.8% of revenue share. This region is home to prominent eGRC market players, including Dell Inc., IBM, Microsoft, and Oracle, whose presence has significantly bolstered regional growth. Furthermore, businesses in North America typically demonstrate more favorable attitudes toward digitalization, cybersecurity, and data protection.

Need Any Customization Research On Enterprise Governance, Risk, and Compliance Market - Inquiry Now

Asia-Pacific Enterprise Governance, Risk, and Compliance (eGRC) Market Trends:

The Asia Pacific region is expected to experience the highest growth rate from 2025 to 2032, driven largely by technological advancements in countries like China and Japan, which are leaders in innovations such as 5G and automation. The continued embrace of cutting-edge technologies is anticipated to further enhance the adoption of GRC solutions in the Asia Pacific region in the coming years. Additionally, fast-growing economies like India are witnessing increased eGRC digitalization and more stringent data protection regulations, requiring compliance from businesses. These elements combined are driving the growth of GRC adoption in India and promoting overall development in the Asia Pacific region.

Europe Enterprise Governance, Risk, and Compliance (eGRC) Market Trends:

Europe accounted for a significant share of the eGRC market in 2024, driven by stringent regulations such as GDPR and growing awareness regarding data privacy and cybersecurity. Countries like Germany, the U.K., and France have been leading in implementing robust governance and compliance frameworks. The increasing focus on digital transformation and the adoption of cloud-based GRC platforms in sectors like banking, insurance, and healthcare are expected to drive the market further.

Latin America Enterprise Governance, Risk, and Compliance (eGRC) Market Trends:

South America is experiencing steady growth in the eGRC market, largely fueled by increasing regulatory frameworks and compliance requirements in countries like Brazil and Argentina. With the growing financial and energy sectors, businesses are adopting GRC platforms to meet evolving risk and governance standards. However, challenges such as limited technological infrastructure in some areas may slightly restrain growth.

Middle East & Africa Enterprise Governance, Risk, and Compliance (eGRC) Market Trends:

The Middle East & Africa region is showing promising growth potential, driven by rapid infrastructure development, digital transformation initiatives, and rising cybersecurity concerns in countries such as the UAE, Saudi Arabia, and South Africa. Increased investments in banking, oil & gas, and telecommunications industries are contributing to the demand for advanced GRC solutions. Additionally, government-led initiatives to enhance data governance and risk management compliance are further supporting market expansion.

Enterprise Governance, Risk, and Compliance (eGRC) Market Key Players:

-

IBM - IBM OpenPages

-

Microsoft - Microsoft Compliance Manager

-

Oracle - Oracle Governance Risk and Compliance

-

SAP - SAP GRC Solutions

-

Dell Inc. - Dell EMC Governance and Compliance Solutions

-

Wolters Kluwer - OneSumX Regulatory Reporting

-

RSA Security - RSA Archer Suite

-

MetricStream - MetricStream GRC Platform

-

ServiceNow - ServiceNow Governance, Risk, and Compliance

-

SAS Institute - SAS Risk Management

-

LogicManager - LogicManager GRC Software

-

SailPoint Technologies - SailPoint Identity Governance

-

CyberSaint - CyberStrong Platform

-

NAVEX Global - NAVEX Risk Management Software

-

Bwise (a Nasdaq Company) - BWise GRC Software

-

RiskWatch - RiskWatch Compliance Solutions

-

Galvanize (now Diligent) - HighBond Platform

-

Trustwave - Trustwave Compliance Solutions

-

Apex Analytix - Apex Analytix Compliance Solutions

-

Cura Software Solutions - Cura GRC Software

Enterprise Governance, Risk, and Compliance (eGRC) Market Competitive Landscape:

Credo AI, founded in 2020 and based in Palo Alto, is a leading AI governance platform that automates oversight, risk management, and compliance across evolving regulations like the EU AI Act, NIST, and ISO. It empowers enterprises to responsibly scale AI adoption with transparency and trust.

-

March 2024: Credo AI launched governance, risk, and compliance solutions for AI, promoting safe technology adoption. This updated platform includes a user-friendly redesign and various new features that simplify the responsibilities of AI Governance Custodians, ensuring ethical AI usage.

Swiss GRC AG (founded 2016, Lucerne) is a leading Swiss provider of Governance, Risk, and Compliance software. Its flagship GRC Toolbox consolidates risk management, ISMS, BCM, ICS, third-party risk, audit, contract, and process management into a modular, adaptable platform. It supports on-premises and cloud deployments.

-

February 2024: Swiss GRC, a European software company specializing in governance, risk, and compliance, announced its expansion into the Indian market. The company will offer on-premise and private cloud deployment options tailored to the Indian sector, with a focus on BFSI players and government entities.

OPEX Technologies (founded 2009, headquartered in San Jose, CA) is a digital transformation leader specializing in agentic AI and automation, helping enterprises enhance efficiency and reduce costs. Trusted by over 70 global brands, iOPEX recently launched a Compliance & Governance add-on for ServiceNow’s Creator Workflows to streamline risk management

-

February 2024: iOPEX introduced a compliance and governance add-on for ServiceNow's creator workflows. This innovative add-on enhances ServiceNow's functionality by seamlessly integrating comprehensive governance and compliance features, including advanced integrated risk management strategies

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 20.49 billion |

| Market Size by 2032 | USD 55.3 billion |

| CAGR | CAGR of 13.22% From 2025to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-premises) • By Organization size (Large Enterprise, Small & Medium Enterprise) • By Vertical (BFSI, Healthcare, Government, Energy & Utilities, Manufacturing, Retail & Consumer Goods, Telecom & IT, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

IBM, Microsoft, Oracle, SAP, Dell Inc., Wolters Kluwer, RSA Security, MetricStream, ServiceNow, SAS Institute, LogicManager, SailPoint Technologies, CyberSaint, NAVEX Global, Bwise (a Nasdaq Company), RiskWatch, Galvanize (now Diligent), Trustwave, Apex Analytix, Cura Software Solutions |