Digital Hearing Aids Market Report Scope & Overview:

Get More Information on Digital Hearing Aids Market - Request Sample Report

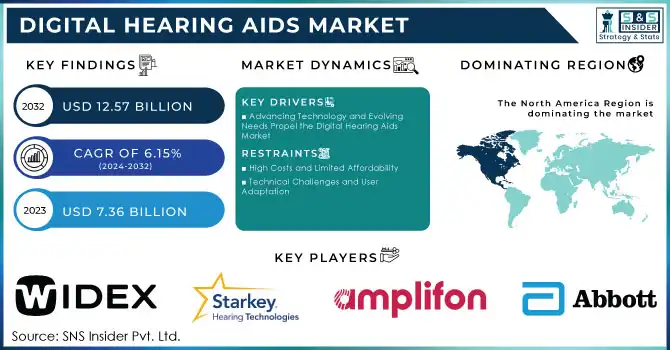

The Digital Hearing Aids Market was valued at USD 7.36 billion in 2023 and is projected to reach USD 12.57 billion by 2032, growing at a CAGR of 6.15% over the forecast period 2024-2032.

The digital hearing aids market has witnessed substantial growth, driven by technological advancements, increasing awareness of hearing health, and the rising prevalence of hearing impairments globally. Digital hearing aids, equipped with features like noise reduction, directional microphones, and Bluetooth connectivity, offer significant improvements over traditional analog models in terms of sound quality, functionality, and user experience.

Globally, over 430 million people live with hearing loss, a number projected to exceed 700 million by 2050, according to the World Health Organization (WHO). This alarming rise has emphasized the need for advanced hearing solutions. Digital hearing aids address this demand with innovations like rechargeable batteries and AI-powered sound adjustments, enabling users to experience more personalized and seamless hearing experiences. Advancements in artificial intelligence have revolutionized the hearing aid industry. Devices now offer adaptive learning capabilities, recognizing user patterns and environmental noise to deliver optimal sound quality. For instance, companies like Oticon and Phonak have introduced hearing aids with deep neural network algorithms that analyze soundscapes in real time, providing better clarity in noisy environments.

The rise of wireless and rechargeable options has further enhanced user convenience. Rechargeable hearing aids, such as those from Starkey and ReSound, eliminate the need for frequent battery replacements, addressing sustainability concerns while reducing user effort. Bluetooth-enabled devices also allow seamless connectivity with smartphones and other devices, making them versatile tools for modern lifestyles. Additionally, government initiatives and insurance policies in regions like the U.S. and Europe have improved accessibility. Programs such as the 2024 coverage expansion under Federal Employee Health Benefit plans offer subsidies for hearing aids, reducing financial barriers for consumers.

Digital hearing aids have become vital in addressing hearing loss, especially among the elderly and young populations with noise-induced impairments. The industry's focus on personalization, coupled with technological advancements, positions it as a vital segment in healthcare technology.

Market Dynamics

Drivers

-

Advancing Technology and Evolving Needs Propel the Digital Hearing Aids Market

The digital hearing aids market is experiencing robust growth driven by advancements in technology and evolving consumer expectations. The increasing focus on personalized healthcare has led to the development of devices equipped with artificial intelligence, enabling adaptive sound processing tailored to individual needs. Improved access to healthcare infrastructure, especially in emerging economies, has expanded the reach of these devices, addressing untreated hearing loss across diverse populations. Additionally, the growing integration of digital hearing aids with smart devices, offering features like app-based controls and wireless connectivity, has enhanced user convenience and appeal. Pediatric hearing loss intervention has also emerged as a significant driver, with advanced diagnostic tools and child-friendly devices gaining traction. Furthermore, diminishing social stigma, coupled with sleek and discreet device designs, has boosted acceptance across various demographics. These factors collectively contribute to the increasing adoption of digital hearing aids, making them a critical component of modern audiology solutions.

Restraints

-

High Costs and Limited Affordability

The advanced features of digital hearing aids often come with high production and retail costs, making them unaffordable for a significant portion of the population, especially in low- and middle-income regions.

-

Technical Challenges and User Adaptation

Issues such as device malfunctions, battery life limitations, and the complexity of adjusting to advanced functionalities can deter users, particularly older individuals less familiar with modern technology.

Segmentation Analysis

By Type of Hearing Loss

The sensorineural segment dominated the market in 2023, holding an estimated 65.0% of the share. This is largely due to the high prevalence of age-related hearing loss, which accounts for a significant proportion of global hearing impairment cases. Sensorineural hearing loss, often resulting from damage to the inner ear or auditory nerve, is effectively managed with digital hearing aids, which offer advanced sound amplification and frequency adjustment. The aging population worldwide, particularly in developed nations, has driven demand for tailored hearing solutions. The availability of digital hearing aids equipped with personalized features, such as feedback cancellation and enhanced speech clarity, further supports this segment's dominance.

The fastest growth in this segment is attributed to increasing awareness of early diagnosis and intervention. Governments and healthcare organizations are launching initiatives to educate the public about the importance of addressing hearing loss promptly. Additionally, rising cases of noise-induced hearing loss among younger individuals due to prolonged exposure to loud environments, such as concerts and workplaces, are contributing to the segment’s rapid expansion. With improved access to hearing healthcare and advanced diagnostic tools, the sensorineural segment continues to experience sustained growth.

By Distribution Channel

Retail stores maintained their dominance in 2023, contributing to around 55.0% of the total market share. They are the preferred distribution channel due to the in-person assistance they provide, including professional consultations and on-the-spot device customization. Consumers value the opportunity to test devices, receive personalized fittings, and access after-sales services such as maintenance and repairs. These advantages make retail stores particularly appealing to first-time buyers and those unfamiliar with hearing aid technology. Moreover, retail outlets often collaborate with audiologists, ensuring accurate diagnoses and tailored recommendations for customers.

E-commerce is the fastest-growing distribution channel, fueled by its convenience, wider product availability, and competitive pricing. Online platforms have revolutionized the purchase process by offering virtual consultations, product reviews, and try-at-home options, enabling users to make informed decisions from the comfort of their homes. This channel has been particularly impactful in reaching underserved areas and tech-savvy individuals who prioritize ease of access. The rise in digital literacy and the proliferation of online marketplaces specializing in healthcare products have further solidified e-commerce as a preferred option for purchasing hearing aids.

Regional Overview

North America emerged as the leading region in the digital hearing aids market in 2023, driven by advanced healthcare infrastructure, high awareness levels, and a strong presence of key market players. The United States, with its aging population and rising prevalence of hearing disorders, represents a significant share of the market. The region benefits from well-established distribution channels, government initiatives like Medicare coverage for hearing aids, and increased adoption of technologically advanced devices.

Europe followed closely, with robust growth fueled by favorable reimbursement policies, an increasing elderly population, and initiatives promoting early diagnosis and treatment. Countries like Germany, France, and the UK are at the forefront, leveraging advanced audiology services and rising consumer preference for discreet, high-performance hearing aids.

The Asia-Pacific region is the fastest-growing market, primarily due to improving healthcare infrastructure, growing disposable incomes, and rising awareness about hearing health. Rapid urbanization in countries like China, India, and Japan has led to better access to hearing care services. Additionally, increased government efforts to address untreated hearing loss and the proliferation of e-commerce platforms offering affordable hearing aids contribute to regional growth.

Need any customization research on Digital Hearing Aids Market - Enquiry Now

Key Players

-

Abbott

-

Amplification System

-

Hearing Instruments

-

-

-

Amplifon Hearing Aids

-

Smart Hearing Solutions

-

-

SeboTek Hearing Systems, LLC

-

SeboTek Digital Hearing Aids

-

Rechargeable Hearing Aids

-

-

Microson

-

Microson Digital Hearing Aids

-

Custom Hearing Aids

-

-

-

Starkey Livio AI

-

Starkey Evolv AI

-

Starkey SoundGear

-

-

-

WIDEX MOMENT

-

WIDEX EVOKE

-

WIDEX UNIQUE

-

-

MED-EL Medical Electronics

-

MED-EL Hearing Aids

-

MED-EL Rondo

-

MED-EL Sonnet

-

-

Audina Hearing Instruments, Inc.

-

Audina Digital Hearing Aids

-

Audina Custom Hearing Aids

-

-

Demant A/S

-

Oticon More

-

Oticon Opn

-

Oticon Real

-

-

Cochlear Ltd.

-

Cochlear Nucleus Sound Processor

-

Cochlear Baha Sound Processor

-

-

Arphi Electronics Private Limited

-

Arphi Digital Hearing Aids

-

Rechargeable Hearing Aids

-

-

Sonova

-

Phonak Audeo Paradise

-

Phonak Naída Marvel

-

Phonak Sky Marvel

-

-

Horentek

-

Horentek Hearing Aids

-

-

GN Store Nord A/S

-

ReSound ONE

-

ReSound LiNX Quattro

-

ReSound Enzo Q

-

-

Sivantos

-

Signia Xperience

-

Signia Pure Charge&Go

-

Signia Styletto X

-

-

RION CO. Ltd

-

RION Digital Hearing Aids

-

-

Sound One India

-

Sound One Digital Hearing Aids

-

-

Amplicon

-

Amplicon Digital Hearing Aids

-

Recent Development

In Sept 2024, Apple received FDA clearance for its new health technology, with the Watch Series 10 now capable of detecting moderate to severe sleep apnea. Additionally, the AirPods Pro 2 offers over-the-counter access to Apple's AI-powered hearing aid software, enhancing user convenience and accessibility.

In Feb 2024, Widex launched the SmartRIC hearing aid, featuring an innovative L-shaped design that enhances microphone angles for improved directionality and speech targeting. This new device aims to provide a more natural listening experience by focusing on the sounds that matter most, allowing users to stay more connected to their surroundings.

In Jan 2024, RCA Accessories launched three upgraded premium hearing aids with enhanced functionality, longer battery life, and advanced volume controls, offering competitive pricing. Having entered the OTC hearing aid market in May 2023, the company also introduced a new protection plan to drive adoption and cater to a broader range of consumers experiencing hearing loss.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.36 Billion |

| Market Size by 2032 | US$ 12.57 Billion |

| CAGR | CAGR of 6.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Hearing Loss (Conductive, Sensorineural, Others) • By Distribution Channel (E-Commerce, Retail Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, Amplifon, SeboTek Hearing Systems, LLC, Microson, Starkey, WIDEX A/S, MED-EL Medical Electronics, Audina Hearing Instruments, Inc., Demant A/S, Cochlear Ltd., Arphi Electronics Private Limited, Sonova, Horentek, GN Store Nord A/S, Sivantos, RION CO. Ltd, Sound One India, Amplicon |

| Key Drivers | • Advancing Technology and Evolving Needs Propel the Digital Hearing Aids Market |

| Restraints | • High Costs and Limited Affordability • Technical Challenges and User Adaptation |