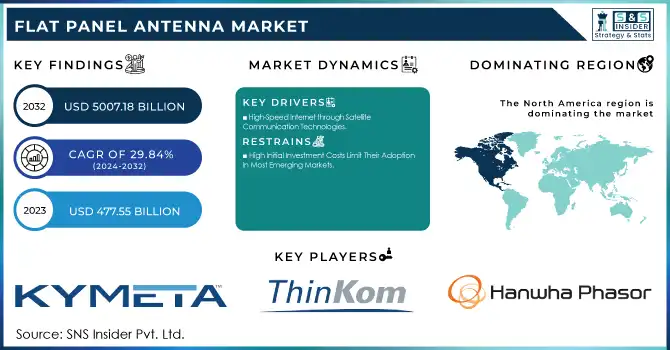

Flat Panel Antenna Market Size & Analysis:

The Flat Panel Antenna Market Size was valued at USD 477.55 Million in 2023 and is expected to reach USD 5007.18 Million by 2032 and grow at a CAGR of 29.84% over the forecast period 2024-2032.

Advancements in Flat Panel Antenna Market have become robustly driven through its growing adoption in key countries of Japan, China, the USA, France, Germany, and India. Governments are supporting the utilization of satellite communication technology to create and improve connectivity within defense, aerospace, and other commercial activities. For example, the Indian government announced its "SpaceCom Policy 2023," which focuses on advanced communication infrastructure, such as flat panel antennas, for rural connectivity and national security. In the United States, the U.S. Department of Defense had increased its investments in satellite-based communication systems that had added enormous demand for new antenna solutions.

Get more information on Flat Panel Antenna Market - Request Sample Report

The recent success of market development has been possible due to continuous technological advancements. The latest in electronically steered antennas (ESAs) includes multi-beam operations, delivering high-speed connectivity in challenging environments such as in high-speed trains and airplanes. Significant launches in 2023 include the lightweight, compact antennas from Kymeta and ThinKom that focus on innovations. For example, in 2023, Kymeta, and low Earth orbit satellite communications company OneWeb, announced that Kymeta's Electronically Steered Peregrine u8 LEO terminal is commercially available, marking the first flat panel antenna to be deployed for service on OneWeb's LEO network in support of the maritime market. These highly portable and energy-efficient antennas find applications in communications and defense applications.

Beside the technological advances, global initiatives to bridge the digital divide created significant opportunities. More than 3 billion people worldwide still do not have reliable internet access; rural areas of countries like India and the USA have a large portion of this group. Flat panel antennas are turning out to be essential for seamless connectivity to those underserved regions. Next generation technologies such as 5G and IoT will see opportunities in the future with these antennas. These antennas are believed to revolutionize various industries like transportation, logistics, and healthcare because they will make real-time communication and data transfer possible.

Cooperation between space agencies and private enterprises is boosting the acceptance of flat-panel antennas. Continued investments, especially in China's Space Development Program and the European Union's Space Policy, which have improved investment in satellite communication, further drive market growth. This market is expected to accelerate because industries realize the potential for these antennas to provide reliable, uninterrupted communication across urban, rural, and remote locations. With increased investment in satellite infrastructure by governments, the future of global connectivity is likely to be shaped by the Flat Panel Antenna Market.

Flat Panel Antenna Market Dynamics

Key Drivers:

-

High-Speed Internet through Satellite Communication Technologies.

The increasing demand for high-speed internet through satellite communications is driving the use of flat-panel antennas worldwide. With 70% of rural areas in countries like India and the USA still lacking broadband, flat-panel antennas are proving to be a reliable alternative to bridge the digital divide. The FCC reports in the USA experienced a 25% increase in new subscribers during 2023 for satellite internet providers. Germany and France have undertaken satellite infrastructure projects under the EU Space Policy, significantly raising the deployment of such antennas. Flat-panel antennas’ ability to provide uninterrupted internet, even in remote and mobile environments, makes them indispensable for improving global connectivity.

-

Growing Usage of Flat-Panel Antennas in Defense and Aerospace.

The defense and aerospace industries are increasingly using flat-panel antennas due to their compact design and enhanced communication capabilities. Governments in regions such as North America and Asia-Pacific are investing heavily in modernizing their military communication networks.

In 2023, the U.S. Satellite-based communication systems were allocated more than USD 1.5 billion by the Department of Defense. Flat-panel antennas are in demand due to their low profile and high reliability, which provide secure data transfer in challenging environments. Their applications in UAVs and modern warfare further solidify their position in improving defense capabilities.

Restrain:

-

High Initial Investment Costs Limit Their Adoption In Most Emerging Markets.

Advanced flat-panel antennas come with a substantial capital cost due to the requirement of huge amounts of capital during development, production, and roll-out. It is a high initial cost factor that significantly deters the massive adoption in most emerging markets with budgetary constraints. For example, in 2023, India's Ministry of Communications reported that flat-panel antennas are more expensive compared to traditional parabolic dishes.

Moreover, limited availability of advanced manufacturing facilities in geographies such as Africa and parts of South America complicate the matter. Even in developed markets, the lack of justification from industries to transition to these high-cost systems can be a big task, especially for non-critical applications. Addressing these cost barriers is going to be very crucial in expanding market penetration through government subsidies, industry collaborations, and advancements in cost-effective materials.

Flat Panel Antenna Market Segmentation Overview

BY TYPE

In 2023, the Mechanically Steered segment dominated the market, with a 42% share, due to its widespread application in commercial maritime and land-based communication systems. It is preferred due to its cost-effectiveness and reliability in applications where mobility requirements are minimal.

The Electronically Steered segment is also rapidly gaining acceptance, with an expected growth with fastest CAGR of 29.96% during the forecast period of 2024-2032. This growth in the ESA segment is largely attributed to technology advancement in the capabilities of beam steering, offering superior performance in dynamic environments, such as aviation and high-speed trains. Moreover, the integration of ESAs in military operations, along with their integration in 5G networks, also contributes to this growth. Industry participants are working to create lightweight and scalable ESA models to meet the increasing demand for seamless connectivity in various applications.

By End-Use Application

In 2023, Telecommunications segment was the most prominent segment of the market with a share of 27%. The rise in demand for reliable communication solutions in rural and remote regions drives the leadership of this segment. Telecommunication companies in countries such as China and the USA have been aggressively deploying flat-panel antennas to improve satellite internet connectivity.

The Commercial segment is expected to grow at a faster CAGR of 30.87% during the period from 2024 to 2032. It finds applications growing in sectors such as transportation, maritime, and media broadcasting. The integration of flat-panel antennas into autonomous vehicles and high-speed rail systems is opening new avenues for growth. Along with the rising investments in smart city projects and connected infrastructure globally, the commercial segment is poised to redefinition in the scope of flat-panel antenna applications.

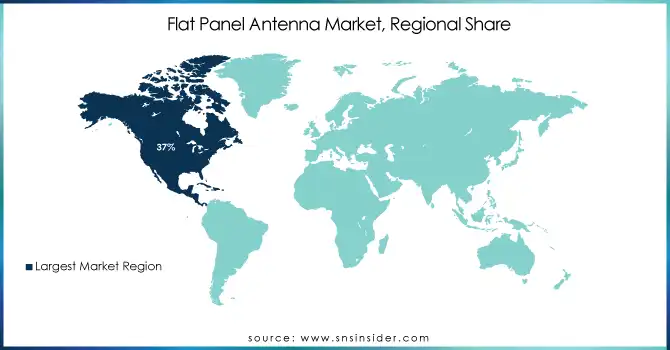

Flat Panel Antenna Market Regional Analysis

The Flat Panel Antenna Market has major regional disparities as it held 37% market share in North America in 2023. This leadership is based upon state-of-art technological infrastructure and substantial government investment in satellite communication projects. As an example, the U.S. Space Force allocated USD 2 billion for satellite advancement in 2023.

The Asia-Pacific region is also expected to have the fastest growth during the forecast period of 2024-2032 with a CAGR of 31.43%. Such factors as rapid urbanization, increasing internet penetration, and government-led initiatives, such as China's 2024 Space Development Program, have contributed to the region's growth. Countries such as India are investing in space and communication technologies, making Asia-Pacific the most prominent growth hub for flat-panel antennas in the next years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Flat Panel Antenna Market are

-

Kymeta Corporation (u8 MIL hybrid terminal, u8 GO terminal)

-

ThinKom Solutions (ThinAir® Ka2517, ThinSat® 300)

-

Hanwha Phasor (Phasor electronically steered antenna, Phasor integrated SATCOM solutions)

-

TTI Norte (TTI flat panel antennas, TTI phased array systems)

-

L3Harris Technologies (L3Harris SATCOM terminals, L3Harris ISR antennas)

-

Ball Aerospace (Ball Aerospace phased array antennas, Ball Aerospace ESA systems)

-

RadioWaves (RadioWaves flat panel antennas, RadioWaves microwave antennas)

-

SatPro Tech (SatPro flat panel antennas, SatPro satellite communication systems)

-

NXT Communications (NXT flat panel antennas, NXT SATCOM solutions)

-

ALCAN Systems (ALCAN flat panel antennas, ALCAN smart antennas)

-

C-COM Satellite Systems (iNetVu® FMA-120, iNetVu® MP-80)

-

Gilat Satellite Networks (Gilat flat panel antennas, Gilat SATCOM solutions)

-

Isotropic Systems (Isotropic multi-beam antennas, Isotropic optical beamforming technology)

-

China Starwin (Starwin flat panel antennas, Starwin phased array antennas)

-

OneWeb (OneWeb user terminals, OneWeb satellite connectivity solutions)

-

ST Engineering (ST Engineering flat panel antennas, ST Engineering SATCOM solutions)

-

Inmarsat (Inmarsat Global Xpress antennas, Inmarsat L-band antennas)

-

Cobham Aerospace Communications (Cobham AVIATOR antennas, Cobham SATCOM solutions)

-

MTI Wireless Edge (MTI flat panel antennas, MTI military antennas)

-

PCTEL (PCTEL flat panel antennas, PCTEL wireless solutions)

Major Suppliers (Components, Technologies)

-

Rogers Corporation (High-frequency laminates, Advanced circuit materials)

-

DuPont (Pyralux® flexible circuit materials, Kapton® polyimide films)

-

Isola Group (High-performance PCB materials, RF/microwave laminates)

-

AGC Inc. (Fluoropolymer films, Specialty glass materials)

-

Mitsubishi Electric (Semiconductor devices, RF components)

-

Analog Devices (RF and microwave ICs, Mixed-signal integrated circuits)

-

Texas Instruments (RFID products, Wireless connectivity solutions)

-

Murata Manufacturing (RF modules, Microwave devices)

-

Kyocera Corporation (Ceramic components, Electronic devices)

-

TE Connectivity (Antenna connectors, RF components)

Recent Trends

-

March 2024: ThinKom Solutions, Inc. recently announced that it has launched the ThinAir GT line of airborne solutions specifically designed for government customers. ThinKom has engineered the ThinAir GT system to provide service in the most demanding EMI, EMC, and EMP environments while sustaining the proven reliability of ThinKom.

-

November 2024: The flat-panel satellite antenna company that is considered as a world leader, Kymeta announced it had launched Goshawk u8. A hybrid GEO/LEO/Cellular terminal designed for seamless mobility, offering a fully customizable solution, to be easily integrated across a wide range of vehicles and vessels that will provide the needed reliable and network-redundant connectivity on the move.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 477.55 Million |

| Market Size by 2032 | USD 5007.18 Million |

| CAGR | CAGR of 29.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mechanically steered, Electronically steered), • By Frequency (C band, X band, Ku band, K band, Ka band), • By End Use Application (Aviation, Military, Telecommunications, Commercial, Others), • By Technology (Microstrip Antenna, Planar Antenna, Phased Array Antenna, Reflector Antenna) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kymeta Corporation, ThinKom Solutions, Hanwha Phasor, TTI Norte, L3Harris Technologies, Ball Aerospace, RadioWaves, SatPro Tech, NXT Communications, ALCAN Systems, C-COM Satellite Systems, Gilat Satellite Networks, Isotropic Systems, China Starwin, OneWeb, ST Engineering, Inmarsat, Cobham Aerospace Communications, MTI Wireless Edge, PCTEL. |

| Key Drivers | • High-Speed Internet through Satellite Communication Technologies. • Growing Usage of Flat-Panel Antennas in Defense and Aerospace. |

| Restraints | • High Initial Investment Costs Limit Their Adoption In Most Emerging Markets. |