Stem Cell Therapy Market Report Scope & Overview

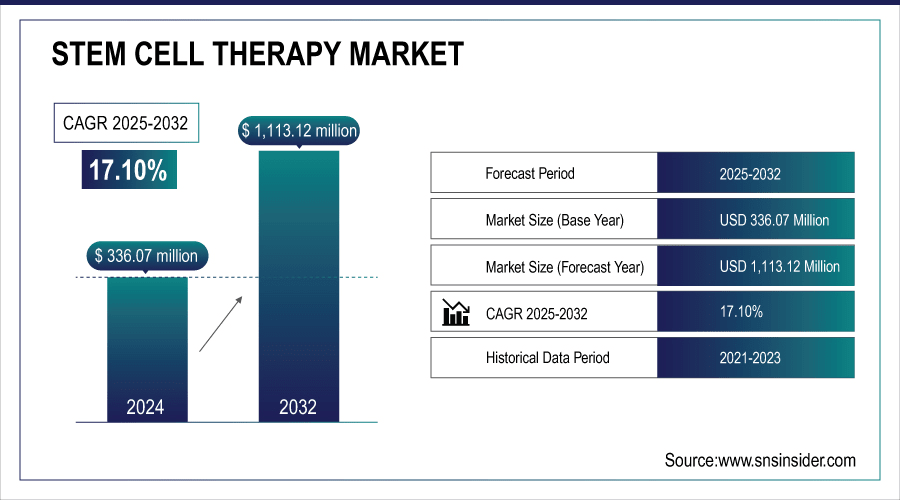

The Stem Cell Therapy Market size was valued at USD 336.07 million in 2024 and expected to reach USD 1,113.12 million by 2032, growing at a CAGR of 17.10% over the forecast period 2025-2032.

The lifted burden of chronic diseases has resulted in the advancement of regenerative stem cell therapy which is being investigated as a good therapeutic agent for these fatal disorders. As an illustration, in December 2023 Mayo Clinic researchers and international collaborators showed that the propagation of stem cell-based regenerative therapy was effective for advanced heart failure.

-

In the January 2023 postponement period, UC Davis Health researchers showed that a stem cell therapy for treating Crohn's disease in preclinical trials fared well. Therefore, the augmented research undertaking in stem cell therapy is expected to drive industry expansion during the forecast years.

Additionally, burgeoning funding/grants to design prospective stem cell-based therapeutics are further anticipated to uphold the market growth. To strengthen its work towards the creation of cutting-edge stem cell treatments to treat several deadly illnesses, CellVoyant supported GBP 7.6 million (USD9.49 million) from Octopus Ventures in January 2024 as an illustration Likewise, in February 2023 the National Institutes of Health awarded USD 2.5 million to a group at Purdue University for stem cell research on which they are working with allogeneic ISCTCs into phase III testing. Therefore, such cash flow activities are expected to fuel the growth of the industry.

To Get More Information On Stem Cell Therapy Market - Request Free Sample Report

Stem Cell Therapy Market Report Highlights

-

Rising Prevalence of Chronic Disorders is driving global demand for stem cell therapy solutions, with cancer, cardiovascular diseases, and autoimmune disorders significantly contributing to market growth.

-

Adult Stem Cells Lead Product Segment holding over 76% market share in 2023, driven by lower ethical concerns, reduced risk of graft rejection, and increasing stem cell banking services.

-

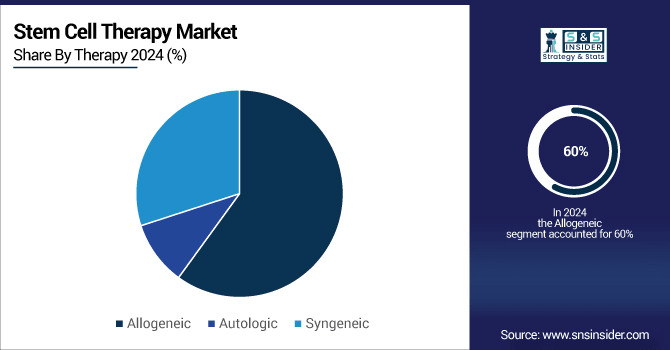

Allogenic Therapy Dominates Revenue Generation with 60% market share due to high adoption rates, growing stem cell banking, and strategic investments by key players like Acepodia and Immatics.

-

Cancer Applications Drive Market Demand accounting for 32% share in 2023, supported by successful clinical outcomes in tissue regeneration, immuno-reconstitution, and anti-tumor treatments.

-

Hefty R&D Investments and Funding from private ventures and government grants, such as CellVoyant’s GBP 7.6M and NIH’s USD 2.5M for Purdue University, are fueling technological advancements in stem cell therapeutics.

-

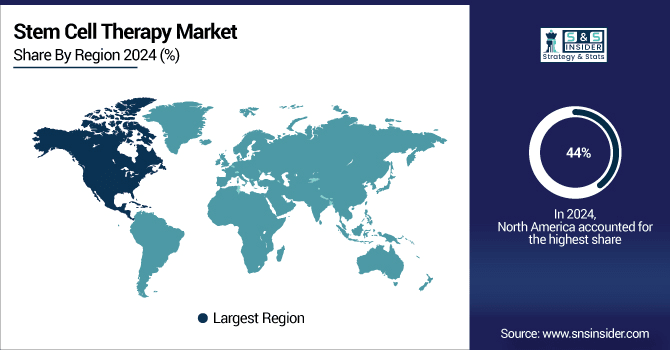

North America Holds 44% Market Share owing to high cancer incidence, adoption of regenerative medicine, and supportive regulatory frameworks, with increasing grants and clinical research further boosting growth.

-

Technological Advancements in Stem Cell Therapy present lucrative opportunities, including innovations in cell processing, preservation, and delivery systems for effective personalized treatments.

-

Regulatory and Cost Challenges remain restraints, as stringent guidelines and high treatment costs may limit adoption in certain regions.

-

Stem Cell Therapy Market Drivers

-

Increasing Prevalence of Chronic Disorders is responsible for the Increasing Demand for Stem Cell Therapy Solutions.

The increasing prevalence of chronic disorders worldwide is a primary driver for the growing demand for stem cell therapy solutions. Chronic diseases such as cancer, cardiovascular disorders, diabetes, and autoimmune conditions are on the rise due to aging populations, sedentary lifestyles, and environmental factors. According to the World Health Organization (WHO), chronic diseases account for approximately 71% of all global deaths, with cancer alone responsible for nearly 10 million deaths annually. The United States Centers for Disease Control and Prevention (CDC) reports that around 60% of adults in the U.S. live with at least one chronic condition, and nearly 40% manage two or more. These alarming statistics underscore the need for advanced therapeutic approaches beyond conventional treatments. Stem cell therapies offer regenerative potential, enabling repair or replacement of damaged tissues and improved treatment outcomes. For instance, hematopoietic stem cell transplants are widely used in treating blood-related cancers, while mesenchymal stem cells are being explored for cardiovascular repair and autoimmune disorders. The growing acceptance of stem cell banking and personalized medicine further supports market expansion, as patients seek long-term therapeutic solutions. Consequently, the increasing global burden of chronic disorders is expected to sustain the adoption of stem cell therapy, making it a critical segment in regenerative medicine over the coming decade.

-

The Growing Demand for Stem Cell Banking is Boosting the Market Growth.

Restraints:

-

Stringent Regulatory Scenario is Hindering Stem Cell Therapy Market Growth.

The stringent regulatory environment is a significant restraint on the growth of the stem cell therapy market. Regulatory agencies across the globe, including the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other regional authorities, impose rigorous requirements for clinical trials, safety assessments, and approval processes for stem cell-based products. These regulations are intended to ensure patient safety and efficacy but often result in lengthy approval timelines and high compliance costs. For example, the FDA mandates extensive preclinical and clinical studies before granting approval for stem cell therapies, which can delay market entry by several years. Additionally, variations in regulatory frameworks between countries create challenges for companies aiming to commercialize therapies internationally. Complex guidelines related to ethical sourcing, manipulation of stem cells, and quality control add further hurdles. High costs associated with regulatory compliance can be prohibitive for smaller companies or startups, limiting innovation and slowing market expansion. As a result, despite the growing demand for stem cell therapies, strict regulatory oversight continues to impede rapid commercialization and adoption of these advanced treatments globally.

-

The Higher Costs of Stem Cell Therapy Procedures Can Limit the Adoption of Stem Cell Therapy.

Stem Cell Therapy Market Opportunities:

-

Technological Advancements are Offering a Lucrative Growth Opportunity for Stem Cell Therapy Procedures.

-

Hefty R&D Investments are Responsible for the Market Growth During Upcoming Years.

Stem Cell Therapy Market Sgmentation Analysis

By Therapy

In terms of revenue generation, the Allogenic therapy segment held for 60% share of this market in 2023. The growth in this segment can be attributed to factors such as the high cost of treatment and increasing stem cell banking. In addition, a lot of cell therapy companies are waiving their business from autologous and moving on to allogenic. As a consequence, this segment is anticipated to push up the growth of the equivalent market.

Further, the competitive moves by major market players to enhance their product offerings will also provide significant prospects over the forecast period. For example, Acepodia raised USD 47M in Series B financing for its allogenic cell therapy candidates’ pipeline just this March of 2021. Later, in June 2022, Immatics had done partnership for developing gamma delta allogeneic cell therapy programs while extending its collaboration with the pharmaceutical firm Bristol Myers Squibb.

By Product

Adult Stem Cells held a market share of 76.36% by the year 202 as this is done without destruction while Embryonic stem cells are destroyed adult stem cells do not carry the threat of graft rejection. Increasing cell banking services along with the development in biopreservation and cryopreservation are expected to drive adult stem cell demand. Adult cells suffer from fewer ethical concerns, further driving the market for this segment. Autologous transformation, low risk of tumor formation, and established treatment options are the several benefits in the US that can be achieved through the adult stem cell banking segment in next forthcoming years.

By Application

An increase in the incidence of cancer and malignancies is expected to drive segmental growth; responsible for 32% market share by 2023. Cancer Australia, for example, states up to 4,600 people will be diagnosed with kidney cancer this year compared to 4,552 in the last calendar period. Kidney cancer is ranked the seventh most common cause of diagnosis in Australia with around 1 in every 65 Australians being afflicted. The increasing prevalence of cancer is expected to further boost the demand for cell therapies such as stem cell therapy to treat it efficiently.

Moreover, in the past few years stem cells have been useful for the repopulation of blood and also immuno-reconstitution following cancer treatment. Moreover, these cells have gained immense popularity among the scientific fraternity as a modality for anti-tumor agent delivery and their utility in tissue regeneration. Quite a few bodies have after implementation also praised this tumor-treating mode. As of data from the Da Vinci Wellness Center (DVC Stem) in October 2023, stem cells have a notable success rate for cancer where around 87.5% experienced improvements.

Stem Cell Therapy Market Regional Insights

North America Stem Cell Therapy Market Growth

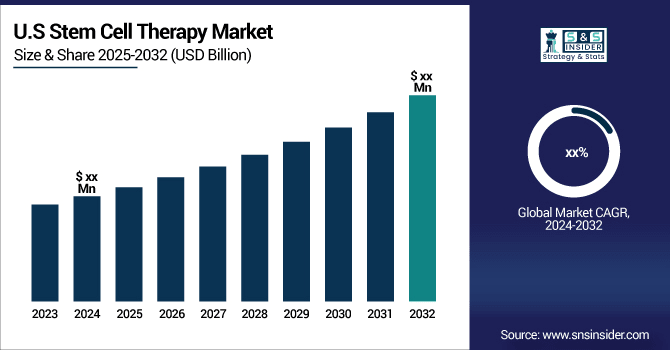

In North America, the market accounted for 44% of the market share owing to the higher incidence rates combined with rising research in stem cell therapies, increased adoption of regenerative medicine within the region, and supportive regulatory framework.

The rise in the incidence of cancer cases in the US will drive market growth. In the same way, based on this data more people will have mouth cancer in 2024 as per the American Cancer Society which was around to report about 15,490 such cases compared with that of the previous year when it reported only --14,820. This is anticipated to propel the demand for stem cell therapies globally as a portion of these therapies are used in advanced cancer treatments, thus subsequently driving the growth of the stem cell therapy market during the projected timeframe.

An increasing focus on the potential of stem cells in cancer management has spurred researchers to explore cell-mediated therapies for various types of cancers. Stem cell therapies in cancer were highlighted by Cedars-Sinai scientists earlier this year, showing how they increase the effectiveness of standard treatments (January 2022).

Likewise, in December 2022 City of Hope and its Alpha Stem Cell Clinic received an $8 million grant from the California Institute of Regenerative Medicine for its work with regenerative medicine and cancer. Therefore, any increase in these research efforts is likely to support the growth of regional stem cell therapy markets.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Stem Cell Therapy Market Key Players

-

Thermo Fisher Scientific, Inc.

-

Merck KGaA

-

CellGenix GmbH

-

Takara Bio

-

Cellartis AB

-

AcceGen

-

Cell Applications, Inc.

-

ATCC

-

Bio-Techne

-

STEMCELL Technologies Inc. & other players.

Stem Cell Therapy Market Competitive Landscape

-

In December 2023, The University of Texas at San Antonio (UTSA) and BioBridge Global subsidiary GenCure signed a master services agreement that formalized their partnership. The agreement details their collaborations to drive the cell therapy product and service development process.

-

In September 2023, The SKAN Research Trust shared its operations with Wellcome-MRC Cambridge Stem Cell Institute hosted in September. They saw a joint research program into the genomic architecture of age-related neurodegeneration diseases in an Indian population.

Stem Cell Therapy Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | US$ 336.07 Million |

| Market Size by 2032 | US$ 1,113.12 Million |

| CAGR | CAGR of 17.10% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Adult Stem Cells (ASCs), Human Embryonic Stem Cells (HESCs), Induced Pluripotent Stem Cells (iPSCs) & Very Small Embryonic Like Stem Cells) •By Application (Neurological Disorders, Orthopaedic Treatments, Oncology Disorders, Injuries and Wounds, Cardiovascular Disorders & Others) •By Therapy (Allogeneic, Autologic & Syngeneic) •By End-Use (Pharmaceutical & Biotechnology Companies, Hospitals & Cell Banks & Academic & Research Institutes) •By Technology (Cell Acquisition, Cell Production, Cryopreservation & Expansion and Sub-Culture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Lonza, Merck KGaA, CellGenix GmbH, Takara Bio, Cellartis AB, AcceGen, Cell Applications, Inc., ATCC, PromoCell GmbH, Bio-Techne, STEMCELL Technologies Inc. & other players |