LCD TV Core Chip Market Size & Trends:

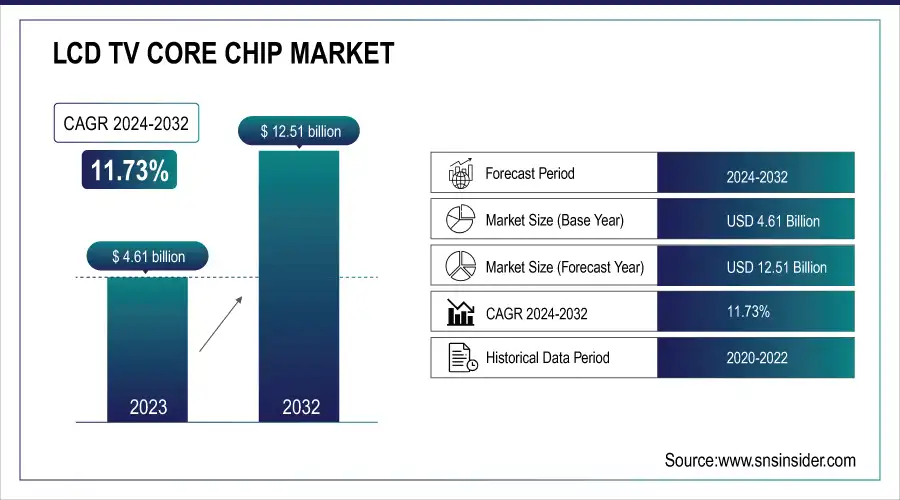

The LCD TV Core Chip Market was valued at 4.61 Billion in 2023 and is projected to reach USD 12.51 Billion by 2032, growing at a CAGR of 11.73% from 2024 to 2032. Key drivers include the widespread adoption of 4K and 8K displays, which require chips with superior processing power and low latency. Integration of AI neural engines is also gaining traction, enabling features such as real-time image enhancement, voice command recognition, and user behavior analytics.

To Get more information on LCD TV Core Chip Market - Request Free Sample Report

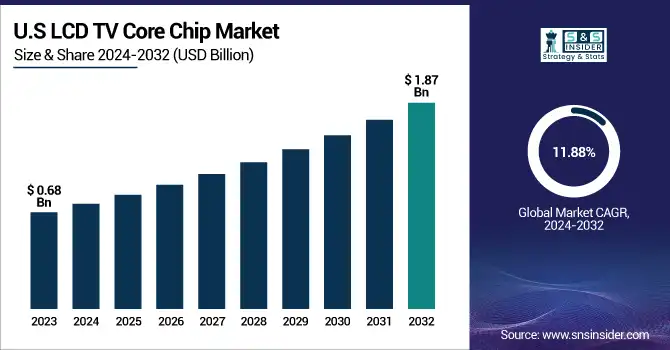

In the U.S., the market was valued at USD 0.68 billion in 2023 and is projected to reach USD 1.87 billion by 2032, growing at a CAGR of 11.88%. Furthermore, the rise of premium content streaming services has driven the need for embedded DRM and encryption technologies to ensure secure content playback. Gaming and high-performance applications are also influencing design priorities, with core chips now expected to support higher frame rates and ultra-low latency. Demand for smart home integration and immersive viewing experiences continues to fuel chip innovation.

LCD TV Core Chip Market Dynamics:

Drivers:

-

Immersive Experiences with Core Chips Fueling Gaming and Interactive Content

Gaming and interactive content are major drivers in the LCD TV core chip market, as they demand high-performance chips capable of handling low-latency processing and high frame rates. With the rise of competitive gaming, streaming platforms, and interactive TV applications, core chips must deliver ultra-fast processing speeds to ensure seamless, lag-free gameplay and responsive user interactions. This includes supporting high refresh rates, typically 120Hz or more, to enable smoother motion and reduce blur during fast action scenes. Additionally, the increasing popularity of cloud gaming and virtual reality (VR) applications puts even more pressure on chips to process graphics-intensive content in real-time while maintaining optimal frame rates. TV manufacturers are concentrating their optics on chip performance to deliver these recalibrated standards. Consequently, the need for low latency and high frame rate processing is critical for a superior and immersive gaming and interactive viewing experience.

Restraints:

-

Navigating Cost and Performance Challenges in Core Chip Adoption Due to Price Sensitivity

Price sensitivity is a key restraint in the LCD TV core chip market, as an increasing number of consumers seek budget-friendly televisions. While there is a demand for high-performance features such as 4K/8K resolution, AI integration, and low-latency processing, many consumers are reluctant to pay a premium for advanced chips. This creates a challenge for TV manufacturers, who must balance the need for cost-effective solutions with the demand for enhanced performance. As a result, many manufacturers may opt for lower-cost, less advanced chips, which limits the ability to provide cutting-edge features, ultimately affecting the overall viewing experience. Another factor limiting adoption may be price sensitivity that comes with new technologies like AI-based image enhancement and real-time upscaling; after all, such functionalities need powerful chips, which some customers may consider too expensive. However, the price-sensitive nature of this market tends to slow the growth of high-performance chip adoption at the macro scale.

Opportunities:

-

Unlocking Growth in Cloud Gaming and VR with Advanced Chip Solutions

The rapid growth of cloud gaming and virtual reality (VR) creates significant opportunities for LCD TV core chip manufacturers. These technologies require chips capable of low-latency and high frame rate processing to ensure seamless, high-quality experiences. Cloud gaming shifts the heavy processing load from expensive gaming consoles to remote servers, requiring chips capable of supporting real-time streaming with minimal delay. Likewise, VR applications require chips that can process high-resolution graphics and sustain smooth performance without interruption. As gaming and VR experiences become more immersive and mainstream, their demand for advanced chips with the power to do all three — handle complex graphics, ultra-fast data processing, and smooth systems motion. Chip makers can explore this changing scenario to come up with advanced solutions to their expanding needs, which can drive the growth of the market.

Challenges:

-

Overcoming Price Sensitivity in LCD TV Core Chip Adoption for Advanced Features

Price sensitivity is a key challenge in the LCD TV core chip market, as many consumers prioritize affordability, particularly in budget-conscious segments. This becomes a problem for adopting high-performance chips that are essential for advanced features such as 4K/8K resolution, AI-driven image processing, low-latency, etc. Manufacturers should balance cutting-edge technology with cost-effectiveness to cater to consumer demand for lower-priced models. Thus, advanced core chip integration is delayed, especially in low-cost TV models driving up the overall growth of the market. In addition, in areas where price dominates purchasing criteria, hesitation to invest in high-performance chips limits the full benefits of new display technologies. Chipmakers are tasked with creating chips that deliver both performance and an accessible price point without stripping away any must-have features.

LCD TV Core Chip Market Segmentation Overview:

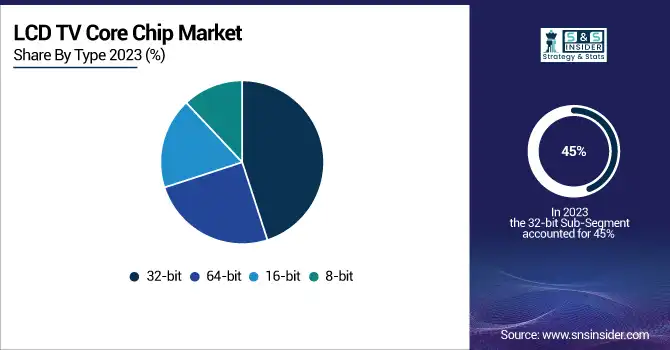

By Type

The 32-bit segment in the LCD TV core chip market dominated with a significant market share of approximately 45% in 2023. This dominance is attributed to the widespread use of 32-bit processors in mid-range to high-end LCD TVs, offering a balanced combination of performance and cost-effectiveness. These chips are capable of handling advanced video processing, smart TV functionalities, and real-time processing for high-resolution displays, making them ideal for delivering enhanced viewing experiences. The demand for 32-bit processors is further driven by their ability to support features like AI-based image enhancement, fast processing speeds, and seamless streaming, which are essential for modern TV experiences. As consumers continue to favor value-for-money products without compromising on performance, the 32-bit segment is expected to maintain a substantial share in the coming years.

The 64-bit segment is expected to dominate the LCD TV core chip market, capturing the largest share of revenue during the forecast period from 2024 to 2032. This expansion is fueled by the demand for chips that can offer high performance, enabling features such as 8K resolution, AI-enhanced functionality, and improved video processing. With consumers increasingly expecting high-performance and premium quality TV shots, the market for 64-bit processors will be further rising demand for high performance and optimum functionalities to deliver intense user experiences through quad-core and multi-core SoC solutions. The trend of wider smart home ecosystems, gaming as well as immersive media content drive the TV to use bigger computational power with 64-bit processors, providing an unprecedented level for rendering higher-definition graphics and low-latency interaction.

By Application

The commercial segment dominated the LCD TV core chip market with a substantial revenue share of approximately 59% in 2023. This dominance is driven by the growing demand for large-scale LCD TV installations in sectors like hospitality, retail, corporate, and entertainment. Commercial applications require high-performance core chips to support advanced features such as digital signage, high-definition displays, and interactive content. The need for durable, scalable, and energy-efficient solutions further fuels the demand for high-quality core chips in commercial settings. Additionally, the rise of smart buildings and the integration of digital systems in business environments are contributing to the adoption of advanced LCD TVs powered by robust core chips. As the commercial sector continues to invest in cutting-edge visual technology for better customer engagement and operational efficiency, this segment is expected to maintain its dominance in the market.

The residential segment is the fastest-growing in the LCD TV core chip market over the forecast period from 2024 to 2032. This growth is fueled by the growing trend for high-quality home entertainment systems, such as 4K and 8K TVs, alongside the increasing adoption of smart TV with features such as voice recognition, AI-powered image enhancement and seamless interconnectivity. The demand for powerful and efficient core chips is on the rise as consumers increasingly demand high-quality visuals along with immersive sound and smart home integration. The increasing uptake of streaming services, gaming and interactive content is also driving this, with home users looking for better performance and improved viewing experiences. The residential market is projected to grow at a high compound annual growth rate (CAGR) owing to increased consumer investments in next-generation TVs, making it a major factor in driving the LCD TV core chip market.

LCD TV Core Chip Market Regional Analysis:

The Asia-Pacific segment dominated the LCD TV core chip market with the largest share of around 46% in 2023. This dominance is attributed to the region's robust manufacturing capabilities, especially in countries like China, South Korea, Japan, and Taiwan, which are home to some of the largest producers of LCD TV panels and chips. The increasing adoption of smart TVs, coupled with the growing demand for 4K and 8K televisions, is driving the need for more powerful core chips in the region. Furthermore, the rise in disposable income, urbanization, and consumer preference for premium home entertainment systems are fueling growth in markets like China and India. As the region continues to be a hub for technological advancements and mass production, Asia-Pacific is expected to maintain its leading position in the global LCD TV core chip market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is the fastest-growing region in the LCD TV core chip market over the forecast period from 2024 to 2032. Growing consumer preference towards high-definition and smart TVs, especially in the region of U.S. and Canada, is propelling the demand for the growth. As consumer spending on premium home entertainment systems reaches new heights, driven by the adoption of 4K and 8K TVs, demand for next-generation core chips that enable high-performance features such as AI-enhanced processing, flexible streaming support, and advanced connectivity is increasing. Moreover, the region’s rich landscape of gaming and interactive content fuels the demand for low-latency and high frame rate processing chips. North America LCD TV Core Chip Market is expanding rapidly due to increasing acceptance of smart home technologies and advancements in TV-related functionalities.

Major Players in LCD TV Core Chip Market along with their Products:

-

Amlogic (China) - Specializes in system-on-chip (SoC) solutions for TVs, including chips for 4K and 8K displays, as well as smart TV processors.

-

Lenovo (China) - Known for its smart TVs with integrated Android TV platforms powered by their proprietary chipsets.

-

LG (South Korea) - Offers advanced OLED and LCD TVs, utilizing in-house chips like the α (Alpha) series for processing and enhancing picture quality.

-

MediaTek (Taiwan) - Provides SoCs for smart TVs, including support for 4K, 8K, and AI-enhanced features.

-

Panasonic (Japan) - Manufactures smart TVs and uses proprietary processors like the Studio Master Processor for high-definition image processing.

-

Philips (Netherlands) - Known for its Ambilight-enabled smart TVs with advanced image processing chips.

-

Sony (Japan) - Offers premium 4K and 8K TVs with the proprietary X1 and Cognitive Processor XR for high-quality video and sound processing.

-

Samsung (South Korea) - Develops a range of smart TVs with its Exynos SoC and Quantum Processor for superior display and AI features.

-

Toshiba (Japan) - Produces smart TVs with advanced picture quality chips and supports 4K resolution and high dynamic range (HDR).

-

Xiaomi (China) - Known for cost-effective smart TVs and Mi TV series powered by custom SoCs and AI technology for enhanced viewing experiences.

-

Broadcom (USA) - Supplies semiconductor solutions for set-top boxes, broadband modems, and TV SoCs used in a variety of television brands.

List of companies that supply raw materials and components for the LCD TV core chip market:

-

Soitec

-

Sumitomo Chemical Co., Ltd.

-

JX Nippon Mining & Metals Corporation

-

Plansee Group

-

Heraeus Group

-

Corning Incorporated

-

Nippon Electric Glass Co., Ltd.

-

Merck Group

-

Tokyo Ohka Kogyo Co., Ltd.

-

LG Chem

Recent Development:

-

July 1, 2024, Amlogic's S905X5M SoC, built on a 6nm process, offers major GPU (up to 2.8x) and CPU (up to 36%) performance gains over the S905X4, along with advanced HDMI 2.1 features like QMS, VRR, and SBTM.

-

9 Jan 2024, Panasonic's new Z95A OLED TV debuts with LG's cutting-edge MLA+ Meta 2.0 panel, delivering up to 3,000 nits peak brightness, 4K at 144 Hz, Dolby Vision IQ, and built-in Fire TV OS.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.61 Billion |

| Market Size by 2032 | USD 12.51 Billion |

| CAGR | CAGR of 11.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (8-bit, 16-bit, 32-bit, 64-bit) • By Application(Residential, Commercial, Educational) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amlogic (China), Lenovo (China), LG (South Korea), MediaTek (Taiwan), Panasonic (Japan), Philips (Netherlands), Sony (Japan), Samsung (South Korea), Toshiba (Japan), Xiaomi (China), Broadcom (USA). |