Generative AI in Packaging Market Report Scope & Overview:

The Generative AI in Packaging Market was valued at USD 708.91 million in 2025 and is expected to reach USD 7799.17 million by 2035, growing at a CAGR of 27.1% from 2026-2035.

The market is transforming traditional packaging design by introducing intelligent automation, personalization, and sustainability. Leveraging AI algorithms, brands can create optimized, visually engaging, and eco-friendly packaging faster and more cost-effectively. This technology enables rapid prototyping, data-driven customization, and reduced material waste, supporting both innovation and environmental goals. Industries such as food & beverage, cosmetics, and pharmaceuticals are increasingly adopting generative AI to enhance consumer engagement and brand identity.

According to a study, the adoption of generative AI in packaging is driven by the demand for design efficiency, with over 60% of packaging companies integrating AI tools into their creative workflows. As a result, design cycle times have decreased by up to 35%, while material usage has been optimized by nearly 25%.

Generative AI in Packaging Market Size and Forecast

-

Market Size in 2025: USD 708.91 Million

-

Market Size by 2035: USD 7799.17 Million

-

CAGR: 27.1% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Generative AI in Packaging Market - Request Free Sample Report

Generative AI in Packaging Market Trends

-

Rising demand for personalized, innovative, and sustainable packaging solutions is driving the generative AI in packaging market.

-

Growing adoption of AI-powered design tools for rapid prototyping, structural optimization, and visual creativity is boosting market growth.

-

Expansion across food & beverage, cosmetics, pharmaceuticals, and e-commerce sectors is fueling deployment.

-

Increasing focus on reducing material waste, improving brand differentiation, and enhancing consumer engagement is shaping adoption trends.

-

Advancements in machine learning, 3D modeling, and simulation technologies are enhancing design efficiency and accuracy.

-

Rising investments in smart manufacturing and digital transformation initiatives are supporting market expansion.

-

Collaborations between AI solution providers, packaging manufacturers, and consumer brands are accelerating innovation and global adoption.

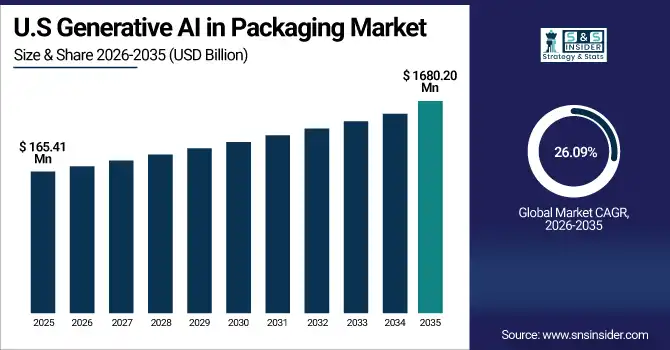

The U.S. Generative AI in Packaging Market was valued at USD 165.41 million in 2025 and is expected to reach USD 1680.20 million by 2035, growing at a CAGR of 26.09% from 2026-2035. The U.S. Market has a strong demand for design automation and sustainable solutions. As a result, over 65% of U.S.-based packaging companies have adopted AI-driven tools to reduce design time and material waste. The U.S. is dominating the North American market due to its advanced technological infrastructure, high R&D investments, and presence of major AI startups. This has led to faster AI integration across industries, accelerating innovation in packaging applications.

Generative AI in Packaging Market Growth Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Generative AI in Packaging Market Growth

The increasing global demand for sustainable and eco-friendly packaging is significantly driving the adoption of generative AI in the packaging industry. As environmental regulations tighten and consumers become more environmentally conscious, companies are under pressure to reduce waste, optimize material usage, and minimize carbon footprints. As a result, generative AI tools are being adopted to design efficient, lightweight, and recyclable packaging formats that meet sustainability targets. These AI-powered solutions can generate thousands of design iterations in seconds, allowing manufacturers to test and implement the most material-efficient option.

In March 2024, a major packaging firm introduced an AI-based tool to design biodegradable packaging optimized for reduced material use. This development is a reflection of how the market is leveraging generative AI to meet environmental objectives while also improving production efficiency and cost management. Such innovations are not only helping brands become greener but also unlocking commercial opportunities for growth by aligning with evolving consumer and regulatory expectations.

Generative AI in Packaging Market Restraints:

-

High Initial Implementation Costs Restrain Generative AI in Packaging Market Expansion

Despite its long-term efficiency benefits, the high upfront cost of deploying generative AI solutions is a significant restraint in the market. Smaller and mid-sized packaging firms often face financial constraints that make investing in AI-based systems difficult. The initial capital expenditure includes costs for AI infrastructure, software licensing, skilled workforce training, and integration with existing manufacturing systems. As a result, many companies hesitate to make the transition from traditional design methods to AI-driven approaches. The complex nature of AI technology also adds a layer of risk and uncertainty regarding return on investment, further limiting adoption among financially cautious players in the market.

This cost-based restraint is particularly evident in developing regions or among firms with limited digital maturity. Without subsidies, incentives, or cost-effective AI solutions, many players may remain reliant on manual or semi-automated packaging processes, which slows overall market growth and restricts the broader implementation of generative AI technologies across the industry.

Generative AI in Packaging Market Opportunities:

-

Surging Demand for Hyper-Personalization Creates Strong Market Opportunities for Generative AI in Packaging Design Innovation

The rising demand for hyper-personalized consumer experiences across sectors like food, beauty, and e-commerce is creating major opportunities in the generative AI in packaging market. Consumers are increasingly drawn to products with packaging that feels tailored to them, whether through names, preferences, or visual themes. In response, brands are turning to generative AI to create uniquely personalized packaging designs at scale. AI algorithms can analyze customer data and generate customized packaging solutions in real time, significantly enhancing brand engagement and loyalty. This personalization trend is pushing companies to explore AI capabilities not just for operational efficiency, but as a core branding strategy.

In February 2024, a prominent cosmetic brand launched a limited-edition product line with packaging created by generative AI based on customer mood profiles and seasonal trends. The campaign led to a notable increase in online engagement and sales conversions. This development highlights how generative AI is transforming packaging from a logistical necessity into a dynamic marketing asset, opening up lucrative avenues for companies willing to embrace personalization through AI-driven design.

Generative AI in Packaging Market Challenges:

-

Lack of Skilled Workforce Challenges Generative AI in Packaging Market, Scalability, and Adoption

A significant challenge faced by generative AI in the packaging market is the shortage of a technically skilled workforce capable of developing, deploying, and maintaining AI systems. While the technology itself is advancing rapidly, many packaging firms struggle to recruit and retain professionals with the necessary AI, machine learning, and data science expertise. This talent gap restricts the full-scale adoption of generative AI solutions, especially in companies aiming to integrate AI seamlessly into design and production workflows. As a result, even with growing awareness and demand, the industry is often slowed down by internal capability limitations.

Without a sufficient talent pipeline, companies are forced to either invest heavily in training or rely on third-party AI vendors, which can further strain budgets or lead to inconsistent results. In such scenarios, the inability to build in-house AI competence undermines long-term scalability, placing companies at a competitive disadvantage in a rapidly evolving market landscape.

Generative AI in Packaging Market Segment Analysis

By Technology

The Machine Learning (ML) segment captured 44% of the revenue share in 2025 due to its ability to analyze vast packaging datasets and optimize design decisions. As packaging companies demand faster innovation cycles, ML automates design selection, material optimization, and visual layout prediction. This efficiency leads to higher output quality and cost savings. Product development using ML, such as AI-assisted dieline creation, enhances packaging functionality, directly contributing to the widespread adoption of ML in the Generative AI in Packaging Market.

The GANs segment is growing at the fastest CAGR of 29.4% as its ability to generate highly creative, realistic, and novel packaging designs fuels adoption. As brands seek unique visual packaging elements, GANs enable the production of AI-generated prototypes indistinguishable from human designs. This capability supports product differentiation and faster iteration. In 2024, several packaging firms integrated GAN-powered tools to test consumer responses to multiple designs, accelerating development and reinforcing GANs' role in transforming the Generative AI in Packaging Market.

By Application

Structural Design accounted for 36% of the market share in 2025 due to the need for packaging solutions that balance material strength, usability, and sustainability. AI tools driven by generative design automate 3D structural optimization, reducing waste and improving protection. This demand for precision leads to broader adoption in industries like food and pharma. In product development, AI-generated structural prototypes help reduce design-to-production time, solidifying Structural Design's pivotal role in the Generative AI in Packaging Market’s growth.

Consumer Personalization is expanding at a CAGR of 29.8% as brands aim to deliver tailored packaging experiences that resonate with individual customers. Generative AI tools allow rapid customization at scale by analyzing customer preferences, seasonal trends, and buying behavior. This boosts engagement and conversion rates. Major brand launched AI-personalized packaging for a limited series, which increased user interaction, showcasing how personalization is reshaping product packaging strategies in the Generative AI in Packaging Market.

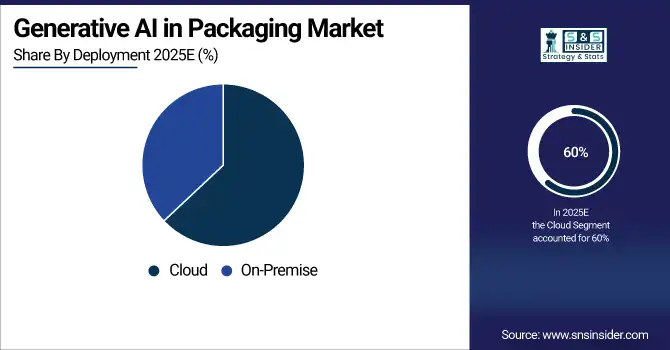

By Deployment

The Cloud segment led with 60% revenue share in 2025 as companies favor scalable, cost-effective, and remotely accessible AI solutions. Cloud-based generative AI platforms enable real-time design collaboration, version control, and faster deployment of design iterations. These benefits are vital for globally distributed packaging teams. leading packaging providers transitioned to cloud-based design tools to support sustainability and agility, making Cloud deployment integral to the evolution of the Generative AI in Packaging Market.

On-premises deployment is growing at a CAGR of 28.4% due to increasing data security concerns and the need for customized, internalized AI workflows. Enterprises handling proprietary design data prefer local infrastructure for tighter control and reduced cyber risk. In 2024, several regulated sectors, such as pharmaceuticals, opted for on-premises generative AI setups to meet compliance. This adoption pattern demonstrates how controlled environments contribute to the safe implementation of generative AI in the Packaging Market.

By End-Use

Food & Beverages led the market with a 30% share in 2025, driven by the sector’s constant need for safe, attractive, and sustainable packaging. Generative AI helps brands design packaging that meets regulatory standards, preserves shelf life, and captures consumer attention. Companies in this sector use AI to prototype flexible, eco-friendly formats rapidly. In 2024, a food brand deployed AI to optimize packaging for extended freshness, proving the segment's continued dominance in the Generative AI in Packaging Market.

Retail & E-commerce is expanding at a CAGR of 30.2% as online businesses demand packaging that enhances unboxing experiences and protects products during transit. Generative AI enables automated design generation for diverse product sizes and branding themes. In early 2025, an e-commerce brand launched a dynamic packaging design engine using AI to personalize boxes by customer order data, improving retention rates and affirming how retail’s innovation focus drives growth in the Generative AI in Packaging Market.

Generative AI in Packaging Market Regional Analysis

North America Generative AI in Packaging Market Insights

North America leads the Generative AI in Packaging Market with a 38.0% share in 2025, driven by early AI adoption, strong R&D investments, and a mature packaging industry. The presence of tech-forward packaging companies and a high demand for automated, sustainable solutions contribute to regional dominance. The United States dominates the North American market due to its advanced AI infrastructure, widespread use of machine learning in design optimization, and increasing demand for intelligent packaging in sectors like food, beauty, and pharmaceuticals.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Generative AI in Packaging Market Insights

Asia Pacific is the fastest-growing region with a 29.1% CAGR, fueled by rapid industrial digitization, booming e-commerce, and the rise of smart manufacturing initiatives. Generative AI is being deployed to meet demand for mass customization, sustainable packaging, and high-volume production efficiency. China dominates the Asia Pacific market due to its aggressive AI technology adoption, strong manufacturing base, and large-scale deployment of generative design tools in consumer goods and logistics packaging.

Europe Generative AI in Packaging Market Insights

Europe is witnessing steady growth, supported by sustainability goals, design automation needs, and strong packaging innovation ecosystems. The region emphasizes eco-conscious production, pushing the adoption of AI for material-efficient design. Germany dominates the European market owing to its advanced manufacturing capabilities, strict environmental regulations, and early use of generative AI in industrial and consumer packaging workflows, particularly in automotive and retail applications.

Middle East & Africa and Latin America Generative AI in Packaging Market Insights

The Middle East & Africa and Latin America regions are seeing emerging adoption of generative AI in packaging, driven by growing industrial activity, modernization of manufacturing, and increasing interest in automation and sustainability. South Africa leads MEA, leveraging AI in packaging for consumer goods and pharmaceuticals. Brazil dominates Latin America, supported by rapid growth in food and beverage exports, demand for efficient logistics packaging, and public-private investments in AI-enabled industrial design tools.

Generative AI in Packaging Market Competitive Landscape:

Adobe Inc.

Adobe Inc. is a global leader in creative software and digital experience solutions, delivering tools for design, multimedia, and generative AI workflows. Adobe leverages AI through its Firefly and Express platforms to accelerate creative production, automate repetitive design tasks, and enable scalable content generation. Its solutions empower enterprises and creators to produce images, video, packaging, and 3D assets faster and more efficiently, while reducing manual effort. Adobe continues to collaborate with technology partners to integrate AI across creative and enterprise workflows.

-

2023: Adobe partnered with NVIDIA to co-develop advanced generative AI models, accelerating creative design workflows, including image and 3D content generation for packaging design tools.

-

2025: Adobe announced Newell Brands uses Adobe Firefly and Express generative AI to scale packaging content production, boosting asset creation 75% and reducing social content time by 33%.

Amazon

Amazon is a global e-commerce and logistics leader leveraging AI and robotics to optimize warehouse operations, fulfillment, and supply chain efficiency. Its AI initiatives include advanced vision-guided packaging, tactile sensing robotics, and generative AI-assisted production processes. By automating packaging design and fulfillment, Amazon reduces material waste, improves speed, and customizes solutions at scale. The company continues to deploy AI-driven solutions globally, integrating robotics, AI perception, and generative automation to enhance operational efficiency and sustainability in logistics and packaging workflows.

-

May 2025: Amazon unveiled its Vulcan robot with AI-driven tactile sensing and AI-enabled packaging machines, deploying over 70 units in Europe to reduce waste and optimize fulfillment operations.

NVIDIA Corporation

NVIDIA Corporation is a leading technology company specializing in GPUs, AI computing platforms, and accelerated computing solutions. Its AI platforms enable robotics, vision-guided automation, and generative AI applications for industrial and enterprise use cases. NVIDIA collaborates with OEMs to embed AI into packaging and processing machines, reducing costs and enhancing efficiency. Through initiatives like Jetson embedded AI computers, NVIDIA empowers manufacturers to implement next-generation AI-powered automation for packaging, logistics, and industrial workflows, combining high-performance AI with robotics and computer vision technologies.

-

January 2025: NVIDIA and OEM partners introduced a low-cost embedded AI “Jetson” computer for robotics and vision, enabling AI-powered packaging machines with generative AI for automation.

Key Players

Some of the Generative AI in Packaging Market Companies

-

Adobe Inc.

-

Amazon Inc.

-

NVIDIA Corporation

-

Microsoft Corporation

-

Clarifai

-

PackageX Inc.

-

Dassault Systèmes

-

Accenture

-

Kebotix, Inc.

-

OpenAI

-

Cognex Corporation

-

GE Digital

-

ABB Group

-

Neurala

-

Midjourney, Inc.

-

Canva

-

IBM

-

Google LLC

-

Autodesk

-

Meta

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 708.91 Million |

| Market Size by 2035 | USD 7799.17 Million |

| CAGR | CAGR of 27.1% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Generative Adversarial Networks (GANs), Natural Language Processing (NLP), Machine Learning (ML), 3D Generative Design Tools) • By Application (Structural Design, Label & Artwork Generation, Sustainability Optimization, Consumer Personalization, Marketing Visualization, Simulation & Testing) • By Deployment (On-premises, Cloud) • By End-Use (Food & Beverages, Consumer Goods, Pharmaceuticals, Retail & E-commerce, Cosmetics & Personal Care, Industrial Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Adobe Inc., Amazon Inc., NVIDIA Corporation, Microsoft Corporation, Clarifai, PackageX Inc., Dassault Systèmes, Accenture, Kebotix, Inc., OpenAI, Cognex Corporation, GE Digital, ABB Group, Neurala, Midjourney, Inc., Canva, IBM, Google LLC, Autodesk, Meta, and Others. |