Fluorescent Pigment Market Report Scope & Overview:

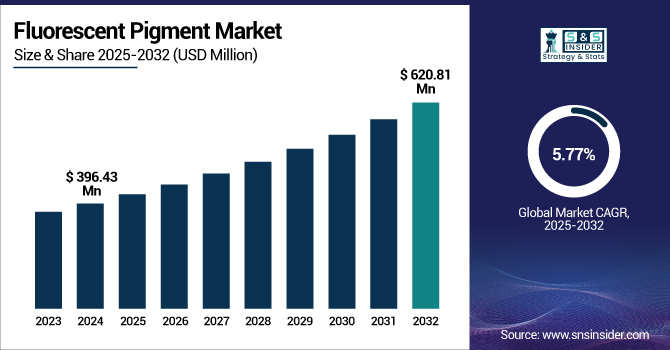

The Fluorescent Pigment Market size was valued at USD 396.43 million in 2024 and is expected to reach USD 620.81 million by 2032, growing at a CAGR of 5.77% over the forecast period of 2025-2032.

To Get more information on Fluorescent Pigment Market - Request Free Sample Report

The fluorescent pigment market is driven by increasing demand for fluorescent pigments from various end-use industries, such as the paint & coating industry, packaging, and textiles. Consumption of fluorescent paint for automotive designs, safety markings, and consumer products is accelerating market growth. The eco-friendly innovations in organic fluorescent pigments, along with regulatory compliance with the environment, drive demand for fluorescent pigment companies. Market dynamics are also influenced by the trends in retail fluorescent dyes for counterfeit prevention and better branding.

Moreover, a rise in safety application demand in fluorescent paint for road marking and high-visibility gear further paves the way for the U.S. fluorescent pigment market and major firms focused on eco-friendly pigments, such as DayGlo Color Corp. and BASF.

Fluorescent Pigment Market Dynamics:

Drivers:

-

Integration of Fluorescent Pigments in Smart Packaging Enhances Product Visibility and Security

High adoption of smart packaging is driving the market growth for fluorescent pigments to increase visibility and security of the product. They are used in packaging materials to produce eye-catching effects and to include hidden security features that protect against counterfeiting. Fluorescent pigments in smart packaging not only attract consumer interest but also help in ensuring product authenticity, which is further projected to grow rapidly across several industries, including pharmaceuticals and consumer goods. This trend is as per the changing dynamics toward smart packaging solutions that can provide both beauty and function, further contributing to the market expansion as a whole.

-

Rising Demand for Fluorescent Pigments in Textile Applications Enhances Market Expansion

The fluorescent pigment market is growing due to the increasing usage of fluorescent pigments in textile applications, including high-visibility clothing and fashion apparel. They are used for vibrant and catchy designs and even to improve safety by increasing visibility in low-light environments in workwear and activewear. The rising focus on safety compliance and the results of fluorescent dye clothing has become a trending topic nowadays for bold fashion statements. The fungible nature of colourfast high-performance pigments is also supporting the trend, along with their compatibility with individual fibre types; all of these factors are fuelling the market share in the textile industry.

Restraints:

-

Environmental Regulations on Pigment Waste Disposal Pose Challenges to Market Growth

The market growth is challenged by the stringent environmental regulations related to the disposal of waste during pigment production. Manufacturers are required to meet standards of waste management for restricting toxic substance pollution into the Ecosystem. Such regulations require sophisticated waste treatment and disposal systems, further increasing the operating costs. Compliance with environmental regulation is highly complex and costly, which restricts their production capacity expansion and discourages new entrants amidst stringent regulations, eventually limiting the overall growth of the market.

-

Health Concerns Related to Exposure to Certain Fluorescent Pigments Limit Market Expansion

The use of some fluorescent pigments is restricted due to health concerns related to exposure to pollution by certain pigments, especially those that are heavy metals and toxic. This has led to increased concern for safety considerations primarily due to occupational exposure in manufacturing processes and potential risks to end-users, further resulting in regulatory scrutiny. The need for safer, non-toxic pigment substitutions, in some cases, is driving research and development activities, and valuable data may be required for these efforts using non-toxic pigments, which means higher manufacturing costs and intensive use of test data. Such health considerations and supporting policies may hamper the fluorescent pigment market analysis, restricting the growth of the market in sensitive application areas, such as food packaging and some children's products.

Fluorescent Pigment Market Segmentation Analysis:

By Formulation

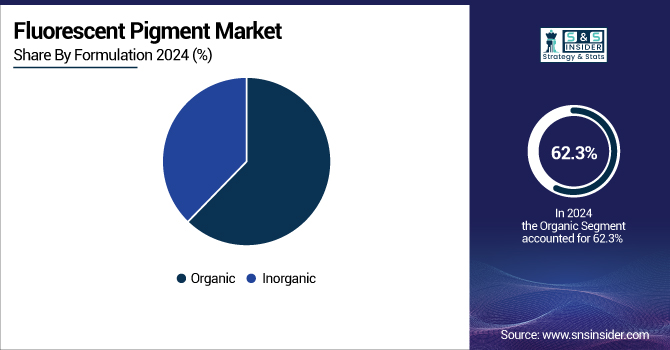

In 2024, organic fluorescent pigments dominated the market, holding 62.3% total share globally due to their bright color strength and environmental safety, broad applications in paints, coatings, and textiles. But, as agencies, such as the EPA, continue to tighten regulations, the demand for alternatives has seen a boom in the market globally. In addition, their higher brightness and color spectrum make them compatible for all high-visibility applications, which may include safety signs and consumer packaging. Similarly, innovations in biodegradable and non-toxic pigment formulations continue to favor the supremacy of their use over the conventional counterparts, fostering wider commercialization of pigments across industries, harnessing sustainability.

In terms of growth, the inorganic pigments segment is anticipated to grow rapidly at a prominent CAGR on account of their superior properties, such as stability against heat, light, and resistance to chemicals. These pigments are preferred in industries including automotive, construction, and road safety, where long-lasting performance is needed. They are stable and bright in even the most extreme of conditions, making them useful for traffic signs, safety equipment, and several other. In response to the increasing emphasis on infrastructure building and measures to improve road and public safety, manufacturers are inclined toward offering novel inorganic solutions, which in turn is increasing their share in the global market.

By Type

In 2024, the daylight fluorescent pigments segment held the largest share in the fluorescent pigments market, adding up to 55.1%. These pigments are fully visible under natural lighting and are used in applications such as advertising, textile printing, and safety signs. The strength of their color intensity helps in highlighting products, essential in any packaging and branding process. Demand for daylight pigments has been increasing as consumer-facing industries are valuing visual attractiveness. Moreover, companies are enhancing the lightfastness and environmentally benign nature of these pigments, making them broader in terms of application and confirming their leadership position within the market.

The phosphorescent pigments are the fastest-growing segment, accounting for significant growth during the forecast period of 2025 to 2032, as they glow after being exposed to light. These pigments are also used in emergency signage, sports gear, safety apparel, and novelties. They glow in the dark to be seen in low-light or no-light situations, making them ideal for many safety and decorative purposes. Continued innovation by pigment manufacturers, enabling phosphorescent formulations to be produced more efficiently and exhibit a prolonged period of phosphorescence after energising, will further drive adoption across industries that place great emphasis on safety and design innovativeness.

By Application

The printing inks and graphic arts, with a 40.2% share, are projected to dominate the market in 2024. Fluorescent pigments are commonly used in promotional materials, labels, posters, and packaging due to their high visibility and bright color. Since they can capture the eyes of consumers, they are one of the bases of branding strategies. Also, demand for specialty inks is rising due to the accelerating adoption of digital printing and high-impact marketing campaigns. The production of eco-friendly fluorescent inks by manufacturers to meet sustainability objectives is also expected to help in maintaining the high demand from the application segment.

The plastics application segment is projected to grow with the highest CAGR during the forecast period of 2025 to 2032. The unique colour fastness of fluorescent pigments makes them especially suitable in consumer goods and toys, packaging, and automotive plastics. These pigments are adding more attractiveness to the product and help in product segregation. Strong global demand is being driven by growth in the packaging and automotive industries and the ongoing development of plastic processing technologies. In addition to these uses, fluorescent pigments also increase safety and visibility in applications, such as traffic cones and emergency tools, expanding their scope of application in the end-user industry.

By End-Use

The textile industry in the fluorescent pigments market for the end-use segment dominated and accounted for a global market share of 28.1% in 2024. Sportswear, fashion and safety clothing always use fluorescent pigment to provide vibrant colours and visibility in different lighting conditions. This segment is witnessing a surge in demand due to the rise in popularity of performance wear, along with the need for high-visibility attachments in construction and road safety. Nike and Adidas use flashes of fluorescent to make it pop. As consumers become more interested in eye-popping fashion, the textile industry remains one of the heaviest users of fluorescent pigment applications.

The packaging segment is anticipated to be the fastest-growing end-use segment with the highest CAGR of about 7.01%. Fluorescent pigments are used to distinguish packaging on retail shelves as consumer goods, which in turn boosts the value of the product and identity of the brand. These pigments are part of almost all food, cosmetics, and electronics packages and are essential for marketing. On the other side, e-commerce and the solutions of premium packaging are driving the demand as well. Moreover, many manufacturers are launching fluorescent but eco-friendly products as brands are looking for attractive yet sustainable products. Combined with innovations in packaging by consumers, these trends are accelerating the growth of this segment globally.

Fluorescent Pigment Market Regional Outlook:

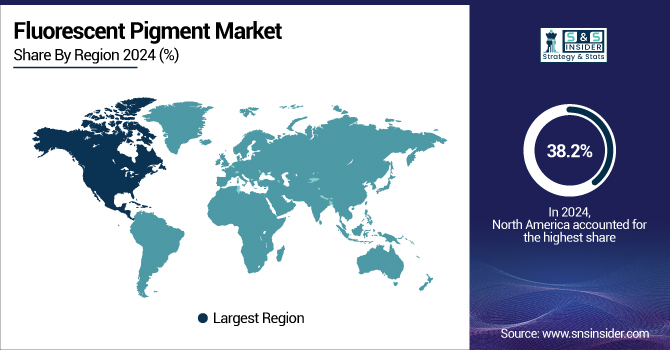

In 2024, North America dominated and held the major share in the fluorescent pigment market, contributing 38.2% to global value, owing to its demand in packaging, printing inks, and automobiles. In North America, the U.S. held a dominant market size of USD 106.31 million and 70% market share, with major stakeholders, such as DayGlo Color Corp., and the rising use of eco-friendly and high-performance pigments drawing demand in safety applications. The region supported its market strength through regulatory support by the U.S. EPA and innovations in sustainable formulations alongside the green trends. Canada ranked first among countries with the greatest growth, mainly driven by the increasing commercial requirements relating to consumer packaging and labeling.

Europe accounts for 28.3% owing to the presence of high manufacturing units of automotive and textiles. Germany remains at the forefront of finding creative ways to incorporate fluorescent pigments into high-end automotive coatings and textiles, while the U.K. moves towards more sustainable packaging. Moreover, the growing pressure of EU green chemistry initiatives and strict environmental regulations in many countries around the world has provided a fertile ground for the development of green pigments. Regional companies such as BASF and Lanxess are driving market development through investing in R&D for natural- and non-toxic pigment products to address sagging demand in the environmentally conscious sectors.

The Asia Pacific is projected to be the fastest-growing region, accounting for 19.7% globally during the forecast period of 2025 to 2032. The rise was driven by greater packaging, textiles, and plastic goods use, led by China, along with a boom in small industry and the move over to non-toxic pigments. Following India and Japan are the nations that took advantage of rapid urbanization and the build-up of infrastructure. The regional growth is likely to be fuelled by the government support for sustainable chemical alternatives, particularly by the Chinese Ministry of Industry and Information Technology. Production capacity was ramped up and brought the local manufacturers ready to serve the global demand, increasing the competitive advantage of the region in sustainable pigment technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the fluorescent pigment market include DayGlo Color Corp., Radiant Color NV, Luminochem Ltd., Sinloihi Co., Ltd., Wanlong Chemical Co., Ltd., Brilliant Group, Inc., Aron Universal Limited, Hangzhou Aibai Chemical Co., Ltd., Wuxi Minghui International Trading Co., Ltd., and Badger Color Concentrates Inc.

Recent Developments:

-

March 2024: Grolman Group signed a distribution agreement for Radiant Color fluorescent pigments in Hungary expanding the market access and technical service for coatings, plastics and cosmetics.

-

February 2023: Brilliant Group announced a partnership with Terra Firma to support its fluorescent pigments business with an emphasis on customer service and technical support for industrial customers.

-

March 2023: DayGlo introduced Elara Luxe, a new range of plant-based fluorescent pigments in a rice protein substrate for cosmetics, offering environmentally friendly, vegan and biodegradable options for colour cosmetics and other personal care products.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 396.43 million |

| Market Size by 2032 | USD 620.81 million |

| CAGR | CAGR of 5.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Formulation (Organic, Inorganic) •By Type (Daylight Fluorescent, Phosphorescent, Others) •By Application (Printing Inks/Graphic Arts, Paints & Coatings, Plastics, Others) •By End-use (Packaging, Automotive & Transportation, Building & Construction, Textiles, Personal Care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | DayGlo Color Corp., Radiant Color NV, Luminochem Ltd., Sinloihi Co., Ltd., Wanlong Chemical Co., Ltd., Brilliant Group, Inc., Aron Universal Limited, Hangzhou Aibai Chemical Co., Ltd., Wuxi Minghui International Trading Co., Ltd., Badger Color Concentrates Inc. |