Gelcoat Market Report Scope & Overview:

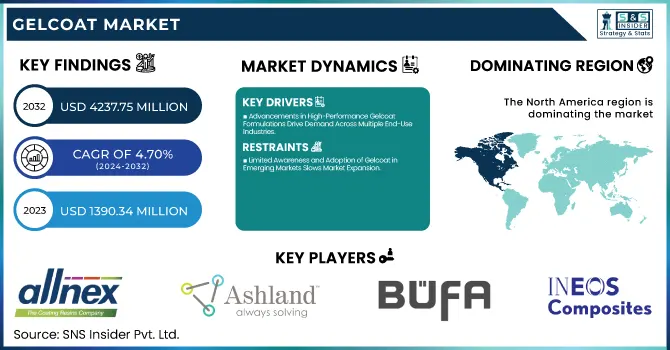

The Gelcoat Market Size was valued at USD 1,390.34 Million in 2023 and is expected to reach USD 4,237.75 Million by 2032, growing at a CAGR of 4.70% over the forecast period of 2024-2032.

To Get more information on Gelcoat Market - Request Free Sample Report

The Gelcoat Market is witnessing steady growth, fueled by rising demand in marine, wind energy, and transportation sectors. Production capacity and utilization rates are key factors driving supply efficiency, as manufacturers optimize operations to meet evolving needs. Raw material availability and pricing trends significantly impact costs, with fluctuations in polyester, vinyl ester, and epoxy resin prices shaping profitability. The impact of economic trends such as inflation and trade policies influence market stability and investments. Exploring supply chain and manufacturing insights reveals logistical challenges and process innovations enhancing efficiency. Additionally, investment analysis highlights capital inflows, mergers, and acquisitions reshaping competition. Our report provides exclusive insights into these crucial elements, offering a strategic outlook on market dynamics and future opportunities.

Gelcoat Market Dynamics

Drivers

-

Advancements in High-Performance Gelcoat Formulations Drive Demand Across Multiple End-Use Industries

Innovations in high-performance gelcoat formulations are significantly shaping the gelcoat market by enhancing durability, chemical resistance, and aesthetic appeal. Manufacturers are focusing on developing UV-resistant, corrosion-resistant, and impact-resistant gelcoats that cater to industries such as marine, automotive, and construction. The introduction of low-styrene and low-VOC gelcoats aligns with global environmental regulations, ensuring sustainability while maintaining superior performance. Additionally, the shift towards nanotechnology-based gelcoats improves mechanical strength and surface protection, making them highly desirable in critical applications. Automotive manufacturers are increasingly adopting gelcoats for lightweight composite components, reducing vehicle weight while ensuring structural integrity. Similarly, in construction, the demand for decorative and protective coatings on architectural structures is boosting market expansion. The increasing focus on customized gelcoat solutions that meet industry-specific requirements strengthens market penetration, ensuring continued adoption across diverse applications.

Restraints

-

Limited Awareness and Adoption of Gelcoat in Emerging Markets Slows Market Expansion

While gelcoat has established applications in marine, construction, and wind energy sectors, its adoption in emerging markets remains relatively low due to limited awareness and lack of technical expertise. Many developing regions prioritize traditional coatings and paints over gelcoats, often due to lower upfront costs and familiarity with conventional materials. Additionally, a lack of skilled professionals and infrastructure for proper gelcoat application restricts its widespread use. The high initial investment in equipment and training further discourages smaller businesses from transitioning to gelcoat-based solutions. Moreover, in industries like automotive and industrial manufacturing, alternative coatings such as polyurethane and epoxy systems often overshadow gelcoats. To overcome this challenge, market players must focus on education, training programs, and partnerships to increase awareness about gelcoat's long-term benefits, durability, and superior protection, ultimately driving greater adoption in untapped regions.

Opportunities

-

Growing Demand for Bio-Based and Sustainable Gelcoat Solutions Enhances Market Expansion

The increasing focus on sustainability and green chemistry presents a significant opportunity for the gelcoat market, as manufacturers shift towards bio-based and eco-friendly formulations. Rising environmental concerns and regulatory pressure on VOC emissions have led to the development of low-styrene, water-based, and renewable raw material-based gelcoats. Companies investing in sustainable resin technologies, such as bio-derived polyester and epoxy systems, are gaining competitive advantages in the market. Additionally, industries such as marine, automotive, and construction are prioritizing environmentally friendly coatings, driving demand for gelcoats with reduced carbon footprints. The adoption of recyclable and low-emission gelcoats is gaining traction, providing a lucrative growth avenue for manufacturers. With increasing consumer awareness and government incentives for sustainable product innovations, the market for bio-based gelcoat solutions is expected to expand significantly in the forecast period.

Challenge

-

Technical Limitations and Performance Trade-Offs Pose Challenges in Advanced Gelcoat Development

Despite advancements in gelcoat formulations, technical limitations and performance trade-offs remain a challenge for manufacturers. Developing low-VOC and bio-based gelcoats that match the adhesion, strength, and chemical resistance of traditional formulations requires extensive R&D efforts. Certain high-performance applications, such as extreme weather-exposed marine and wind energy components, demand coatings with exceptional UV stability and mechanical strength, which some eco-friendly alternatives struggle to achieve. Additionally, compatibility issues with various substrates and application methods further complicate the development of advanced gelcoat solutions. Overcoming these challenges requires continuous innovation, collaboration with research institutions, and strategic investments in material science, ensuring that new gelcoat formulations meet both performance standards and environmental sustainability goals.

Gelcoat Market Segmental Analysis

By Resin Type

Polyester resin dominated the gelcoat market in 2023 with a market share of 52.8%. Polyester gelcoats are widely used due to their cost-effectiveness, durability, and excellent water resistance, making them a preferred choice in marine, transportation, and construction industries. The National Marine Manufacturers Association (NMMA) has emphasized the increasing use of polyester-based gelcoats in boat manufacturing, ensuring long-term performance and protection against harsh marine environments. Additionally, the American Composites Manufacturers Association (ACMA) highlights polyester gelcoat's superior compatibility with fiberglass-reinforced plastics (FRP), making it an industry standard for automotive and infrastructure applications. Its widespread availability and ease of application further drive its dominance over vinyl ester and epoxy alternatives, which are often costlier and used for specialized applications.

By Application Pattern

Spray-up application dominated the gelcoat market in 2023 with a market share of 67.4%. The efficiency, uniform coating thickness, and suitability for large-scale manufacturing make spray-up the preferred application method across industries. This technique is widely utilized in marine, automotive, and wind energy sectors, where high-volume production and seamless finishes are critical. According to the Composites Manufacturing Magazine, spray-up gelcoat application has become an industry norm for boat hulls, wind turbine blades, and vehicle exteriors, ensuring high-quality finishes with minimal material wastage. The United States Environmental Protection Agency (EPA) has also acknowledged improvements in spray technology, reducing volatile organic compound (VOC) emissions, further encouraging its adoption in environmentally regulated regions.

By End-Use Industry

The marine industry dominated the gelcoat market in 2023 with a market share of 38.2%. Gelcoats are extensively used in yacht, boat, and ship manufacturing due to their high-water resistance, UV stability, and corrosion protection. The International Maritime Organization (IMO) has introduced stringent regulations on vessel coatings, pushing manufacturers to use high-performance gelcoats for extended durability. Additionally, reports from Boat International Media indicate a rise in luxury yacht production, particularly in the United States, Europe, and Asia-Pacific, where gelcoats play a vital role in achieving aesthetic appeal and structural integrity. The National Marine Manufacturers Association (NMMA) also supports advancements in composite materials, further driving gelcoat demand in the marine industry.

Gelcoat Market Regional Outlook

North America dominated the gelcoat market in 2023 with a market share of 38.5%. The region’s dominance is driven by the strong presence of marine, automotive, and aerospace industries, where gelcoats are widely used for enhanced surface protection, durability, and aesthetic appeal. The National Marine Manufacturers Association (NMMA) reported that over 95% of boats sold in the U.S. are made domestically, fueling significant demand for high-performance gelcoats. Additionally, the U.S. Department of Transportation has emphasized the increasing use of composite materials in automobile manufacturing, further boosting gelcoat adoption. The United States remains the leading contributor to North America’s market share, supported by a well-established marine and automotive sector, with major manufacturers like Sea Ray, General Motors, and Tesla integrating advanced gelcoat solutions. Canada is also a significant player, with a growing shipbuilding industry supported by government investments, such as the National Shipbuilding Strategy (NSS), which promotes the use of composite-based coatings, including gelcoats.

Moreover, Asia Pacific emerged to be the fastest-growing region in the gelcoat market during the forecast period, with a substantial growth rate during the forecast period. The region's rapid expansion is fueled by booming construction, marine, and wind energy sectors, particularly in China, India, and South Korea. China leads the growth due to strong government initiatives promoting wind energy, as reported by the Global Wind Energy Council (GWEC), which stated that China installed over 50 GW of new wind power capacity in 2023, significantly driving gelcoat demand. India is also experiencing increased adoption, with Make in India policies supporting local composite manufacturing in the transportation and marine sectors. South Korea’s expanding shipbuilding industry, led by Hyundai Heavy Industries and Samsung Heavy Industries, is driving significant gelcoat consumption for marine coatings and protective applications. The rising investments in infrastructure and renewable energy projects across the region further reinforce Asia Pacific’s role as the fastest-growing gelcoat market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Allnex (Crestacoat 5000, Viapal Gelcoats)

-

Ashland (Maxguard, Enguard)

-

BÜFA Composite Systems GmbH & Co. KG (BÜFA-ISO-Gelcoat, BÜFA-Flexshield)

-

Fiberglass Coatings Inc. (FGCI ISO NPG Gelcoat, FGCI Marine Gelcoat)

-

GRP Factors Ltd. (GRP Standard Gelcoat, GRP Marine Gelcoat)

-

Gurit Services AG (Ampreg Gelcoat 90, Spabond Gelcoat)

-

HK Research Corporation (Aquaguard, UltraShield)

-

INEOS Composites (Neogel, Optus Gelcoat)

-

Interplastic Corporation (CoREZYN, Silmar)

-

Poliya (Polijel 712, Polijel 730)

-

Polynt Reichold (Dion Gelcoat, Polygel)

-

Resoltech (Resoltech 8020, Resoltech 5010G)

-

Scott Bader (Crystic Gelcoat 65PA, Crystic Permabright)

-

Sea Hawk Paints (Gelcoat White, Gelcoat Neutral)

-

Sicomin Epoxy Systems (SGi 128, SGi 15)

-

Spectrum Color (Spectrum Premium Gelcoat, Spectrum Color Matched Gelcoat)

-

Turkuaz Polyester (Turkuaz ISO Gelcoat, Turkuaz NPG Gelcoat)

-

Soromap Group (Soromap Iso Gelcoat, Soromap Topcoat Marine)

-

Bang & Bonsomer (BangGel ISO, BangGel NPG)

-

Atul Ltd (Atul Epoxy Gelcoat, Atul Polycoat)

Recent Developments

-

December 2024: KPS Capital Partners acquired INEOS Composites for €1.7 billion (US$1.8 billion) to strengthen its presence in the global composites industry, expanding into automotive, construction, renewable energy, and sports sectors.

-

January 2024: Scott Bader opened a £12.5 million advanced facility in North Carolina to enhance production of adhesives, gelcoats, and polymer-based products, expanding its footprint in North America.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1,390.34 Million |

| Market Size by 2032 | USD 4,237.75 Million |

| CAGR | CAGR of 4.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Polyester, Vinyl Ester, Epoxy, Others) •By Application Pattern (Spray-up, Brush & Roller) •By End-use Industry (Marine, Wind Energy, Transportation, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HK Research Corporation, Scott Bader, INEOS Composites, BÜFA Composite Systems GmbH & Co. KG, Allnex, Polynt Reichold, Ashland, Interplastic Corporation, Turkuaz Polyester, Poliya and other key players |