Immunodiagnostics Market Size & Trends

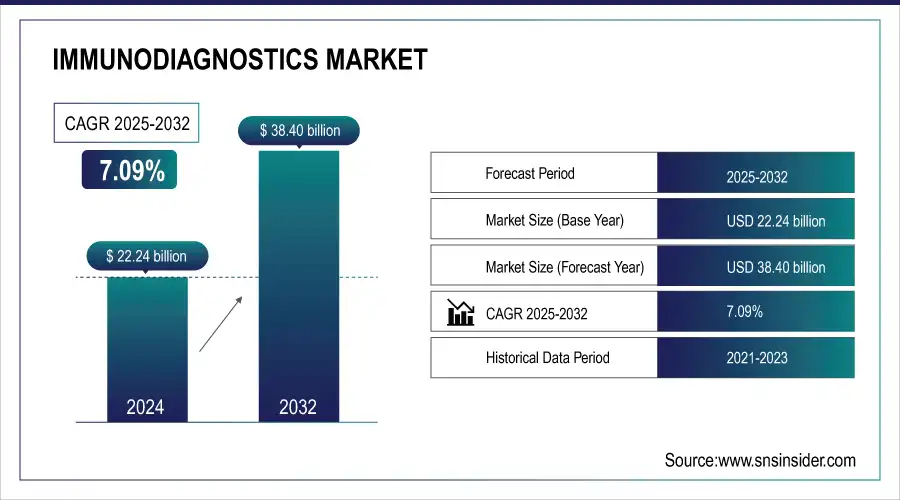

The Immunodiagnostics Market size was valued at USD 22.24 billion in 2024 and is expected to reach USD 38.40 billion by 2032, growing at a CAGR of 7.09% over 2025-2032.

To Get more information On Immunodiagnostics Market - Request Free Sample Report

The immunodiagnostics market is experiencing high growth due to the rise in prevalence of cancer, infectious diseases, and autoimmune diseases, increased awareness, and the need for early detection. For instance, breast cancer is still the most diagnosed cancer in women globally, and over 2.3 million people develop it yearly (American Cancer Society, 2024).

Likewise, global rates of HIV are still significant, with more than 1.2 million people in the U.S being HIV positive, emphasizing the necessity for ongoing diagnostic testing (CDC HIV Surveillance, 2024). Market participants on the supply side are exercising tactical acquisitions, enhanced product offerings, and increased production capacity to meet demand. PerkinElmer acquired Immunodiagnostic Systems in 2023 to expand its specialty diagnostics portfolio, and Freenome bought Oncimmune Ltd. in 2023 to augment its immune profiling portfolio for early cancer detection.

For instance, in February 2025, Korea’s National Microbiome Framework Facility announced support for the development of AI-powered immunodiagnostics through academic–industry cooperation, showcasing cross-sector partnerships in R&D and commercialization.

R&D spending and government funding are also driving the market. The NIH awarded USD 4.2 billion on immunology and diagnostics in FY2023, and leading institutions, such as Johns Hopkins, are developing rapid diagnostic tests for infectious diseases that have real-time improved sensitivity. The development of new technologies, including photoelectrochemical immunosensors, nanoplasmonic biosensors, and AI-based analytical platforms, contributes to testing optimization and time-to-result decrease. Furthermore, regulatory agencies, including the FDA and EMA, have fast-tracked approvals for essential immunodiagnostics, especially post-COVID-19, making way in the market for new entrants and innovative products.

In October 2024, Auburn University's Dr. Pengyu Chen landed a multi-year extension award from the NIH to create nanotechnology-based diagnostics for infectious diseases, signaling an increase in federal funding for next-gen immunodiagnostics.

Immunodiagnostics Market Dynamics

Drivers:

-

Growing Disease Burden, Technological Advancements, and R&D Funding Are Driving the Immunodiagnostics Market Forward

Growth of the immunodiagnostics market is driven by the rising incidence of chronic and infectious diseases, increasing availability of funds for research, and the growth in funding for research. For instance, commercials diseases such as autoimmune diseases affect around 4% of the global population (WHO, 2024), while infections are also responsible for 1.3 million deaths per year, including tuberculosis with infections (WHO, 2024). This has continued to drive both public and private investments.

The EU4Health Programme was set up by the European Commission in 2024, offering more than €5.3 billion to support health innovations, including diagnostic capacity. On the innovation side, biotechnology players, such as Roche Diagnostics and BioMérieux, are incorporating multiplex assay technology as well as artificial intelligence into immunoassay platforms in order to enhance accuracy and decrease time-to-diagnosis. The U.S. FDA has also granted breakthrough device designations to multiple immunodiagnostic devices to expedite their regulatory approval. There are also skyrocketing numbers of academic/diagnostics firm partnerships (the University of Oxford is co-developing antibody-based rapid tests for emerging pathogens with Thermo Fisher). As global healthcare moves toward preventative health, the need for scalable, rapid, inexpensive diagnostics will only increase, thereby positioning immunodiagnostics as a cornerstone of modern medical diagnostics.

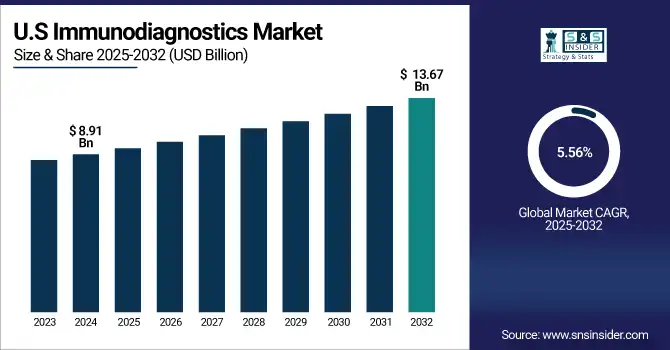

The U.S. immunodiagnostics market size was valued at USD 8.91 billion in 2024 and is expected to reach USD 13.67 billion by 2032, growing at a CAGR of 5.56% over 2025-2032. The U.S. is the largest nation attributed to a major share due to the large number of disease screening programs, such as cancer and infectious diseases. Across the U.S., the number of cancer screenings in 2024 reached more than 18 million (ACS), and immunodiagnostics play an important role in this workflow. Canada is also enhancing its diagnostics capacity through partnerships between the public and private sectors and by relying on AI-centered automation of labs. The fastest introduction of testing has been in Mexico, where the government has been pushing to decentralize the testing and get it out into rural areas.

Restraints:

-

Regulatory Complexities, High Cost of Advanced Diagnostics, and Skilled Workforce Gaps That Challenge Market Expansion

The strict regulatory landscape is one of the main barriers. Immuno-diagnostic products need to satisfy multiple staged regulatory clearances from the likes of the FDA, EMA, and TGA, which tend to lengthen time-to-market. For instance, in the U.S., premarket approval (PMA) for Class III immunodiagnostic devices could require 180 days or longer, especially when novel biomarkers were involved. There is also the problem of very high costs of established immunoassay platforms (over USD 250,000 per unit), which limits their use in resource-limited environments and smaller diagnostic facilities. There is a lack of a trained workforce to perform and interpret high complexity immunoassays, which is still unmet in many areas, as evidenced by the 2023 report of the WHO that estimated the deficit of over 5 million clinical laboratory professionals internationally.

Supply chain weaknesses also bottleneck reagents and critical raw materials, especially in times of geopolitical disturbances. In addition, high-level quality control must be assured in multiplex or high-throughput systems with continuous technical and calibration support, which drives costly long-term maintenance expenses. These hindrances can impede the adoption of innovation and keep it from reaching widespread use, particularly in developing countries that have budget restrictions and/or infrastructure limitations.

Immunodiagnostics Market Segmentation Analysis

By Product

The reagents & consumables market is projected to be the fastest-growing segment during the forecast period, as they are highly consumed in each testing cycle and are relatively inexpensive and easy to replace, in addition to the increasing number of tests performed in infectious diseases and oncology. High test volume in routine diagnostics and specialized immunoassays, and the availability of high-sensitivity reagents are major factors. Furthermore, the novelty in enzyme labeled reagents, nanoparticle-labeled antibodies, and lyophilized kits sections is improving the longevity and dependability of these consumables. Manufacturers are now scaling up production lines of reagents due to the increasing prevalence of diseases around the world, in decentralized and point-of-care conditions.

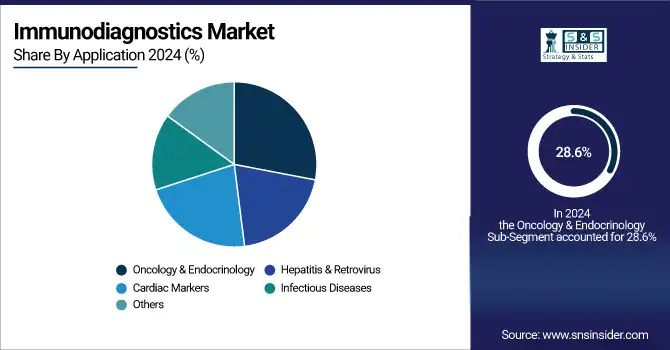

By Application

The oncology & endocrinology application field held the largest market share of 28.6% in 2024. The growth is on account of the increasing occurrence of cancer and hormonal diseases, including diabetes and thyroid malfunction. The growing importance of tumor marker testing and hormonal assay screening in early cancer diagnosis and endocrine dysfunction has broadened the horizon of immuno-diagnostic applications. Biological markers have also become popular in the clinic, catalyzed by the availability of panels of markers, such as CA-125 for ovarian cancer, and PSA for prostate cancer.

The infectious diseases application is expected to be the fastest-growing segment due to the rising incidence of viral infections, such as COVID-19, RSV, or monkeypox. The increasing pressure of AMR and the upsurge in the need for reliable and rapid pathogen detection have driven the development of more sophisticated immunodiagnostic kits. Businesses are also focusing on multiplex testing formats for the simultaneous detection of several pathogens, driving uptake in both developed and developing regions.

By End-user

The clinical laboratories end-user category is projected to witness the highest CAGR as a result of the progressive conversion of diagnostic testing from hospitals to specialized labs in an attempt to achieve better operational efficiency, reduced turnaround times, and low costs. The increase in outsourced diagnostic services and health system partnerships with big reference labs is driving testing volume. Along these lines, technological adoption, such as automation and LIMS (Laboratory Information Management Systems), is being used to streamline operations, further positioning clinical labs as the preferred environment for immunodiagnostic testing.

Immunodiagnostics Market Regional Insights

The immunodiagnostics market in North America, however, is estimated to be the largest in 2024 and also the fastest-growing region over the forecast period, owing to high healthcare expenditure, the presence of diagnostic majors, such as Abbott and Quest Diagnostics, and well-established infrastructure for laboratory and POC testing.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe was the second largest market for the immunodiagnostics market owing to nationalized health programs, early disease detection programs and increasing research and development collaborations. Germany leads the regional market due to its strong diagnostic infrastructure and early launch of automated immunoassay systems. In 2024, over 125 million diagnostic tests are performed each year in clinical laboratories, with some of them being immunoassays. It is the fastest-growing country globally, driven by initiatives by the NHS to digitize diagnostic workflows and improve cancer screening penetration. France and Italy are also large contributors to immunodiagnostic R&D with vigorous academic-industry partnerships.

Asia Pacific is a growing region in the immunodiagnostics market, as it has a large patient base and increasing healthcare expenditure, and demand for high-quality diagnostic products. China is taking the lead, supported by government-funded healthcare reform and a large home-grown diagnostic manufacturing base. In 2024, China spent more than USD 10 billion on its national diagnostics expansion plan. India is the fastest-growing country, driven by programs such as Ayushman Bharat and a growing demand for low-cost, high-throughput testing for tuberculosis, hepatitis, and cancer. Japan and South Korea are also growing their clinical diagnostics offerings with AI and molecular testing combinations rolled out in urban health care facilities.

Immunodiagnostics Market Key Players

Leading immunodiagnostics companies operating in the market are Abbott, Roche Diagnostics, DiaSorin, Danaher Corporation, QIAGEN, bioMérieux, Thermo Fisher Scientific, Quest Diagnostics, Siemens Healthineers, and Becton, Dickinson and Company.

Recent Developments in the Immunodiagnostics Market

In October 2024, Bio-Rad Laboratories introduced its External Quality Assurance Services (EQAS) Specialty Immunoassay (SPIA) Program, covering 13 complex immunoassay analytes such as procalcitonin and IL-6. These liquid-format, ISO/IEC 17043-accredited proficiency testing kits enhance lab accuracy while reducing costs through consolidated testing.

In May 2023, the U.S. FDA granted clearance for Thermo Fisher’s B·R·A·H·M·S PlGF plus KRYPTOR and sFlt‑1 KRYPTOR immunoassays. These are the first blood-based biomarkers with breakthrough designation to assess the risk of severe preeclampsia, delivering results in under 30 minutes.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 22.24 billion |

| Market Size by 2032 | USD 38.40 billion |

| CAGR | CAGR of 7.09% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Reagents & Consumables) • By Application (Oncology & Endocrinology, Hepatitis & Retrovirus, Cardiac Markers, Infectious Diseases, and Others) • By End user (Clinical Laboratories, Hospitals, Physicians’ Offices, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott, Roche Diagnostics, DiaSorin, Danaher Corporation, QIAGEN, bioMérieux, Thermo Fisher Scientific, Quest Diagnostics, Siemens Healthineers, and Becton, Dickinson and Company |