Artificial Intelligence in Genomics Market Size & Overview:

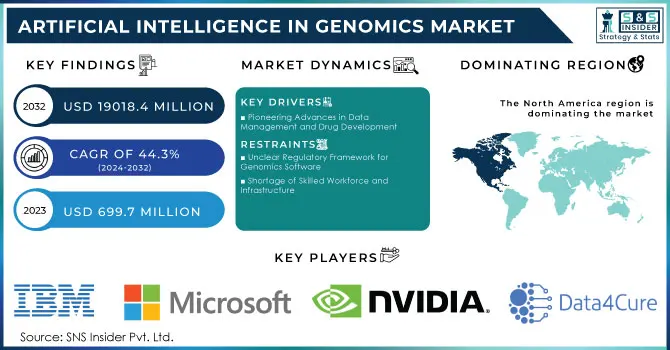

The Artificial Intelligence in Genomics Market Size was valued at USD 699.7 million in 2023 and is expected to reach USD 19018.4 million by 2032 and grow at a CAGR of 44.3% over the forecast period 2024-2032.

The AI revolution is changing the genomics market by integrating it into the healthcare sphere, which finds impetus based on increased demand for tailored medicines and R&D spending. The AI in the genomics market is experiencing spectacular growth. This growth can primarily be attributed to revolutionary advancements in AI technologies and the cost-effectiveness of such technologies.

Get more information on Artificial Intelligence In Genomics Market - Request Sample Report

Machine learning and deep learning algorithms have advanced significantly in the analysis of genomic data. Advanced tools enable researchers to notice patterns or interconnected patterns that could not be detected by natural methods. AI-based solutions allow for faster efficiency and reduce the cost of operations by automating most tasks related to genomic research. For example, during the COVID-19 pandemic, companies such as NVIDIA designed innovative genomics sequencing tools. Using these tools, researchers could track and analyze COVID-19 variants more effectively. It coordinated the efforts of the interested parties in the health sector to rush through the production of vaccines and drugs to curb acute health problems and expounds upon AI's contribution toward the effort.

AI-generated models of the human body significantly make new drugs safer and more effective. It now allows for more precise diagnoses that can lead to the development of proper treatment courses. One of the most groundbreaking developments recently designed is AI tools that can predict the outcome of genome-editing repair strategies without errors in treatments used for genetic diseases. These developments enhance not only the accuracy of genetic interventions but also the use of AI technology in clinical settings. The rise of prime editing, the latest genome editing revolution, is one instance of further synergy between AI and genomics in transforming the treatment of genetic disorders and propelling personalized medicine. In general, the growth of AI within the Genomics market signals a transformational shift in healthcare in which data-driven insights guide therapeutics to effectively tailor medical treatment and enrich patient care.

| Application Area | Description | Impact on AI in Genomics |

|---|---|---|

| Genomic Data Interpretation | Analyzing vast genomic datasets to identify mutations. | Accelerates understanding of genetic diseases |

| Drug Discovery | Using AI to predict drug interactions with genetic profiles. | Reduces time and cost of new drug development |

| Precision Medicine | Tailoring treatments based on individual genetic makeup. | Improves treatment efficacy and patient outcomes |

| Genomic Diagnostics | Enhancing the accuracy of genetic tests through AI algorithms. | This leads to earlier and more accurate disease detection. |

| Population Genomics | Analyzing genetic variations across populations. | Informs public health strategies and personalized care |

| Trend | Description | Potential Impact |

|---|---|---|

| Increased Automation | More automated processes in genomic data analysis. | Enhances efficiency and reduces human error |

| Enhanced Data Sharing | Improved platforms for sharing genomic data across institutions. | Promotes collaboration and accelerates research |

| AI-Driven Research | AI becoming integral in genomic research methodologies. | Fosters innovation and discovery in genetics |

| Integration of Multi-Omics Data | Combining genomic data with proteomic and metabolomic data. | Provides a holistic view of biological systems |

| Real-Time Genomic Analysis | Advancements enabling real-time analysis of genomic data. | Facilitates immediate clinical decision-making |

Artificial Intelligence in Genomics Market Dynamics

DRIVERS

-

Pioneering Advances in Data Management and Drug Development

The unprecedented surges in the generation of genomic data, estimated to be wide-ranging from 2 to 40 billion gigabytes annually in biomedical research and large-scale collaborations, are causing rapid growth. This increase in genomic data is mainly the reason genomics needs artificial intelligence today. For example, now that AI technologies like machine learning and deep learning algorithms are used to better manage and analyze enormous datasets, it has opened up avenues for extracting valuable insights in genomics and accelerating discoveries. Given the boom of biomedical and genomic data, scientists are now in the process of developing useful AI algorithms for processing complex data patterns and inferring relationships buried within DNA sequences. Such sophisticated solutions present a lot of promise, but several challenges still linger in this case, related to the inner workings of AI algorithms that might introduce biases into the analysis of DNA data.

Further, the rising adoption of AI-based solutions also supports the growing market. AI is moving very fast at identifying genetic mutations in tumors by employing high-resolution 3D imaging techniques. Today, some latest technologies have emerged with the capacity to detect glioma-type tumors from scans taken directly from the brain without needing an invasive biopsy to reduce the risk involved in the surgery. The diagnosis is made automatically through AI and machine learning which is revolutionizing the health sector and finds support in the digitization of health-related data and swift technological advancements.

There is also the pressure of rising costs of R&D that squeeze the profit margins of the pharmaceutical industry. As companies seek to revolutionize these areas, one of the exciting spaces where AI can make a difference is in drug discovery. According to Bloomberg, AI can improve timelines up to two or three times the speed of traditional methods, create a dramatically better cost structure, and increase the chances of approval. Many of them are significant companies, such as Johnson & Johnson, AstraZeneca, and Pfizer, that have undertaken substantial efforts to integrate AI with genomics and engineering tools towards better target identification and validation. For example, the knowledge graphs and image analysis applied in AstraZeneca will derive insights on diseases and classify biomarkers 30% faster than traditional processes. Other relevant collaborations are those carried out between industry firms and AI specialists, like Renalytix AI, which showcases the commitment of the pharmaceutical industry to innovation in drug discovery.

The increasing investments from pharmaceutical companies in drug discovery and development activities are expected to drive the growth of AI in genomics. Moreover, since these processes tend to be highly costly, embracing AI technologies will most likely improve operational efficiency and quality, thus saving costs. So, an increased amount of chronic and infectious diseases have been increasing demand from pharmaceutical companies as well as stimulating huge investment in drug discovery and development, which will eventually augment the growth of global AI in the genomics market.

RESTRAINTS

-

Unclear Regulatory Framework for Genomics Software

-

Shortage of Skilled Workforce and Infrastructure

Artificial Intelligence in Genomics Market Segmentation Analysis

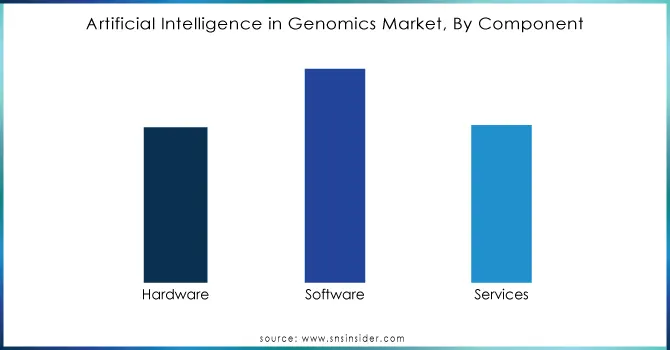

By Component

services. In 2023, the major share of the market was accounted for by the software component, holding an approximate 40% share, and is further projected to gain the highest compound annual growth rate, 46.6%, in the forecast period. The growth is mainly due to the adoption of AI-based software solutions in healthcare institutions and research and development centers.

Artificial intelligence technology has already been integrated into several healthcare applications, such as cybersecurity, clinical trials, virtual assistants, telemedicine, and fraud detection, amongst others, thus propelling the rapid growth of this segment. In addition to tBIOhis, public as well as private sector initiatives are highly driving ahead the market growth. For instance, in July 2018, Illumina, Inc. released open-source AI software that would differentiate between disease-causing mutations and the millions of benign genetic variants that exist in individuals.

Need any customization research on Artificial Intelligence In Genomics Market - Enquiry Now

By Technology

Technology is further segmented into machine learning and computer vision. In 2023, the share of the machine learning segment accounted for about 63% and is anticipated to witness the highest compound annual growth rate during the forecast period. There are a few ways machine learning helps in genomic research as scientists need to make discoveries and advance knowledge related to the genetics of health and disease. Algorithms can automate labor-intensive time-consuming work like annotating genomic data and finding potential drug targets to improve efficiency.

On the other hand, the computer vision segment is expected to gain a significant CAGR of more than 45% during the forecast period. Computer vision refers to algorithms that are used for analyzing and interpreting images, which has been gaining ground in genomics applications. With automated processes and outcomes more accurate, computer vision is bound to play an important role in furthering genomics research.

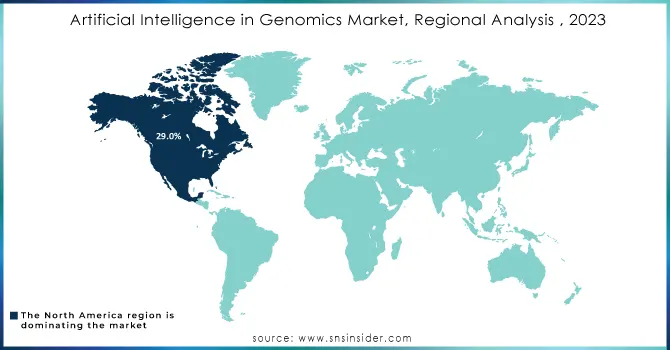

Artificial Intelligence in Genomics Market Regional Analysis

North America dominated the global AI in the genomics market in 2023, holding around 29.0% of the revenue share. The reason for this massive share is significant among all other factors. This is because North America is home to the presence of several major players involved in this market, such as Danone, Abbott, Nestlé, Targeted Medical Pharma, Inc., and Mead Johnson & Company, LLC. Market Share is also expected to be dominated by North America, as it houses the largest and most well-endowed research institutes and biotechnology companies worldwide, that are highly investing in developing AI-driven solutions for genomics. The wave of investments is fostering innovative software and tools for genomic data analytics and driving the development of the AI in genomics market in this region.

The Asia Pacific region is expected to grow the fastest with a CAGR of 47.1% during the forecast period. It is driven by multiple factors such as rapidly escalating healthcare expenses, an increased focus on precision medicine, improved genomics technology, and a large and increasing population base. Many Asian countries have embarked on national genomics programs to establish genetic databases of the population through the sequencing of the DNA of healthy individuals. For example, in 2019, the Thai government entered into a five-year Genomics Initiative worth USD 150 million to characterize the genomes of 50,000 citizens. As such, this strategic focus is highly likely to push demand for AI in genomics within the Asia Pacific region very significantly.

KEY PLAYERS

AI Platforms and Software

-

IBM

-

Microsoft Corporation

Genomic Data Analysis and Interpretation

-

Data4Cure, Inc.

-

Freenome Holdings, Inc.

Genomic Sequencing and Tools

-

Thermo Fisher Scientific

-

Illumina, Inc.

Genomic Data Integration and Interpretation

-

SOPHiA GENETICS

-

BenevolentAI

-

Fabric Genomics

Recent Developments:

In May 2024, the AI-driven EXPRESSO model was developed to predict the risk of autoimmune diseases by analyzing genomic data, epigenetics, and other relevant information, enabling the identification of specific risk genes associated with these conditions.

In February 2023, Accenture Ventures announced a strategic investment in Ocean Genomics, a technology and AI firm that has created advanced computational platforms aimed at helping biopharma companies enhance the discovery and development of more effective diagnostics and therapeutics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 699.7 million |

| Market Size by 2032 | US$ 19018.4 million |

| CAGR | CAGR of 44.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology [Machine Learning (Deep Learning, Supervised Learning, Unsupervised Learning, Others), Computer Vision] • By Functionality (Genome Sequencing, Gene Editing, Others) • By Application (Drug Discovery & Development, Precision Medicine, Diagnostics, Others) • By End-use (Pharmaceutical and Biotech Companies, Healthcare Providers, Research Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Microsoft Corporation, NVIDIA Corporation, DEEP GENOMICS, Data4Cure, Inc., Freenome Holdings, Inc., Thermo Fisher Scientific, Illumina, Inc., SOPHiA GENETICS, BenevolentAI, Fabric Genomics |

| Key Drivers | • Pioneering Advances in Data Management and Drug Development |

| Restraints | • Unclear Regulatory Framework for Genomics Software • Shortage of Skilled Workforce and Infrastructure |