Erythropoietin Drugs Market Overview & Report Scope

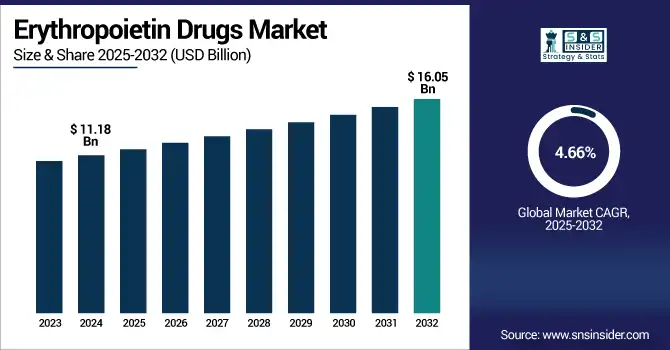

The Erythropoietin Drugs Market size was valued at USD 11.18 billion in 2024 and is expected to reach USD 16.05 billion by 2032, growing at a CAGR of 4.66% over the forecast period of 2025-2032.

The availability and penetration of biosimilar erythropoietin agents is one of the key market driving factors. Biosimilars also offer the potential for cost-effective alternatives to reference biologics, such as Epogen and Aranesp, improving access to erythropoietin therapy in emerging and cost-constrained markets. As important patents have expired, the pharmaceutical companies are now marketing "biosimilars" that are compliant with regulations prescribing required levels of safety and efficacy, which significantly expands the potential for use for both renal care and for oncology. Governments and those paying for care are also promoting greater use of biosimilars to lower the cost of treatment.

For instance, in September 2024, WHO added biosimilar erythropoietin to its Essential Medicines List, leading to a 42% increase in government procurement in low- and middle-income countries across Asia and Africa.

To Get more information on Erythropoietin drugs market - Request Free Sample Report

U.S. Erythropoietin Drugs Market Size and Growth Analysis

The U.S. Erythropoietin Drugs Market was valued at USD 3.58 billion in 2024 and is expected to reach USD 5.06 billion by 2032, growing at a CAGR of 4.45% over 2025-2032.

The erythropoietin drugs market is led by the U.S. on account of the high occurrence of chronic kidney disease (CKD) and cancer-associated anemia, which are key applications for EPO treatment. The country possesses a well-established dialysis network, wide availability of oncology care, and good insurance coverage, facilitating extensive patient access to erythropoietin drugs. Further, early acceptance of biosimilars, continued clinical development, and the presence of big biopharma players such as Amgen and Pfizer also support market leadership.

For instance, as of March 2025, 37 million U.S. adults have CKD, with 38% experiencing anemia requiring erythropoietin therapy.

Market Dynamics

Drivers:

-

Technological Advancements in EPO Formulations, Driving the Erythropoietin Drugs Market Growth

Development of long-acting erythropoietin (EPO) preparations, such as Mircera is currently a major factor for growth. These second-generation EPO derivatives provide for less frequent dosing, enhancing patient convenience, compliance, and clinical responses, particularly in patients with chronic kidney disease and cancer. Furthermore, progress has been made in drug delivery and recombinant DNA science to improve the stability and bioavailability of the drugs. These advances will drive other physicians and health care systems to encompass the newer EPO products, resulting in additional market demand.

For instance, in January 2025, Roche reported a 12% sales increase for Mircera, driven by expanded use of once-monthly dosing in CKD patients.

Restraints:

-

Patent Expiry and Price Pressure Restraining the Erythropoietin Drugs Market

The expiration of important patents for the original erythropoietin products, such as Epogen and Aranesp, has provided an opportunity for many similar products to be introduced into the market. This broadening of access and accessibility, however, also leads to substantial price erosion for innovator companies. The increased competition from biosimilars has obliged originator manufacturers to drop prices and profit margins, causing difficulties in maintaining premium pricing. This limited scope of research and development of erythropoietin has been dissuading prominent players from making more investments, which is acting as a restraint to the market, adding to which is the cost constraint in the global market, particularly in regions with high biosimilar penetration.

For instance, as of April 2024, global erythropoietin prices dropped by 28% since patent expirations, causing margin pressure for originator brands, especially in Europe and Latin America.

Erythropoietin Drugs Market Segmentation

By Type

Biologics were the dominant segment in the Erythropoietin Drugs Market analysis, with a 54.96% market share in 2024, owing to their established effectiveness, safety with prolonged use, and large-scale experience in the treatment of anemia associated with CKD and cancer. Throughout the history of the first biologics, there is well-documented clinical confidence and broad physician acceptance. Their potential to induce targeted and prolonged production of red blood cells is one of the perpetuated choices. In addition, biologics have solid regulatory endorsements, reimbursement support, mainly in the more developed markets, and thus solid ongoing demand even in the face of increasing biosimilar competition.

Biosimilars are emerging as the fastest growing segment in the Erythropoietin Drugs Market with the highest CAGR of 5.19%, owing to the cost-effectiveness, expired patents of the branded ones, and the rising number of approvals by regulatory globally. Governments and health care systems, particularly in Europe and Asia-Pacific, are aggressively marketing biosimilars to attain cost-effective therapies. Their increasing clinical adoption, availability of reimbursement, and vast patient population with CKD in the developing world contribute to the fast growth and global adoption.

By Application

In 2024, the Erythropoietin Drugs market share was dominated by the renal diseases segment with a 32.80% market share. Anemia is a frequent complication of chronic kidney disease (CKD), particularly in those undergoing dialysis. It is also necessary to treat anemia in these patients, and it is therefore a standard treatment in nephrology. The increasing incidence of CKD globally, increasing dialysis centers, and government-sponsored renal care programs have played a crucial role in the high consumption of erythropoietin in this market.

The most rapidly growing sector of the erythropoietin delivery market is cancer, which is driven by the growing global cancer population and the increase in the number of people with chemotherapy-induced anemia who need supportive erythropoietin therapy. Improvements in treatment for cancer, greater rates of survival, and more people receiving two types of treatment all contribute to demand. The segment is gaining its erythropoietin drugs market share at a high pace, in developed countries that propose the supportive care guidelines suggesting the use of EPO for the treatment of anemia, and this, in turn, enhances the patient's quality of life.

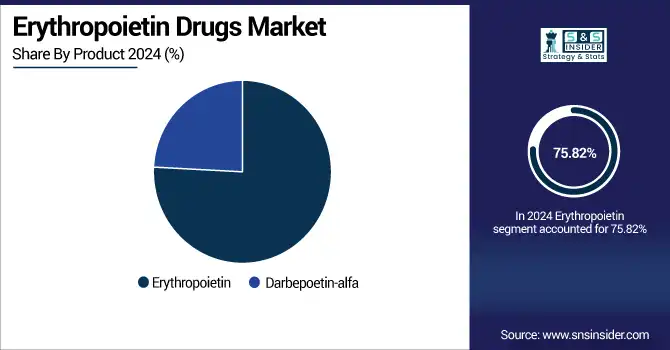

By Product

The Erythropoietin leads the Erythropoietin Drugs Market Analysis with a significant market share of 75.82%, owing to the well-demonstrated effects on erythropoiesis and its broad prescribing in the treatment of anemia in patients with CKD and cancer. Physician preference remains strong due to its clinical performance, long-term safety, and extensive regulatory approvals. Due to the rising number of anemia cases globally, this segment is still the king in the erythropoietin drugs market share in dialysis and oncology-related treatments in not only developed but also emerging markets.

Most rapidly growing is darbepoetin-alfa for the former, since it has a longer half-life and less frequent dosing, thus requiring a smaller dose, and thereby making it more convenient to use for patients and staff. It provides better treatment compliance and has been used more commonly in CKD (chronic kidney disease) and oncology populations. Growth in the use of the drug for various indications is driven by growing acceptance for long-acting forms and increasing approvals, and global availability. Subsequently, Darbepoetin-alfa is increasingly capturing the erythropoietin drugs market share in other therapeutic indications.

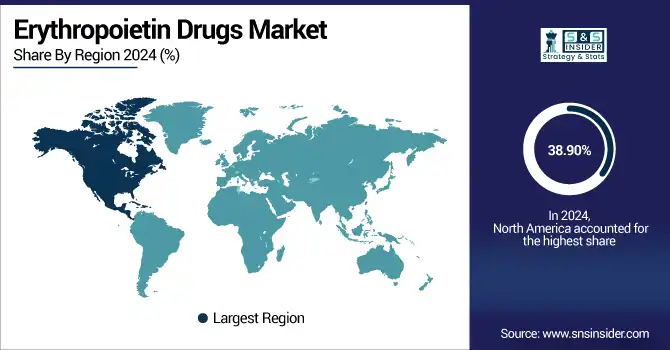

Regional Insights: Global Erythropoietin Drugs Market Share

In 2024, the North American region dominated the Erythropoietin Drugs Industry and accounted for 38.90% of the overall revenue share, owing to its very developed health care system, high CKD burden, and a great number of oncologic patients. The level of drug insurance is high in the region, under both Medicare and private payers, which makes it easier the accessibility to access expensive biologics. Furthermore, the early acceptance of biosimilars, the presence of key players, such as Amgen and Pfizer, and the strong clinical guidelines for anemia management continue to provide a continuing demand. Favorable FDA regulations and continued financial investment in healthcare for nephrology and oncology play a major role in North America's ERPO drug market standing in the first position worldwide.

The European erythropoietin drugs market is the second largest market due to higher disease prevalence, patient awareness levels, and greater purchasing power of the patients. Firstly, cost-containment measures in countries, such as Germany, the U.K. and France, in which substitution with biosimilar erythropoietin therapies is promoted, have expanded access to treatments. European Erythropoietin Drugs Market Share, Soars High By 2027.

The Asia Pacific region is projected to grow with the fastest CAGR of 5.39% over the forecast period. The drug market is growing because of its growing patient population, particularly the number of patients with chronic kidney disease (CKD) and cancer-related anemia. The market in the region is undergoing substantial development due to rising accessibility to dialysis services and for treating cancer in countries, such as India, China, and Japan. The governments are introducing public dialysis projects and drug subsidy projects, and Epo therapies are becoming more accessible and less expensive.

The increasing adoption and manufacture of biosimilars will also reduce treatment costs, raising adoption levels. The arrival of regional pharmaceutical companies, such as 3SBio, Biocon, and Dr. Reddy’s is also helping drive local supply and innovation. Together, these factors are contributing to the strong the erythropoietin drugs market growth in the region, positioning Asia-Pacific as a key player in future erythropoietin drugs market growth internationally.

The Middle East & Africa erythropoietin drugs market is growing at a steady pace due to a growing incidence of chronic kidney disease (CKD), a rising prevalence of cancer, and slowly improving healthcare infrastructure. Governments throughout the GCC and some parts of Africa have been increasingly investing in renal care centres, dialysis service provision, and access to critical drugs. Global health initiatives and working with global pharmaceutical firms are improving the availability of biosimilar erythropoietin medicines, particularly in resource-poor settings.

However, the lack of a reimbursement system and economic inequality continue to pose challenges in the erythropoietin drugs market. Increased awareness, increasing health care spending, and enhanced diagnosis are impacting market growth for erythropoietin drugs. Increased access and affordability are projected to drive the region's erythropoietin drugs market growth during the forecast period, with a focus on increasing access and affordability in the region.

The erythropoietin drugs market in Latin America is growing at a stable pace owing to an increase in the incidence of chronic kidney disease and cancer-induced anemia. Brazil and Mexico are increasing the availability of public healthcare and dialysis, stoking demand for erythropoietin treatments. Wider uptake of biosimilars is also driving the affordability of treatment. But accessibility remains problematic due to reimbursement issues and infrastructure limitations. Despite this, increasing knowledge about the disease, healthcare expenditures, and rising numbers of patients are the key factors fueling the market of erythropoietin drugs in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Erythropoietin Drugs Market

-

Johnson & Johnson

-

Roche Holding AG

-

Pfizer Inc.

-

Hospira, Inc.

-

LG Chem

-

3SBio Inc.

-

Dr. Reddy’s Laboratories Ltd.

-

Biocon Limited and other players.

Recent Developments in the Erythropoietin Drugs Industry:

-

In January 2025, MyFitnessPal introduced AI-based nutrition coaching with dynamic meal recommendations and integration with wearables, advancing its position in fitness and lifestyle tracking apps for weight and diet management.

-

On 31 March 2025, Apple is reportedly working on a major overhaul of its Health app, introducing an AI-powered health coach to provide personalised wellness guidance. According to Bloomberg’s Mark Gurman, this initiative, internally referred to as "Project Mulberry," aims to transform the Health app into a more interactive and insightful tool for users.

-

On 25 April 2025, A new study using data from the National Institutes of Health's (NIH) All of Us Research Program found that artificial intelligence (AI) may be able to predict the risk of hospitalization from wearable fitness tracker data. Researchers presented these findings as an oral abstract today at Heart Rhythm 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.18 billion |

| Market Size by 2032 | USD 16.05 billion |

| CAGR | CAGR of 4.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | "• By Type (Biologics, Biosimilars) • By Application (Cancer, Renal Diseases, Neurology, Others) • By Product (Erythropoietin, Darbepoetin-alfa)" |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amgen Inc., Johnson & Johnson, Roche Holding AG, Pfizer Inc., Novartis AG, Hospira, Inc, LG Chem, 3SBio Inc., Dr. Reddy’s Laboratories Ltd., Biocon Limited, and other players. |