Scrubber System Market Key Insights:

To Get More Information on Scrubber System Market - Request Sample Report

The Scrubber System Market size was valued at USD 5.3 Billion in 2023 and is projected to reach USD 9.05 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.15% over the forecast period of 2024-2032.

The Scrubber System is a technology used to remove harmful pollutants from industrial exhaust gases. It is a crucial component in reducing air pollution and ensuring compliance with environmental regulations. The system works by passing the exhaust gas through a series of scrubbing devices, which use various chemical and physical processes to remove pollutants such as sulfur dioxide, nitrogen oxides, and particulate matter. The cleaned gas is then released into the atmosphere, while the captured pollutants are disposed of safely. The Scrubber System is widely used in industries such as power generation, oil and gas, and chemical manufacturing. It not only helps to protect the environment but also improves the health and safety of workers by reducing exposure to harmful pollutants.

The market for scrubber systems has been growing steadily in recent years, driven by increasing environmental regulations and a growing awareness of the negative impact of air pollution on human health and the environment. As a result, companies that produce scrubber systems are investing heavily in research and development to create more efficient and effective systems that can meet the demands of a changing market. In addition to traditional wet scrubbers, which use water to remove pollutants from exhaust gases, there are also dry scrubbers, which use chemicals to neutralize pollutants. Both types of scrubbers have their advantages and disadvantages, and the choice of system depends on the specific needs of the industry in question.

Market Dynamics

Drivers

-

Rising demand for liquefied natural gas

-

Increasing demand for cleaner and more sustainable energy sources

The demand for cleaner and more sustainable energy sources is on the rise. With stricter environmental regulations, companies are searching for innovative solutions to reduce their carbon footprint and comply with emissions standards. As the world becomes more conscious of the impact of pollution on the environment, the need for cleaner energy sources has become increasingly important. Companies are under pressure to reduce their carbon footprint and comply with emissions standards. Scrubber systems offer a practical solution to this problem by effectively removing harmful pollutants from exhaust gases. This makes them an attractive option for industries that rely heavily on fossil fuels, such as shipping, power generation, and oil and gas.

Restrain

-

High capital investment associated with the scrubber system

-

High maintenance cost and time-consuming process

Opportunities

-

Growing trend towards digitalization and automation

-

Limitation of the sulfur content in the fuel oil by IMO

The International Maritime Organization's (IMO) restriction on sulfur content in fuel oil presents a significant opportunity for the scrubber system market. This regulation mandates that ships reduce their sulfur emissions to 0.52% by weight, down from the previous limit of 3.51%. As a result, ship owners and operators are seeking solutions to comply with this regulation, and scrubber systems offer a viable option. These systems remove sulfur oxides from exhaust gases, allowing ships to continue using high-sulfur fuel oil while still meeting the IMO's requirements. This presents a significant opportunity for the scrubber system market, as demand for these systems is expected to increase significantly in the coming years. Additionally, the use of scrubber systems can also lead to cost savings for ship owners, as they can continue to use cheaper high-sulfur fuel oil instead of switching to more expensive low-sulfur alternatives.

Challenges

-

Stringent regulatory policies imposed by the government for the disposal of contaminated effluent from scrubber system

Impact of Russia-Ukraine War:

The war has predominately disrupted the supply chain for scrubber systems. Many of the components used in these systems are manufactured in Ukraine, a country that has been severely affected by the conflict. As a result, the supply chain has been disrupted, leading to delays in the delivery of scrubber systems and negatively impacting the market.

Moreover, the international sanctions imposed on Russia have resulted in a decrease in demand for scrubber systems in the country. Russia was one of the largest markets for these systems, and the sanctions have caused a decline in the country's industrial output. The invasion of Ukraine has also reduced the price spread between high and low-sulfur fuel oils, which has impacted the economics of scrubbers. Russia plays a pivotal role in the global high-sulfur fuel oil (HSFO) market, with almost 92% of its approximately 800,000 barrels per day (bpd) of fuel exports being HSFO. Following Russia's attack on Ukraine, Wärtsilä, a major supplier of scrubber systems, immediately suspended all deliveries, sales, orders, and bidding to Russia. This has led to a decrease in the supply of scrubber systems, further negatively impacting the market. In addition to the disruption in the supply chain and decrease in demand, the war has also led to an increase in the cost of raw materials used in the manufacture of scrubber systems. The conflict has disrupted the transportation of these materials, leading to an increase in their cost. This increase in cost has affected the profitability of companies in the scrubber system market.

Impact of Recession:

The ongoing recession predominantly impacted the Shipping and Bunker Industry, leading to a decrease in demand for scrubber systems in the shipping sector. In June 2023, the Ship and Bunker Index experienced a significant decrease of 43.7% compared to the same period in 2022. The economic downturn has now surpassed concerns related to Russia's supply as the primary factor driving global oil markets. More insights are included in the final report.

Key Market Segmentation

By Product Type

-

Wet Scrubber System

-

Dry Scrubber System

By Orientation

-

Vertical

-

Horizontal

By Application

-

Gaseous/Chemical Cleaning

-

Particulate Cleaning

By End-use Industry

-

Oil & Gas

-

Marine

-

Chemical & Petrochemical

-

Glass

-

Pharmaceutical

-

Metal & Mining

-

Water & Wastewater Treatment

-

Others

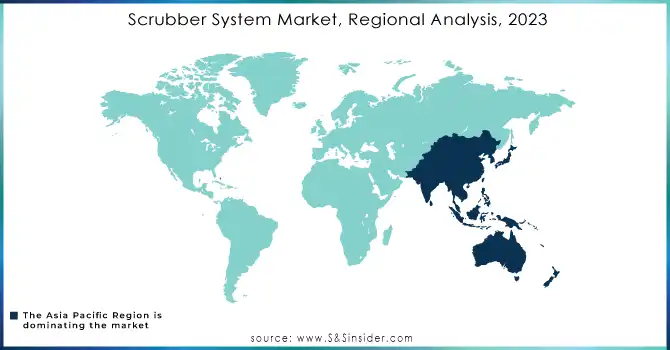

Regional Analysis

The Asia Pacific region dominated the scrubber system market and is expected to lead this market during the forecast period of 2023-2030. This is attributed to the region's robust economic growth, increasing industrialization, and stringent environmental regulations. One of the primary drivers of the scrubber system market in the Asia Pacific region is the region's rapid economic growth. As countries in the region continue to develop and modernize, there is a growing demand for cleaner and more efficient industrial processes. Scrubber systems are an effective solution for reducing harmful emissions and improving air quality, making them an essential component of many industrial operations. In addition to economic growth, the Asia Pacific region is also experiencing increasing industrialization. As more industries are established in the region, there is a greater need for effective pollution control measures. Scrubber systems are an ideal solution for reducing emissions from industrial processes, making them a popular choice for businesses in the region. Furthermore, the Asia Pacific region has implemented stringent environmental regulations aimed at reducing pollution and improving air quality. These regulations have created a strong demand for scrubber systems, as businesses seek to comply with these regulations and reduce their environmental impact.

The Scrubber System Market in Europe is projected to experience substantial growth during the forecast period. This growth is expected to be driven by the increasing demand for cleaner and more sustainable energy sources, stricter environmental regulations, and the rising awareness of the harmful effects of air pollution. Furthermore, the implementation of the International Maritime Organization's (IMO) regulations mandating the use of scrubber systems in ships is expected to boost the demand for these systems in Europe. The region's robust shipping industry and the increasing number of vessels retrofitting scrubber systems are also contributing to the market's growth. For instance, In the year 2021, the European Union imported approximately 1.13 trillion euros worth of goods, while exporting around 958 billion euros worth of cargo via sea. In addition, the growing adoption of hybrid scrubber systems, which combine wet and dry scrubbing technologies, is expected to further drive the market's growth in Europe. These systems offer several advantages, including higher efficiency, lower operating costs, and reduced environmental impact.

Do You Need any Customization Research on Scrubber System Market - Enquire Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are B&W, CECO, Alfa Laval, Dupont, Evoqua, Fuji Electric, GEA, Wartsila, Hamon Research-Cottrell, Yara Marine, Verantis, and other key players mentioned in the final report.

Recent Developments:

-

Nov. 2022, Safe Bulkers will once again turn to Alfa Laval for their scrubber needs in 2023. The Greek shipowner has placed an order for additional Alfa Laval PureSOx exhaust gas cleaning systems, bringing the total number of vessels to be fitted with these systems to 25.

-

In May 2021, Ceco Environmental Corp was awarded a lucrative contract worth US$3.5 million. The contract is to provide more than a dozen Ceco HEE-Duall scrubber and exhaust systems, as well as Ceco Fybroc recirculation pumps, to a global semiconductor chip manufacturer.

-

In January 2021, DuPont Clean Technologies announced a new scrubbing project with BELCO Technology. Chilean oil refiner ENAP Refinerías S.A. has selected BELCO® scrubbing technology, licensed by DuPont Clean Technologies, to improve emissions control from its 31,449 BPSD fluid catalytic cracking (FCC) unit at the Aconcagua refinery.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.3 Bn |

| Market Size by 2032 | US$ 9.05 Bn |

| CAGR | CAGR of 6.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Wet Scrubber System and Dry Scrubber System) • By Orientation (Vertical and Horizontal) • By Application (Gaseous/Chemical Cleaning and Particulate Cleaning) • By End-use Industry (Oil & Gas, Marine, Chemical & Petrochemical, Glass, Pharmaceutical, Metal & Mining, Power Generation, Water & Wastewater Treatment, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | B&W, CECO, Alfa Laval, Dupont, Evoqua, Fuji Electric, GEA, Wartsila, Hamon Research-Cottrell, Yara Marine, Verantis |

| Key Drivers | • Rising demand for liquefied natural gas • Increasing demand for cleaner and more sustainable energy sources |

| Market Opportunities | • Growing trend towards digitalization and automation • Limitation of the sulfur content in the fuel oil by IMO |