Genomics In Cancer Care Market Report Scope & Overview:

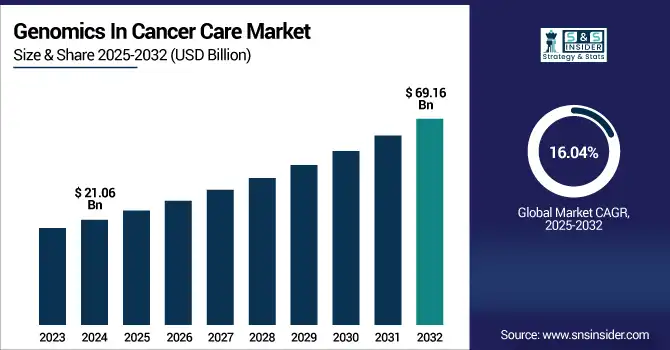

The genomics in cancer care market size was valued at USD 21.06 billion in 2024 and is expected to reach USD 69.16 billion by 2032, growing at a CAGR of 16.04% over 2025-2032.

To Get more information on Genomics-In-Cancer-Care-Market - Request Free Sample Report

The global genomics in cancer care market is booming as precision medicine, but its benefits are opening a new era of medicine that enables improved diagnoses and treatment, and provides access to novel therapies. The rising prevalence of cancer, along with an increase in demand for genomic profiling tests for early diagnosis, risk assessment, and treatment selection, are the key driving factors of the market. In the past few years, key genomics in cancer care players such as Illumina, Roche, and Thermo Fisher Scientific have heavily invested in R&D to further the development of the sequencing platforms and bioinformatics software.

In May 2024, Roche announced the launch of the AVENIO Edge System, a platform that streamlines NGS library preparation and establishes Roche's leadership in the genomics in cancer care market.

For instance, Illumina spent more than USD 1.2 billion on R&D in 2023, a sign of the rapid innovation the industry has been experiencing. Moreover, continued regulatory backing has also influenced the global market for genomics in cancer care, e.g., the FDA has approved/pending the approval of several companion diagnostics, and of course, broadened approval of tumor-agnostic therapies. Furthermore, growing numbers of public-private partnerships and more funding from outfits such as the NIH are bolstering the supply side. The genomics in cancer care market trends also gain momentum from declining costs of sequencing, increased clinical utility, and the rapid transition to liquid biopsies, which are non-invasive and increasingly favored by clinicians. This has resulted in strong demand from developed and developing economies is expected to drive genomics in the cancer care market analysis.

In January 2024, Guardant Health received FDA approval for its Shield blood-based colorectal cancer screening test that can increase non-invasive early detection, one of the most disruptive genomics cancer care market trends.

Market Dynamics:

Drivers:

-

Precision Medicine Demand, Innovation, and Regulatory Backing Propel Market Growth

The genomics in cancer care market is driven by the rising need for precision oncology, technological advancements, and a favorable reimbursement scenario. One key growth driver will be the broad adoption of genomic testing to select treatments, since nearly 80% of all new oncology trials in the U.S. include genomic biomarkers. Growing uptake of NGS, combined with decreasing sequencing costs (from ~USD 10,000 in 2010 to

The demand has also been bolstered by increasing reliance on clinical oncologists for companion diagnostics in targeted therapies. On the supply side, vendors such as QIAGEN and Agilent continue to add cancer-focused genomic assays to their menus under increased demand by labs. Regulatory bodies such as the FDA and EMA are fast-tracking approvals of tumor-agnostic drugs and their genomic diagnostics to help increase market adoption.

For instance, in 2023, the FDA approved FoundationOne Liquid CDx for multiple solid tumors. Public-private collaborations such as the AACR Project GENIE are also improving the integration of clinical-genomic data. Taken together, these drivers are greatly contributing to the upward momentum of the genomics in cancer care market growth and adoption globally.

Restraints:

-

High Costs, Data Complexity, and Skilled Workforce Gaps Hamper the Market Expansion

Many critical barriers need to be overcome for genomics in cancer care, as resistance mechanisms to targeted therapy are discovered, and more approaches to overcome this resistance are needed. Despite advances in technology, the genomics in cancer care market is still subject to several key limitations, such as a high implementation cost, a lack of standardization, and a shortage of workforce. While the cost of sequencing has come down, the real cost of genomic integration, informatics, interpretation, and clinical validation remains high, often over USD 2000/patient in the case of comprehensive testing. Small and medium-sized healthcare organizations have limited financial and operating capacity to implement and utilise M-health solutions, particularly in low-resource contexts.

In addition, the complex nature of genomic data also demands sophisticated bioinformatics infrastructure and human capacity, but the current global lack of genomic experts hinders its scalability. Less than 15% of cancer centres globally have in-house expertise for genomic analysis, according to the Global Alliance for Genomics and Health 2023 report.

A further limitation is the restraint of data privacy and the necessity of conforming to changing standards like GDPR and HIPAA that require a huge global harmonization effort. Furthermore, disparate regulatory trajectories for LDTs and variations in clinical practices from country to country hamper the acceptance of the test. For example, the FDA has been moving toward increased regulation of LDTs, but in the meantime, certain jurisdictions have not warned of a lack of compliance, causing product launches to be delayed. These issues slow market growth despite demand, which slows genomics in the cancer care market share and integration in routine clinics.

Segmentation Analysis:

By Product

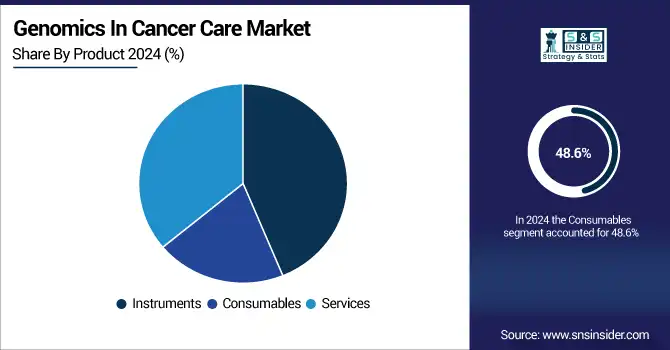

In 2024, the consumables were the leading product and occupied 48.6% of the genomics in cancer care market share. This is attributable, in part, to the repetitive nature and high usage of reagents, assay kits, primers, and buffers in genomic workflows like PCR (Polymerase Chain Reaction), next-generation sequencing, and microarray-based testing workflows. Rising application of genomic testing in oncology, both as a diagnostic tool as well as for monitoring, is further fuelling the demand for these consumables, specifically, in clinical laboratories as well as research.

In contrast, the services sector is the fastest-growing, driven by the growing tendency to outsource sequencing and data analysis to specialist service organisations. Increasingly complex genomic data interpretation and limited in-house bioinformatics expertise in health care facilities contribute to an impetus to depend on third-party service providers. In addition, new service models such as sequencing-as-a-service and cloud-delivered genomic platforms are growing fast.

By Application

Diagnostics was the largest segment of the genomics in cancer care market in 2024, accounting for 42.1% of total revenue. This segment is led by the growing adoption of genomics tools in cancer screening, mutation detection, and companion diagnostic tests for choosing target therapies. The widespread application of next-generation sequencing and liquid biopsy tumor profiling has integrated genomics fully into clinical oncology. The increasing payer coverage of diagnostic panels and FDA clearances of companion diagnostics continue to drive this leadership.

In the meantime, personalized medicine is a highly developing segment. Leveraging genomics to inform individualized treatment plans, including actionable mutations such as EGFR, BRAF, and ALK, is becoming increasingly prevalent with the trend towards precision oncology. This segment is expected to grow rapidly, driven by developments in clinical outcomes and the demand for specific therapies, as more and more oncologists approach treatment based on a patient’s genomic profile.

By Technology

The technology segment was dominated by genome sequencing in 2024, generating revenue of 35.8% in the genomics in cancer care market. Its power of analyzing both somatic and germline mutations makes it one of the most core elements in clinical oncology pipelines. Alongside the growing adoption of whole-genome and targeted sequencing for cancer identification, treatment stratification, and biomarker discovery, the segment has been advancing. Sequence-based readouts and cost reductions in sequencing technology have made a new generation of diagnostic testing available in clinical and research-based operations.

Digital Droplet PCR (ddPCR) is the fastest-growing technology segment. ddPCR provides a highly sensitive and precise tool for detecting rare genetic variants, which is important for MRD detection and real-time tracking for cancer relapse using liquid biopsy. The increasing use of liquid biopsy, for non-invasive, accurate detection of oncogenic mutations, is propelling its widespread implementation, especially among leading diagnostic labs and companies developing precision medicine.

By End-Use

Biotechnology and pharmaceuticals were the largest genomics in cancer care market share in 2024, as a result of high employment of genomics in the development of oncology drugs, in clinical trials, and to find biomarkers to treat cancer. These companies use genomic technologies to develop better treatments, stratify patient populations, and help discern resistance mechanisms. Strategic partnerships with diagnostic companies and academic centres have further enhanced their genomic capacity.

In contrast, diagnostic laboratories are the fastest-growing end-user segment. The growth of outsourced genomic testing by small clinics, hospitals, and oncology centers also supported the growth of advanced cancer diagnostic labs, performing next-generation sequencing, liquid biopsy, and RNA expression profiling. And increasing accreditations (e.g., CLIA, CAP) and regulatory quality (LDTs) also help instill confidence in genomic test quality, and are driving the movement to centralized, high-throughput genomic labs.

Regional Analysis:

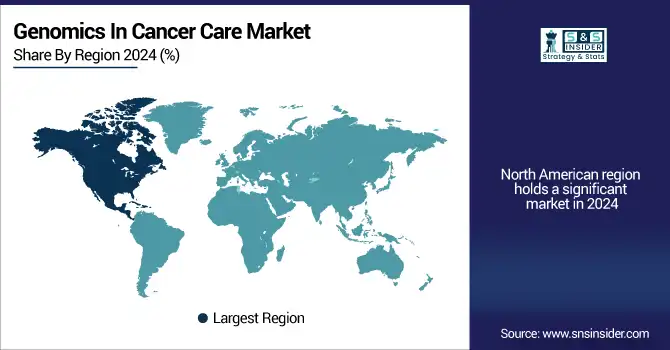

North America held a significant genomics in cancer care market share in 2024 on account of its well-established healthcare system, high prevalence of cancer, and increasing investments by governments and private entities for precision oncology.

The U.S. genomics in cancer care market size was valued at USD 7.83 billion in 2024 and is expected to reach USD 25.21 billion by 2032, growing at a CAGR of 15.70% over 2025-2032. The largest market share in the U.S. is attributed to the broad adoption of NGS, availability of companion diagnostics, and FDA approvals for genomic technology, products, and services. Over 75% of U.S. oncology clinical trials make use of genomic biomarkers, and billions of dollars are spent on related diagnostic tests by large companies like Illumina and Guardant Health. Canada is also seeing an uptick in adoption with government-sponsored cancer genomics programs like the All for One precision health initiative brought in place there. The market share is highest in North America, with a moderate growth rate (as a result of market saturation). Despite the continued preference for generic screening trays, innovation, policy support, and payer coverage of genomic diagnostics should support its leadership.

Europe is also projected to be the second fastest growing region for genomics in the cancer care market due to the robust academic research environment and the presence of centralised biobanks, combined with legal clarity, under the In Vitro Diagnostic Regulation (IVDR).

The UK is the regional front-runner in the adoption of genomics, mainly thanks to projects such as Genomics England, which seeks to develop up to 5 million genomes. Germany itself is a big player, following investments in cancer research centers and between pharma and diagnostics companies. The UK and Germany’s single-payer systems make it easier to provision medical genetic testing. The demand is also stoked by more and more EU-funded research collaboration and public-private partnerships. The fragmented nature of healthcare systems in countries like Italy and Spain is making efforts difficult, but the burgeoning awareness and incorporation of genomic tools are driving growth across the region. Europe’s regulation strengthening and public data-sharing are huge reasons for growth to become a fact.

Asia Pacific is the fastest-growing region due to the growth of genomics in cancer care, as cancer is prevalent, fast-growing technology adoption, and increasing government and private investments.

China leads in the region, with the most genomics integrated into clinical cancer care, buoyed by projects such as the China Precision Medicine Initiative and investment by large players like BGI and WuXi NextCODE. In 2024, more than 60% of top-tier hospitals in China adopted NGS-based testing for cancer diagnosis. India is rising quickly with cheap testing and government-supported genomic medicine efforts, such as the Genome India Project. Japan also contributes to this with its national cancer genome screening programme (SCRUM-Japan). Rising awareness, better reimbursement, and indigenous innovation ecosystems are spurring the growth in the region. Growing participation of Asian biopharma in targeted therapy development additionally drives genomics-based research and clinical implementation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading genomics in cancer care companies operating in the market comprise Agilent Technologies, Roche Diagnostics, Beckman Coulter, Illumina Inc., Abbott Laboratories, Cancer Genetics Inc., Bio-Rad Laboratories, Pacific Biosciences, GE Healthcare, Quest Diagnostics, PerkinElmer Inc., Luminex Corporation, Thermo Fisher Scientific, Guardant Health Inc., Sysmex Corporation, Personalis Inc., Natera Inc., DNAnexus, QIAGEN, and Exact Sciences Corporation.

Recent Developments:

-

In April 2024, Illumina launched its NovaSeq X Plus system with enhanced AI-powered analysis, aiming to reduce whole-genome sequencing costs further and accelerate oncology applications.

-

In May 2024, Roche introduced the AVENIO Edge System, an automated NGS library preparation platform to improve efficiency and reproducibility in cancer genomics labs.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.06 billion |

| Market Size by 2032 | USD 69.16 billion |

| CAGR | CAGR of 16.04% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Consumables, and Services) • By Application (Diagnostics, Personalized Medicine, Drug Discovery & Development, and Research) • By Technology (Genome Sequencing, PCR, Microarrays, Nucleic Acid Extraction and Purification, Sanger Sequencing, Digital Droplet PCR (ddPCR), RNA sequencing (transcriptomics), and Epigenomics tools (e.g., methylation arrays, chromatin immunoprecipitation sequencing)) • By End-Use (Hospitals & Clinics, Academic & Research Institutes, Biotechnology & Pharmaceutical Companies, and Diagnostic Laboratories) |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | Agilent Technologies, Roche Diagnostics, Beckman Coulter, Illumina Inc., Abbott Laboratories, Cancer Genetics Inc., Bio-Rad Laboratories, Pacific Biosciences, GE Healthcare, Quest Diagnostics, PerkinElmer Inc., Luminex Corporation, Thermo Fisher Scientific, Guardant Health Inc., Sysmex Corporation, Personalis Inc., Natera Inc., DNAnexus, QIAGEN, and Exact Sciences Corporation. |