Hardware Encryption Market Report Scope & Overview:

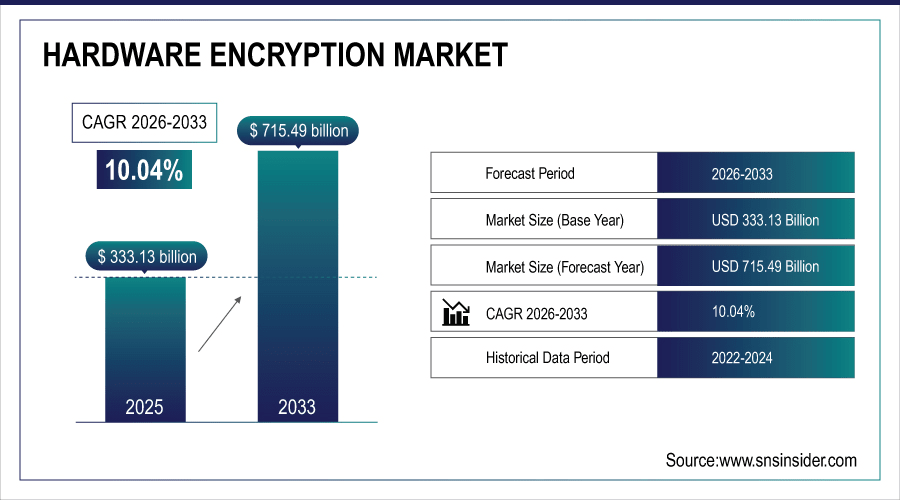

The Global Hardware Encryption Market size was valued at USD 333.13 Billion in 2025E. Looking ahead, the market is estimated to reach USD 715.49 Billion by 2033, allowing for a CAGR of 10.04% between 2026-2033.

The Global Hardware Encryption Market is projected to be driven by the rising pressure of data breaches, cyber-attacks, and need for regulatory compliances. The market is growing by the rising adoption of encrypted storage devices in enterprises, BFSI, and government. With the growing need for secured key management, cloud-based deployments and proliferation of Internet of Things (IoT) applications, enabling strong data protection has become more dependable in securing sensitive information across multiple applications.

-

In September 2025, encrypted storage devices held over 50% share, while hardware security modules neared 45%. BFSI and government drove more than 40% of demand, with North America leading and Asia-Pacific growing fastest.

To Get More Information On Hardware Encryption Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 333.13 Billion

-

Market Size by 2033: USD 715.49 Billion

-

CAGR: 10.04% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Hardware Encryption Market Trends:

-

At the top end of the market we´ll see Thales, Broadcom and Samsung already include this hardware encryption that was integrated in storage more advanced also in another device end point.

-

Enterprise data centers quickly adopted SEDs, decreasing reliance on software-based encryption.

-

Financial: use cases HSMs (HSMs in financial services for key protection and compliance)

-

Wider incorporation of hardware encryption with IoT and edge devices to mitigate potential logistical vulnerabilities within connected environments.

-

Increasing need of hardware-based encryption in cloud storage favored hybrid and multi-cloud security models.

-

Government regulations (GDPR, data protection laws) have driven the proliferation of hardware encryption in BFSI, defense and health industry.

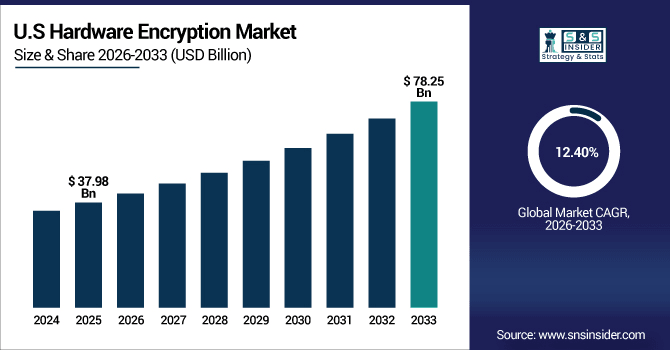

The U.S. Hardware Encryption Market was valued at USD 37.98 Billion in 2025E and is projected to reach USD 78.25 Billion by 2033, at a CAGR of 12.40%. The Hardware Encryption Market is being influenced by following factors, including increasing concern for data security and privacy issues; compliance etc. across enterprise & SMB’s and government bodies in various regions of the world. Top industry vendors such as Broadcom, Thales, Samsung, and IBM are providing smart solutions which drive secure key management and cloud integration on the market scaling.

Hardware Encryption Market Growth Drivers:

-

Rising Cybersecurity Threats and Stricter Compliance Mandates Drive Enterprises Toward Hardware-Based Encryption Solutions

The increasing number of cyber threats and the stringent government directives in favor of data privacy is expected to propel the growth of the Hardware Encryption Market. Enterprises and government agencies are under pressure to protect sensitive data, remain compliant with regulations such as the GDPR and HIPAA, and avoid expensive breaches. Hardware-based encryption delivers enhanced security (compared to software methods), improved performance and reduced total cost of ownership making it the ideal choice when securing data, managing risk and maintaining end user productivity even under the most challenging conditions.

-

In August 2025, reports showed a sharp rise in ransomware attacks and higher impacts from data breaches. This trend is pushing organizations to adopt stronger hardware-based encryption to protect sensitive information.

Hardware Encryption Market Restraint:

-

High Implementation and Integration Costs, Specialized Hardware and Budget Constraints Limit Adoption Among SMEs and Enterprises

One of the key restraints to Hardware Encryption Market is cost for set up is high. Secure hardware encryption, secure key management systems and integration to existing infrastructure require a good investment. Big businesses can absorb those costs, but small and midsize businesses have a hard time making enough budget. This cost factor impedes uptake in sectors, hampers the ability to scale a hardware solution in response to an infestation of advanced data security needs.

Hardware Encryption Market Opportunity:

-

Surge in Cloud Adoption Driving Demand for Hardware-Based Encryption to Secure Data Across Hybrid and Multi-Cloud Environments

Cloud services adoption is one of the main opportunity factors for Hardware Encryption Market. In a world where more and more businesses are moving to cloud, hybrid, or multi-cloud solutions governments too demand robust data protection. Security based hardware encryption offers both the strongest protection and is found to be faster processing as well, so it is recognized and trusted to effectively protect sensitive information while optimizing business network efficiency.

-

In June 2025, the Thales Global Cloud Security Study highlighted rising cloud adoption and reliance on multiple key management systems. It also pointed to increasing risks in cloud environments, boosting demand for hardware-based encryption.

Hardware Encryption Market Segmentation Analysis

-

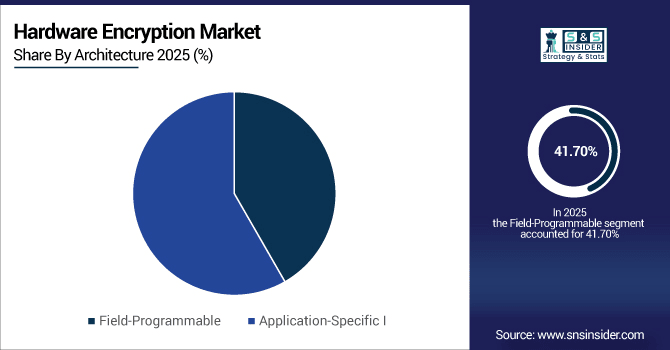

By Architecture, the field-programmable gate array (FPGA) was the highest contributor to the market with 41.7% share in 2026, whereas application-specific integrated circuit (ASIC) segment is expected to witness fastest CAGR of 11.9% from 2026-2033.

-

By Product, The Solid-State Drives (SSDs) was the leading product type segment: with 36.0% share in 2026 and Smart Cards are anticipated to grow at highest CAGR 15.50% over the forecast period.

-

By Application, Data Security accounts for 33.4% share in 2026 and Cloud Encryption is projected to grow at the highest CAGR of 12.8% during the forecast period 2026–2033.

-

By End User, Government & Defense is projected to grow at the highest 11.80% CAGR during 2026–2033 for Consumer Electronics, it accounted for the largest share in 2026 at 38.2%.

By Architecture, Field-Programmable Gate Arrays (FPGAs) lead adoption, while Application-Specific Integrated Circuits (ASICs) expand fastest

Consumer electronics was the largest market for hardware encryption, as the adoption of smartphones, laptops and other connected devices by consumers made it necessary to secure personal information and data storage. Conversely, Government & Defense is expected to experience the fastest growth, with growing cyber threats, needs for protecting critical infrastructure and heavy investments on advanced encryption technologies for national security and preservation of sensitive information.

By Product, Solid-State Drives (SSDs) dominate market share, while Smart Cards grow fastest

SSDs led the hardware encryption market; they are faster, reliable and offer higher- level security which is essential for enterprises and data centers that handle high-value work. In contrast, Smart Cards are anticipated to grow at the fastest rate on account of increasing demand for authentication in BFSI, government and identity applications guaranteeing secure financial transaction across multiple applications. Their portability and low cost increasingly encourage uptake, while expanding e-payments ecosystems reinforce demand longer term.

By Application, Data Security holds majority share, while Cloud Encryption rises fastest

Key Findings Data Security led the hardware encryption market as companies continue to highlight protecting sensitive data against breaches, ransomware, and compliance issues, driving a need for robust encryption across storage and networks. Cloud Encryption on the other hand will experience the fastest growth due to rapid adoption of cloud platforms, growing hybrid infrastructure platforms and increasing requirement of securing mission critical data in various industry verticals operating under multi-cloud environments.

By End-use, Consumer Electronics drive demand, while Government & Defense grow fastest

Consumer Electronics market is a major source of revenue for this industry, and with the increase in demand for secure smartphones, laptops and storage devices, encryption has become an essential feature ensuring protection of personal and financial data. A – Government & Defense is anticipated to be the fastest growing segment on the back of rising government investments towards national security, security for sensitive data and adoption of advanced encryption techniques in order to combat ever-growing cyber threats and protect vital infrastructure.

Hardware Encryption Market Regional Analysis

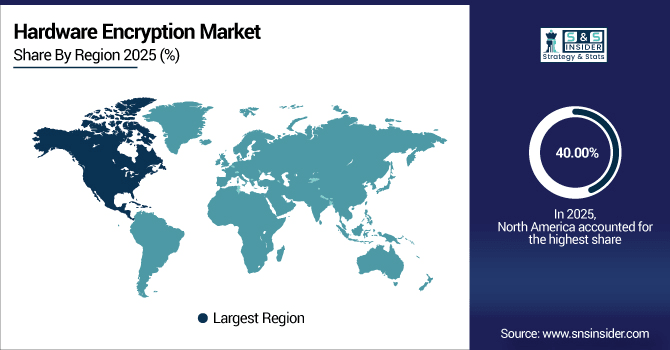

North America Hardware Encryption Market Insights:

The Hardware Encryption Market Region with the largest market share is North America, 40.00% of The Hardware Encryption Market is in North America. The region has an upper hand in the market due to strong presence of technology industry leaders, early adoption on advanced encryptions solutions and stringent regulations such as HIPAA and compliance requirement under GDPR. The increasing IT threats online and an increased demand for secure storage solutions in enterprises and data centers continue to boost its dominance and large spending on cloud infrastructure investments and digitalization projects also continue to bolster North America’s market dominance. Adoption is further propelled by burgeoning BFSI and healthcare digitization.

Get Customized Report as Per Your Business Requirement - Enquiry Now

US Hardware Encryption Market Insights:

The US is the biggest country in the Hardware Encryption Market. The next two countries are Canada and Mexico. The domination of the country can be attributed to the existence of major tech giants, heavy adoption of advanced encryption hardware in enterprises and stringent data protection regulations such as HIPAA and CCPA. Growing cyberattacks, increasing need for secure cloud solutions and government investment in cybersecurity also support the surge. Also, high pace of digital transformation in the BFSI, healthcare and defense applications confirms U.S. dominance across the globe.

Asia-Pacific Hardware Encryption Market Insights:

Hardware Encryption Market in Asia-Pacific is growing at the highest rate of 11.38% owing to increasing plans for digital transformation in China, India, Japan and South Korea. The growth in the region is attributed to VMs adoption at a rapid pace, growing deployment of IT infrastructure and rising number of cyber security threats. Initiatives from the government, increase in business investment on safe data management, as well as growing start-up ecosystem also contribute to its adoption. Furthermore, increasing BFSI, healthcare and telecom sectors are reaffirming the firm hold of Asia-Pacific as one of the most remunerative hardware encryption markets globally. Increasing e-commerce penetration and expanding smartphone use are also driving demand for encryption.

China Hardware Encryption Market Insights:

Asia-Pacific occupied the highest market share because of surge in digitalization and increased demand from end-user verticals particularly in China. Heavy investment in cloud infrastructure, 5G deployment and government-mandated cybersecurity regulations are driving leadership of the country. Increasing utilization from BFSI, telecom and e-commerce industry also favors the adoption.

Europe Hardware Encryption Market Insights:

Europe holds a substantial market share in the Hardware Encryption Market due to rigorous data privacy laws including GDPR and the increasing demand for compliance across industry verticals. The region enjoys strong IT infrastructure, growing enterprise focus on secure data storage and increasing incidence of cyberattacks. Rising demand is also backed by solid traction in BFSI, government and healthcare among others.

Germany Hardware Encryption Market Insights:

Germany has a dominant position in the hardware encryption demand across Europe due to the presence of a developed industrial base, high uptake of data security solutions and stringent regulations. The demand for safe storage and encryption technology in the country is being propelled by its manufacturing, automotive and BFSI (Banking, financial services and insurance) sectors. Increasing digitalization, Industry 4.0 projects and government support for cybersecurity also serve to reinforce Germany as a major player in the European market.

Middle East & Africa (MEA) and Latin America Hardware Encryption Market Insights:

The hardware encryption market in the Middle East America and Latin America has witnessed steady growth due to digital transformation, increasing cloud adoption, and growing awareness of cybersecurity. MEA has UAE and Saudi Arabia in the forefront generating demand, thanks to smart city projects, BFSI investments, government cybersecurity initiatives. Brazil and Mexico are leading in Latin America with growing e-commerce, digital payments, and regulatory requirements.

Competitive Landscape Hardware Encryption Market Insights:

Western Digital and the Hardware Encryption Market Western Digital is one of the leaders in advanced self-encrypting drives (SEDs) and secure storage solutions. Its encryption-embedded hard-disk drives and solid-state drives are sold to enterprise data centers, cloud service providers and consumer products. With strong R&D and big global distribution, the company fulfills growing security and compliance facilitation requirements.

-

In June 2025, the company successfully reduced a patent infringement award concerning its self-encrypting drives, avoiding major liability linked to encryption technology.

Samsung dominates the hardware encryption space through its leadership in NAND flash, SSDs, and mobile devices with integrated encryption technology. Its focus on high-performance, secure storage solutions aligns with growing enterprise, cloud, and consumer security needs. By integrating encryption into smartphones and servers, Samsung strengthens global adoption, especially in Asia-Pacific and North America.

-

In July 2025, they further rolled out Knox Enhanced Encrypted Protection (KEEP), updated Knox Matrix threat response, and quantum-safe Secure Wi-Fi for Galaxy devices, enhancing on-device AI security and cross-device protection.

Samsung already is the leader in hardware encryption because Samsung is a leader in NAND and SSDs and mobile devices embedded with encryption. Its emphasis on fast, secure storage plays into an increasing demand for enterprise, cloud and consumer security. Samsung boosts global adoption, especially in Asia-Pacific and North America, by embedding encryption on smartphones and servers.

-

In September 2025, Micron launched a new portfolio of high-performance SSDs with self-encrypting features, hardware root of trust, firmware verification, and secure execution environments, designed for AI-intensive data center workloads.

Hardware Encryption Market Key Players:

Some of the Hardware Encryption Market Companies are:

-

Western Digital Technologies, Inc.

-

Samsung Electronics Co., Ltd.

-

Micron Technology, Inc.

-

Kingston Technology Corporation

-

Seagate Technology Holdings PLC

-

NetApp, Inc.

-

Intel Corporation

-

Thales e-Security, Inc.

-

McAfee, LLC

-

Broadcom Inc.

-

Maxim Integrated Products, Inc.

-

Giesecke+Devrient

-

IDEMIA

-

NXP Semiconductors N.V.

-

Infineon Technologies AG

-

Toshiba Corporation

-

Kanguru Solutions

-

WinMagic Inc.

-

Futurex LP

-

Apricorn, Inc

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 333.13 Billion |

| Market Size by 2033 | USD 715.49 Billion |

| CAGR | CAGR of 10.04 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Hard Disk Drive, Solid-State Drive, USB Flash Drive, Smart Card) •By Architecture (Field-Programmable Gate Array, Application-Specific Integrated Circuit) •By Application (Data Security, Network Security, Database Encryption, Cloud Encryption) •By End User (Consumer Electronics, BFSI, Government & Defense, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Western Digital Technologies, Inc., Samsung Electronics Co., Ltd., Micron Technology, Inc., Kingston Technology Corporation, Seagate Technology Holdings PLC, NetApp, Inc., Intel Corporation, Thales e-Security, Inc., McAfee, LLC, Broadcom Inc., Maxim Integrated Products, Inc., Giesecke+Devrient, IDEMIA, NXP Semiconductors N.V., Infineon Technologies AG, Toshiba Corporation, Kanguru Solutions, WinMagic Inc., Futurex LP, Apricorn, Inc. |