Non-alcoholic Steatohepatitis Biomarkers Market Size & Overview:

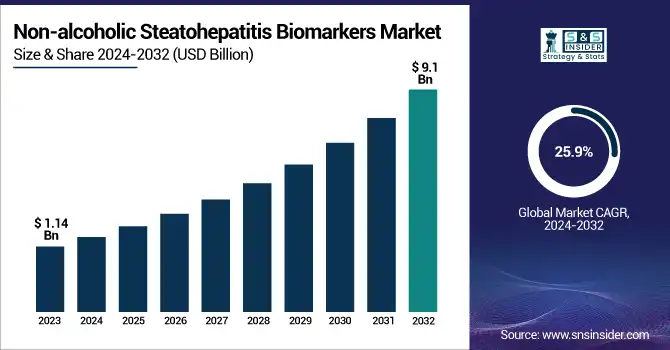

The Non-alcoholic Steatohepatitis Biomarkers Market size was USD 1.14 Billion in 2023, projected to hit USD 9.1 Billion by 2032, growing at a CAGR of 25.9% over the forecast period 2024-2032.

To Get more information on Non-alcoholic Steatohepatitis Biomarkers Market - Request Free Sample Report

The Non-alcoholic Steatohepatitis (NASH) Biomarkers Market Report provides key statistical insights and trends, including the incidence and prevalence of NASH in 2023 across regions and demographics. It has also studied biomarker adoption, showing that more and more people are moving away from biopsies and toward non-invasive diagnostic tools, including circulating imaging, and genomic biomarkers. The report introduces trends in prescription and treatment monitoring whilst exploring how biomarker-driven strategies influence emerging treatment options. Besides, it also includes healthcare expenditure trends, and price comparisons for diagnostic solutions. It assesses the regulatory environment, particularly addressing adherence to the guidelines set by the FDA, EMA, and PMDA.

The growth of the market is primarily associated with the increasing number of NASH and associated liver diseases. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), NASH affects 3-12% of adults in the United States, with higher rates among those with obesity and type 2 diabetes.

Non-alcoholic Steatohepatitis Biomarkers Market Dynamics

Drivers

-

The increasing global incidence of NASH, driven by factors such as obesity and metabolic disorders, is fueling the demand for effective biomarkers for early detection and monitoring.

The growing rate of Non-Alcoholic Steatohepatitis (NASH) contributes to the growing demand for effective biomarkers. Global prevalence for Non-Alcoholic Fatty Liver Disease (NAFLD), the predecessor to NASH, has been suggested to be as high as 32.4%, with incidences of 46.9 per 1,000 person-years. This increase is closely tied to the growing rates of obesity and type 2 diabetes. Notably, in individuals with obesity and type 2 diabetes, NAFLD prevalence ranges between 50% and 70%. The estimated annual prevalence of NASH in the United States increased from 1.51% in 2010 to 2.79% in 2020. This increase is significantly associated with metabolic conditions, with odds ratios for diabetes mellitus and obesity of 18.61 and 20.97, respectively, both of which promote the development of NASH. It is expected that the global prevalence rates of NAFLD will increase to 46.10% in males and 41.02% in females, whereas NASH prevalence will increase to 18.90% in males and 18.41% in females by 2030. These numbers emphasize the urgent need for reliable NASH biomarkers for disease detection, monitoring of disease progression, and assessment of therapeutic efficacy for combatting the rising health burden associated with NASH.

Restraints:

-

The absence of standardized guidelines for the use and interpretation of NASH biomarkers poses challenges to their widespread adoption in clinical practice.

The lack of standardization in Non-Alcoholic Steatohepatitis (NASH) biomarkers significantly hampers their clinical application. Currently, there is no universally accepted protocol for utilizing and interpreting these biomarkers, leading to inconsistencies in diagnosis and disease monitoring. This variability can lead to misdiagnosis or delayed treatment, resulting in poor outcomes for the patient. Additionally, the lack of standardizations makes it difficult to compare findings among studies, hindering the validation of potential biomarkers and the development of effective diagnostic equipment. The creation of consistent protocols and stringent validation methods is therefore critical to address these issues and ensure both the reliability and clinical utility of NASH biomarkers.

Opportunities:

-

Innovations in omics-based approaches, imaging techniques, and artificial intelligence are enhancing the development of novel biomarkers, offering potential for more accurate and non-invasive diagnostics.

Advancements in diagnostic technologies are significantly enhancing the identification and monitoring of Non-Alcoholic Steatohepatitis (NASH). A notable development is the application of artificial intelligence (AI) in imaging techniques. As an example, HistoIndex's stain-free & AI-powered tissue imaging technology outperformed in clinical trials. Compared to manual assessments performed by pathologists, this technology detected a greater percentage of patients showing improvement following treatment with Resmetirom in the MAESTRO-NASH Study. Proteomics profiling is another area contributing to NASH biomarker development. Researchers utilizing Standard BioTools' SomaScan Platform identified 69 blood biomarkers correlating with clinical measures of liver disease. These biomarkers were markedly increased in the NASH individual’s vs NAFLD, demonstrating their potential to differentiate between these conditions.

Nash detection is also synthesized on machine learning models. A study involving gradient-boosted decision trees trained on longitudinal prescription and medical claims data achieved an area under the receiver operating characteristic curve (AUROC) of 0.84. At 10% recall, the model's precision was 4.3%, indicating a 60-fold increase over the baseline NASH incidence. This suggests that machine learning could effectively identify probable NASH patients for further diagnostic evaluation.

Challenges:

-

Navigating complex regulatory pathways and securing reimbursement approvals are significant challenges that can impede the development and commercialization of NASH biomarkers.

Regulatory and reimbursement challenges can be enormous for the development and commercialization of Non-Alcoholic Steatohepatitis (NASH) biomarkers. Regulatory authorities like the U.S. Food and Drug Administration (FDA) require that biomarkers be extensively validated to establish their accuracy, reliability, and clinical utility. This process requires considerable evidence from many studies, making it an extensive and lengthy process. For example, the approval of Madrigal Pharmaceuticals' Rezdiffra by the FDA in March 2024 highlights the demanding standards for providing evidence of safety and efficacy in therapies for NASH.

Additionally, securing reimbursement for NASH biomarkers poses hurdles. Healthcare payers mandate robust evidence of clinical and economic value before granting coverage. This has led to the emergence of new diagnostic services that may be limited to specific regions, as well as a lack of standardized guidelines for their use, thus restricting patient access to biomarker-based strategies. Addressing these challenges is crucial for the successful integration of NASH biomarkers into clinical practice.

Non-alcoholic Steatohepatitis Biomarkers Segmentation Insights

By Type

The serum biomarkers segment accounted for the largest market share of 33% in 2023, the market is primarily dominated by serum biomarkers, owing to their non-invasive nature and ease of use in clinical settings. The best-known NASH biomarkers are a group of substances in the blood, including fragments of cytokeratin-18 (CK-18), they are less invasive than known liver biopsies and can be used to diagnose and monitor NASH. Serum CK-18 levels had a sensitivity of 78% and specificity of 87% for diagnosing NASH.

The apoptosis biomarkers segment is projected to grow at lucrative growth rates. The apoptosis biomarkers segment is gaining traction due to the critical role of programmed cell death in NASH pathogenesis. Research supported by the NIH has shown that hepatocyte apoptosis is a key feature of NASH and correlates with disease severity. Both apoptosis markers like soluble Fas (sFas) have shown high diagnostic accuracy the area under the curve (AUC) for diagnosis of NASH was 0.93 when combined with CK-18 fragments of apoptosis. Apoptosis is likely to play a significant role in the synthetic development of tests and biomarkers to inhibit NASH progression, and investment opportunities in drugs and personalized medicine approaches are increasing.

By End-use

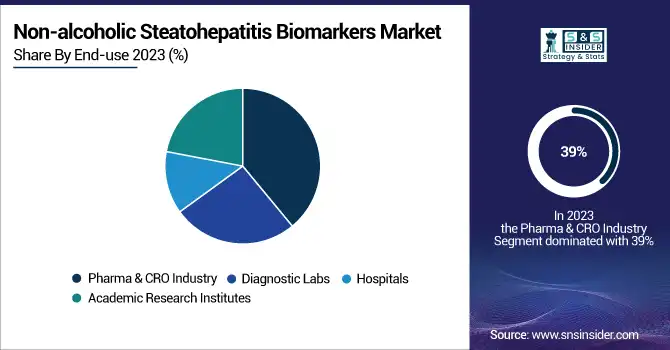

In 2023, the pharma and CRO industry end-use segment accounted for the largest market share of 39%. This dominance is attributed to the intensive research and development activities in NASH therapeutics. According to the U.S. National Library of Medicine's ClinicalTrials.gov database, there were over 200 active clinical trials for NASH treatments as of early 2025. The pharmaceutical industry and CROs are investing heavily in biomarker discovery and validation, as a complement to drug development activities. These biomarkers are essential for patient stratification, monitoring treatment efficacy, and as surrogate endpoints in clinical trials.

The FDA has promoted non-invasive biomarker use in NASH clinical trials, which is leading to greater adoption in the pharma and CRO space. A 2023 FDA guidance on drug development for NASH addresses the role of biomarkers in speeding up the approval of new drugs. This regulatory underpinning has catalyzed collaborations between biotech companies and academic institutions to drive innovation around the development and validation of biomarkers for NASH.

Non-alcoholic Steatohepatitis Biomarkers Market Region Analysis

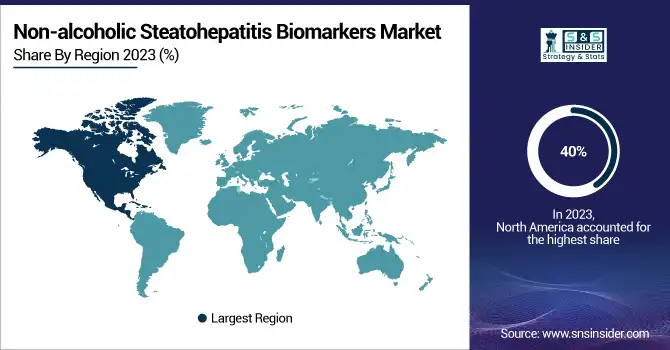

In 2023, the Non-alcoholic Steatohepatitis Biomarkers Market was led by North America, with about 40% of the market share. This prevalence is partly a reflection of the extremely high burden of NASH and its associated risk factors in the United States. A major risk factor for the development of NASH, the U.S. Centers for Disease Control and Prevention (CDC) reported that the prevalence of obesity among U.S. adults was 42.4% in 2023. North America dominates the market due to the strong healthcare infrastructure, advanced research facilities, and presence of major pharmaceutical players in the region. The region has a high amount of money being invested in researching NASH, with the NIH investing over USD 100 million per year in liver disease, including NASH. Additionally, the U.S. has a favorable regulatory environment for biomarker development and validation, exemplified by the FDA's Biomarker Qualification Program, which has accelerated the integration of novel biomarkers into drug development pipelines.

Europe region accounted for a significant revenue share and is anticipated to grow at a significant CAGR over the forecast period. Fueled By Rising NASH Prevalence & Robust Research Efforts. There has also been support for the development of biomarkers in NASH reflected in the recent Qualification Opinion issued by the EMA, as part of ongoing global efforts to enhance diagnostic and therapeutic opportunities.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

-

In Sept 2024, Siemens Healthineers released a next-generation NASH biomarker assay that integrate multiple serum-based markers into a single assay via AI algorithms to enhance diagnostic accuracy. In a breakthrough towards non-invasive NASH diagnosis, the (assay) received clearance from the FDA to be used in clinical settings.

-

In Jan 2025, AstraZeneca and Novo Nordisk teamed up to create a biomarker platform for NASH that combined genomic, proteomic and metabolomic information. This approach is to discover new therapeutic targets and to offer personalized treatment methods for patients with NASH.

Key Players

Key Service Providers/Manufacturers

-

GENFIT (NIS4™, Elafibranor)

-

Gilead Sciences (Selonsertib, Cilofexor)

-

AstraZeneca (Dapagliflozin, Epanova)

-

Novartis AG (Tropifexor, LJN452)

-

GE Healthcare (LiverMultiScan, FibroScan)

-

Siemens Healthineers (ADVIA Centaur® CP Immunoassay System, Atellica® Solution)

-

Bristol-Myers Squibb (Pegbelfermin, BMS-986036)

-

Pfizer Inc. (PF-06865571, PF-05221304)

-

Akero Therapeutics (Efruxifermin, AKR-001)

-

89bio (Pegozafermin, BIO89-100)

Users:

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Medicine

-

Massachusetts General Hospital

-

University of California, San Francisco (UCSF) Medical Center

-

Cedars-Sinai Medical Center

-

Mount Sinai Hospital

-

Duke University Hospital

-

Stanford Health Care

-

Houston Methodist Hospital

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.14 Billion |

| Market Size by 2032 | USD 9.1 Billion |

| CAGR | CAGR of 25.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Serum Biomarkers, Oxidative Stress Biomarkers, Hepatic Fibrosis Biomarkers, Apoptosis Biomarkers, Others) • By End-use (Pharma & CRO Industry, Diagnostic Labs, Hospitals, Academic Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GENFIT, Gilead Sciences, AstraZeneca, Novartis AG, GE Healthcare, Siemens Healthineers, Bristol-Myers Squibb, Pfizer Inc., Akero Therapeutics, 89bio |