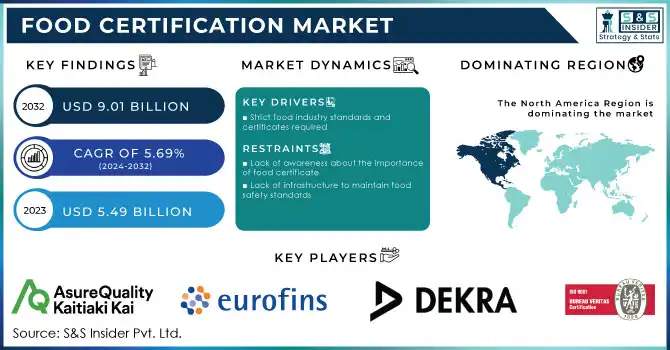

Food Certification Market key Insights:

Get PDF Sample Copy of Food Certification Market - Request Sample Report

The Food Certification Market size was valued at USD 5.49 billion in 2023 and is expected to grow to USD 9.01 billion by 2032, at a CAGR of 5.69% over the forecast period of 2024-2032.

The food certification business is based on a certifying body that has been authorized and approved. Control Union Certifications offers third-party certification audits against the most important food safety standards. Food safety has been rapidly digitalized in the food business in recent years. Businesses began to adopt digital solutions to more correctly record food safety data, eliminate human error, and improve overall compliance. As new software programs and computerized apps for food businesses hit the market, the industry is projected to embrace this trend even more.

Rising consumer awareness about food safety, demanding food certification and requirements, and an increasing number of government measures to promote food safety are driving the Food Certification market. The high expense of food certification, which makes it difficult for small farmers to afford, as well as a lack of technical skills among small firms and a lack of universal food safety standards, are impeding the expansion of the Food Certification sector.

The market is further divided by type, with ISO 22000 - Food Safety Management System, BRCGS, SQF, IFS, Halal certification, GMP+/FSA, and Other being the most common.

MARKET DYNAMICS

KEY DRIVERS

-

Strict food industry standards and certificates required

Food certification helps to ensure the safety of food products by validating that they were produced, handled, stored, and transported in conformity with strict food safety regulations. Globally, governments and food safety groups are enforcing more strict laws to safeguard the safety and quality of food items. As firms seek to demonstrate compliance with these standards and enhance consumer confidence in their products, there is a growing demand for food certification. Non-GMO Food certification is given to food products that are free of genetically modified organisms (GMOs). It will be available in the United States in 2021. Vegan Food Certification was introduced in Europe in 2022 for vegan food products.

RESTRAIN

-

Lack of awareness about the importance of food certificate

-

Lack of infrastructure to maintain food safety standards

Many developing countries lack the resources needed to implement food safety and security measures, such as modern food processing facilities, well-trained food safety personnel, adequate water and sanitation facilities, and limited workplaces. Due to weak infrastructure and insufficient resources, developing countries rely heavily on small-scale and local food enterprises that are unable to attain global food certification.

OPPORTUNITY

-

Rising need for food certification in developing countries

Food safety and security systems in developing countries in North Africa and Asia region have inadequate infrastructure and implementation capabilities. This is due to a lack of basic supporting infrastructure for food product certification, the food certificate market in these nations is expected to grow at a slower rate. Furthermore, developing nations are increasingly exporting food to industrialized nations. These countries frequently have stringent food safety regulations that require imported food to meet particular requirements. This is boosting the demand for food certification for developing-country exports.

CHALLENGES

-

Lack of resources and financial support

Many small-scale food producers in developing countries may be unaware of the benefits of food certification or the steps required to achieve it. Small-scale food producers may find it challenging to take advantage of food certification prospects as a result of this. Small-scale food producers may lack the financial resources to afford food certification, as well as the resources required to develop food safety and quality management systems, such as trained employees and equipment.

IMPACT OF RUSSIA UKRAINE WAR

Food security is a complicated issue with numerous factors, such as violence, supply chain interruptions, weather conditions, other disasters, and so on. Food production and supply lines in Ukraine and Russia have been interrupted by the war, increasing demand for food certification from businesses and consumers worldwide. This is because food certification can help to ensure that food products are safe and of good quality, especially during times of crisis. Food certification standards are also expected to change as food certification agencies react to the additional challenges provided by the war. Food certification authorities, for example, may need to set new requirements for food items coming from Ukraine or Russia.

IMPACT OF ONGOING RECESSION

The recession has had the greatest impact on food certification standards for small-scale food producers. Export restrictions on wheat, rice, and citrus crops have resulted in price hikes predicted at 9%, 12.3%, and 8.9% respectively in 2022. This has resulted in higher food prices, which has indirectly resulted in higher production costs and the maintenance of food safety requirements. Food certification expenses have also risen as a result of the war since food certification organizations face additional transportation and logistics expenditures. This is likely to increase the cost of food certification for businesses, which may harm future demand for food certification.

MARKET SEGMENTATION

by Type

-

ISO 22000

-

BRCGS

-

SQF

-

IFS

-

Halal certification

-

GMP+/FSA

-

Other

by End-user

-

Meat

-

Poultry

-

Seafood Products

-

Dairy Products

-

Bakery and Confectionery

-

Baby Food

-

Beverages

-

Other

REGIONAL ANALYSIS

The food certificate market in North America is predicted to grow at a rapid pace. In the North American region, certification authorities ensure that enterprises involved in food and beverage manufacturing follow acceptable food management standards through follow-up and rigorous audits. Due to the region's growing concern for health and customer awareness of the adverse effects of contaminated food goods, the United States leads the North American market.

Asia Pacific is the fastest-growing region for the food certification market owing to the growing middle class in the region, which is leading to increased demand for safe and high-quality food products. China is the largest market for food certification in the Asia Pacific, followed by India, Japan, Australia, and South Korea. This is due to the large and growing population in China, as well as the increasing demand for safe and high-quality food products in the country.

Europe is expected to be the largest market for food and beverages, as well as for food certifications. Europe's food business is massive. Europe has put in place strong regulatory systems for food safety and quality. Hygiene Packaging, General Food Laws, and Special Food Regulations are examples of regulations. As a result, there is a considerable demand for food certificates across Europe.

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Bureau Veritas, DEKRA, NSF International, Eurofins Scientific, AsureQuality, Intertek Group PLC, Eagle Certification Group, DNV GL, SGS Group, TUV NORD GROUP, Underwriters Laboratories Inc, Lloyd’s Register Group Ltd, and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2023, According to the NSF International organization, Serim Hyunmi Ltd, a South Korean rice bran oil firm, successfully obtained certification of BeVeg Vegan standards for its production facility, validating claims that they are Vegan, free of animal components, and cruelty-free.

In 2023, Intertek Cristal revealed that it has received five separate certifications from the Sheraton Abu Dhabi Hotel & Resort, based on the Intertek Cristal standards of health and safety, water safety hygiene, and food safety criteria.

In 2022, SCS Global Services has introduced a plant-based certification scheme. The initiative encourages the use of plant-based alternatives and acknowledges creativity in a variety of consumer items. The SCS-109 Standard allows for certification of food & beverages, Cannabidiol oil, and body care items. The certification certifies that no animal-derived components are used in the product's manufacturing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.49 Billion |

| Market Size by 2032 | US$ 9.01 Billion |

| CAGR | CAGR of 5.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (ISO 22000, BRCGS, SQF, IFS, Halal certification, GMP+/FSA, and Other) • By End-user Industry (Meat, Poultry, Seafood Products, Dairy Products, Bakery and Confectionery, Baby Food, Beverages, and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Bureau Veritas, DEKRA, NSF International, Eurofins Scientific, AsureQuality, Intertek Group PLC, Eagle Certification Group, DNV GL, SGS Group, TUV NORD GROUP, Underwriters Laboratories Inc, Lloyd’s Register Group Ltd |

| Key Drivers | • Strict food industry standards and certificates required |

| Market Opportunity | • Rising need for food certification in developing countries |