Managed Domain Name System Market Report Scope & Overview:

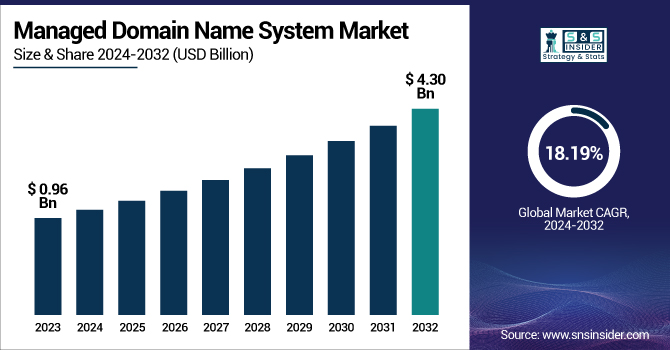

The Managed Domain Name System Market was valued at USD 0.96 billion in 2023 and is expected to reach USD 4.30 billion by 2032, growing at a CAGR of 18.19% from 2024-2032.

To Get more information on Managed Domain Name System Market - Request Free Sample Report

This report includes insights on DNS attack mitigation rates, geographic traffic routing efficiency, incidents of DNS hijacking and spoofing prevented, adoption of AI-based DNS optimization, and DNS analytics utilization rates.

Market growth is fueled by the rising threat of cyberattacks, prompting enterprises to adopt AI-driven DNS security solutions. Efficient traffic routing and analytics are enhancing network performance and security, while AI is driving automated DNS management. Increasing cloud adoption and reliance on resilient DNS infrastructure further support market expansion. With organizations prioritizing secure and optimized DNS services, the managed DNS market is set to witness significant advancements in the coming years.

U.S. Managed Domain Name System Market was valued at USD 0.26 billion in 2023 and is expected to reach USD 1.16 billion by 2032, growing at a CAGR of 17.92% from 2024-2032.

The U.S. Managed Domain Name System (DNS) Market is experiencing strong growth due to rising cybersecurity concerns, increasing cloud adoption, and the need for resilient DNS infrastructure. Businesses are prioritizing AI-driven DNS optimization to enhance security, performance, and traffic management. The demand for efficient DNS analytics and mitigation of cyber threats is driving adoption. Additionally, the expansion of e-commerce, digital services, and remote work is fueling reliance on scalable and secure DNS solutions. As organizations continue to invest in advanced DNS management to improve reliability and security, the market is set for sustained expansion in the coming years.

Managed Domain Name System Market Dynamics

Drivers

-

Growing Cyber Threats Drive Demand for Secure and Resilient Managed DNS Solutions to Prevent DDoS Attacks, Spoofing, and Service Disruptions.

The rise in cyberattacks, such as Distributed Denial-of-Service (DDoS) attacks and DNS spoofing, has increased the demand for strong DNS management tools. Organizations and companies are increasingly exposed to risk as cyber attackers target weaknesses in conventional DNS infrastructures, resulting in service downtime, data breaches, and losses. As cyber threats increase in complexity, organizations have made security-centric DNS solutions a priority, with support for sophisticated threat detection, mitigation, and automated response capabilities. Furthermore, regulatory environments that focus on cybersecurity compliance encourage companies towards managed DNS services with inherent security. With increasing digital transformation in various industries, keeping the internet services running smoothly and continuously has become imperative, boosting the use of managed DNS solutions further. Greater security against growing cyber attacks has become a necessity, strengthening the need for secure and robust DNS handling.

Restraints

-

High Costs, Integration Complexity, and Data Privacy Concerns Restrict Widespread Adoption of Managed DNS Solutions Among Cost-Sensitive Enterprises.

Managed DNS services' adoption has been stifled by extremely high implementation and subscription fees, particularly for small and medium-sized businesses (SMEs). Most organizations use free or entry-level DNS services, viewing premium managed services as an overindulgence. Moreover, the complexity of managing DNS with managed DNS and legacy IT infrastructure can be challenging, demanding expert professionals for configuration and management. On-premise legacy systems in organizations can create compatibility problems, which also delay adoption. Data privacy and control concerns also discourage some organizations from outsourcing DNS management. Though managed DNS solutions provide greater security and performance, cost-conscious organizations might resist investing, thus affecting market growth. Overcoming theses will call for providers to provide cost-efficient solutions and easier deployment models.

Opportunities

-

Expanding IoT Networks and Edge Computing Increase Demand for Scalable, Secure, and Low-Latency Managed DNS Solutions to Ensure Seamless Connectivity.

The rapid expansion of Internet of Things (IoT) networks and edge computing has triggered the urgent need for scalable DNS management solutions. As companies increasingly connect more devices within more industries, the management and protection of DNS traffic become more and more challenging. Conventional DNS infrastructures usually find it difficult to manage the explosion in data requests from IoT ecosystems, which causes latency problems and security exposures. Managed DNS solutions provide increased scalability, reliability, and security, with no device communication hiccups or disruptions. Also, edge computing necessitates low-latency networking, so optimized DNS management is crucial for real-time data processing. As more organizations embrace IoT-driven solutions, the demand for intelligent, automated DNS services that can manage dynamic and distributed networks will increase exponentially.

Challenges

-

Dependence on External DNS Providers Increases Risks of Downtime, Service Disruptions, and Revenue Loss for Businesses Relying on Continuous Online Availability.

Third-party managed DNS providers pose some inherent threats of service unavailability, which directly affect businesses that require uninterrupted online presence. An outage in a managed DNS service can impair website performance, impair cloud-hosted applications, and impact overall business processes. High-traffic digital businesses like e-commerce and financial services suffer immense revenue loss and reputation when DNS fails. Moreover, unplanned spikes in traffic, cyberattacks, or DNS provider technical failures can result in service disruption, and therefore reliability is also a major consideration. Although managed DNS solutions ensure scalability and security, companies have to deploy redundancy measures, such as multi-DNS setups, to avoid the risk of downtime. Maintaining high availability and failover options is still an important priority for companies that use managed DNS services.

Managed Domain Name System Market Segment Analysis

By Enterprise Size

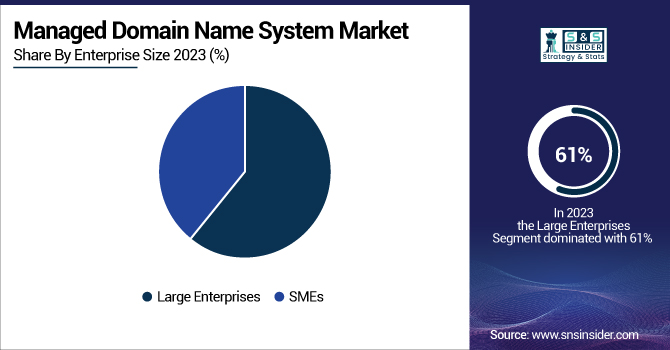

Large enterprises dominated the Managed Domain Name System (DNS) Market in 2023, holding the highest revenue share of approximately 61%. Their dominance is driven by the need for advanced security, scalability, and reliability in DNS management. These organizations operate large-scale online infrastructures, requiring high-performance DNS solutions to handle massive traffic volumes and prevent cyber threats. Additionally, compliance with stringent data security regulations pushes large enterprises to invest in managed DNS services, ensuring seamless connectivity, data protection, and business continuity across multiple digital platforms.

SMEs are expected to grow at the fastest CAGR of approximately 19.37% from 2024 to 2032, driven by increasing digital transformation and cloud adoption. As small and medium businesses expand their online presence, they require cost-effective, scalable DNS solutions to improve website performance and security. The rising awareness of cyber threats and the affordability of managed DNS services make them attractive for SMEs. Additionally, the shift toward e-commerce and SaaS-based operations further accelerates the adoption of managed DNS solutions in this segment.

By End-use

The IT & Telecom segment dominated the Managed Domain Name System (DNS) Market in 2023, holding the highest revenue share of approximately 24%. This dominance is driven by the sector’s heavy reliance on high-performance network infrastructure, requiring resilient DNS solutions for uninterrupted connectivity. Telecom providers and IT enterprises manage vast amounts of data and online services, making scalability, security, and low-latency DNS management essential. Additionally, the increasing deployment of 5G networks and cloud-based applications further strengthens the demand for managed DNS in this segment.

The Retail & E-Commerce segment is expected to grow at the fastest CAGR of approximately 21.16% from 2024 to 2032, driven by the rapid expansion of online shopping platforms and digital transactions. Businesses in this sector prioritize DNS performance to ensure fast website loading times, seamless customer experiences, and protection against cyber threats. The growing adoption of omnichannel retail strategies, mobile commerce, and personalized digital services further fuels demand for reliable managed DNS solutions, making this segment the fastest-growing in the market.

By Service

The Distributed Denial of Service (DDoS) Protection segment dominated the Managed Domain Name System (DNS) Market in 2023, holding the highest revenue share of approximately 36%. The rising frequency and sophistication of DDoS attacks have made security a top priority for businesses, driving demand for DNS solutions with built-in attack mitigation capabilities. Enterprises across industries invest in managed DNS services with advanced DDoS protection to ensure network availability, prevent downtime, and safeguard online operations from cyber threats that can disrupt business continuity.

The GeoDNS segment is expected to grow at the fastest CAGR of approximately 20.47% from 2024 to 2032, driven by the increasing need for optimized global website performance. As businesses expand their digital footprint, GeoDNS enables faster content delivery by directing users to the nearest server location. This enhances website speed, reduces latency, and improves user experience. The rise of content-driven platforms, streaming services, and global e-commerce further accelerates the demand for GeoDNS solutions.

By Deployment

The Cloud segment dominated the Managed Domain Name System (DNS) Market in 2023, holding the highest revenue share of approximately 66%, and is expected to grow at the fastest CAGR of about 18.81% from 2024 to 2032. This dominance and rapid growth are driven by the increasing adoption of cloud computing across industries, as businesses shift to cloud-based applications and services requiring scalable, high-availability DNS solutions. Cloud-managed DNS offers enhanced security, automated traffic management, and resilience against cyber threats like DDoS attacks. Additionally, the growing trend of remote work, digital transformation, and multi-cloud strategies further accelerates demand. Enterprises prefer cloud-based DNS for its cost efficiency, easy deployment, and ability to support global operations with low-latency access, ensuring continued market expansion.

Regional Analysis

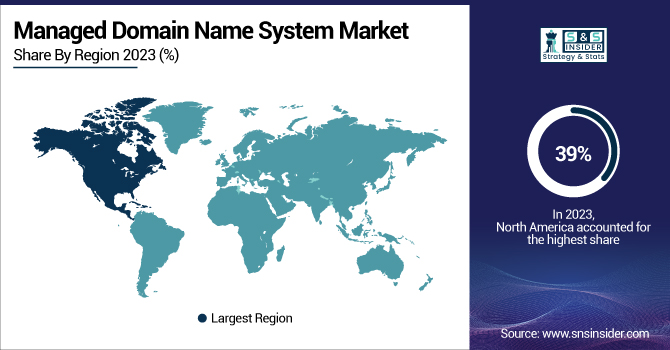

North America dominated the Managed Domain Name System (DNS) Market in 2023, holding the highest revenue share of approximately 39%. This dominance is attributed to the region’s strong internet infrastructure, high adoption of cloud computing, and growing cybersecurity concerns. Leading technology firms, financial institutions, and e-commerce giants drive demand for managed DNS solutions to ensure security, scalability, and optimal performance. Additionally, stringent regulatory frameworks and increased investments in digital transformation further boost the adoption of advanced DNS management services across various industries.

Asia Pacific is expected to grow at the fastest CAGR of approximately 20.15% from 2024 to 2032, driven by rapid internet penetration, expanding digital businesses, and increasing cloud adoption. The region's booming e-commerce sector, growing IT infrastructure, and rising cyber threats contribute to the demand for managed DNS solutions. Governments and enterprises are investing in secure and scalable DNS services to support digital expansion. The widespread adoption of mobile internet and emerging economies further fuel market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM [IBM NS1 Connect, IBM Cloud Internet Services]

-

Amazon Web Services, Inc. (Amazon.com, Inc.) [Amazon Route 53, AWS Global Accelerator]

-

CDNetworks Inc. [CDNetworks DNS, CDNetworks Cloud Security]

-

Cloudflare, Inc. [Cloudflare DNS, Cloudflare Load Balancing]

-

Corporation Service Company (CSC) [CSC Domain Management, CSC Security & Risk Management]

-

DigiCert, Inc. (Clearlake Capital Group, L.P.) [DigiCert DNS Security, DigiCert Secure Site]

-

Google LLC (Alphabet Inc.) [Google Cloud DNS, Google Public DNS]

-

Infoblox [Infoblox Advanced DNS Protection, Infoblox Cloud Services Platform]

-

Microsoft Corporation [Azure DNS, Microsoft Defender for DNS]

-

Oracle Corporation [Oracle Cloud DNS, Oracle Traffic Management Steering]

-

VeriSign, Inc. [Verisign Managed DNS, Verisign Recursive DNS]

-

Vitalwerks Internet Anycast Networks, LLC [No-IP Plus Managed DNS, No-IP Enhanced Dynamic DNS]

-

GoDaddy Inc. [GoDaddy Premium DNS, GoDaddy Domain Backorders]

-

Neustar, Inc. (TransUnion LLC) [UltraDNS Managed Services, UltraDNS Traffic Controller]

-

Akamai Technologies, Inc. [Akamai Edge DNS, Akamai Global Traffic Management]

Recent Developments:

-

In 2024, Akamai introduced Shield NS53, a hybrid DNS security solution designed to protect on-premises and cloud DNS infrastructure from resource exhaustion attacks. This enhances security and resilience for enterprises managing critical network services.

-

In October 2024, AWS Route 53 added support for HTTPS, SSHFP, SVCB, and TLSA DNS record types. These enhancements improve security, authentication, and performance for DNS queries, benefiting cloud and hybrid infrastructures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.96 Billion |

| Market Size by 2032 | US$ 4.30 Billion |

| CAGR | CAGR of 18.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Anycast Network, Distributed Denial of Service (DDoS) Protection, GeoDNS, Others) • By Deployment (On-premises, Cloud) • By Enterprise Size (Large Enterprises, SMEs) • By End-use (BFSI, IT & Telecom, Media & Entertainment, Retail & E-commerce, Healthcare, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Amazon Web Services, Inc. (Amazon.com, Inc.), CDNetworks Inc., Cloudflare, Inc., Corporation Service Company (CSC), DigiCert, Inc. (Clearlake Capital Group, L.P.), Google LLC (Alphabet Inc.), Infoblox, Microsoft Corporation, Oracle Corporation, VeriSign, Inc., Vitalwerks Internet Anycast Networks, LLC, GoDaddy Inc., Neustar, Inc. (TransUnion LLC), Akamai Technologies, Inc. |