Internet Of Things (IoT) In Energy Market Report Scope & Overview:

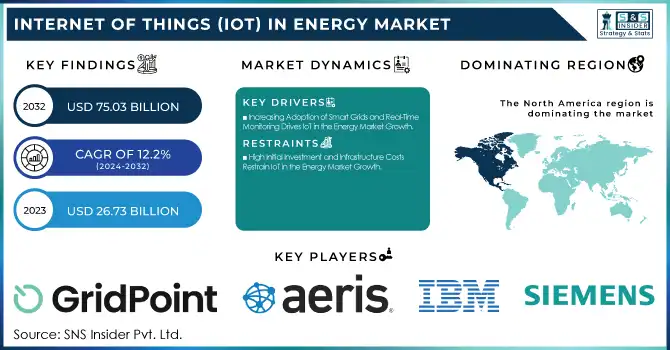

The Internet Of Things (IoT) In Energy Market Size was valued at USD 26.73 Billion in 2023 and is expected to reach USD 75.03 Billion by 2032 and grow at a CAGR of 12.2% over the forecast period 2024-2032.

To Get more information on Internet Of Things (IoT) In Energy Market - Request Free Sample Report

The IoT in the Energy Market is revolutionizing the industry by improving efficiency, optimizing resources, and enabling predictive maintenance. Key applications include real-time monitoring, smart grids, and remote asset management, driving cost savings and sustainability. IoT adoption has led to 30% energy waste reduction, 25% lower maintenance costs, and 17% shorter outage durations. Additionally, IoT enhances solar and wind energy efficiency by 10%. The integration of AI and machine learning further boosts energy analytics and automation. With increasing IoT deployments and a push for carbon reduction, the market is set for significant growth and transformation.

Market Dynamics

Key Drivers:

-

Increasing Adoption of Smart Grids and Real-Time Monitoring Drives IoT in the Energy Market Growth

Smart grids leverage IoT sensors, connected devices, and AI-driven analytics to enhance power distribution efficiency, minimize energy losses, and improve grid resilience. Real-time monitoring enables energy providers to track power consumption, detect faults, and optimize electricity distribution, leading to significant cost savings and enhanced sustainability.

Moreover, IoT-based energy management systems help industries and residential consumers reduce their energy consumption by identifying inefficiencies and automating power usage. Governments worldwide are also investing in smart grid infrastructure to modernize aging power systems, enhance renewable energy integration, and improve demand-side energy management. The rising need for reliable power supply and sustainable energy solutions further accelerates IoT adoption in the energy sector.

Additionally, the increasing penetration of AI, machine learning, and cloud computing further strengthens IoT capabilities, enabling enhanced automation and decision-making in the energy market. As energy companies seek to improve efficiency and sustainability, the adoption of IoT-enabled smart grids and monitoring systems is expected to surge significantly in the coming years.

Restrain:

-

High Initial Investment and Infrastructure Costs Restrain IoT in the Energy Market Growth

Despite its benefits, the IoT in the energy market faces a major restraint due to high initial investment and infrastructure costs. Deploying IoT-based energy solutions requires substantial financial investment in hardware, software, and network infrastructure, making it challenging for small and medium-sized enterprises (SMEs) and developing regions to adopt such technologies. The cost of implementing IoT-enabled smart grids, connected sensors, and real-time monitoring systems can be prohibitively expensive, particularly in areas with aging power infrastructure.

Additionally, integrating IoT with existing energy management systems demands specialized expertise and customized solutions, further escalating operational costs. The high cost of data storage and cybersecurity measures also adds to the overall expenditure, making large-scale IoT adoption financially daunting. Energy companies must ensure robust cybersecurity protocols to prevent data breaches, increasing compliance costs.

Opportunities:

-

Growing Integration of IoT with Renewable Energy Creates Significant Market Opportunities

As the global focus shifts towards sustainability and carbon footprint reduction, renewable energy sources such as solar, wind, and hydroelectric power are gaining traction. IoT solutions play a crucial role in optimizing renewable energy generation, storage, and distribution by providing real-time data insights, predictive analytics, and automated controls. Smart IoT sensors and AI-driven analytics help monitor weather conditions, predict energy output, and optimize energy distribution.

IoT enables smart energy storage systems, allowing for better energy management and grid stability by storing surplus renewable energy and distributing it during peak demand periods. Governments and private investors are increasingly funding IoT-enabled renewable energy projects, further boosting market growth. The development of smart microgrids and decentralized energy systems also benefits from IoT adoption, allowing energy providers and consumers to efficiently manage power flow. As renewable energy adoption continues to expand globally, IoT solutions will play a pivotal role in improving efficiency, reducing costs, and accelerating the transition toward a sustainable energy future.

Challenges:

-

Cybersecurity Threats and Data Privacy Concerns Pose Challenges to IoT in the Energy Market Growth

The IoT in the energy market faces significant challenges due to cybersecurity threats and data privacy concerns. As IoT-connected devices generate and transmit vast amounts of real-time energy data, they become prime targets for cyberattacks, hacking, and data breaches. Critical infrastructure vulnerabilities can lead to severe consequences, including power outages, operational disruptions, and financial losses. The lack of standardized security protocols across IoT energy systems further increases the risk of cyber threats. Many legacy energy infrastructures were not designed with IoT security in mind, making them susceptible to hacking and unauthorized access.

Additionally, IoT-based energy management solutions rely heavily on cloud computing and data analytics, raising concerns about data ownership, regulatory compliance, and privacy protection. Governments and regulatory bodies are enforcing stricter cybersecurity laws and compliance measures to mitigate these risks, but energy companies still struggle with implementing comprehensive security frameworks. Ensuring end-to-end encryption, secure authentication, and real-time threat monitoring is crucial to safeguarding IoT-driven energy networks.

Segments Analysis

By Component

In 2023, the Solution segment dominated the IoT in the energy market, accounting for 82% of revenue. This segment encompasses hardware and software components that facilitate real-time monitoring, data analytics, and automation within energy systems. The substantial revenue share reflects the energy sector's increasing investment in IoT solutions to enhance operational efficiency and sustainability. Notable developments include Schneider Electric's launch of the EcoStruxure IoT platform, designed to provide comprehensive energy management solutions through advanced analytics and automation. Similarly, Siemens introduced the MindSphere IoT operating system, enabling seamless integration and analysis of energy data to optimize performance.

The Services segment is projected to experience the Fastest CAGR of 13.4% during the forecast period. This segment includes consulting, implementation, and managed services that support the deployment and maintenance of IoT technologies in the energy sector. The anticipated growth is driven by the increasing complexity of IoT ecosystems, necessitating specialized expertise for effective implementation and management. Companies like IBM have expanded their IoT services offerings, providing comprehensive consulting and integration services tailored to the energy industry.

Additionally, Accenture has developed specialized IoT services to assist energy companies in digital transformation initiatives, focusing on enhancing efficiency and sustainability. The rising demand for these services highlights the importance of expert guidance in navigating the complexities of IoT adoption, ensuring secure and efficient integration into existing energy infrastructures.

By Application

In 2023, the Smart Grid segment emerged as the leading revenue contributor in the IoT in Energy Market. Smart grids utilize IoT technologies to enhance the efficiency, reliability, and sustainability of electricity distribution. This platform exemplifies how IoT solutions are being deployed to modernize grid infrastructures, improve operational efficiency, and support decarbonization efforts. The integration of IoT into smart grids enables real-time monitoring, predictive maintenance, and efficient energy management, thereby reducing operational costs and enhancing service reliability. The dominance of the Smart Grid segment underscores the critical role of IoT technologies in transforming traditional energy infrastructures into more intelligent and responsive systems, aligning with global sustainability goals.

The Coal Mining segment is projected to experience the highest compound annual growth rate (CAGR) within the forecasted period. The adoption of IoT in coal mining operations aims to enhance safety, optimize production processes, and reduce operational costs. IoT applications in this sector include real-time monitoring of equipment, environmental conditions, and worker safety, which collectively contribute to more efficient and secure mining operations. While specific company launches and product developments in the coal mining IoT segment were not highlighted in the provided sources, the anticipated growth indicates a significant trend toward digital transformation in the industry. The integration of IoT technologies in coal mining reflects a broader movement toward leveraging advanced technologies to improve operational efficiency and safety standards in traditional energy sectors.

By Connectivity

In 2023, Wi-Fi emerged as the dominant connectivity technology in the IoT energy market, capturing 35% of the revenue share. Wi-Fi's widespread adoption is attributed to its robust data transmission capabilities, established infrastructure, and seamless integration with existing networks, making it ideal for energy applications requiring high data throughput and reliable communication. A notable development in this space is Morse Micro's recognition at the 2023 Wi-Fi NOW Awards, where it won the Best Wi-Fi IoT Product award for its innovative Wi-Fi HaLow solutions. These solutions are tailored for IoT applications, offering extended range and lower power consumption, which are crucial for energy sector deployments. The integration of advanced Wi-Fi technologies facilitates real-time monitoring, predictive maintenance, and efficient energy management, thereby enhancing operational efficiency and reducing costs.

The Z-Wave segment is projected to experience the highest CAGR of 13.0% during the forecasted period. Z-Wave's growth is driven by its reliable, low-power, and secure mesh networking capabilities, which are particularly suited for energy management applications. In April 2024, Trident IoT launched the Taurus Z-Wave Series, encompassing system-on-chip (SoC) solutions and modules that support the latest advancements in Z-Wave technology, including Z-Wave Long Range (ZWLR). This innovation enables extended connectivity, supporting up to 4,000 devices on a single network, which is beneficial for large-scale energy management systems. Additionally, Shelly Group unveiled an upgraded Z-Wave lineup featuring ZWLR technology, offering up to a 1-mile connectivity range and enhanced energy efficiency, making it ideal for extensive energy infrastructures. The rapid adoption of Z-Wave technology reflects a growing trend toward implementing scalable and efficient IoT solutions in the energy sector, facilitating improved monitoring, control, and optimization of energy resources.

Regional Analysis

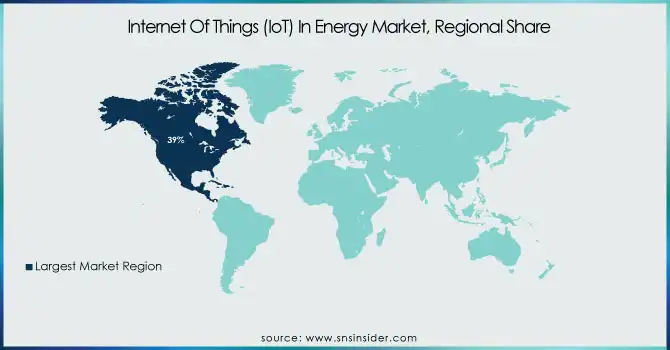

In 2023, North America led the Internet of Things (IoT) in the energy market, accounting for approximately 39% of the global revenue share. This dominance is attributed to the region's robust technological infrastructure and strong policy support for smart energy solutions. For example, the integration of IoT technologies has enabled efficient management of renewable energy sources, enhanced grid reliability, and provided consumers with real-time energy usage data, thereby optimizing energy production and consumption.

Meanwhile, the Asia Pacific region is experiencing rapid growth in the IoT energy sector, with an anticipated CAGR of 13.3% from 2024 to 2032. This surge is driven by rapid urbanization and the rising need for efficient energy management systems. Investments in smart grid technologies and the expansion of renewable energy sources are complemented by IoT innovations, allowing for enhanced energy distribution and monitoring, catering to the region's escalating energy demands. For instance, countries like China and Japan are focusing on reducing their carbon footprints and investing heavily in smart city projects, which include the deployment of IoT solutions in energy management.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Internet Of Things (IoT) In Energy Market are:

-

GridPoint, Inc. (GridPoint Energy Management System, GridPoint Smart Building Platform)

-

Aeris Communications, Inc. (Aeris Fusion IoT Network, Aeris Intelligent IoT Connectivity)

-

IBM Corporation (IBM Maximo Asset Monitor, IBM Watson IoT Platform)

-

Siemens AG (MindSphere IoT Platform, Siemens Spectrum Power)

-

Johnson Controls International PLC (OpenBlue Enterprise Manager, Johnson Controls Metasys)

-

AGT International SpA (IoTA Industrial IoT Platform, AGT Predictive Energy Analytics)

-

Cisco Systems, Inc. (Cisco Kinetic for Cities, Cisco IoT Control Center)

-

Davra Networks Limited (Davra IoT Platform, Davra Energy Optimization Suite)

-

Intel Corporation (Intel IoT Gateway, Intel Edge Insights for Industrial)

-

SAP SE (SAP Leonardo IoT, SAP Predictive Maintenance and Service)

Recent Trends

-

September 2023: Aeris Communications, an IoT and telematics solutions provider based in Noida, India, reported that over 75% of its revenue originated from the domestic electric vehicle (EV) industry, particularly from electric two- and three-wheeler original equipment manufacturers (OEMs) and last-mile delivery and logistics service providers.

-

January 2025: IBM highlighted the transformative role of IoT data in driving innovation across industries. The proliferation of 5G technology facilitated the widespread deployment of IoT devices, from vehicles and household appliances to drones and manufacturing plants. These devices collected and shared data over high-speed networks, enabling advancements in artificial intelligence and cloud computing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 26.73 Billion |

| Market Size by 2032 | US$ 75.03 Billion |

| CAGR | CAGR of 12.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component type (Solution [Asset Management, Energy Management, Safety Solution, Connected Logistics, Compliance & Risk Management, Data Management & Analytics, Others], Service [Professional Services, Managed Services]) •By Application (Oil & Gas, Coal Mine, Smart Grid) •By Deployment Mode (On-premise, Cloud) •By Connectivity (Zigbee, Wi-Fi, Bluetooth, Z-Wave, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GridPoint, Inc., Aeris Communications, Inc., IBM Corporation, Siemens AG, Johnson Controls International PLC, AGT International SpA, Cisco Systems, Inc., Davra Networks Limited, Intel Corporation, SAP SE. |