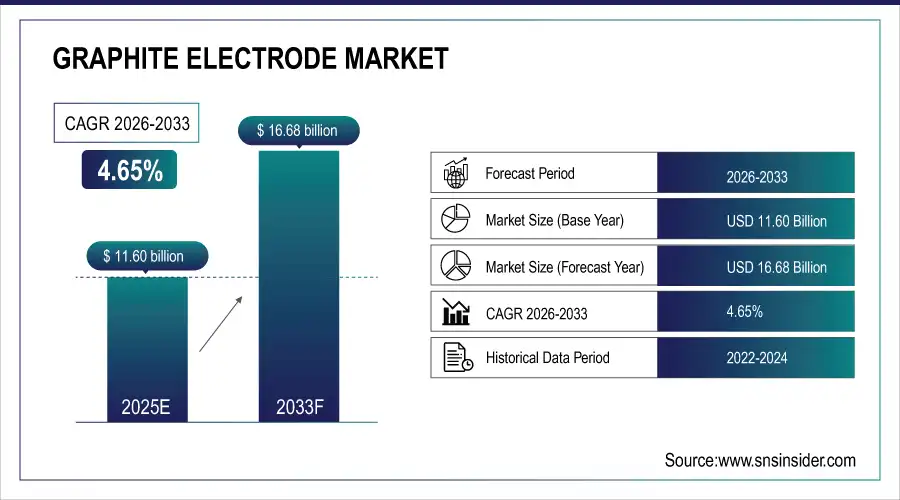

Graphite Electrode Market Size Analysis:

The Graphite Electrode Market size was valued at USD 11.60 Billion in 2025E and is projected to reach USD 16.68 Billion by 2033, growing at a CAGR of 4.65%during 2026–2033.

The graphite electrode market is witnessing significant growth, driven by increasing steel production and rising adoption of electric arc furnace (EAF) technology. Ultra-high power (UHP) electrodes dominate due to their efficiency and durability. Asia-Pacific, led by China, remains the largest market, while North America is the fastest-growing region. Growth is supported by infrastructure development, sustainable steel production initiatives, and rising demand across automotive, aerospace, and metallurgical industries, making graphite electrodes a critical component in modern steelmaking processes globally.

In September 2025 – Graphite India Limited shares rose over 2% after acquiring a 6.82% stake in US-based GrafTech International, boosting global presence and supporting its graphite electrode capacity expansion plans.

Graphite Electrode Market Size and Forecast:

-

Market Size in 2025: USD 11.60 Billion

-

Market Size by 2033: USD 16.68 Billion

-

CAGR: 4.65% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Graphite Electrode Market - Request Free Sample Report

Graphite Electrode Market Highlights

-

Market growth driven by rising demand for nuclear-grade graphite, advanced nuclear reactors, and global clean energy initiatives

-

Increasing adoption of high-temperature gas-cooled and small modular reactors supports sustained market expansion

-

Key restraints include high production costs, complex manufacturing, supply chain limitations, and stringent regulatory requirements

-

Opportunities arise from metal fleece technology enabling thicker, faster-charging electrodes, boosting energy density and reducing material usage

-

Applications in electric vehicles, renewable energy storage, and high-performance electronics fuel market demand

-

Investments in R&D, technological advancements, and production capacity expansion enhance competitiveness and support industry growth

Graphite Electrode Market Drivers:

-

Rising Demand for Nuclear-Grade Graphite Drives Global Clean Energy Growth

The nuclear-grade graphite market is driven by increasing adoption of advanced nuclear reactors, including high-temperature gas-cooled and small modular reactors. Growing focus on clean energy, reliable supply chains, and the need for high-quality synthetic graphite in reactor cores to ensure efficiency, safety, and performance are fueling market growth. Additionally, investments in R&D, technological advancements, and expansion of production capabilities are supporting the rising demand for nuclear-grade graphite across energy, industrial, and advanced manufacturing applications, making it a critical component in the evolving clean energy infrastructure.

May 23, 2024 – Radiant Industries and Amsted Graphite Materials partnered to secure domestic nuclear-grade graphite supply for the Kaleidos microreactor, reducing reliance on foreign sources and supporting U.S. advanced reactor development.

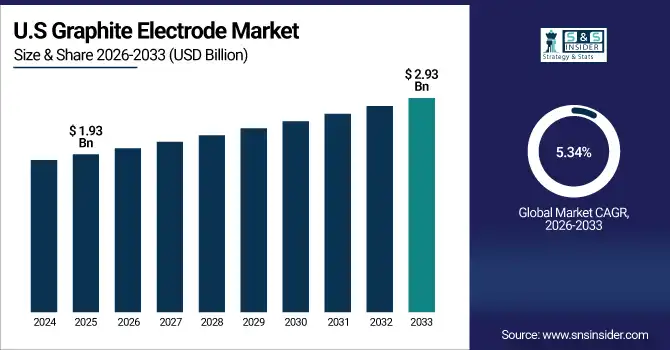

The U.S. Graphite Electrode Market size was valued at USD 1.93 Billion in 2025E and is projected to reach USD 2.93 Billion by 2033, growing at a CAGR of 5.34%during 2026–2033. Growth is driven by increasing adoption of electric arc furnace (EAF) steelmaking, rising steel recycling rates, demand for high-quality ultra-high power electrodes, and investments in cleaner, energy-efficient steel production, supporting the region’s expanding industrial and manufacturing activities.

Graphite Electrode Market Restraints:

-

Supply and Regulatory Constraints Limit Expansion of the Nuclear-Grade Graphite Market

The nuclear-grade graphite market faces several challenges that could limit growth. High production costs, complex manufacturing processes, and stringent quality requirements make scaling operations capital-intensive. Supply chain disruptions, limited availability of high-purity synthetic graphite, and dependence on specialized raw materials further constrain market expansion. Additionally, regulatory hurdles, safety standards, and long approval timelines for advanced nuclear reactors can delay projects and investments. Market volatility, competition from alternative materials, and technological uncertainties in emerging reactor designs also pose risks. These factors collectively act as significant restraints, potentially slowing the adoption and commercialization of nuclear-grade graphite across energy and industrial applications.

Graphite Electrode Market Opportunities:

-

Revolutionizing Batteries with Metal Fleece Technology for Enhanced Energy and Rapid Charging

The development of metal fleece electrodes presents significant opportunities for the battery industry. By enabling thicker, faster-charging electrodes, manufacturers can achieve higher energy densities while reducing material usage and production costs. This innovation supports electric vehicle adoption, renewable energy storage, and high-performance electronic applications. Additionally, the simplified manufacturing process allows for smaller, more efficient production facilities and the use of environmentally friendly techniques. Companies investing in this technology can gain a competitive edge, improve sustainability, and meet growing global demand for efficient, high-capacity batteries, positioning themselves strategically in the rapidly expanding energy storage and electric mobility markets.

In October 2025, Metal Fleece Electrodes Enhance Battery Energy Density and Charging Speed – Max Planck Researchers, Researchers at the Max Planck Institute have developed metal fleece electrodes that enable thicker, faster-charging batteries, boosting energy density up to 85% while reducing material usage and manufacturing complexity.

Graphite Electrode Market Segment Highlights:

-

By Type: Dominant – Ultra High Power (UHP) Graphite Electrode (56.88% in 2025E → 68.00% in 2033); Fastest-Growing – UHP Graphite Electrode (CAGR 6.99%)

-

By Application: Dominant – EAF Steelmaking (68.88% in 2025E → 74.13% in 2033); Fastest-Growing – EAF Steelmaking (CAGR 5.61%)

-

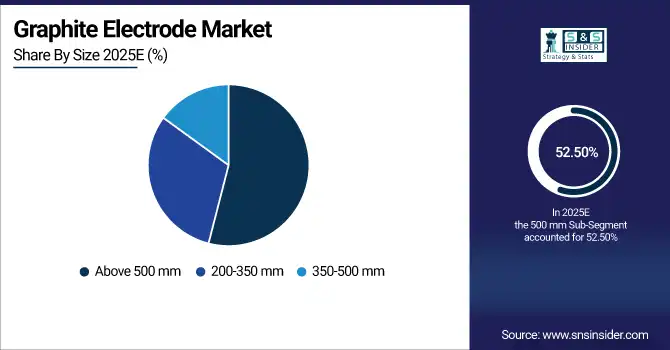

By Size: Dominant – Above 500 mm (52.50% in 2025E → 60.00% in 2033); Fastest-Growing – Above 500 mm (CAGR 6.40%)

-

By Raw Material: Dominant – Needle Coke (66.25% in 2025E → 73.75% in 2033); Fastest-Growing – Needle Coke (CAGR 6.05%)

Dominating & Fastest-Growing Segment – By Type: Ultra High Power (UHP) Graphite Electrode

Ultra High Power (UHP) graphite electrodes are both the dominating and fastest-growing segment, driven by rising demand for high-performance electrodes in electric arc furnace steelmaking. Their efficiency, durability, and suitability for large-scale steel production, along with ongoing technological advancements, continue to accelerate market growth.

Dominating & Fastest-Growing Segment – By Application: EAF Steelmaking

EAF steelmaking is both the dominating and fastest-growing application segment, driven by increasing adoption of electric arc furnace technology in steel production. The segment benefits from higher efficiency, cost-effectiveness, and growing demand for recycled steel, supporting sustained market expansion.

Dominating & Fastest-Growing Segment – By Size: Above 500 mm

Graphite electrodes above 500 mm dominate and grow fastest in the market, favored for large-scale steel production due to their high current-carrying capacity, durability, and efficiency, meeting rising industrial demand.

Dominating & Fastest-Growing Segment – By Raw Material: Needle Coke

Needle coke-based graphite electrodes are the dominating and fastest-growing raw material segment, preferred for their superior density, electrical conductivity, and performance in high-power applications, driving widespread adoption in steel manufacturing.

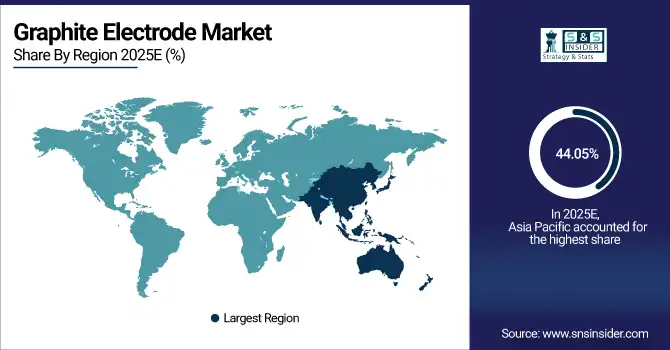

Graphite Electrode Market Regional Highlights:

-

Dominating Region (by market share %): Asia-Pacific – 44.05% in 2025E → 40.02% in 2033 (slight decline, CAGR 3.40%)

-

Fastest-Growing Region (by market value): North America – 25.15% in 2025E → 28.47% in 2033, CAGR 6.27%

-

Europe: 20.40% in 2025E → 21.97% in 2033, CAGR 5.62%

-

South America: 5.95% in 2025E → 5.05% in 2033, CAGR 2.51%

-

Middle East & Africa: 4.45% in 2025E → 4.49% in 2033, CAGR 4.77%

Asia-Pacific Graphite Electrode Market Trends:

The Asia-Pacific region leads the graphite electrode market, supported by strong steel manufacturing activity and rapid industrial growth in countries like China, India, and Japan. The region’s dominance is driven by rising demand for electric arc furnace technology, increasing infrastructure projects, and expanding production capacity, making it the central hub for graphite electrode manufacturing globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Graphite Electrode Market Insights:

China is the dominant country in the Asia-Pacific graphite electrode market, leading global production and consumption. Its strong steel manufacturing base, large number of electric arc furnaces, and extensive graphite electrode production capacity make China the primary contributor to both regional and global market growth.

North America Graphite Electrode Market Trends:

The North America graphite electrode market is the fastest-growing region, led by strong adoption of electric arc furnace (EAF) technology, rising steel recycling, and increasing demand for high-quality electrodes. Investments in cleaner, energy-efficient steel production and technological advancements are accelerating growth, positioning the region as a key expansion hub in the global graphite electrode market.

U.S Graphite Electrode Market Insights:

The United States dominates the graphite electrode market, driven by high steel production, widespread electric arc furnace adoption, advanced manufacturing capabilities, and strong demand for high-quality electrodes across industrial and recycling applications.

Europe Graphite Electrode Market Trends:

The Europe graphite electrode market is experiencing emerging growth, fueled by increasing adoption of electric arc furnace (EAF) steel production, rising demand for high-quality electrodes, and investments in modernized manufacturing facilities. Sustainability initiatives and government support for cleaner steel production further enhance market expansion across key European countries.

Germany Graphite Electrode Market Insights:

Germany is the dominant country in the Europe graphite electrode market, leading regional production and consumption due to its strong steel industry, advanced manufacturing infrastructure, and early adoption of electric arc furnace (EAF) technology.

Latin America Graphite Electrode Market Trends:

The Latin America graphite electrode market is witnessing steady growth, driven by increasing steel production, rising use of electric arc furnace (EAF) technology, and expanding industrial infrastructure. Key countries like Brazil and Argentina are investing in modern steel facilities, supporting demand for high-quality graphite electrodes across the region.

Brazil Graphite Electrode Market Insights:

Brazil is the dominant country in the Latin America graphite electrode market, leading regional production and consumption due to its large steel industry, extensive EAF usage, and growing infrastructure and industrial development.

Middle East & Africa Graphite Electrode Market Trends:

The Middle East & Africa graphite electrode market is experiencing moderate growth, driven by rising steel production, increasing adoption of electric arc furnace (EAF) technology, and investments in infrastructure development. Countries like Saudi Arabia, the UAE, and South Africa are expanding industrial capacity, supporting steady demand for high-quality graphite electrodes.

United Arab Emirates (UAE) Graphite Electrode Market Insights:

Saudi Arabia is the dominant country in the Middle East & Africa graphite electrode market, leading regional production and consumption due to its large-scale steel industry, growing industrialization, and adoption of electric arc furnace (EAF) technology.

Graphite Electrode Market Competitive Landscape:

Tokai Carbon Co., Ltd., established in 1918, is a leading global carbon manufacturer producing graphite electrodes, carbon black, fine carbon, industrial furnaces, and friction materials. Headquartered in Tokyo, it operates worldwide, including Japan, Europe, China, and the U.S., focusing on efficiency, innovation, and meeting evolving steel and industrial market demands.

-

In July 2024, Tokai Carbon announced that it will reduce graphite electrode production capacity in Japan and Europe from 56,000 tons to 32,000 tons by July 2025, consolidating operations at the Hofu Plant and temporarily closing the Shiga Plant to optimize efficiency amid declining global steel demand.

HEG Limited Founded in 1977,is a leading graphite electrode manufacturer based in India, supplying ultra-high power (UHP) and high-power electrodes to steel producers worldwide. The company operates one of the world’s largest single-site graphite electrode plants and focuses on capacity expansion, R&D, and sustainability-driven manufacturing for electric arc furnace applications.

-

In July 2025 – HEG and Graphite India shares surged up to 13% after Resonac Holdings announced the closure of its graphite electrode units in China and Malaysia, tightening global supply and boosting market optimism for Indian producers.

Graphite Electrode Companies are:

-

SGL Carbon

-

Showa Denko

-

Graphite India

-

Resonac Holdings Corporation

-

Fangda Carbon New Material Co., Ltd.

-

Sangraf International

-

SEC Carbon, Ltd.

-

Nippon Carbon Co., Ltd.

-

Dan Carbon

-

Jilin Carbon

-

HEG Limited

-

Kaifeng Pingmei New Carbon Materials Technology Co., Ltd.

-

Liaoning Dantan Technology Group Co., Ltd.

-

Nantong Yangzi Carbon Co., Ltd.

-

Zhongze Group

-

Orient Carbon Industry Co., Ltd.

-

El 6 LLC

-

Misano Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 11.60 Billion |

| Market Size by 2033 | USD 16.68 Billion |

| CAGR | CAGR of 4.65% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Regular Power (RP) Graphite Electrode, High Power (HP) Graphite Electrode and Ultra High Power (UHP) Graphite Electrode) • By Application(EAF steelmaking, LF (Ladle Furnace) and Others) • By Size(200-350 mm, 350-500 mm and Above 500 mm) • By Raw Material(Petroleum Coke, Needle Coke, Coal Tar Pitch) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | GrafTech International, SGL Carbon, Showa Denko, Tokai Carbon, Graphite India, Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd., Sangraf International, SEC Carbon, Ltd., Nippon Carbon Co., Ltd., Dan Carbon, Jilin Carbon, HEG Limited, Kaifeng Pingmei New Carbon Materials Technology Co., Ltd., Liaoning Dantan Technology Group Co., Ltd., Nantong Yangzi Carbon Co., Ltd., Zhongze Group, Orient Carbon Industry Co., Ltd., El 6 LLC, Misano Group. |