Zeolite Market Report Scope & Overview:

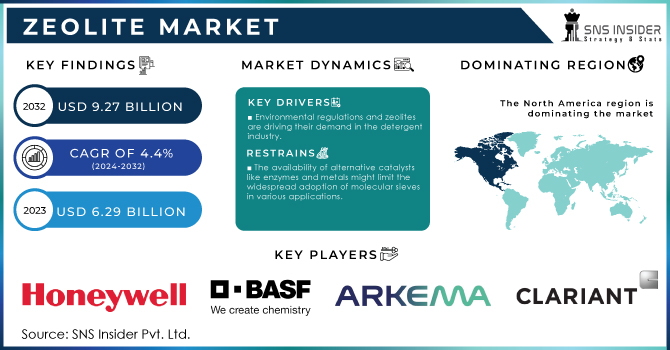

The Zeolite Market Size was valued at USD 6.3 billion in 2023 and is expected to reach USD 9.3 billion by 2032 and grow at a CAGR of 4.4% over the forecast period 2024-2032.

Get More Information on Zeolite Market - Request Sample Report

The zeolite market is prompted by its widespread applications in such industries as petrochemicals, water treatment, and agriculture. Zeolites, which can selectively absorb molecules and catalyze reactions, have emerged as critical agents in environmental protection and industrial processes. Zeolite is used as a catalyst for refining processes and petrochemical production, making the processes more efficient and less wasteful for heavy industries. However, improvements in zeolite technology have been motivated mainly by the increased need to develop sustainable and energy-efficient solutions, two key requirements behind its applications in water purification through utilizing its adsorption capacity to remove heavy metals and other pollutants.

Recent technological advancements have further widened the sphere of zeolite application fields, especially in catalysis. In September 2024, researchers introduced a new method where microwave energy is used to heat zeolite catalysts more efficiently. This new approach boosts the efficiency of zeolite-based systems, therefore speeding up and increasing cost-effectiveness in industries. Microwave technology is creating new opportunities for industries to reduce energy consumption and optimize their catalytic processes, demonstrating the growing potential of zeolite in today's technology-driven sectors.

Zeolites have had significant applications in the nuclear industry, particularly in waste management and environmental cleanup. Indeed, in March 2024, the breakthrough came at Sellafield with the removal of the first zeolite skip taken from a pond. This development manifests yet another application of zeolites in the treatment of nuclear waste, where the material efficiently captures radioactive particles that could otherwise get lost in the environment. This then forms one important step toward improving the safety and sustainability of nuclear operations, thus showing the versatility of zeolites over even well-established industrial applications.

Zeolites are one of the most significant catalysts in application, particularly in converting syngas, a mixture of hydrogen and carbon monoxide, into useful fuels and chemicals. In September 2023, a research team unveiled the role that zeolite catalysts play in making syngas conversion more efficient. Zeolites significantly contribute to an increased yield of desired products and reduced environmental footprint of those chemical processes. Of course, on the list would be a more important significance, which is this role in further advancing cleaner energy solutions. In that respect, these efforts reflect ongoing advancements in industrial development aimed at creating more sustainable systems, where zeolite catalysts will significantly contribute to reducing emissions and optimizing fuel production.

Such recent developments reflect growing interest in exploring new avenues to enhance the efficiency of zeolites, their environmental sustainability, and broader applications. With further innovation in catalysis, better environmental management, and energy-efficient processes, growth in zeolite markets is expected. More pressure for industrial cleanliness and technological breakthroughs can be expected to drive an increase in the use of zeolites in streams from refining to chemical production nuclear waste processing.

Zeolite Market Dynamics:

Drivers:

-

Rising Demand for Zeolites Driven by Pollution Control Benefits Amid Stricter Regulations and Sustainability Efforts

Zeolites increasingly hold a focus on sustainability, and higher demand is shown toward zeolites in environmental uses such as water purifying and treating, air treating, and soil remediation. Zeolites in the use of water treatment can act by adding these metals to remove heavy metals, ammonium, and radioactive substances, and hence clean water. They are also efficient at absorbing harmful gases, thus making the air filtration system very potent, especially in urban areas where high pollution levels exist. Agriculture industries also benefit from zeolites' soil conditioning in retaining water and nutrients while helping to promote agricultural work on sustainable farming practices.

Increasing the pressure to abide by environmental regulations and curb the carbon footprint, generally in sectors such as chemicals, petrochemicals, and manufacturing, is bound to speed up the adoption of zeolites. With a long list of industrial companies vying to achieve environmental standards, the use of zeolite-based solutions provides an avenue through which pollution is curtailed and the industrial outputs are clean. An increasing demand for such solutions is expected to see zeolites remain popular in the near future.

-

Zeolites are in High Demand in Petrochemical Refining for their Catalytic Efficiency, Enhancing Output, and Reducing Environmental Impact

Zeolites are indispensable in the petrochemical and refining industries, where they are widely used as catalysts to speed up chemical reactions with minimal by-product production. For instance, in crude oil refining, zeolites accelerate cracking processes and thereby ensure greater conversion of crude oil into liquid fuels and other chemicals, such as gasoline and diesel. For rising global energy consumption, especially within developing countries, there is a need to have higher and more efficient refining processes that are less polluting. Another factor that calls for growth within this market is the increase in petrochemical applications whereby zeolites are further used in producing a vast variety of plastics, resins, and synthetic fibers.

Zeolites play a key role in the industry's investment to further expand refining capacities and upgrade technology for higher efficiency standards. More use of zeolites not only leads to higher productivity but will also consume less energy and emit fewer carcinogenic issues, fitting into the whole picture of environmental sustainability globally. Thus, the boundless petrochemical and refining sectors will see the demand increase for zeolites, as the operations will require increasing efficiency on an environmental basis.

Restraints:

-

High Production Cost of Synthetic Zeolites Limits their Accessibility, Restraining Market Growth

The main disadvantage in the zeolite market is the high cost of production of synthetic zeolites, which are applied in specific applications such as catalysis, adsorption, and Ion-exchange materials. Energy consumption for its production, complex machinery, and expensive raw materials are some cost-building elements found in synthetic zeolites. This now makes zeolite-based solutions untenable for smaller companies or industries, especially those working within limited budgets in regions with access to cheaper alternative supplies.

Although natural zeolites are less expensive, they may offer lower performance or versatility compared to synthetic zeolites, resulting in a trade-off between cost and efficiency. For instance, for such applications requiring very selective or high-capacity adsorbents, synthetic zeolites must be used, thus increasing the operating cost. Higher cost also pushes up the value of end products and may deprive zeolite-based technologies of competitiveness in comparison with other technologies. The high cost of production creates a significant barrier to wider market penetration, and despite the effective environmental and industrial efficiency it provides.

Opportunities:

-

Zeolites Enhance Energy Efficiency and Catalyze Reactions, making them Vital for Sustainable Clean Energy Technologies

Increasing focus on renewable energy sources brings with it the prospect of increasing opportunities for zeolite. Zeolites are researched concerning their roles in energy storage, fuel cells, and biofuel production. Specifically, zeolites have been recorded as reagents that may be applied to accelerate and optimize processes in biofuels; thus, biofuels become a more competitive alternative to fossil fuels. Another area where zeolites have gained the limelight is in the production of hydrogen.

Zeolites can convert methane and other hydrocarbons into hydrogen gas, which is considered a cleaner fuel and might be at the center of activities once renewable energy sources are established. Additionally, zeolites are important for creating carbon capture technology as they can hold a lot of carbon dioxide, helping to lower greenhouse gas emissions in industries to very low levels. As governments and industries are pouring significant investment into renewable energy and green technologies, the demand for materials underpinning these initiatives will increase. In this respect, zeolites, with their wide range of potential applications in the renewable energy field, occupy an excellent position to exploit this Zeolite Market trend.

Challenges:

-

Cheaper Materials are Preferred Over Zeolites due to Lower Costs, Causing Reduced Market Demand for Zeolites

Alternative materials, such as activated carbon, silica gel, and many metal-organic frameworks (MOFs) have been available for adsorption, catalysis, and ion exchange applications as a major competitive threat to the zeolite market. They can be produced at comparable functionality and at a lower cost, which attracts industrial customers directing their priorities toward efficiency rather than performance. For instance, although zeolites are more selective and show higher capacities of adsorption, due to lower cost, activated carbon is more extensively used in water treatment and air filtration.

Similarly, in catalysis, MOFs have become more favored due to the great potential of structure customization and properties tailoring toward specific chemical reactions. Therefore, for such industries that have tight budgets and face cost constraints, these alternatives are opted for rather than zeolites irrespective of the compromise on performance. The competition is strong in those markets, particularly where the cost factor really affects the developing regions and small industries. Breaking through this barrier needs more diligence in reducing costs and process innovations on the part of zeolite manufacturers, and educating potential buyers on the long-term savings afforded by using zeolites despite the higher initial prices.

Zeolite Market Segmentation Analysis:

By Type

The synthetic zeolite segment dominated the zeolite market in 2023 with an approximate market share of about 65%. Superior properties offered by synthetic zeolites, such as higher purity and uniformity, along with tailored pore sizes, might be responsible for this lead. For instance, synthetic zeolites serve as catalysts widely in the refining of petrochemicals. They increase efficiency in cracking and hydrocracking, among others. As these materials can be engineered to meet particular applications, their use becomes very valuable to industries requiring specific performance from their raw material or waste-contaminant treatment. Synthetic zeolites are favored in water treatment applications as they can remove contaminants and heavy metals from wastewater. On the other hand, despite being very economical and environmentally friendly, natural zeolites' performance can vary, and thus, high-performance applications favor the synthetic version.

By Function

The catalyst segment dominated the zeolite market in 2023, accounting for an estimated market share of around 50%. Growth in this particular segment is mainly impacted by the increasingly greater applications of zeolites in catalytic applications, particularly in the petrochemical and refining industries. Zeolites are an effective catalyst due to their unique porous structure that encourages chemical reactions with the least possible formation of by-products.

For instance, in gasoline and diesel production, zeolites play a crucial role in catalytic cracking, wherein they increase the yields of lighter, more valuable fuels from heavy hydrocarbons. Zeolites are also widely applied in the production of many chemicals, methanol and syngas, thus facilitating reaction rates and selectivity. Advances in catalyst technology and the ongoing expansion of petrochemical refineries are drivers that will continue to buy demand for zeolite catalysts in the near term.

By Application

In 2023, the adsorbents segment dominated the zeolite market size and accounted for a revenue share of about 30%. This dominance is primarily driven by the increased use of zeolites in several applications for adsorption essential within environmental management and industrial processes. Zeolites are very potent adsorbents in terms of their high surface area and selective adsorption capabilities and could potentially remove contaminants from both gaseous and liquid environments.

Due to this reason, zeolites are used as adsorbents for heavy metals and ammonium in wastewater treatment, and hence, significant water quality enhancement. They also find extensive use in many air purification systems to adsorb VOCs along with other impurities and hence improve the quality of an urban environment. Agriculture with regard to soil remediation, along with the use of zeolites as adsorbents, makes nutrients stay longer in the soil, and leaching of fertilizers is reduced. The most notable drivers of growth in this market segment for zeolites are their adaptability and effectiveness in applications related to adsorption.

Zeolite Market Regional Outlook:

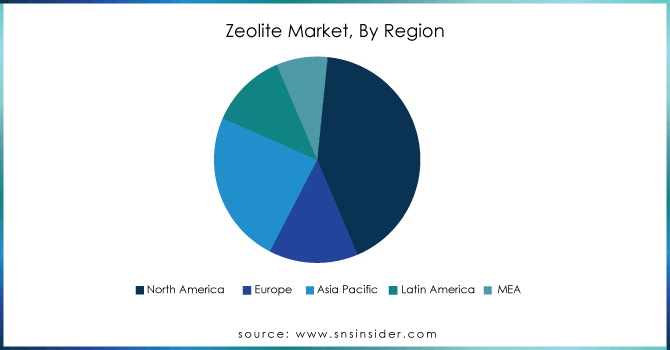

The North American region dominated the zeolites market in 2023 and accounted for a Zeolite market share of about 40% in the global market. The main reason for this relatively high share is attributed to the presence of the powerful petrochemical industry in the region and a growing regulatory requirement for environmental sustainability. Several large-scale players in the petrochemical sector are present in North America, which use zeolites as catalysts in major refinement processes, including catalytic cracking and hydrocracking.

For instance, major refineries in the U.S. are utilizing synthetic zeolites to enhance their efficiency while minimizing harmful emissions. Water treatment applications are also growing steadily based on severe environmental regulations and improving quality. In terms of research and development, the region continues to invest in the resource, further enhancing the adoption of advanced zeolite applications across industries, thus making it the market leader in zeolites.

Moreover, the Asia Pacific region emerged as the fastest growing market for zeolites in 2023 and is expected to have a CAGR of about 8%. This expansion can be largely attributed to the growing industrial base in countries such as China and India, where zeolites are applied in considerable amounts for construction materials, agriculture, and environmental management. The rapidly expanding construction industries in the region create demand for zeolites as they enhance the properties of concrete and other building materials, making them more durable and resistant to environmental conditions.

The agriculture sector is working to improve productivity and sustainable practices by using zeolites in applications such as animal feed and soil remediation. Government policies on clean and green practices also enhance growth in the Asia Pacific region through increased awareness and use of the benefits of zeolites in wastewater treatment applications. That is how the demand for zeolites will continue to grow, and thus the region can be placed for immense Zeolite Market growth in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

Major Zeolite Market Companies are:

-

Arkema S.A. (Kraton G series, Zeolite A)

-

BASF SE (Catalysts, Zeolite Y)

-

Bear River Zeolite Co. (Bear River Zeolite, Animal Feed Supplements)

-

Blue Pacific Minerals Ltd (Natural Zeolite, ZeoFill)

-

Clariant AG (Hydrophobic Zeolite, Zeolite ZSM-5)

-

Hengye Inc. (Hengye Molecular Sieves, 3A Molecular Sieves)

-

Honeywell International Inc. (UOP Zeolite Y, UOP 13X)

-

International Zeolite Corp (NEREA Nutrient Delivery Products, Natural Zeolite)

-

KNT Group (KNT-01 Zeolite, KNT-02 Zeolite)

-

Shijiazhuang Jianda High-tech Chemical Co., Ltd. (Molecular Sieves, Zeolite A)

-

St. Cloud Mining (Natural Zeolite, St. Cloud Zeolite)

-

Tosoh Corporation (Tosoh Molecular Sieves, Zeolite 4A)

-

Union Showa KK (Union Zeolite, Union A-1)

-

W. R. Grace & Co. (Grace Y, Super Dispersible Zeolite)

-

Zeochem AG (ZEOdrier, ZEOtrap)

-

Zeolyst International (Zeolite Beta, Zeolite ZSM-5)

-

Zeotech Corporation (ZeoSorb, ZeoFill)

-

MHR (Molecular Sieves) (MHR 3A Molecular Sieves, MHR 4A Molecular Sieves)

-

CP Chemicals (Zeolite 13X, Zeolite 5A)

Recent Developments

-

February 2024: ZEOCHEM announced that its global R&D teams will work on the development of innovative zeolite solutions, not only further developing products such as 3A and 4A molecular sieves. Such a tactic was directed toward developing tailored solutions and new products for specific customer needs.

-

March 2023: International Zeolite commissioned a new plant in Jordan, Ontario. The plant would help the company reach its daily production capacity to 25 tons, diverting attention back to their NEREA nutrient delivery products

Zeolites Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.3 Billion |

| Market Size by 2032 | US$ 9.3 Billion |

| CAGR | CAGR of 4.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Natural, Synthetic) •By Function (Ion-Exchange, Molecular Sieve, Catalyst) •By Application (Construction & Building Materials, Animal Feed, Wastewater Treatment, Soil Remediation, Detergents, Catalysts, Adsorbents, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Arkema S.A., Tosoh Corporation, BASF SE, W. R. Grace & Co., Clariant AG, Zeochem AG, Zeolyst International, Bear River Zeolite Co., Blue Pacific Minerals Ltd, Union Showa KK, St. Cloud Mining, Zeotech Corporation, Hengye Inc., Shijiazhuang Jianda High-tech Chemical Co., Ltd., KNT Group, International Zeolite Corp and other key players |

| Drivers | •Rising demand for zeolites is driven by environmental sustainability efforts and stricter regulations, as they aid in pollution control and support greener industrial practices. •Zeolites are in high demand in petrochemical refining for their catalytic efficiency, enhancing output, and reducing environmental impact. |

| Opportunity | •The high production cost of synthetic zeolites limits their accessibility, restraining market growth. |