Green Electronics Manufacturing Market Size Analysis:

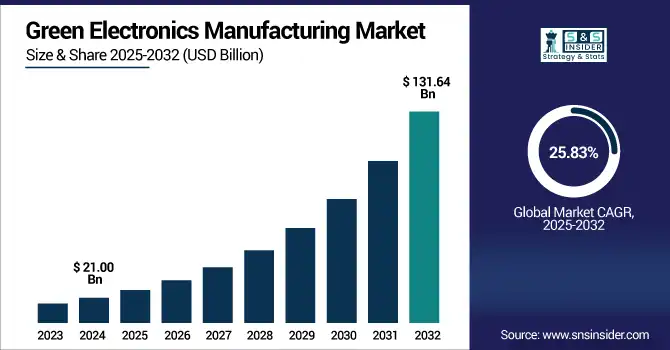

The Green Electronics Manufacturing Market size was valued at USD 21.00 billion in 2024 and is expected to reach USD 131.64 billion by 2032, growing at a CAGR of 25.83% over the forecast period of 2025-2032.

To Get more information on Green Electronics Manufacturing Market - Request Free Sample Report

Green Electronics Manufacturing Market Trends are driven by rising adoption of eco-friendly materials, energy-efficient technologies, and circular economy practices. Manufacturers increasingly focus on recyclable designs and compliance with global environmental standards.

The growth of Green Electronics Manufacturing Market in production is further propelled by rising government incentives to ensure sustainability during production, advanced green semiconductor technologies and faster developments in AI and automation to integrate energy optimized manufacturing lines. Moreover, the rise in corporate ESG commitments, demand for low-carbon supply chains, and the shift towards modular and repairable electronic products are driving manufacturers to adopt greener processes to meet both regulatory and consumer expectations.

In 2024, the U.S. Department of Energy allocated USD 70 million through the Advanced Manufacturing Office to support energy-efficient and sustainable electronics production projects.

The U.S Green Electronics Manufacturing Market size was valued at USD 4.09 billion in 2024 and is expected to reach USD 25.06 billion by 2032, growing at a CAGR of 25.46% over the forecast period of 2025-2032. U.S. Green Electronics Manufacturing Market growth is accelerated by robust federal incentives, CG-inspired corporate investments, soaring consumer demand for sustainable technology, and developments in efficient and recyclable electronic production processes.

Green Electronics Manufacturing Market Dynamics:

Drivers:

-

Regulations Consumer Awareness and Green Innovations Accelerate Global Adoption of Sustainable Electronics Manufacturing Practices

Increase in regulatory pressure to reduce environmental impact, including RoHS, WEEE, and ENERGY STAR mandates, primarily drives the global Green Electronics Manufacturing Market. Increased consumer awareness towards e-waste and demand for sustainable and energy-efficient products are encouraging manufacturers to follow eco-friendly practices. Moreover, technological breakthrough of green materials based on recycled plastics or lead-free solders or bio-based polymers with energy-optimized manufacturing systems will further hasten through market penetration at high pace with multiple applications in consumer electronics along with automotive and industrial sectors.

Samsung integrated recycled ocean-bound plastics into over 50% of its smartphone components in 2024, aiming to expand this initiative across all product lines by 2026.

Restraints:

-

Fragmented Standards and Limited Access Hinder Global Progress in Green Electronics Manufacturing Adoption

Lack of global harmonization of standards and certification schemes is one of the key restraints in the Green Electronics Manufacturing Market as it leads to inconsistency in terms of the compliance of Global climatic regulations. Manufacturers are thus unable to cut across fragmented land and maximize sustainability practices through their global supply chain strips. While lack of green materials and technologies accessibility in developing nations inhibits the large scale practice of environmental friendly process.

Opportunities:

-

Emerging Markets and Smart Technologies Fuel the Next Wave of Growth in Green Electronics Manufacturing

High growth potential in emerging economies across Asia Pacific and Latin America will drive demand for the product owing to the rapid industrialization, environmental policy reform initiatives and market adoption of the product. In addition, the shift towards modular and easily repairable product design, the integration of AI for efficiency and reducing emissions, and the increasing demand for solar powered and low-power IoT devices, are all significant growth markets.

Brazil introduced new e-waste management regulations under its National Solid Waste Policy in 2024, mandating manufacturers to increase product take-back and recycling mechanisms.

Challenges:

-

Overcoming Design Challenges and Awareness Gaps to Advance the Future of Green Electronics Globally

The major challenge is the technical complexity of designing green electronics that can perform well and are also durable while being less harmful for the environment. However, these goals are still hard to reach recyclability and modularity are achieved at the sacrifice of functionality. In addition, certain markets have low consumer awareness of the benefits of green electronics, which limits demand, and logistical issues in product take-back and recycling systems prevent the creation of a circular economy.

Green Electronics Manufacturing Market Segmentation Analysis:

By Material Type

Lead-free solders accounted for the largest share of 35.1% of the Green Electronics Manufacturing Market in 2024. The extensive adoption of these elements can be mainly seen in their high dependence on rigorous global environmental regulations such as RoHS, where the hazardous materials in electronic components are restricted such as lead. Lead-free solders, the new standard for consumer and industrial electronics, provide better health and environmental profile while maintaining electrical performance and reliability.

Bio-based polymers are expected to see the highest CAGR between 2025 and 2032. They are increasingly being adopted due to a growing demand for biodegradable, low-toxicity substitutes to petroleum-based plastics. Biosourced plastics are becoming more prominent in consumer electronics with increasing innovation in bio-resins and sustainable packaging that holds promise for meaningful steps to fully recyclable product designs.

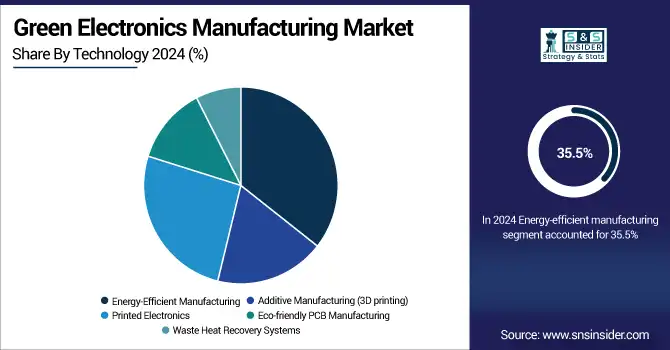

By Technology

The energy-efficient manufacturing segment led the green electronics manufacturing market in 2024, accounting for 35.5% of the market share. This dominance owes to the increasing adoption of smart factory systems, AI-based energy optimization, and demand for low carbon footprints for electronics manufacturing. Manufacturers are implementing energy-efficient machinery and cleanroom conformances to address the environmental regulations while minimizing operational energy usage across consumer electronics, industrial and automotive sectors.

Additive manufacturing (3D printing) is expected to have the highest CAGR between 2025 and 2032. Its potential to reduce material waste, number of production steps, and develop lightweight and customizable components has fueled this growth. With green design taking precedence, 3D printing has become the ideal sustainable prototyping and small-batch electronic product manufacturing solution for eco-friendly electronics.

By Application

Energy-efficient consumer devices dominating the segment with 36.7% in 2024. As the demand for sustainable home devices, smartphones, laptops and wearables increases, manufacturers are forced by these social developments to design products with energy conservation built in. Government-backed labeling programs, such as ENERGY STAR, and the increasing consumer awareness have increased brand competition in making devices that consume less power while providing the same level of performance and functionality.

The low power IoT devices are predicted to grow at the highest CAGR during the period between 2025–2032. The rise is powered by rising adoption in smart homes, agragriculture, healthcare, and industrial monitoring. They are designed to run with ultra-low power, usually using energy harvesting or solar power, and may meet sustainability goals for the next generation of connected ecosystems.

By Certification/Compliance

RoHS (Restriction of Hazardous Substances) was the leading segment in the Green Electronics Manufacturing Market in 2024, accounting for 33.5% share. This is the reason behind its supremacy, following widespread RoHS-compliant laws and penalties in Europe, North America and various regions in Asia. The regulation introduced is having become one of the major standards for phasing out substances such as lead, cadmium and mercury from electronic products so manufacturers are redesigned components and materials to achieve compliance.

EPEAT certified products are anticipated to experience the highest growth rate from 2025 to 2032. EPEAT focuses on the environmental performance of a product over its whole lifecycle, such as energy efficacy, recyclability and use of environmentally sound materials. This certification has witnessed rapid growth globally, driven by the increasing adoption of ESG frameworks by enterprises and the growing preference of institutional buyers for certified green products.

Green Electronics Manufacturing Market Regional Outlook:

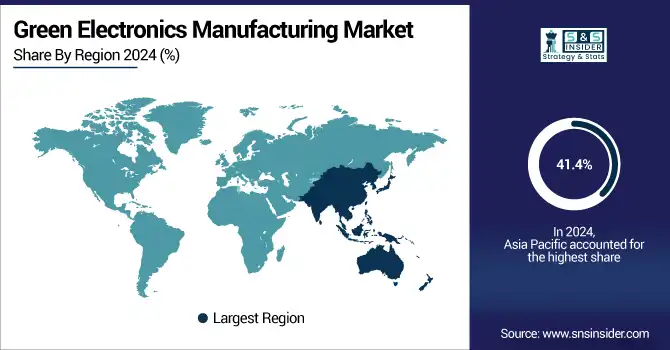

Asia Pacific held 41.4% of the global Green Electronics Manufacturing Market share in 2024, and it is anticipated to register the highest CAGR from 2025 to 2032, Electronics manufacturing ecosystems, a favorable environmental regulation, and investment in green technologies across China, Japan, South Korea, and India this is driving the growth. Supportive mass-producing facilities, governmental drive for sustainable solutions, and an increasing pool of eco-conscious consumers create a ripe growing environment for the region. Also, global green standards are also being set along these lines by manufacturers by increasingly adopting different energy efficient and low emission manufacturing processes.

The economics for China remained unrivaled in Asia Pacific with its large-scale production of electronics and green policies adhering to stringent standards with swift investments in sustainable technologies.

North America is attributed the major stakeholder in the Green Electronics Manufacturing Market owning to strong regulatory mechanisms, high consumer cognizance, and extensive corporate investment in sustainability. Green manufacturing is being increasingly adopted due to pressure from large technology companies that are now aggressively going after carbon neutral and ESG efforts. Policy support for green electronics development has been backed by large government initiatives, such as the Inflation Reduction Act, and a patch work of state-level e-waste recycling laws across the United States. Furthermore, there was also growth for ENERGY STAR qualified equipment, modular product architecture, and low-power IoT technology in the area. The United States and Canada ranked highest in green technology production and innovation in the region.

Europe is at the forefront for advocating the manufacture of sustainable electronics due to the detailed regulations, including RoHS, WEEE and Ecodesign Directive. The area is focused on circular economy principles — including eco-design/ recyclability/ longevity of use. More and more manufacturers are utilizing green materials, energy efficient production methods, modular designs, and other sustainable manufacturing practices. Innovation around green technologies is driven by government funding and compliance standards. Germany, France, and the Netherlands are leading the pack in harmonising complementary action on the industry and policy-level to cut the overall electronics footprint.

The green electronics manufacturing market in Brazil and the Middle East & Africa are among the emerging markets as concerns related to the environment and global warming push the nations to cross the green electronics production path with the support of regulatory reforms and international partnerships. Nations such as Brazil, UAE, United Arab Emirates, and South Africa are implementing sustainable infrastructure and encouraging electronics production with eco-friendly practices.

Get Customized Report as per Your Business Requirement - Enquiry Now

Green Electronics Manufacturing Companies are:

The Key Players in Green Electronics Manufacturing Market are Apple, Samsung, Panasonic, Sony, HP, Dell, Lenovo, LG, Intel, Acer, ASUS, Microsoft, Toshiba, Fujitsu, Sharp, Nokia, Cisco, Xiaomi, Siemens, Epson and others.

Recent Developments:

-

In July 2025, Apple inked a USD 500 million multi-year deal with MP Materials to build a U.S. rare‑earth magnet production and recycling facility combining Texas manufacturing with new California recycling lines ensuring 100% recycled magnets in its devices and strengthening domestic clean-supply chains.

-

In May 2024, Samsung moblie Galaxy S25 won the 2025 ReMA Design for Recycling® Award, using recycled cobalt in batteries and integrating at least one recycled material in every external component and packaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.00 Billion |

| Market Size by 2032 | USD 131.64 Billion |

| CAGR | CAGR of 25.83% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Recycled Plastics, Bio-based Polymers, Lead-free Solders, Halogen-free Laminates and Low-VOC Adhesives) • By Technology (Energy-Efficient Manufacturing, Additive Manufacturing (3D printing), Printed Electronics, Eco-friendly PCB Manufacturing and Waste Heat Recovery Systems) • By Application (Energy-Efficient Consumer Devices, Solar-Powered Systems, E-Waste Minimization Solutions, Smart Energy Management, and Low Power IoT Devices) • By Certification/Compliance (RoHS (Restriction of Hazardous Substances), WEEE (Waste Electrical and Electronic Equipment), ENERGY STAR Rated, EPEAT Certified Products and ISO 14001 Compliant Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Apple, Samsung, Panasonic, Sony, HP, Dell, Lenovo, LG, Intel, Acer, ASUS, Microsoft, Toshiba, Fujitsu, Sharp, Nokia, Cisco, Xiaomi, Siemens, and Epson. |