Data Governance Market Report Scope & Overview:

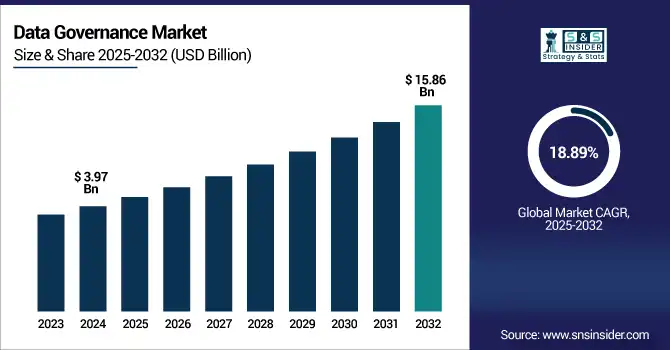

The Data Governance Market size was valued at USD 3.97 billion in 2024 and is expected to reach USD 15.86 billion by 2032, expanding at a CAGR of 18.89% over the forecast period of 2025-2032.

The Data Governance Market is growing fast as organizations attempt to manage and secure data against growing regulatory pressures. Compliance with data privacy regulations such as GDPR and CCPA is driving companies to implement formal data governance programs. Cloud-native solutions are becoming increasingly popular because of scalability and cost-effectiveness, while AI and machine learning support better monitoring of data and policy compliance. BFSI, telemedicine, and telecom industries are at the forefront of adoption, fueled by the urge to protect sensitive information. Yet, technical complexity and high implementation costs are hurdles, particularly for SMEs. As digital transformation picks up speed, demand for strong data governance increases further.

To Get more information on Data Governance Market - Request Free Sample Report

The U.S data governance market size reached USD 0.74 billion in 2024 and is expected to reach USD 2.65 billion in 2032 at a CAGR of 17.38% from 2025 to 2032.

The U.S. leads the data governance market due to its well-developed digital infrastructure, strict regulatory norms, and early adoption of data-driven technologies. The availability of top technology providers like IBM, Oracle, and Informatica also makes the market ecosystem more robust. Key drivers are the mandating of data privacy regulations such as CCPA and HIPAA, growing security threats, and rapid adoption of AI and cloud-based offerings. Moreover, businesses across industries like BFSI, healthcare, and retail are spending considerably on governance platforms for compliance with regulations, data quality management, and risk mitigation, further cementing the U.S. leadership in the international market.

Data Governance Market Dynamics

Drivers:

-

Increasing Complexity of Global Data Privacy Regulations and Compliance Requirements Drives Adoption of Robust Data Governance Frameworks.

The increasing complexity in global data privacy regulation, such as GDPR, CCPA, and HIPAA, is the major factor driving the growth of the data governance market. Organizations are driven to adopt strong data governance strategies to be compliant and avoid any risk of data breach and abuse. In recent trends, we are seeing more automated compliance tools driven by AI/ML that improve data classification and policy enforcement, which allow organizations to remain current with changing regulations and protect sensitive data.

Restraints:

-

High Implementation Costs and Technical Complexity Hinder Widespread Adoption of Data Governance Solutions Among Small and Medium Enterprises.

The substantial investment of resources needed for implementing end-to-end data governance solutions is a major barrier, especially for SMEs. Connecting governance solutions with front-end IT typically requires special knowledge and therefore creates additional workloads. This is not suitable for customary applications in cost-sensitive sectors. Further, the costs of continuing maintenance and support, and of skills development, are causing organisations to hesitate and hold back the market in those sectors where there is insufficient in-house resource to deploy and run a mature data governance system well.

Opportunities:

-

Growing Shift to Cloud-Based Deployments Creates Significant Opportunities for Scalable and Automated Data Governance Solutions.

The swift migration to cloud computing has created a great deal of opportunity for scalable, low-cost data governance in organizations. Cloud-based deployment also enables better integration, real-time monitoring, and access to data, which handles many classical hurdles. New advances, such as hybrid cloud architectures. AI-based platforms that offer enhanced modularity or flexibility to drive automation and enable organizations to manage data governance and stewardship within any distributed setting with speed and efficiency all serve to increase the rate at which enterprises of all kinds are implementing these solutions.

Challenges:

-

Rapid Evolution of Cybersecurity Threats Challenges Traditional Data Governance Frameworks, Necessitating Advanced Adaptive Security Measures.

Meanwhile, more sophisticated cyber threats such as ransomware, insider breaches and AI-powered attacks put a strain on traditional data governance methodologies. Legacy models are not able to respond to newly arising threats and therefore leave organizations exposed. This requires constant updating and proactive threat detection, and real-time response; all of which are challenging to achieve without sophisticated technology and knowledge. A key ongoing challenge for firms is how to manage the tension between access to data and security.

Data Governance Market Segmentation Analysis

By Component

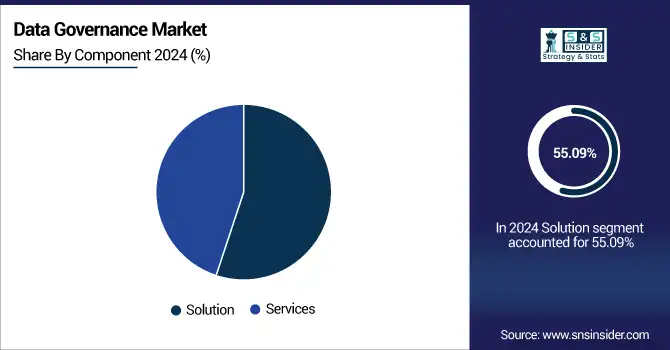

The Solution segment led the data governance market share of 55.09% in 2024, driven by the increasing need for holistic data management and compliance solutions. Solutions in data cataloguing and metadata management tools continue to be deployed by organizations to protect data quality and ensure regulatory compliance. At the same time, data governance market companies such as IBM and Oracle have recently introduced sophisticated AI-based governance solutions that increase data visibility while automating policy enforcement. These data governance market industry-first capabilities are driving market expansion and responding to the growing data governance needs of businesses by enabling companies in all industries to ensure data accuracy and privacy.

The Services segment is expected to witness the fastest CAGR of 19.42% during the forecast period, fueled by the growing need for consultancy, integration, and managed services for complex governance frameworks. Companies such as SAS and Talend have broadened their offerings; they not only provide consulting but also consultancy capabilities designed to help organizations customize their data governance approaches. Such services help enterprises in the efficient handling of changing regulations and in deploying resources more effectively, thereby fostering the growth of data governance services across the world.

By Deployment

The On-Premises deployment segment held a dominant 44.50% revenue share in 2024, preferred by organizations that require a high level of data security and compliance, especially financial services and government sectors. Big players like SAP and Informatica have released more powerful on-premises options featuring the ability to tailor control and integrate as you see fit. This is due to the organisations placing more focus on data sovereignty and in-house control of sensitive data assets, driving demand for security and governance solutions that can govern data privacy within the corporate network for compliance with regional and industry laws and regulations.

The Cloud deployment segment is projected to grow at a rapid CAGR of 19.48%, fueled by higher cloud adoption for more scalable, flexible, and cost- effective data governance.” Cloud and AI data-governance providers such as Zaloni and Magnitude Software have released a new generation of cloud-native platforms that use AI and automation to enhance data quality standards and policy enforcement. The explosive growth of remote work and hybrid cloud environments is demanding cloud governance solutions that enable large organizations to securely control their distributed data compliantly in a way that is operationally agile in extremely dynamic market conditions.

By Application

The Risk Management application segment commanded the largest revenue share of 41.16% in 2024, with the urgent requirement to identify, quantify, and manage data risks in the face of increased cybersecurity threats and regulatory scrutiny. Major enterprises such as IBM and Oracle have launched sophisticated risk analytics and real-time monitoring services to assist organizations in staying ahead of their vulnerabilities. These offerings help businesses reduce data breaches as well as regulatory fines and, as such, enhance their general data governance platforms, which in turn promote the growth of the risk management application market.

The Compliance Management segment is poised for the fastest CAGR of 19.99%, driven by more and more regulations, including GDPR, CCPA, and HIPAA, around the world. Suppliers such as SAS and Talend have developed automation tools for compliance that help to make audits and reporting less of a manual chore and less prone to error. With an increasing volume of pressure on organizations to comply with data privacy regulations, these solutions are intended to provide easily scalable models for ongoing compliance, creating a strong growth opportunity in the data governance market via better regulatory fit.

By Vertical

The BFSI vertical led the market with a 20.11% revenue share in 2024, motivated by severe regulatory requirements for compliance and the immense requirement to mitigate risk within financial services. Players like IBM and SAP have made customized governance products that guarantee data integrity and financial confidentiality. As BFSI involves a high volume of transactions and high-risk data privacy, the move towards digitization of banking and financial services further contributes to demand for strong governance frameworks and acts as a driver for the market.

The Healthcare vertical is expected to grow at the fastest CAGR of 21.65%, driven by the increasing amount of clinical, patient, and research data for which strong policy is needed to safeguard privacy and compliance. Leaders in the space, such as Oracle and Informatica, have brought intriguing offerings to market, designed to keep EHRs safe and to help organizations adhere to HIPAA and other healthcare-based mandates. Rising Healthcare Digitization and the Increasing Adoption of Telemedicine to Accelerate the Growth of the Market. The rise in healthcare digitization and the increasing adoption of telemedicine are expected to create opportunities for the growth of the market in the coming years.

Data Governance Market Regional Analysis

North America accounted for the largest market share in 2024, due to the early adoption of advanced data management solutions, stringent regulations such as CCPA and HIPAA, and established vendors for data governance. Enterprises from industries including BFSI, healthcare, and government are making significant investments in data governance platforms in order to maintain data compliance and security.

The U.S. led the North American market because of well-established IT infrastructure of the country, stringent cyber security laws are there, and heavy investments by enterprises for enjoying digital transformation.

The European data governance market is growing steadily, because of stringent compliance and enforcement of GDPR, the rise in the data privacy concerns and digitalization of verticals such as banking and manufacturing. Organizations are using governance strategies to be compliant and trustworthy, have a measure of control and to be able to manage risk.

The European market is dominated by Germany, which has a robust industrial sector, has aligned its regulations with GDPR at an early stage, and focuses more on structured data management in enterprises.

The Asia Pacific market is projected to be the fastest-growing region with a CAGR of 19.93% due to the rapid digitization, increase in the adoption of cloud technology, and the rise in regulatory compliance. Growing IT spending and developing economies such as India and China are major factors for the data governance market growth in the region.

China, with its thriving tech ecosystem, localization laws, and government handling of the tech sector, dominates the APAC market around secure and transparent data management.

The Middle East & Africa and Latin America are gradually embracing data governance practices, driven by digital government programs, increasing cloud coverage, and evolving data privacy laws. In some countries, such as the UAE and Brazil, there is a clear lead in the region driven by strong digital adoption, the regulatory space, and growing demand from enterprises to store data.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Data Governance Market are Oracle, SAP, IBM, SAS, Informatica, Talend, Magnitude Software, Infogix, Zaloni, Alex Solutions, and others.

Key Developments

-

In May 2025, IBM partnered with Scuderia Ferrari to improve fan interaction through a revamped app based on its Watson AI platform, highlighting sophisticated data management and immersive experience creation in the entertainment and sports industry.

-

In May 2025, SAP deepened its partnership with Collibra to bring AI governance into its data assets to improve transparency, accountability, and adherence to regulatory and privacy regulations in enterprise data landscapes.

-

In May 2025, SAS introduced its AI Governance Maturity Model, a strategic framework used to help organizations effectively measure, build, and expand their data and AI governance capabilities at the Gartner Data & Analytics Summit 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.97 Billion |

| Market Size by 2032 | USD 15.86 Billion |

| CAGR | CAGR of 18.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Solution, Services) •By Application (Compliance Management, Risk Management, Audit Management, Incident Management, Others) •By Data Governance Deployment (On-Premises, Cloud) •By Data Governance Vertical (BFSI, Retail & Consumer, Government, Healthcare, Manufacturing, Telecom and IT, Transportation & Logistics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Oracle, SAP, IBM, SAS, Informatica, Talend, Magnitude Software, Infogix, Zaloni, Alex Solutions |