Grey Hydrogen Market Report Scope & Overview:

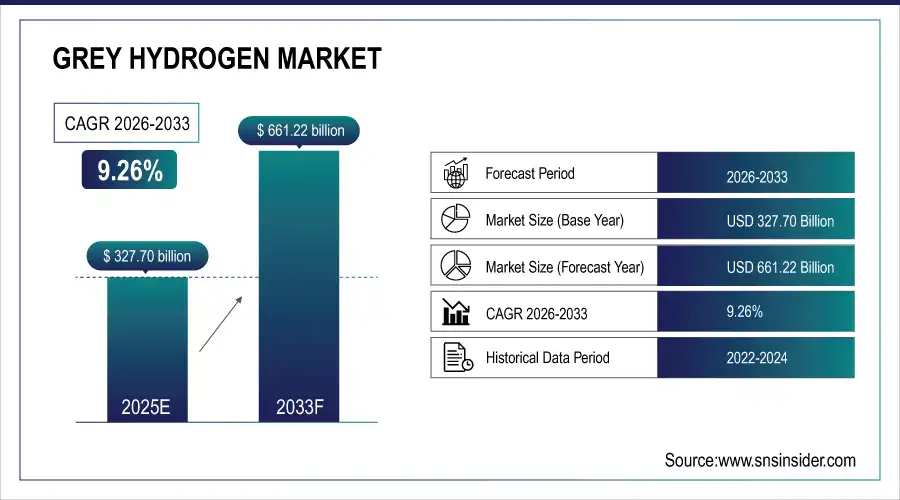

Grey Hydrogen Market was valued at USD 327.70 billion in 2025E and is expected to reach USD 661.22 billion by 2033, growing at a CAGR of 9.26% from 2026-2033.

The Grey Hydrogen Market is growing due to rising demand from petroleum refineries, chemical industries, and ammonia production. Abundant natural gas availability, cost-effective production via steam methane reforming, and established industrial infrastructure support widespread adoption. Expansion of refinery capacities, modernization projects, and growing global energy requirements further drive consumption. Additionally, increasing investments in hydrogen supply chains and industrial applications ensure steady market growth and strong revenue generation during the forecast period.

Market Size and Forecast

-

Market Size in 2025: USD 327.70 Billion

-

Market Size by 2033: USD 661.22 Billion

-

CAGR: 9.26% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Grey Hydrogen Market - Request Free Sample Report

Grey Hydrogen Market Trends

-

Rising industrial hydrogen demand is driving the grey hydrogen market.

-

Predominant production via steam methane reforming (SMR) using natural gas fuels supply growth.

-

High consumption in chemical, refining, and fertilizer industries is boosting market adoption.

-

Focus on cost-effective hydrogen production is shaping market trends.

-

Growing interest in transitioning to blue and green hydrogen is influencing long-term strategies.

-

Technological advancements in carbon capture and storage may impact future grey hydrogen use.

-

Collaborations between energy companies, industrial users, and technology providers are accelerating deployment and innovation.

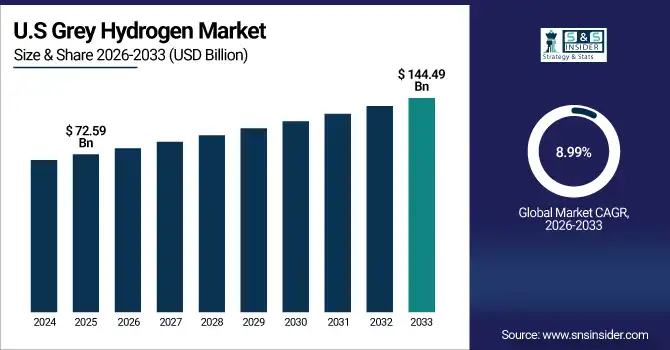

U.S. Grey Hydrogen Market was valued at USD 72.59 billion in 2025E and is expected to reach USD 144.49 billion by 2033, growing at a CAGR of 8.99% from 2026-2033.

The U.S. Grey Hydrogen Market is growing due to high industrial demand from refineries and chemical sectors, abundant natural gas supply, established production infrastructure, and increasing investments in hydrogen-based energy solutions supporting large-scale adoption and market expansion.

Grey Hydrogen Market Growth Drivers:

-

Rising global demand for hydrogen in petroleum refining and chemical industries is accelerating Grey Hydrogen Market growth significantly

Increasing hydrogen consumption in petroleum refineries for hydrocracking, desulfurization, and cleaner fuel production is a major growth factor. Additionally, hydrogen is a key feedstock for ammonia and methanol production, driving industrial demand. Expansion of refinery capacities, modernization initiatives, and rising global energy requirements support steady adoption. Established infrastructure for steam methane reforming and widespread availability of natural gas reduce production costs, making grey hydrogen economically viable. Combined with growing investments in industrial hydrogen supply chains and government support for energy security, these factors are driving the market forward.

Grey Hydrogen Market Restraints:

-

Dependency on fossil fuels for production is constraining the Grey Hydrogen Market globally

Grey hydrogen relies heavily on natural gas, making it vulnerable to fossil fuel price fluctuations and supply disruptions. Geopolitical tensions, energy security issues, and rising natural gas prices can impact production economics and availability. Dependence on non-renewable resources also attracts environmental criticism, slowing adoption in regions prioritizing decarbonization. This reliance limits long-term sustainability and hinders market expansion in areas with strict emission regulations. Industries may seek alternative hydrogen sources or green production methods, creating a constraint on grey hydrogen market growth and potentially affecting investment and development plans globally.

Grey Hydrogen Market Opportunities:

-

Rising investments in low-carbon technologies offer significant growth opportunities in the Grey Hydrogen Market

Industries are investing in carbon capture, utilization, and storage (CCUS) technologies to reduce emissions from grey hydrogen production. Integrating CCUS can make grey hydrogen more sustainable and compliant with global emission regulations. This innovation allows companies to continue using existing infrastructure while improving environmental performance. Governments and private investors are funding projects to enhance production efficiency and reduce carbon intensity. These initiatives create opportunities for manufacturers, technology providers, and industrial consumers to expand grey hydrogen adoption while aligning with sustainability goals, opening new markets and revenue streams.

Grey Hydrogen Market Segment Highlights

-

By Transportation Mode, Pipeline dominated with ~71% share in 2025; Cryogenic Liquid Tankers fastest growing (CAGR)

-

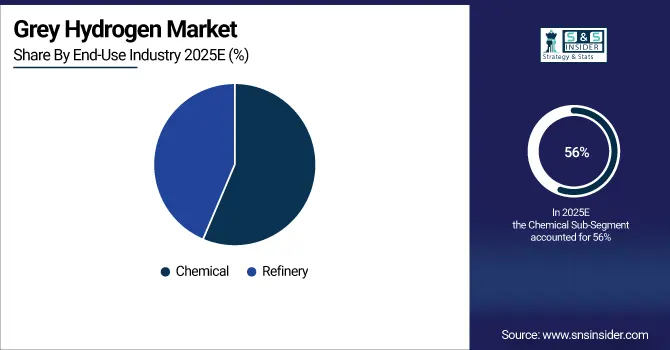

By End-Use Industry, Chemical dominated with ~56% share in 2025; Refinery fastest growing (CAGR)

-

By Technology, Steam Methane Reforming dominated with ~49% share in 2025; Methane Pyrolysis fastest growing (CAGR)

-

By Application, Petroleum Refinery dominated with ~32% share in 2025; fastest growing (CAGR)

Grey Hydrogen Market Segment Analysis

By Transportation Mode, Pipeline segment dominated in 2025; Cryogenic Liquid Tankers segment projected fastest growth 2026–2033

Pipeline segment dominated the Grey Hydrogen Market in 2025 due to its cost-effective, safe, and efficient method for transporting large volumes of hydrogen over long distances. Industrial and chemical facilities rely on pipelines for continuous supply, ensuring minimal losses and reliable delivery, which supports widespread adoption and market dominance.

Cryogenic Liquid Tankers segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing demand for flexible, long-distance hydrogen transport. Growing industrial hydrogen consumption in regions without pipeline infrastructure and rising adoption of liquefied hydrogen for storage and export are driving rapid market growth for this transportation mode.

By End-Use Industry, Chemical segment led in 2025; Refinery segment expected fastest growth 2026–2033

Chemical segment dominated the Grey Hydrogen Market in 2025 as hydrogen is extensively used in chemical manufacturing, including ammonia production and methanol synthesis. High industrial demand and established supply chains in the chemical sector ensure consistent consumption, making it the largest end-use segment in terms of revenue.

Refinery segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing use of hydrogen in petroleum refining processes. Expansion of refinery capacities, modernization projects, and rising hydrogen requirements for cleaner fuel production drive rapid adoption and growth in this segment.

By Technology, Steam Methane Reforming segment dominated in 2025; Methane Pyrolysis segment projected fastest growth 2026–2033

Steam Methane Reforming segment dominated the Grey Hydrogen Market in 2025 because it is the most established and cost-effective method for large-scale hydrogen production. Widespread industrial use, mature technology, and existing infrastructure support its continued dominance globally.

Methane Pyrolysis segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing focus on low-carbon hydrogen production. Technological advancements, environmental regulations, and rising industrial interest in sustainable hydrogen drive rapid adoption of methane pyrolysis methods.

By Application, Petroleum Refinery segment led in 2025 and expected fastest growth 2026–2033

Petroleum Refinery segment dominated the Grey Hydrogen Market in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to the high demand for hydrogen in refining processes such as hydrocracking and desulfurization. Increasing global energy demand, expansion of refinery capacities, and modernization initiatives to produce cleaner fuels are driving adoption. The reliance on hydrogen for efficient fuel production and growing investments in petroleum infrastructure further support the segment’s dominance and rapid growth during the forecast period.

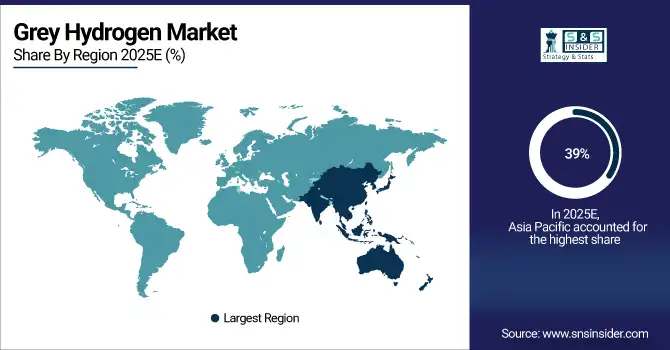

Grey Hydrogen Market Regional Analysis

Asia Pacific Grey Hydrogen Market Insights

Asia Pacific dominated the Grey Hydrogen Market in 2025 with the highest revenue share of about 39% due to the region’s abundant natural gas resources and growing industrial demand. Rapid industrialization, expansion of chemical and petroleum refining sectors, and increasing investments in energy infrastructure drive grey hydrogen consumption. Additionally, supportive government policies, rising energy requirements, and established production and distribution networks further strengthen market dominance in Asia Pacific during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Grey Hydrogen Market Insights

North America in the Grey Hydrogen Market is witnessing steady growth due to high demand from petroleum refineries and chemical industries. Established infrastructure for steam methane reforming, abundant natural gas supply, and technological advancements support large-scale production. Increasing investments in energy and industrial sectors, coupled with strong government focus on energy security and industrial efficiency, drive market adoption, making North America a significant contributor to global grey hydrogen revenue and stable market growth.

Europe Grey Hydrogen Market Insights

Europe in the Grey Hydrogen Market is experiencing moderate growth due to demand from chemical and refinery industries. Strict environmental regulations and carbon emission concerns are prompting investments in cleaner production technologies. Established industrial infrastructure, availability of natural gas, and technological advancements support grey hydrogen production. Additionally, government initiatives for energy transition and modernization of refineries drive adoption, positioning Europe as a key market while balancing industrial demand with sustainability requirements.

Middle East & Africa and Latin America Grey Hydrogen Market Insights

Middle East & Africa in the Grey Hydrogen Market is growing due to abundant natural gas resources and increasing demand from petroleum refineries and chemical industries. Investments in energy infrastructure and industrial expansion further drive adoption.Latin America in the Grey Hydrogen Market is witnessing growth as industrialization and refinery capacities expand. Rising energy demand, availability of natural gas, and government initiatives to strengthen industrial hydrogen supply chains support market development in the region.

Grey Hydrogen Market Competitive Landscape:

Air Liquide

Air Liquide is a global leader in gases, technologies, and services for industry and health. The company focuses on advancing low-carbon solutions, including hydrogen production, storage, and distribution. Its hydrogen strategy emphasizes renewable production, efficiency, and collaboration with industrial and energy partners to support the global energy transition and decarbonization efforts.

-

2024: Air Liquide launched an electrolyzer to produce renewable hydrogen in Oberhausen, Germany, demonstrating the power of collective efforts in advancing low-carbon hydrogen solutions.

Chevron

Chevron is a multinational energy corporation with operations spanning oil, gas, and renewable energy. The company’s hydrogen strategy includes green, blue, and gray hydrogen, targeting commercialization opportunities in renewable fuels, carbon capture, utilization, and storage (CCUS), and hydrogen supply chains. Chevron aims to integrate hydrogen into its portfolio while supporting energy transition initiatives.

-

2023 & 2024: Chevron’s approach to hydrogen envisions the use of green, blue, and gray hydrogen, focusing on commercialization opportunities in renewable fuels, CCUS, and hydrogen.

Reliance Industries Limited

Reliance Industries is a diversified conglomerate in energy, petrochemicals, and refining. The company is transitioning from grey to green hydrogen by leveraging seawater desalination expertise and technological innovations. Reliance aims to achieve cost and performance targets, positioning itself as a leader in large-scale green hydrogen production in India and supporting the national energy transition agenda.

-

2025: Reliance Industries aims to progressively commence the transition from grey to green hydrogen, after proving cost and performance targets.

Indian Oil Corporation (IOCL)

Indian Oil Corporation is India’s largest oil refining and distribution company. IOCL is advancing green hydrogen adoption in its refineries, focusing on replacing grey hydrogen and supporting sustainable industrial operations. Its hydrogen projects target decarbonization in fuel production and downstream chemical applications.

-

2024: IOCL plans to replace grey hydrogen with green hydrogen in its refineries, starting with a 10 KTPA Green Hydrogen project at its Mathura refinery.

Ørsted

Ørsted is a global renewable energy company specializing in offshore wind and decarbonization solutions. The company is actively developing renewable hydrogen technologies, aiming to decarbonize industries like steel, chemicals, and refineries in Europe. Hydrogen is a strategic pillar in Ørsted’s commitment to sustainable industrial transformation and achieving net-zero emissions.

-

2024: Ørsted continues its focus on renewable hydrogen, considering it critical for the European industrial economy in decarbonizing steel, chemicals, and refineries.

Iberdrola

Iberdrola is a leading utility company focused on renewable energy generation and grid integration. The company is developing Europe’s largest renewable hydrogen plant in Puertollano, Spain, to replace grey hydrogen with green hydrogen for the production of green fertilizers and ammonia. Iberdrola’s projects align with industrial decarbonization and sustainable energy production goals.

-

2024: Iberdrola is constructing Europe’s largest renewable hydrogen plant in Puertollano, Spain, targeting green hydrogen for fertilizers and ammonia.

Grey Hydrogen Companies are:

-

Air Liquide

-

Linde plc

-

ExxonMobil Corporation

-

Chevron Corporation

-

Reliance Industries Ltd.

-

Indian Oil Corporation Ltd.

-

China National Petroleum Corporation (CNPC)

-

Sinopec Limited

-

Messer Group GmbH

-

Orsted A/S

-

Praxair Technology, Inc. (now part of Linde)

-

TotalEnergies SE

-

BP plc

-

Shell plc

-

Petrobras

-

Saudi Aramco

-

PetroChina Company Limited

-

Eni S.p.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 327.70 Billion |

| Market Size by 2033 | USD 661.22 Billion |

| CAGR | CAGR of 9.26% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, Others) • By End-Use Industry (Chemical, Refinery) • By Technology (Coal Gasification, Steam Methane Reforming, Methane Pyrolysis, Alkaline Electrolyzer, PEM Electrolyzer, SOEC Electrolyzer, Gas Partial Oxidation, Auto Thermal Reforming) • By Transportation Mode (Pipeline, Cryogenic Liquid Tankers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Air Liquide, Air Products and Chemicals, Inc., Linde plc, ExxonMobil Corporation, Chevron Corporation, Reliance Industries Ltd., Indian Oil Corporation Ltd., China National Petroleum Corporation (CNPC), Sinopec Limited, Messer Group GmbH, Orsted A/S, Iberdrola S.A., Praxair Technology, Inc. (now part of Linde), TotalEnergies SE, BP plc, Shell plc, Petrobras, Saudi Aramco, PetroChina Company Limited, Eni S.p.A. |