Hexamethylenediamine Market Size & Overview:

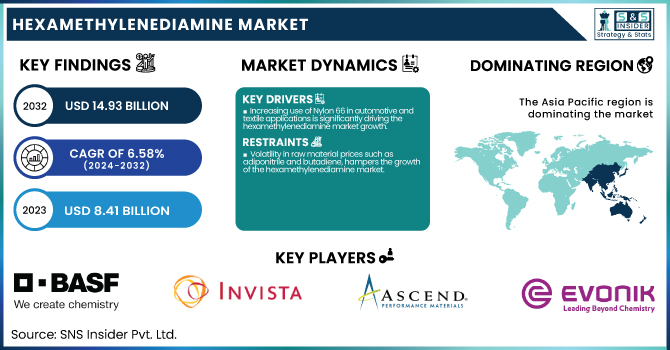

The Hexamethylenediamine Market size was USD 8.41 billion in 2023 and is expected to reach USD 14.93 billion by 2032 and grow at a CAGR of 6.58% over the forecast period of 2024-2032.

To Get more information on Hexamethylenediamine Market - Request Free Sample Report

The report provides a comprehensive analysis of key operational and regulatory metrics shaping the industry. It includes 2023 data on global production capacity and utilization by type, highlighting regional supply- demand gaps. The report examines feedstock price trends, particularly adiponitrile and butadiene, across major producing countries. It also evaluates the regulatory impact on manufacturing and transportation, especially in North America, Europe, and Asia-Pacific. Environmental performance indicators such as GHG emissions, waste management, and sustainability initiatives, are assessed across key regions. Additionally, the study explores innovation trends and R&D investments in bio-based HMDA and nylon-66 applications. The analysis supports strategic decisions with a focus on long-term market resilience and compliance.

The United States held the largest market share in the Hexamethylenediamine market in 2023, valued at USD 1.33 billion, and is projected to reach USD 2.40 billion by 2032, growing at a CAGR of 6.84% during 2024–2032. due to its well-established nylon-66 manufacturing ecosystem, strong industrial base, and high demand from key end-use sectors such as automotive, textiles, and coatings. The country benefits from the abundant availability of key feedstocks like adiponitrile and butadiene, supported by advanced refining and petrochemical infrastructure. Additionally, the presence of major global players such as INVISTA and Ascend Performance Materials drives innovation, large-scale production, and efficient supply chain integration. Government support for domestic manufacturing and emphasis on sustainable chemical practices further enhance the market's growth potential.

Hexamethylenediamine Market Dynamics

Drivers

-

Increasing use of Nylon 66 in automotive and textile applications is significantly driving the hexamethylenediamine market growth.

Hexamethylenediamine (HMDA) plays a critical role in the production of nylon 66, a material widely utilized in automotive components and textile manufacturing due to its strength, heat resistance, and durability. The growing demand for lightweight materials in the automotive sector, aimed at improving fuel efficiency and reducing emissions, is fueling the consumption of nylon 66 and, in turn, HMDA. Additionally, the textile industry is increasingly adopting nylon 66 in industrial fabrics, activewear, and technical textiles due to its high tensile strength and wear resistance. The shift toward high-performance and durable materials in both sectors creates consistent demand for HMDA. With automotive electrification and industrial modernization on the rise, especially in countries like the U.S., China, and Germany, the use of nylon 66 is projected to grow further, reinforcing HMDA demand across the forecast period.

Restrain

-

Volatility in raw material prices such as adiponitrile and butadiene, hampers the growth of the hexamethylenediamine market.

One of the major restraints facing the Hexamethylenediamine market is the significant price volatility of its primary feedstocks adiponitrile and butadiene. These raw materials are derived from petrochemical processes and are subject to fluctuations in crude oil prices, geopolitical instability, and supply chain disruptions. For instance, any sharp rise in crude oil prices leads to increased production costs for adiponitrile, which in turn raises the overall cost of manufacturing HMDA. In addition, global supply constraints or trade restrictions can result in inconsistent availability, further impacting production planning and cost forecasting for key market players. Such instability poses a challenge to manufacturers, particularly smaller firms with limited financial flexibility. The price-sensitive nature of end-use industries such as textiles and automotive compounds this issue, making raw material volatility a critical restraint in the market’s growth trajectory.

Opportunity

-

The emergence of bio-based hexamethylenediamine as a sustainable alternative creates lucrative opportunities for market players.

The increasing global focus on sustainability and the circular economy is opening up significant opportunities for bio-based alternatives in the chemical industry, including bio-based Hexamethylenediamine. Innovations in green chemistry and biotechnology are enabling the production of HMDA from renewable feedstocks, reducing dependence on fossil-derived raw materials. This shift is supported by growing regulatory pressure and environmental concerns associated with traditional petrochemical processes, especially in regions like Europe and North America. Companies such as Genomatica are already investing in developing bio-based nylon intermediates, signaling strong future potential. Bio-based HMDA not only reduces the carbon footprint but also aligns with the corporate sustainability goals of major manufacturers. As industries such as automotive, textiles, and packaging increasingly favor environmentally friendly solutions, the adoption of bio-based HMDA could become a key differentiator and unlock new revenue streams for early adopters in this evolving market landscape.

Challenge

-

Stringent environmental regulations on emissions and waste management pose operational challenges to HMDA manufacturers globally.

The production of hexamethylenediamine involves energy-intensive processes and the handling of hazardous chemicals, leading to significant environmental concerns, including greenhouse gas emissions and chemical waste. As a result, regulatory bodies across the globe are imposing stricter environmental and safety regulations on chemical manufacturing facilities. For instance, compliance with the European Union’s REACH regulation and the U.S. Environmental Protection Agency’s emission standards requires heavy investment in waste management systems, emissions control technologies, and periodic audits. These regulations increase operational complexity and costs, especially for facilities in developing regions that may lack advanced infrastructure. Additionally, failure to comply with environmental standards can lead to fines, shutdowns, or reputational damage. Balancing production efficiency with environmental compliance presents a persistent challenge for HMDA manufacturers, potentially affecting profitability and slowing down capacity expansion in cost-sensitive markets.

Hexamethylenediamine Market Segmentation Analysis

By Application

Nylon Synthesis segment accounted for the largest share, around 42%, in the hexamethylenediamine market. HDMA is one of the key raw materials in the polymerization of nylon 66, where it interplays with adipic acid, forming the polyamide chain. Nylon 66 is known for its superior mechanical strength, heat resistance, and wear properties, which can be used for high-performance automotive components, textiles, electrical equipment, and industrial machinery. Nylon 66 is increasingly becoming the go-to choice with the growing demand for low-weight and high-durability material, especially in vehicles and transportation. Nylon 66 is the largest segment in nylon synthesis application, and this is how consistent, large-volume usage of HMDA in nylon 66 additive production has further benefited the overall growth, value, and market space of HMDA.

By End Use

Automotive held the largest market share, around 32%, in 2023. It is highly regarded in the automotive industry for its strength, thermal stability, and its abrasion and chemical resistance. Nylon 66 has a required raw material, that is, the hexamethylene diamine (HMDA). Those characteristics create benefits, making it fit for use in under-the-hood parts, fuel system components, engine covers, cable insulation, and structural elements, especially as automakers move toward lighter materials to improve fuel efficiency and satisfy tough emission regulations. The skyrocketing sales of electric vehicles (EVs) have also resulted in the growing demand for high-performance polymers in thermal and electrical insulation applications. Consequently, the automotive industry has been at the forefront of performance optimization and sustainability, therefore making the automotive sector the largest end-use segment within the HMDA market.

Hexamethylenediamine Market Regional Outlook

Asia Pacific held the largest market share, around 38%, in 2023. It is owing to the stronghold of the region in terms of industrial base, urbanization, and fast-growing automotive and textile manufacturing. China, India, and the rest of Asia, Japan, and South Korea have all enjoyed rapid growth in demand for the nylon 66 that depends on dial, the principal raw chemical building block, to power their market expansions. The availability of large-scale production plants, a cheap skilled workforce, and government policies promoting chemical manufacturing in the region also intensify the market growth. Furthermore, increasing investments in infrastructure, coupled with rising consumer markets and rising nylon-based product exports, have also helped the consumption of HMDA in the region. HMDA business in Asia Pacific continues to lead the global market, and this trend is likely to persist over the forecast period owing to a progressive rise in manufacturing technologies, coupled with a shift towards high-performance materials in several industrial applications, including automotive, construction, and electronics.

North America held a significant market share. It is due to its developed industrial ecosystem, home to major producers and high demand from end-use industries (automotive, textiles, and coating). North America, especially the U.S., is the region of the world containing integrated nylon 66 and nylon 66 intermediate production facilities by major producers, including INVISTA and Ascend Performance Materials. Given the development of its petrochemical industry, the region also enjoys stable supply chains of feedstock like adiponitrile and butadiene. In addition, the growing emphasis on lightweight and fuel-efficient vehicles has fueled the consumption of nylon 66 in automotive applications, in turn driving the demand for HMDA. Additionally, stringent regulations that encourage sustainability and high-performance materials support the growth of the market. Currently, North America accounts for a significant demand for HMDA, which is expected to pave an important role in the eve of the U.S. HMDA market landscape with persistent R&D and expansions to increase the capacities.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Ultramid, Polyhexamethylene Adipamide)

-

INVISTA (ADN, DYTEK A)

-

Ascend Performance Materials (Vydyne, Hexatran)

-

Evonik Industries AG (Vestamid, TEGOSTAB)

-

Radici Group (Radilon, Heraflex)

-

Toray Industries Inc. (Amilan, TORELINA)

-

Solvay (Technyl, Ixef)

-

LANXESS (Durethan, Ultramid B3)

-

DSM Engineering Materials (Stanyl, Akulon)

-

UBE Corporation (UBE NYLON 6, UBE NYLON 66)

-

Shandong Haili Chemical Industry Co., Ltd. (HMDA, Nylon 66 Salt)

-

Genomatica, Inc. (bio-HMDA, GENO™ Nylon)

-

Asahi Kasei Corporation (Leona, Hexalon)

-

DOMO Chemicals (Technyl, Stabamid)

-

Mitsubishi Chemical Corporation (Novamid, DURANEX)

-

LANXESS AG (Caprolactam, Adipic Acid)

-

UBE Industries Ltd. (Hexamethylene Diamine, Adiponitrile)

-

Liaoning Shuangyi Chemical Co., Ltd. (HMDA 99.9%, Nylon Salt)

-

Hengshui Haoye Chemical Co., Ltd. (Industrial HMDA, Refined HMDA)

-

Rennovia Inc. (Bio-Adipic Acid, Bio-HMDA)

Recent Development:

-

In October 2024, Evonik revealed its intention to restructure its keto and pharmaceutical amino acids business. The company is assessing strategic options for its manufacturing facilities in Ham, France, and Wuming, China, and plans to cease production at its Hanau, Germany, site by the end of 2025.

-

In October 2024, Evonik formed a partnership with Kolmar Cosmetics to foster innovation within the Chinese beauty industry. The collaboration aims to develop sustainable and high-performance beauty products by integrating both global and local technological capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.41 Billion |

| Market Size by 2032 | USD 14.93 Billion |

| CAGR | CAGR of 6.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Nylon Synthesis, Coating Intermediates, Biocides, Lubricants, Adhesives, Others) •By End Use (Automotive, Textile, Paints & Coatings, Petrochemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, INVISTA, Ascend Performance Materials, Evonik Industries AG, Radici Group, Toray Industries Inc., Solvay, LANXESS, DSM Engineering Materials, UBE Corporation, Shandong Haili Chemical Industry Co., Ltd., Genomatica, Inc., Asahi Kasei Corporation, DOMO Chemicals, Mitsubishi Chemical Corporation, LANXESS AG, UBE Industries Ltd., Liaoning Shuangyi Chemical Co., Ltd., Hengshui Haoye Chemical Co., Ltd., Rennovia Inc. |