Herbicide Safeners Market Report Scope & Overview

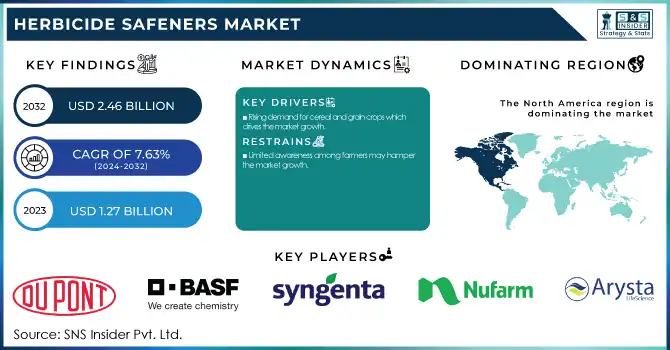

The Herbicide Safeners Market size was USD 1.27 Billion in 2023 and is expected to reach USD 2.46 Billion by 2032 and grow at a CAGR of 7.63 % over the forecast period of 2024-2032. This report provides a comprehensive analysis of production volume and utilization rates across regions in 2023, highlighting key manufacturing trends. It examines feedstock prices and cost structures by type, offering insights into raw material fluctuations. The report assesses the regulatory impact on safener formulations across major agricultural economies. Environmental metrics such as residue levels, biodegradability, and sustainable formulations are analyzed to track eco-friendly advancements. Additionally, it explores innovation and R&D investments driving new product developments. Market adoption trends across key crops like corn, soybean, wheat, and rice are detailed, showcasing demand patterns. This report provides a data-driven outlook on the evolving landscape of herbicide safeners.

To Get more information on Herbicide Safeners Market - Request Free Sample Report

Herbicide Safeners Market Dynamics

Drivers

-

Rising demand for cereal and grain crops which drives the market growth.

Increased demand for dietary grains & cereal crops is one of the primary factors that is driving the herbicide safeners market owing to ever-increasing food consumption and changing dietary preferences in the global population. To maximize output and protect against weeds, heavy use of herbicide is applied to major crops including corn, wheat, and rice. Nevertheless, herbicides can adversely affect the crop they are designed to safeguard, resulting in a growing use of herbicide safeners, which improve the level at which crops can tolerate herbicides without compromising weed control. Moreover, the worldwide government promotes agricultural productivity due to subsidies in agriculture whereby trend then forward crop protection solutions. Consequently, increasing dependence on high-yielding cereal and grain production is directly proportional to the demand for herbicide safeners; thus, contributing towards the market growth.

Restraint

-

Limited awareness among farmers may hamper the market growth.

The market growth may be restricted as plenty of growers in developing countries do not know about herbicide safeners that protect crop from chemical stress. Many small farmers use the conventional herbicide application method while they are not aware of the role of safeners in enhancing crop tolerance and yield. Furthermore, access to training programs or agricultural extension services has been lacking, limiting adoption as farmers are unlikely to invest in products they do not understand. Because of this knowledge gap, the market potential for safeners is limited, thus hindering their adoption in crop protection programs. As a counter approach, stakeholders and also the government is emphasizing on educational and field demonstration, awareness, and promotional campaigns to support the benefits of herbicide safeners which in turn is expected to propel the market growth.

Opportunity

Growing demand for high-yield crops creates an opportunity in the market.

Increasing demand for high yield crops offers a lucrative opportunity for the growth of global Herbicide safeners Market as rising global population is increasing the demand for greater agricultural output. Farmers are pressured to gain maximum crop yield with minimum loss from weeds, pests, and extreme weather conditions. The purpose of herbicide safeners is to facilitate the application of relatively high-strength herbicides, so that the crop can be protected from damage caused by herbicides during weeding, while ensuring effective control of competitive weeds, such as corn, wheat and rice. Furthermore, reducing arable land and increasing demand for food have bolstered the need for new crop protection products. Soaring adoption of high-yield crops supported by new investment potentials in novel safener formulations is likely to create lucrative opportunities for market players.

Challenges

Compatibility issues with herbicides may create a challenge for the market.

High herbicide safener incompatibility may hinder the market as not all herbicide safeners are compatible with various herbicide compositions. They are designed compounds and materials to protect crops from stress induced by the herbicide application itself, but they may show a high dependence on the crop, herbicide composition and environmental conditions. If on the other hand a safener does not cooperate well with a given herbicide, there could be decreased weed control efficacy, or crop injury, which deters the grower from adoption. Moreover, it requires compatibility testing and formulation changes which means an increase in R&D costs for the manufacturers. Such challenges restrict the overall penetration of safeners and prevent the companies from developing multi-herbicide-compatible safener solutions, which can limit the restraining market growth.

Herbicide Safeners Market Segmentation Analysis

By Product

Dichlormid segment held the largest market share around 30% in 2023. It is due to the extensive usage of Dichlormid as an herbicide safener in corn crops to protect from the stress caused by herbicides, especially from the herbicides based on acetochlor and S-metolachlor based herbicide, it held the largest market share in the Herbicide Safeners Market. Corn is one of the most widely grown cereal crops worldwide, therefore, increases the demand of efficient safeners that improve crop tolerance to pre-emergent herbicides. Due to its high efficacy, stability, and compatibility with many of the major herbicide combinations, dichloride is widely favored amongst farmers and agrochemical manufacturers. Moreover, the firm hold of Dichlormid on the market is governed by voluminous research and subsequent regulatory approvals in key agricultural economies which include the U.S., Brazil, and China.

By Crop

The Soybean segment held the largest market share around 40% in 2023. Soybean, an important cash crop, is among the most widely planted and fast-growing agricultural commodities, especially in the agricultural powerhouse countries such as the United States, Brazil, and Argentina, fueling the demand for crop protection products. Activators of herbicide safeners are important to help soybean plants overcome herbicide stress that may limit their growth and yield. Furthermore, the expansion of genetically modified (GM) soybean varieties that have increased the application of herbicides needs has also contributed to the demand for safeners. Herbicide safeners in soybeans have a strong market share as demand for soybeans as food, animal feed, and biofuel continues to rise all over the world.

By Application

The Pre-emergence segment held the largest market share around 64% in 2023. These pre-emergence safeners protect corn, soybeans, and wheat from the stress of herbicides during their critical growth stages of development. Pre-emergence safeners improve the crop's ability to stand selective herbicides so that it can kill weeds in a well-balanced way while seedlings are unharmed, giving a better yield. Moreover, usages of conservation tillage and no-till farming have kept on expanding, requiring pre-emergence herbicides to counterbalance soil development. Increasing anxiety regarding herbicide resistance is leading farmers to use pre-emergence safeners to safeguard their productivity as the champions of the market are being left behind.

Herbicide Safeners Market Regional Outlook

North America held the largest market share around 39% in 2023. It is owing to the well-developed agricultural sector, large-scale farming practices, and the adoption of advanced crop protection solutions in this region. Corn, soybeans, and wheat are important crops that use most available herbicide safeners, and the U.S. and Canada are ranked among the top producers of each. Furthermore, the growing innovations from leading companies in agrochemical such as Corteva Agriscience, Bayer CropScience, and Syngenta have also emphasized the availability of high-performance safener formulations. Moreover, in North America, stringent herbicide usage regulations have driven the market towards crop-safe solutions, with an increasing dependency on safeners. North America remained the largest market for herbicide safeners due to growing concern about herbicide resistance in weeds and the increasing adoption of conservation tillage practices (e.g. no-tillage and reduced tillage), which have also enhanced the demand for pre-emergence and post-emergence herbicide safeners in the region.

Europe is growing rapidly due to the factors such as increasing regulatory restrictions pertaining to herbicide use, increasing adoption of sustainable farming practices, and growing demand for high-yield crops. Agrochemical companies and farmers have been developing various crop-protective solutions, including herbicide safeners, in order to meet stringent agrochemical regulations enforced mainly in Europe but gradually in rest of the world to allow agrochemical companies while keeping the weed control efficacy. Moreover, the growing trend of precision agriculture and integrated weed management approaches in the region has increased the need of safeners that increase herbicide selectivity and reduce crop stress.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

DuPont (Benoxacor, Furilazole)

-

BASF SE (Cyprosulfamide, Cloquintocet-mexyl)

-

Bayer AG (Isoxadifen-ethyl, Cyprosulfamide)

-

Syngenta AG (Fenclorim, Benoxacor)

-

Nufarm Limited (Fluxofenim, Dichlormid)

-

Adama Agricultural Solutions (Dichlormid, Fluxofenim)

-

Arysta LifeScience (Furilazole, Isoxadifen-ethyl)

-

Drexel Chemical Company (Dichlormid, Benoxacor)

-

Land O’Lakes (Fenclorim, Cloquintocet-mexyl)

-

Sipcam-Oxon Group (Isoxadifen-ethyl, Benoxacor)

-

Corteva Agriscience (Furilazole, Isoxadifen-ethyl)

-

UPL Limited (Dichlormid, Cloquintocet-mexyl)

-

FMC Corporation (Benoxacor, Fluxofenim)

-

Helm AG (Cyprosulfamide, Furilazole)

-

Albaugh LLC (Dichlormid, Cyprosulfamide)

-

Rotam CropSciences Ltd. (Cloquintocet-mexyl, Fluxofenim)

-

Oxon Italia S.p.A. (Benoxacor, Dichlormid)

-

Shandong Qiaochang Chemical Co., Ltd. (Fenclorim, Cyprosulfamide)

-

Meiji Seika Pharma Co., Ltd. (Furilazole, Isoxadifen-ethyl)

-

China National Chemical Corporation (ChemChina) (Cloquintocet-mexyl, Benoxacor)

Recent Development:

-

In May 2023, BASF launched two new products, Facet and Duvelon. Facet is formulated to effectively control grassy weeds, such as Echinochloa spp., in rice fields, while Duvelon is designed to enhance weed management in tea plantations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.27 Billion |

| Market Size by 2032 | USD 2.46 Billion |

| CAGR | CAGR of7.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Benoxacor, Furilazole, Dichlormid, Isoxadifen, Other) • By Crop, (Corn, Soybean, Wheat, Rice, Others) • By Application (Post-emergence,Pre-emergence) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DuPont, BASF SE, Bayer AG, Syngenta AG, Nufarm Limited, Adama Agricultural Solutions, Arysta LifeScience, Drexel Chemical Company, Land O’Lakes, Sipcam-Oxon Group, Corteva Agriscience, UPL Limited, FMC Corporation, Helm AG, Albaugh LLC, Rotam CropSciences Ltd., Oxon Italia S.p.A., Shandong Qiaochang Chemical Co., Ltd., Meiji Seika Pharma Co., Ltd., China National Chemical Corporation (ChemChina) |