Hardware in the Loop Market Size & Trends:

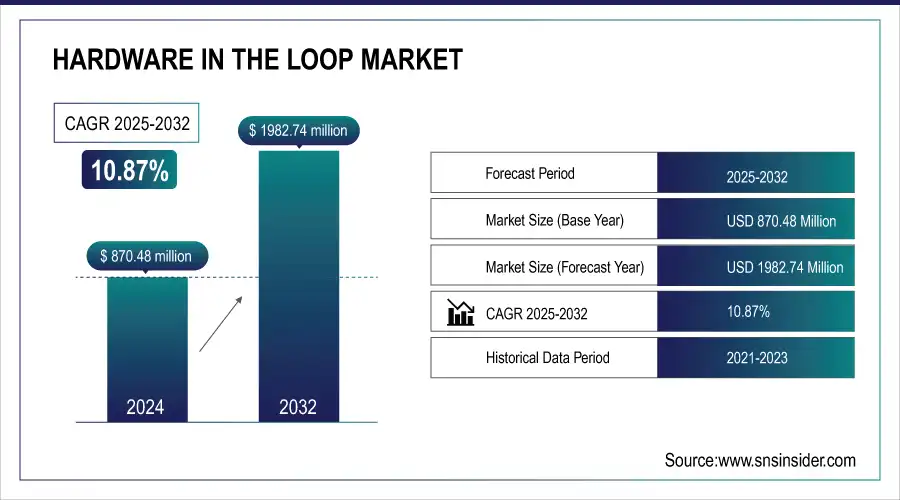

The Hardware in the Loop Market size was valued at USD 870.48 million in 2024 and is expected to reach USD 1982.74 million by 2032, growing at a CAGR of 10.87% over the forecast period 2025-2032.

To Get more information On Hardware in the Loop Market - Request Free Sample Report

The Hardware in the Loop market is primarily driven by the growing demand for advanced testing in the automotive and aerospace industries, the rising complexity of embedded systems, and the need for a cost-effective, real-time simulation solution. Rising usage of battery-electric vehicles and driverless technologies also stimulates market development in different enterprise verticals.

The Hardware in the Loop market is currently thriving because of its adoption in various renewable energy systems, robotics, and industrial automation. Continued regulatory pressure relating to product safety and compliance is leading to companies adopting more stringent validation approaches. Moreover, the recent introduction of digital twins and IoT technology is improving the edges of the testing environment, and is improving system models. The market is seeing investment in R&D infrastructure in emerging economies, leading to more avenues for HIL adoption across the education and industrial spectrum.

According to the International Federation of Robotics (IFR), global robot installations reached a record of over 500,000 units in 2023. HIL is used to test robot control algorithms before hardware deployment, especially in safety-critical applications like collaborative robots (cobots).

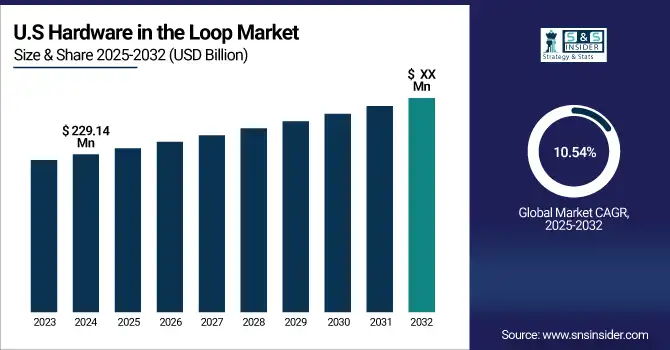

The U.S. Hardware in the Loop Market size is estimated to be USD 229.14 million in 2024 and is projected to grow at a CAGR of 10.54%. The U.S. hardware in the Loop market growth is driven by several factors such as demand for autonomous vehicles, strict safety regulations, and demand for high-end embedded system validation. Increasing application in defense modernization and smart grid development, and rapid IoT and AI integration in industrial automation, is further driving the growth.

Hardware in the Loop (HIL) Market Dynamics

Key Drivers:

-

Rising Demand for HIL Simulation Drives Innovation in Automotive, Aerospace, and Industrial Sectors

The increasing complexity of embedded systems in automotive, aerospace, and industrial sectors is fuelling the demand for the global Hardware in the Loop market. The booming trend of autonomous and electrified vehicles is making more and more real-time testing environments necessary to validate the control systems. Hardware in Safe Loop (HIL) simulation allows for low-cost yet high-accuracy validation of electronic control units (ECUs), thereby significantly minimizing risks and development cycles. It aligns with the strict compliance and regulatory scrutiny for safety-critical applications in aerospace and defense, where it also integrates capabilities to simulate mission scenarios and environmental conditions.

Fiat Chrysler Automobiles (FCA) developed a HIL testbed for functional analysis of multiple control units in hybrid electric vehicles. The system effectively verified functionalities shared among ECUs dedicated to internal combustion engines, transmissions, brakes, and electric motors.

Restrain:

-

High Costs and Integration Challenges Hinder Adoption of HIL Simulation for SMEs

The high initial cost for HIL setup, combined with the high expenses on specific hardware, software licenses, and skilled personnel, is acting as a major restraint for the Hardware in the Loop market. That could be a huge obstacle to small and medium enterprises (SMEs) or institutions with low R&D budgets. Furthermore, the integration of HIL systems into existing development workflows is not straightforward, as it often involves significant customization, resulting in delays in deployments and increased operating expenses.

Opportunity:

-

Digital Transformation and Emerging Technologies Drive Adoption of HIL Simulation Globally

Changing global digital transformation trends and the introduction of new technologies are acting as a catalyst for newer avenues for the adoption of HIL simulation. Digital twins and IoT platforms can enable even smarter, data-driven simulation environments. HIL is being extensively used to validate power electronics and control algorithms for sectors such as renewable energy, smart grid systems, and electric mobility. Also, significant expansion potential exists with an increase in research and development investments, particularly in emerging economies in the Asia-Pacific region, Latin America, and Eastern Europe.

-

Equinor's project utilized digital twins to monitor and predict turbine performance, leading to a reduction of 200,000 tons of CO₂ and 1,000 tons of NOx emissions annually by replacing gas turbines with wind energy

Challenges:

-

Technological Advancements and Protocol Incompatibility Challenge HIL System Adoption Across Industries

The fast-paced nature of technological innovation is another challenge, as HIL systems tend to become obsolete and cannot keep up with the latest requirements of embedded systems and real-time simulations. This poses a technical challenge to ensure compatibility with new protocols for communication, new standards, and new types of increasingly complex control algorithms. There is also a shortcoming in the uniformity of testing protocol across verticals, which leads to difficulties in adopting widespread patterns and benchmarking in industries such as aerospace, automotive, and energy as well.

Hardware in the Loop Market Segments Analysis

By Type

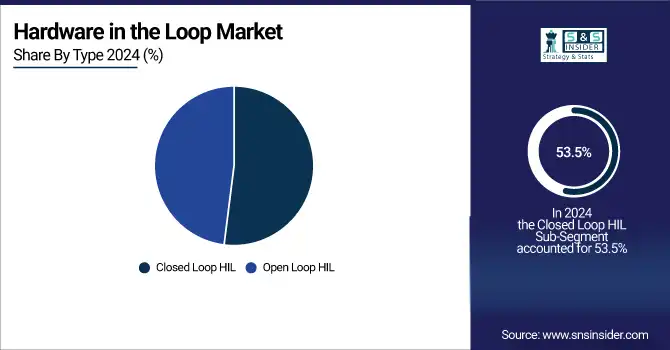

In 2024, the Closed Loop Hardware in the Loop segment dominated the global market, accounting for a 53.5% share. This is due to its extensive feedback mechanisms that offer the possibility of real-time feedback between the controller and all simulated systems, enabling a high level of accuracy and reliability when testing complex embedded systems, especially for automotive and aerospace systems.

The Open Loop HIL segment is expected to achieve the highest CAGR during the years 2025 to 2032. This trend is being propelled by the increasing need for more efficient yet economical testing solutions, especially during early-stage development. Open-loop HIL systems are flexible and easily implementable, making them a perfect fit for early software validation and academic use cases.

By Application

In 2024, the automotive sector was the largest end-use industry in the Hardware in the Loop market, with a share of 41.5% of the total revenue. The growing share is aided by factors such as electronic control unit (ECU) complexity, the proliferation of electric vehicles (EVs), and advancements in autonomous driving technology. HIL simulation is an essential tool in automotive R&D since it allows the efficient and risk-free testing of vehicle components, like ADAS, powertrains, and battery management systems.

The aerospace and defense sector is projected to post the highest CAGR from 2025 to 2032. Increasing demand for HIL simulation in the aerospace and defense market is determined by the growing requirement for safe, cost-effective, high-fidelity testing environments for critical systems (avionics, flight control, and mission systems). As aircraft systems continue to evolve into software-driven solutions, rapid adoption of real-time simulation without physical prototypes is becoming important for its use in aerospace & defense applications.

By Offering

The Hardware-to-loop (HIL) simulation market was dominated by the hardware segment in 2024, with an overall market share of 54.7%. Hardware has a major role in the physical modeling of real-time systems, including controllers, sensors of various types, and actuators. Hardware-in-the-loop (HIL) systems are popular with a strong accuracy and reliability, which are widely applied in automotive, aerospace, and industrial automation industries for real-time physical simulation tests of the embedded systems and components.

The fastest CAGR during the period 2025 to 2032 is projected for software. Software solutions are getting better & better, enabling the most flexible and scalable testing environments. They enable a complex simulation environment and easy changing without hardware modification. This rapid growth of the software segment can be attributed to the increasing demand for flexible, economical, and remote testing solutions for industries including automotive (for autonomous vehicle testing) and aerospace (for software-driven avionics systems).

Hardware in the Loop Market Regional Overview

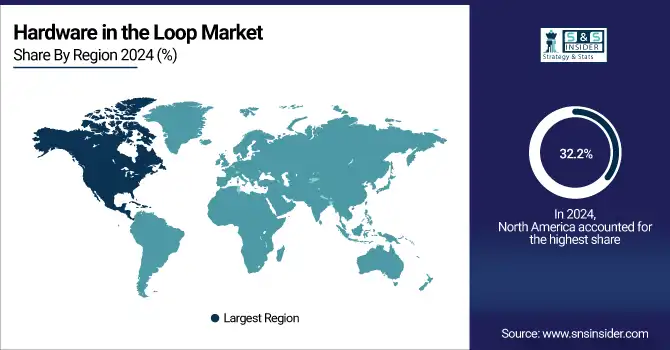

North America accounted for the largest number of the Hardware in the Loop market share with 32.2% of total revenue in 2024. This dominance is primarily due to the existence of major sectors like automotive, aerospace, and defense that depend on HIL simulation for product development and assessment. For example, HIL simulation is utilized for ADAS and electric vehicle components testing at General Motors and Ford. Furthermore, North America holds great potential for demand for hardware-in-the-loop as companies, including Lockheed Martin and Raytheon, use HIL for testing complicated avionics and defense systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

The US tops the HIL simulation market owing to a strong automotive, aerospace & defense industry and high R&D investments. Innovation, led by a backdrop of heavy technological infrastructure, continuously encourages greater adoption.

From 2025 to 2032, Asia Pacific is projected to observe the highest CAGR. Countries like China, Japan, and India have seen an increase in manufacturing practices, and the quick industrialization of the region is driving the demand for HIL simulations. Companies such as Toyota and Honda are realizing the potential of HIL simulation for autonomous vehicle development in Japan.

Hardware-in-Loop (HIL) Simulation Market, China to Lead the Asia Pacific HIL Simulation Market. The fast pace of industrialization and considerable investment in aerospace and automotive sectors, for example, in the use of HIL for testing avionics by the AVIC, is a factor that determines the growth of the market.

The Hardware in the Loop market in Europe is a crucial market in this global market because of Europe's strengths in the automotive and aerospace industries, as well as industrial automation. And countries such as Germany, the UK, and France are leading the way, with the likes of BMW, Airbus, and Rolls-Royce already using HIL simulation as an integral part of their product development processes. The rise in the demand for HIL is attributed to increasing electric mobility, sustainable manufacturing, as well as stringent safety regulations in the region.

The Hardware-in-the-Loop (HIL) Simulation Market in Europe was led by Germany. Dominated by a vibrant automotive industry, where automotive giants such as BMW, Audi, and Volkswagen used HIL for advanced vehicle testing, and especially in electric and autonomous systems.

The market in the Middle East & Africa (MEA) is estimated to grow at a slow pace due to limited investments in automotive testing, aerospace, and industrial automation in this region. The demand for real-time simulation and testing tools is also driven by the diversification strategies of countries such as the UAE and Saudi Arabia, which are looking to diversify their economies away from oil and focus on smart mobility, defense modernization, and advanced manufacturing.

Key Players in the Hardware in the Loop Market are:

Some of the major Hardware in the Loop companies are dSPACE, National Instruments, Vector Informatik, Siemens, Typhoon HIL, Speedgoat, Opal-RT, Eontronix, Robert Bosch Engineering, and ModelingTech Energy.

Recent News:

-

In July 2023, FEV and dSPACE partnered to globally deliver customized power HIL test benches, enhancing validation of power electronics in electric mobility. The collaboration combines FEV’s automation expertise with dSPACE’s HIL systems for turnkey testing solutions.

-

In August 2024, Siemens' Simcenter Prescan 2407 introduces a scalable, hardware-agnostic Hardware-in-the-Loop (HiL) framework, enhancing real-time sensor data transfer and enabling modular testing setups.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 870.48 Million |

| Market Size by 2032 | USD 1982.74 Million |

| CAGR | CAGR of 10.87% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Open Loop HIL, Closed Loop HIL) • By Application (Automotive, Aerospace & Defense, Electronics and Semiconductor, Industrial Equipment, Research and Education, Energy and Power, Others) • By Offering (Hardware, Software, Service) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | dSPACE, National Instruments, Vector Informatik, Siemens, Typhoon HIL, Speedgoat, Opal-RT, Eontronix, Robert Bosch Engineering, and ModelingTech Energy. |