Frequency Converter Market Size & Trends:

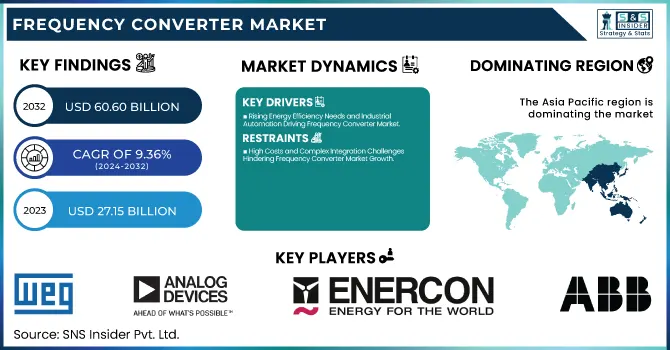

The Frequency Converter Market Size was valued at USD 27.15 billion in 2023 and is expected to reach USD 60.60 billion by 2032, growing at a CAGR of 9.36% over the forecast period 2024-2032. Power rating and capacity in the frequency converter market refers to analyzing the capacities of converters and mapping them with specific industries, thus delivering optimum energy efficiency as well as performance. The push toward smaller, more efficient, controllable converters from the technology standpoints pulls toward higher-performing controls. Depending on the industrial application, operational and performance characteristics can include reliability, reduced energy consumption, and compatible precision speed control. The advent of digital transformation and the Internet of Things (IoT) is also boosting remote monitoring, predictive maintenance, and real-time data analysis that make frequency converter systems smarter and more efficient throughout industries.

To Get more information on Frequency Converter Market - Request Free Sample Report

Frequency Converter Market Dynamics:

Key Drivers

-

Rising Energy Efficiency Needs and Industrial Automation Driving Frequency Converter Market

Growing energy efficiency needs and adoption of automation in several industries are a few of the aspects driving the global frequency converter market. The rising focus on efficient energy consumption and the need to cut down on power consumption, due to the increasing cost of energy sources, is driving demand for frequency converters – it helps lower energy consumption by enabling motor speed control. Moreover, the growing industrialization and urbanization in emerging economies are driving the demand for sophisticated infrastructure, which in turn is accelerating the need for frequency converters in HVAC systems, pumps, and conveyors. The growth of the renewable energy industry, especially wind and solar power would also create further room for the market as frequency converters are an essential component for renewable energy grid integration.

Restrain

-

High Costs and Complex Integration Challenges Hindering Frequency Converter Market Growth

There are many restraints for the frequency converter market such as high capital investment and also complex installation process. The high cost of sophisticated frequency converters is a barrier to entry for many small and medium enterprises. In addition, the technical difficulty of integrating these systems with the existing infrastructure requires more skilled professionals, which in turn increases installation and maintenance costs. Fluctuations in raw material costs also affect total production costs, which can in turn buffer the growth of the market. In addition, low-cost alternatives, available e.g. as soft starters, challenge frequency converters with a wide range of frequency converters available to this day especially in high-volume, low-cost markets.

Opportunity

-

Smart Manufacturing and Electrification Trends Fueling Frequency Converter Market Opportunities

The frequency converter market is filled with opportunities, particularly with the rise of smart manufacturing efforts and Industry 4.0. With IoT and connected devices becoming mainstream, industries will need intelligent frequency converters for remote monitoring, predictive maintenance, and increasing operational efficiency. Furthermore, growing opportunities for market growth from the electrification of transportation such as electric vehicles and railways, also drive the demand for oleochemicals in coming years. The continuous investments in infrastructure expansion, especially in developing economies, additionally open up growth opportunities for frequency converters in construction, mining, and many more heavy industries.

Challenges

-

Compatibility and Cybersecurity Challenges Impacting Frequency Converter Market

Technological compatibility and cybersecurity are also challenges in the frequency converter market. However, with industries rapidly implementing digitalization and connected devices, it becomes essential that converters are compatible with all different types of industrial automation systems. The inability to communicate in a standard manner can cause a halt in smooth integration at work, giving way to a detriment in operational efficiency. Furthermore, the implementation of IoT-enabled frequency converters increases the vulnerability of systems to hacking and data breaches due to an increase in interconnectivity. Compounding the challenges is the need for regulatory compliance and environmental responsibilities associated with electronic waste disposal, calling for manufacturers to come up with innovative and sustainable approaches to frequency converter design that are eco-friendly and secure as well.

Frequency Converter Market Segmentation Overview:

By Phase

Three-phase frequency converter segment led the market in 2023, with a 62.3% market share. Its dominance is due to its extensive usage in heavy industrial applications, such as manufacturing, mining, and energy sectors, where high power and efficiency are important. Three-phase converters are more suited for large-scale operations, where productivity is important because they provide constant power output and can support a larger load, which is also important to keep energy costs low and make the processes more efficient.

The single-phase frequency converter segment is projected to witness the highest CAGR from 2024-2032. As less power is needed and cost-effectiveness becomes paramount, growing demand mainly in residential and smaller commercial applications is driving this growth. Increased productivity of home automation with miniature industry setup increases the requirement for single-phase converters.

By Type

The static frequency converter segment accounted for the largest revenue share at 64.8% of the market in 2023 owing to its high efficiency, compact design, and low maintenance requirement. Static converters play an essential role in applications, such as aerospace, renewable energy systems, and industrial automation, where reliable and continuous power supply is important. NTEMs allow more accurate frequency regulation and energy saving from frequency disturbances, proving to be the ideal type of controllable resource for critical applications.

The rotary frequency converter segment is forecast to register the highest CAGR over the period 2024 and 2032. All these factors will contribute to the growth of this segment, supported by growing demand across heavy-duty industrial applications, including mining, manufacturing, and military applications that require durable and robust power handling. They are adopted widely as they can handle high surge loads and fluctuations in voltage.

By Application

The aerospace & defense segment accounted for the largest share of 27.5% in the frequency converter market in 2023. That leadership stems from the strong need for reliable power supply systems in aircraft, satellite, and military equipment applications where frequency regulation has to be precise for the operation of the end product to be safe and effective. Demand for frequency converters from this segment is further supported by the increasing requirements for advanced avionics systems and the rising global defense budgets.

The process industry segment is expected to grow at the fastest CAGR between 2024 and 2032. Such growth is due to surging adoption in industries like chemicals, pharmaceuticals, and food processing to automate various processes and energy efficiency requirements. Frequency converters find their usage on account of requirements such as precise motor control and consistent power supply in complex manufacturing processes.

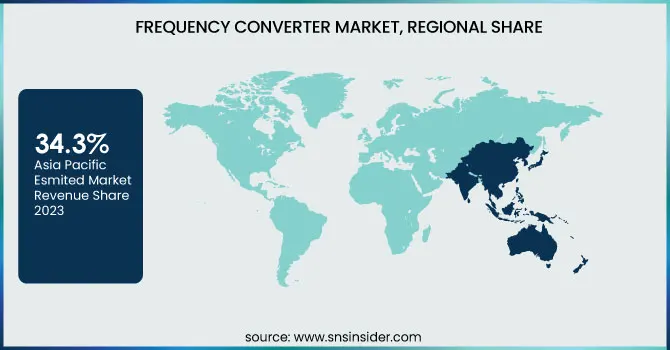

Frequency Converter Market Regional Analysis:

Asia Pacific accounted for the largest share of 34.3% of the frequency converter market in 2023 led by the region being home to rapidly developing countries across the globe such as China, Japan, and India. Such dominance can be attributed to the increasing need for energy-efficient systems in the manufacturing, automotive, and electronics industries. In China, large organizations such as Huawei and Delta Electronics are commonly investing in high-end frequency converters to improve industrial automation and power management. Expansion in frequency converters demand in Japan in production facilities as the automotive sector would be transitioning towards electric vehicles.

North America is anticipated to grow at the fastest CAGR from 2024 to 2032. This growth is being led by the U.S. and Canada which is investing heavily in renewable energy and industrial automation. For example, generalized electric and Rockwell Automation are focused on next-generation frequency converters with IoT integration for effective operational efficiency and remote monitoring developments. Similarly, the increase in the U.S. aerospace and defense expenditure again leads to the need for high-performance frequency converters to support high-end military equipment and aircraft systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major players in the Frequency Converter Market are:

-

GE Power Conversion (Variable Frequency Drives (VFDs), Electric generators)

-

WEG Industries (Electric motors, Motor drives)

-

Analog Devices (Data converters, Power management ICs)

-

Enercon (Wind energy converters, Annular generators)

-

Siemens (SINAMICS frequency converters, SIMOTICS motors)

-

ABB (ACS880 industrial drives, DCS880 DC drives)

-

Schneider Electric (Altivar Process drives, Altivar Machine drives)

-

Danfoss (VLT AutomationDrive, VLT HVAC Drive)

-

Mitsubishi Electric (FR-A800 series inverters, FR-F800 series inverters)

-

Yaskawa Electric Corporation (GA700 AC drives, A1000 AC drives)

-

Hitachi Industrial Equipment Systems (NE-S1 series inverters, SJ-P1 series inverters)

-

Fuji Electric (FRENIC-Ace inverters, FRENIC-MEGA inverters)

-

Rockwell Automation (PowerFlex 750 series drives, PowerFlex 520 series drives)

-

Toshiba International Corporation (TOSVERT VF-AS3 inverters, TOSVERT VF-MB1 inverters)

-

Vacon (Variable-speed AC drives, Inverters for renewable energy)

Recent Trends:

-

In September 2024, WEG Industries introduced the MW500, a decentralized variable speed drive designed to enhance industrial operations requiring precise speed and torque control in three-phase motors.

-

In February 2024, ABB launched the ACH580 4X variable frequency drive, designed for HVACR applications in harsh environments with robust protection against extreme weather and dust.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 27.15 Billion |

|

Market Size by 2032 |

USD 60.60 Billion |

|

CAGR |

CAGR of 9.36% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Phase (Single Phase, Three Phase) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Vacon, GE Power Conversion, WEG Industries, Analog Devices, Enercon, Siemens, ABB, Schneider Electric, Danfoss, Mitsubishi Electric, Yaskawa Electric Corporation, Hitachi Industrial Equipment Systems, Fuji Electric, Rockwell Automation, Toshiba International Corporation. |