Gene Therapy Platform Market Size & Trends:

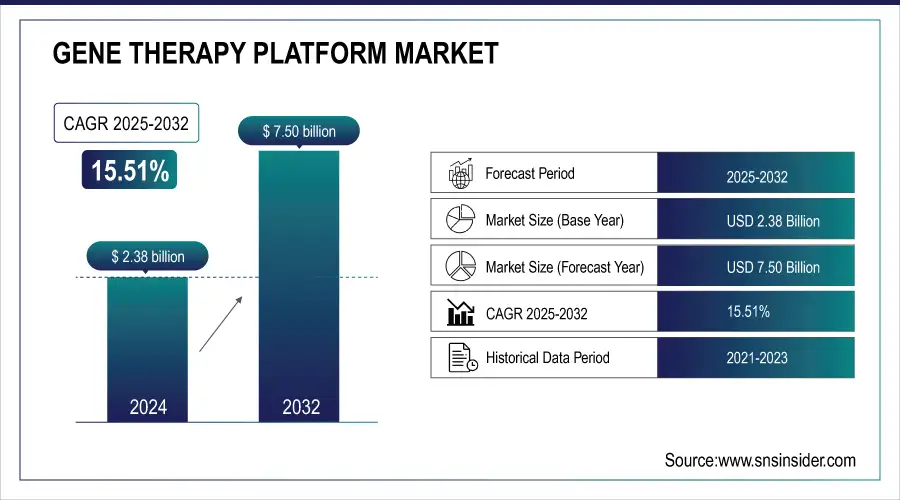

The Gene Therapy Platform Market size was valued at USD 2.38 billion in 2024 and is expected to reach USD 7.50 billion by 2032, growing at a CAGR of 15.51% over the forecast period of 2025-2032.

The global gene therapy platform market is rapidly growing, largely due to advancements in vector development, gene editing, and increasing investments in rare and genetic diseases. Increasing regulatory approvals and expanding clinical trials will help accelerate the growth of viral and non-viral delivery platforms. With growing interest in regenerative and personalized medicine, pharmaceutical and biotech companies are focusing more and more on in vivo and ex vivo gene therapy, in order to fill unmet medical needs in the fields of oncology, neurology, and genetic disorders.

To Get more information on Gene Therapy Platform Market - Request Free Sample Report

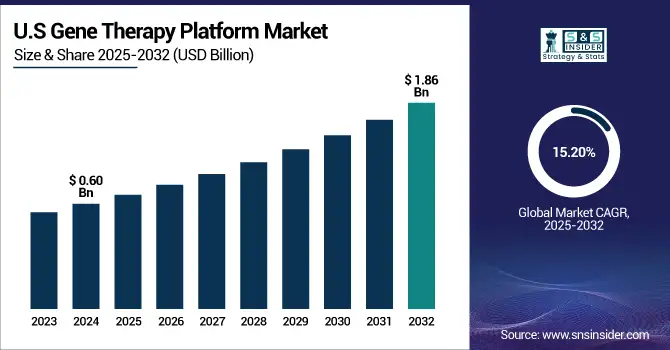

The U.S. gene therapy platform market size was valued at USD 0.60 billion in 2024 and is expected to reach USD 1.86 billion by 2032, growing at a CAGR of 15.20% over the forecast period of 2025-2032.

The U.S. dominates the market share of North America's gene therapy platform market analysis due to strong R&D infrastructures, amenable regulatory models, and high volumes of clinical trials. The U.S. has most of North America's approvals and innovation, led by formidable companies such as Novartis, Spark Therapeutics, and CRISPR Therapeutics. Streamlined FDA processes, such as breakthrough and orphan designations, have facilitated commercial launch, thus supporting continued U.S. leadership in the region.

Gene Therapy Platform Market Dynamics:

Drivers

-

Increasing Incidence of Genetic and Rare Diseases is Driving Market Growth

The increasing incidence of inherited and monogenic diseases on a global scale is one of the greatest drivers for the gene therapy platform market growth. Hemophilia, sickle cell anemia, spinal muscular atrophy (SMA), and Duchenne muscular dystrophy (DMD) have been demonstrated to have poor long-term outcomes with conventional therapies. Each of these diseases is met with promise when gene therapy can offer a one-time potential "cure", with gene correction or replacement of faulty genes at their site of action. With increasing incidence from improvements in genetic testing and newborn screens, the need for fundamental therapies such as gene therapy is growing, and investment into platforms for safe and specific delivery of genes continues to pour in.

Gene therapies targeting rare diseases have promising approval rates, with ~19% of gene therapy targets for rare diseases approved by the FDA (more than double the standard drug approval rate of 7.3%).

According to NCBI, FDA approvals of new gene therapies include: Casgevy (a CRISPR-based product for beta-thalassemia & sickle cell disease) received US approval in December 2023 and an EU approval in February 2024. Beqvez (hemophilia B gene therapy in an adeno-associated virus vector) was approved in Canada (December 2023), the US (April 2024), and the EU (July 2024).

-

Progress in Vector Engineering and Gene Editing Technologies is Leading to the Development of Gene Therapy Platforms More Rapidly

Viral vectors (e.g., adeno-associated virus (AAV) and lentiviruses) are becoming more effective and tissue-specific, while low immunogenicity non-viral vectors and lipid nanoparticles are becoming more widely accepted and evaluated as alternatives. Precise gene editing technologies such as CRISPR-Cas9, TALENs, and base editors make it possible to precisely correct gene defects with minimal off-target effects. These technologies are expanding the therapeutic potential for gene therapies, increasing platform flexibility and safety, and driving uptake in both clinical-stage and commercial pipelines.

Eli Lilly announced a USD 1.3 billion acquisition of Verve Therapeutics, which demonstrated ~60% LDL reduction in a phase 1 base-editing cardiovascular program.

According to the NIH, in 2025, a CRISPR-based, patient-tailored therapy for an ultra-rare liver disease of a child (CPS1 deficiency) achieved >80% correction of liver enzyme function, leading to independence from ammonia-scavenging drugs.

Restraint

-

High Cost of Development and Treatment is Restraining the Market Growth

One of the largest restraints on the gene therapy platform trends market is the astronomically high cost of creating and delivering these therapies. To illicit a gene therapy consists of long preclinical and clinical studies, adhering to disparate regulatory policies, and the fabrication of complex biological materials such as viral vectors. These are operations that require specialized facilities, highly-trained personnel, and robust quality systems; ultimately resulting in very high research and production costs.

For patients, therapy may cost more than USD 1 million to USD 3 million per dose, as with therapies such as Zolgensma (spinal muscular atrophy) and Hemgenix (hemophilia B). These costs impose an enormous burden on health systems and limit treatment access for patients, especially in low- and middle-income countries. Insurers and national health authorities will be hesitant to reimburse these therapies without providing longer-term evidence, and this will also impact the uptake of treatment despite promises of clinical benefit.

National Library of Medicine indicated that the cost of Hemgenix, therefore, makes it the most expensive medicine in the world, easily surpassing Novartis' Zolgensma gene therapy for spinal muscular atrophy (SMA), which is around USD 2 million and is also a single dose.

Gene Therapy Platform Market Segmentation Analysis:

By Type

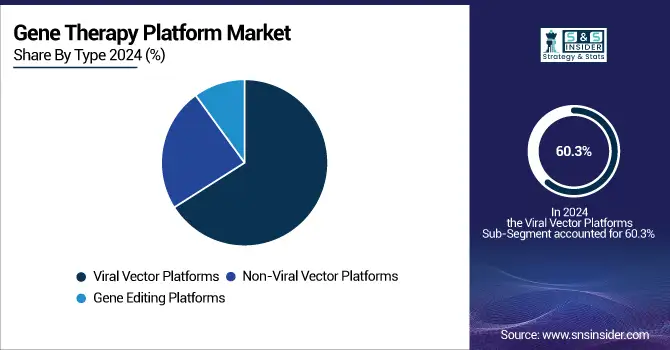

The viral vector platforms segment dominated the market in 2024 with a 60.3% market share based on its established record of enabling efficient transduction of therapeutic genes into target cells with long-term expression. Due to their proven safety, scalable manufacturing, and in vivo/ex vivo capabilities, adeno-associated viruses (AAVs), lentiviruses, and retroviruses are the mainstay for the majority of approved gene therapies, especially for rare genetic disorders and hematologic diseases.

Gene editing platforms segment is the fastest-growing segment during the forecast period, propelled on the back of technology advancements in CRISPR, TALENs, and base-editing reagents that allow for precise, programmable modifications to the genome. Gene Editing Platforms allow for gene addition and direct mutation correction of the cause of disease, and provide different avenues for therapeutic intervention, specifically in genetically complex and inherited diseases. Increased R&D spend in gene genome editing, the continued ramping up of CRISPR-based clinical trials, and regulatory momentum in light of initial clinical successes are all-important drivers. Growing needs for personalized, long-term therapies in oncology, neurology, and orphan diseases make gene editing platforms the gene therapy space's most dynamic space.

By Delivery Mode

The in vivo gene therapy segment dominated the gene therapy platform market share with a 48.26%, due to its relatively simple treatment process and direct administration of the genetic therapeutic material in a patient's body. In vivo gene therapy is especially ideal for treating neurological, ocular, and muscular diseases in which a localized gene delivery can be attained via viral vector and AAV (adeno-associated virus). In Vivo Gene Therapy is assumed to be less complex and resource-intensive than Ex Vivo possibility with the elimination of complicated cell extraction and re-infusion. In-vivo gene therapy demonstrated valuable delivery, while also obtaining recent progressions and approvals for other Orphan diseases such as spinal muscular atrophy and retinal dystrophies (all of which only flosses its market-leading position).

The ex vivo gene therapy segment is anticipated to have the highest growth in the forecast period, as it is trending with its potential accuracy and increasing potential in oncology and genetic blood disorders. In this method, cells are altered outside of the organism and then retransplanted back into the patient, which allows for stringent quality control and modified editing solutions with the likes of CRISPR technology. Ex Vivo Gene Therapy is expected to generate positive outcomes in hematological cancers, primarily based on the ongoing success of the CAR-T Cell Therapy.

By End Use

The pharmaceutical & biotechnology companies segment led the 2024 gene therapy platform market with a 38.13% market share, as these companies lead the development, innovation, and commercialization of gene therapy technology. Major pharma and biotech companies that have the benefit of established research & development infrastructure, access to capital, and established regulatory pathways have progressed gene therapy candidates from discovery to approval. In contrast to other companies, they undoubtedly have proprietary delivery platforms (viral vectors, gene editors) and routinely spend significant amounts of money on clinical trials in specialized areas of oncology, neurology, and rare diseases. Their strategic emphasis on regenerative and personalized medicine has led them to become the predominant growth drivers and technology enablers within the gene therapy markets.

Contract development & manufacturing organizations (CDMOs) are expected to grow the fastest during the forecast period, as demand for cloud manufacturing requires specialism, scale, and cost in gene therapy manufacture. As gene therapies get increasingly complex and increasingly personalized, many are finding they are unable to manufacture their trials, particularly small to mid-sized biotechs, and look to subcontract manufacture and process development to CDMOs with demonstrated expertise in the manufacture of viral vectors, engineering of cells, and regulatory requirements.

Gene Therapy Platform Market Regional Insights:

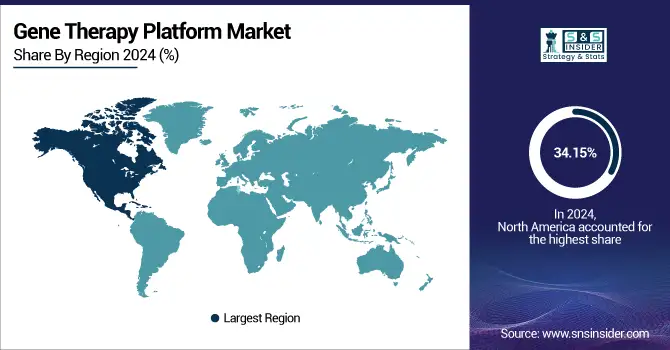

North America leads the gene therapy platform market with a 34.15% market share in 2024, through its highly developed biotechnology environment, vigorous research and development investment, and favorable regulatory environment. The presence of large pharmaceutical and biotech companies such as Novartis, Gilead (Kite), and Spark Therapeutics allows for rapid innovation and commercialization of gene therapy platforms. The U.S. FDA has played a critical role in supporting gene therapy approvals, including expedited pathways such as Fast Track, Orphan Drug, and Breakthrough Therapy designations. In addition, a high density of clinical trials, academic institutions, and public and private institutions in these areas further enhances North America's position.

Get Customized Report as per Your Business Requirement - Enquiry Now

The fastest-growing region for the gene therapy platform market trends is the Asia Pacific region, with 16.37% CAGR over the forecast period, as a result of increasing healthcare investments, improved biotechnology possibilities, and a rising number of patients with unmet medical needs. Nations such as China, Japan, and South Korea are increasing funding for gene therapy research; the regulations regarding approvals are getting better. China has advanced in gene editing and viral vectors; as a result, many companies are even part of international clinical trial networks. The increasing number of collaborations involving international biotech companies and regional players, as well as government-funded genomic medicine programs, will propel the rapid growth of the Asia Pacific region in this area.

The gene therapy platform market analysis in Europe is experiencing substantial growth as a result of continued strong R&D investments, favorable regulatory environments, and the rising incidence of rare diseases and genetic disorders. The UK, Germany, and France are ramping up their clinical trial pipelines, developing better vectors (both viral and non-viral), and expanding their manufacturing capabilities. Other highlights include conditional marketing authorizations of gene therapy products, including Casgevy for β-thalassemia and sickle cell disease. There are also government programs as well as public–private partnerships that are fostering the uptake of gene therapy technologies in Europe.

Latin America and the Middle East & Africa (MEA) markets are showing moderate growth in the Gene Therapy Platform Market, resulting from increasing biotech capabilities, partnerships, and investments in healthcare. For instance, in March 2024 agreement between Caring Cross and Fiocruz to produce CAR T and stem-cell therapies domestically, using serious commitments to price and platform technology generation. These efforts are fostering a modestly growing environment for gene therapy platforms in the region.

Growth is driven primarily by rising biotech investments and increasing levels of regulatory support in the UAE and South Africa in MEA. The Department of Health in Abu Dhabi and Opus Genetics signed a memorandum in June 2024, which is targeting the development of gene therapies for UAE retinal rare diseases. In addition to this, the rate of adoption of both viral and non-viral platforms by MEA is on the rise, but the overall growth is still modest against broader ambitions to include advanced therapies into public health systems.

Key Players in the Gene Therapy Platform Market:

The gene therapy platform companies, Novartis AG, Gilead Sciences Inc. (Kite Pharma), Spark Therapeutics Inc. (a Roche company), bluebird bio Inc., REGENXBIO Inc., Sarepta Therapeutics Inc., uniQure N.V., Audentes Therapeutics Inc. (Astellas), Amicus Therapeutics Inc., 4D Molecular Therapeutics, and other players.

Recent Developments in the Gene Therapy Platform Market:

-

January 2024 – Voyager Therapeutics, Inc., a biotechnology company dedicated to the advancement of neurogenetic therapies, entered into a strategic collaboration and capsid license agreement with Novartis Pharma AG, a member of the Novartis group. According to this agreement, Novartis obtains a target-exclusive license to use Voyager's TRACER capsids and related intellectual property for the creation of gene therapies for Huntington's disease (HD) and spinal muscular atrophy (SMA). Both firms will collectively move forward with a preclinical gene therapy candidate for Huntington's disease.

-

January 2023 – Gilead Company Kite entered into a research collaboration and license agreement with Epicrispr Biotechnologies (Epic Bio) to use Epic Bio's platform for proprietary gene regulation to develop next-generation cancer cell therapies. The partnership seeks to improve the functionality of CAR T-cell therapies by regulating key genes using the technology of Epic Bio.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.38 Billion |

| Market Size by 2032 | USD 7.50 Billion |

| CAGR | CAGR of 15.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Viral Vector Platforms, Non-Viral Vector Platforms, Gene Editing Platforms) • By Application (Oncology, Rare Genetic Disorders, Cardiovascular Diseases, Neurological Disorders, Ophthalmic Diseases, Hematological Disorders [e.g., Hemophilia, Sickle Cell], Musculoskeletal Disorders, Infectious Diseases [e.g., HIV, COVID-19 adjunct therapies]) • By Delivery Mode (In Vivo Gene Therapy, Ex Vivo Gene Therapy, Others [In-situ Gene Therapy]) • By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Contract Development & Manufacturing Organizations [CDMOs], Hospitals & Gene Therapy Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Novartis AG, Gilead Sciences Inc. (Kite Pharma), Spark Therapeutics Inc. (a Roche company), bluebird bio Inc., REGENXBIO Inc., Sarepta Therapeutics Inc., uniQure N.V., Audentes Therapeutics Inc. (Astellas), Amicus Therapeutics Inc., 4D Molecular Therapeutics, and other players. |