Frozen Desserts Market Report Scope & Overview:

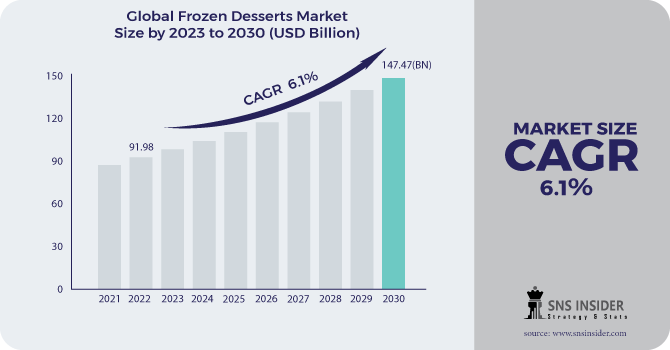

The Frozen Desserts Market Size was esteemed at USD 91.98 billion out of 2022 and is supposed to arrive at USD 147.47 billion by 2030, and develop at a CAGR of 6.1% over the forecast period 2023-2030.

Frozen yogurt and frozen pastry are food items from the frozen food industry. They are consumed after a feast or filled in as a reward between dinner courses. Frozen yogurt and frozen sweets are made out of milk and cream joined with leafy foods, making them satisfying to the shopper. The developing pattern of the utilization of frozen yogurt and frozen dessert after a feast as stomach-related item power the development of the worldwide frozen yogurt and frozen dessert market. Another component affecting the business development is the flood popularity of frozen yogurt and frozen yogurt. The two children and grown-ups are on the ascent for these delectable frozen food items on account of the healthy benefit acquired from their utilization.

Get PDF Sample Report on Frozen Desserts Market - Request Sample Report

The worldwide frozen yogurt and frozen dessert market are supposed to observe huge development over the gauge period because of the ascent in discretionary cash flow and the developing populace size of people consuming frozen sweets universally. Nonetheless, the market is scheduled to observe a decrease in development because of the rising well-being worries among buyers. Shoppers are on the watch for items with low-calorie satisfaction with sound befitting properties.

In 2021, Mengniu jumped all over the advancement chances in the dairy item industry through persistent item advancements and updates, rebranding endeavors, and extending on the web and disconnected channels for omnichannel improvement, prompting income development that by and by surpassed assumptions.

Market Dynamics:

Driving Factors:

-

The rising fame of low-fat pastries.

-

Rising extra cash and rising urbanization.

Restraining Factors:

-

Rising worries about the item's high sugar and fat substance.

Opportunities:

-

Clients can now arrange frozen treats on the web and appreciate them in the solace of their homes.

-

A wide assortment of frozen treats is sold in shopping centers, retail chains, multiplexes, and other dissemination channels.

Challenges:

-

The adverse consequence of COVID-19 on the creation and production network.

Impact of Covid-19:

Frozen treats deal at first fell because of COVID-19 limitations on physical stores. Notwithstanding, central parts are endeavoring to harden their market position by zeroing in on web-based business and internet showcasing to arrive at shoppers across geological limits. Moreover, the pandemic provoked customers to search out resistance helping items as well as other sustained items that give medical advantages, bringing about central parts working on the piece of their pastries items by integrating natural fixings, making them sans cholesterol, and sending off veggie-lover variations with no additional additives or added substances.

Distribution Channel:

Based on circulation channels, the market has been divided into general store/hypermarkets, general stores, bistro and pastry kitchen shops, and the web. It is normal to arise as the quickest developing section over the estimated period attributable to the acquisition of frozen pastries, alongside the everyday staple things, which is credited to the consistently expanding interest for treats in day-to-day food components. The developing pattern of buying items from specific stores has brought about the kickoff of different bistros and pastry kitchens looking for frozen dessert items.

Product Type:

As a result, the market is separated into confectionary and confections, and frozen yogurt. Frozen yogurt is one of the significant items in this market and this section represented the biggest piece of the pie. The interest in frozen yogurt is expanding to an enormous scope because of its developing ubiquity among all ages. Frozen yogurt is expected to observe the quickest development over the gauge period inferable from a few medical advantages related to the item. It is a frozen pastry made with yogurt and in some cases other dairy and non-dairy items. Frozen yogurt frequently contends with frozen yogurt, and is normally viewed as a better other option.

Market Segmentation:

By Product Type:

-

Confectionary & Candies

-

Ice Cream

-

Tofu

-

Cakes & pastries

-

Others

By Distribution channel:

-

Supermarket/Hypermarket

-

Convenience Stores

-

Cafes & Bakery Shops

-

Online

-

Others

.png)

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Analysis:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

the UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

North America rules the frozen sweets market and will keep on doing such during the figure time frame because of buyer inclinations in this district moving from dairy-based frozen treats to non-dairy-based frozen pastries items. Moreover, item improvement, an elevated degree of extra cash, and the presence of different frozen pastries flavors will speed up the market's development rate around here. Because of rising buyer interest for frozen pastries and rising frequencies of stomach-related problems, for example, lactose bigotry around here, Asia-Pacific is supposed to develop at a critical rate during the conjecture time of 2022-2028.

Key Players:

Amul, Baskin Robbins, Britannia Industries Ltd., Conagra Foods, Danone, Ferrero Spa, General Mills Inc., London Dairy Co. Ltd., Mother Dairy Fruit & Vegetable Pvt. Ltd., Nestle Sa, Unilever Group, Wells Enterprises.

Amul-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 91.98 Billion |

| Market Size by 2030 | US$ 147.47 Billion |

| CAGR | CAGR 6.1% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Confectionary & Candies, Ice Cream, Tofu, Cakes & pastries, Others) • by Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Cafes & Bakery Shops, Online, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amul, Baskin Robbins, Britannia Industries Ltd., Conagra Foods, Danone, Ferrero Spa, General Mills Inc., London Dairy Co. Ltd., Mother Dairy Fruit & Vegetable Pvt. Ltd., Nestle Sa, Unilever Group, Wells Enterprises |

| Drivers | •The rising fame of low-fat pastries. •Rising extra cash and rising urbanization. |

| Market Challenges: | •The adverse consequence of COVID-19 on the creation and production network. |