Bioethanol Yeast Market Size:

Get More Information on Bioethanol Yeast Market - Request Sample Report

The Bioethanol Yeast Market Size was valued at USD 17.5 Billion in 2023 and is expected to reach USD 57.3 Billion by 2032 and grow at a CAGR of 14.1% over the forecast period 2024-2032.

The growth of biofuel consumption stems from a global trend towards renewable energy that is largely driven by increasingly stringent government measures to limit fossil fuel use worldwide. Globally, biofuel production amounted to roughly 170 billion liters in 2021, while bioethanol represented about 90 billion liters of the total according to the International Energy Agency (IEA). To achieve climate goals detailed in international agreements like the Paris Agreement, several governments are implementing policies and incentives so biofuels can take greater hold.

An example of one such program is the Renewable Fuel Standard (RFS), administered by the U.S. Environmental Protection Agency (EPA) which requires renewable fuels including bioethanol to be blended into transportation fuel. The Renewable Fuel Standard (RFS) aimed for 20.82 billion gallons of renewable fuels in 2023, demonstrating the expanding contributions of bioethanol to the energy portfolio. The European Union, likewise, is now implementing the Renewable Energy Directive, which contains a target for at least 10% renewable energy in transport and debates are ongoing to increase these targets. Such regulations and incentives increase the demand for bioethanol which, in turn, increases the demand for the yeast used in fermentation of bioethanol and also drives growth of the global market over a given period.

R&D is a crucial phase where an upsurge in the investment for R&D drives the bioethanol manufacturing process to be efficient and sustainable. Many industries have invested a lot of time and money into research and development (R&D) for fermentation technologies, such as private firms, research institutes, and government agencies to enhance yeast activity. These endeavors aim to develop engineered yeast able to grow in harsh conditions at elevated temperatures and extreme ethanol levels, which finally increases fermentation efficiency. Research and Development are also focusing on new enzymatic routes to break down the complex biomass into fermentable sugars to lower the overall production cost and improve efficacy.

According to the DOE's Bioenergy Technologies Office (BETO), the federal investment in bioenergy research and development reached approximately USD 700 million in the fiscal year 2021, aimed at advancing technologies for biofuels, including bioethanol. This funding supports various initiatives focused on improving fermentation efficiency, enhancing yeast performance, and developing sustainable production methods, demonstrating the significant commitment to R&D in the bioethanol sector.

Bioethanol Yeast Market Dynamics

Drivers

-

Diversification of feedstocks drives the market growth.

Diversification of feedstocks is a major growth driver for the bioethanol yeast market, as it provides more raw materials available to produce bioethanol. Bioethanol has traditionally been produced from food crops like corn and sugarcane, but now advances in fermentation technology and yeast development enable the use of a wider range of feedstocks agricultural residues, lignocellulosic biomass, and even municipal waste. This not only alleviates competition with food supply but also enhances sustainability by utilizing waste materials that would otherwise be disposed of and pollute the environment. Fermentation of these diverse substrates demands specialized yeast strains, propelling the demand for bioethanol yeast. Using non-food feedstocks also helps stabilize supply chains and lowers price volatility of traditional crops, so that bioethanol from this type of production has a more secure future. With the increased acceptance of these alternative feedstocks by the producers, the bioethanol yeast market will inevitably deliver significant growth for various fermentation needs with a suitable and competitive product offering for different raw materials.

Restrain

-

Limited Consumer Awareness and Acceptance may hamper the market growth.

One of the major hindrances in the market growth of bioethanol is limited consumer awareness and acceptability regarding these types of renewable fuel substitutes. Even though bioethanol is a cleaner, more sustainable alternative to traditional fossil fuels, people are often largely unaware of its environmental advantages and performance. However, consumers are often not aware of the role of bioethanol in reducing greenhouse gas emissions and decreasing dependence on petroleum-based fuels which makes them hesitant to switch to bioethanol-blended fuels. In addition to this, the misconception regarding biofuels in terms of compatibility with vehicles or the reduction in engine efficiency has also played an important role in continuing low acceptance. These competitive forces are essential market dynamics, but demand is mostly a factor of consumer preferences, and neglecting such awareness will affect demand.

Bioethanol Yeast Market Segmentation

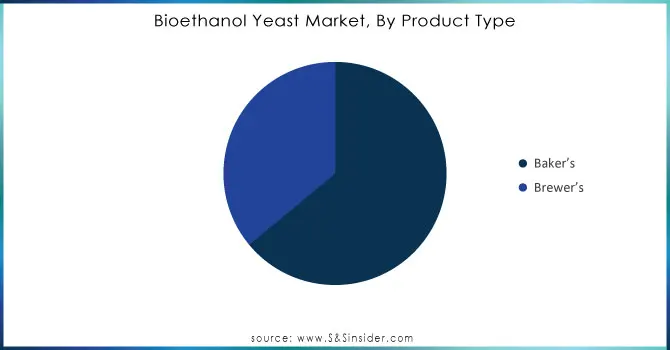

By Product Type

Bakers held the largest market share around 64% in 2023. This is owing primarily to their stronger and more constant demand for yeast as a vital ingredient in bread-making. Yeast is responsible for fermentation, which is essential for producing the texture, flavor and volume in baked goods. Specific strains of yeast that ferment sugars and produce carbon dioxide are very important in the baking industry because carbon dioxide induces dough swelling. In addition, the expanding global bakery trend due to high consumer inclination for baked items such as artisan bread, pies & pastries, and other convenience food products has further strengthened the market position of yeast. Innovation of yeast applications has also been prompted by the trend for healthier and more diverse bakery products including gluten-free and other specialty breads with bakers looking for strains that can meet these requirements. Also, bakers usually have relationships with yeast suppliers that last a while, directing regular purchases and stability of demand respectively. The high-volume continuous demand for quality yeast during the baking process is one of the key factors attributing to bakers' lead in terms of market share in the bioethanol yeast market.

Need Any Customization Research On Bioethanol Yeast Market - Inquiry Now

By Application

Food held the largest market share around 38% in 2023. Mostly because yeast is heavily used in most foods to help with baking and fermentation processes. Yeast is an essential component in bread, pastries, and other baked goods to leaven the dough and develop flavors. Besides, yeast finds its use in the manufacture of alcohols like beer and wine, which again provides a huge boost to market demand from the food industry. Consumer preference for artisanal and specialty foods as well as the consumption of home-baked fermentation is driving demand for high-quality yeast strains. Moreover, the variety of end products, from traditional baked goods to new gluten-free creations in bioethanol yeast also contributes to the application in food that continues to draw consumer attention. The changing trends of the food industry constantly keep demanding specialized yeast strains to be used, which in turn improves the quality of product and meets dietary preferences therefore driving the need for bioethanol yeast remains high. The food sector is considered vital because it continues to represent more than two-thirds of all bioethanol yeast market segments.

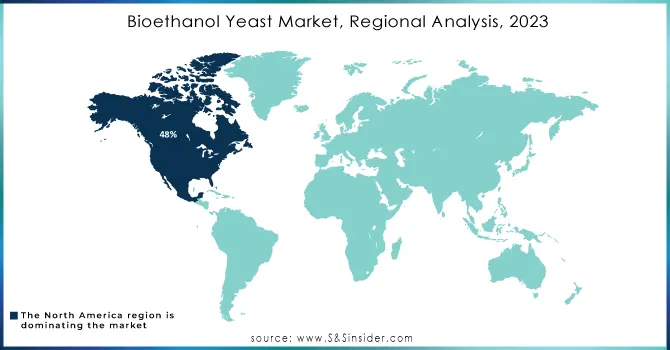

Bioethanol Yeast Market Regional Analysis

North America held the largest market share around 48% in 2023. It is because of several interconnected factors, whereby they have created a conducive environment for growth. Importantly, the region has an advanced biofuel sector based on government policies and incentives to reduce reliance on fossil fuels and encourage renewable energy. The Renewable Fuel Standard (RFS) in the U.S., for example, requires blending biofuels into conventional fuels, creating a strong market for bioethanol production. Also, North America contains large agricultural resources and can break down diverse feedstock such as corn and sugarcane for bioethanol fermentation. Leading baking and brewing sector participants are also driving the bioethanol yeast demand, as these end-use industries are among the major consumers of yeast for fermentation. Additionally, continuous development of yeast for better performance and efficiency will further enhance the market growth. With a supportive regulatory framework, access to feedstock, and a vibrant food and beverage sector.

Key Players

-

Angel Yeast Co., Ltd. (Angel Yeast, Bioethanol Yeast)

-

Lesaffre (Safbrew, Safinvert)

-

AB Vista (AB Biotek Yeast, Bioethanol Yeast)

-

Yeast Technologies (Aqua-Yeast, Fermax)

-

Fermentis (a subsidiary of Lesaffre) (SafSpirit, Fermentis Yeast)

-

Baker's Yeast Co. (Baker's Yeast, Bioethanol Yeast)

-

Lallemand Inc. (Lallemand Biofuels & Distilled Spirits, Lallemand Yeast)

-

DANISCO (DuPont) (Danisco Yeast, Bioethanol Yeast)

-

Kraft Foods Group, Inc. (Kraft Yeast, Baker's Yeast)

-

Ginkgo BioWorks (Ginkgo Yeast, Bioethanol Strain)

-

Saccharomyces Cerevisiae (S. Cerevisiae Strain, Ethanol-Optimized Yeast)

-

Genomatica (Genomatica Bioethanol, Bioengineered Yeast)

-

Austrianova (Austrianova Yeast, Bioethanol Strain)

-

Alltech (Alltech Yeast, Bioethanol Yeast)

-

Synlogic (Synlogic Yeast, Bioethanol Strain)

-

Novozymes (Novozymes Yeast, Bioethanol Solutions)

-

Pioneer Hi-Bred International, Inc. (Pioneer Yeast, Bioethanol Technology)

-

Syngenta (Syngenta Yeast, Bioethanol Strain)

-

AB Enzymes (AB Enzymes Yeast, Bioethanol Solutions)

-

Advanced Biofuels USA (Advanced Yeast Strain, Bioethanol Yeast)

Recent Development:

-

In 2023: AB Vista developed a new yeast product designed to enhance fermentation performance under various temperature conditions, addressing challenges in bioethanol production during extreme climates.

-

In 2023: Genomatica achieved a significant milestone by developing a new bioengineered yeast strain capable of converting multiple types of sugars into bioethanol more efficiently, which enhances the sustainability of bioethanol production.

-

In 2022, Lesaffre introduced a range of innovative yeast solutions aimed at enhancing ethanol yield, including the Safbrew range tailored for fuel ethanol production, which has shown improved performance in diverse conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.5 billion |

| Market Size by 2032 | US$ 57.3 Billion |

| CAGR | CAGR of14.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Baker’s, Brewer’s) • By Application (Food, Animal Feed, Biofuel, Cleaning & Disinfection, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Angel Yeast Co., Ltd., Lesaffre, AB Vista, Yeast Technologies, Fermentis, Baker's Yeast Co., Lallemand Inc., DANISCO (DuPont), Kraft Foods Group, Inc., Ginkgo BioWorks, Saccharomyces Cerevisiae, Genomatica, Austrianova, Alltech, Synlogic, Novozymes, Pioneer Hi-Bred International, Inc., Syngenta, AB Enzymes, Advanced Biofuels USA, and others. |

| Key Drivers | • Diversification of feedstocks drives the market growth. |

| Restraints | • Competition with Food Production may hamper the market growth. |