Hazardous Area Equipment Market Size Analysis:

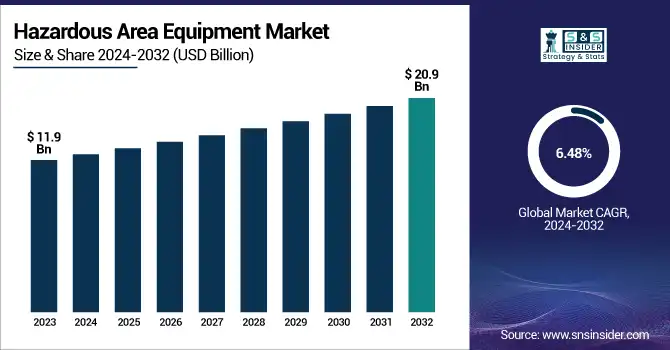

The Hazardous Area Equipment Market was valued at USD 11.9 billion in 2023 and is expected to reach USD 20.9 billion by 2032, growing at a CAGR of 6.48% from 2024-2032.

This report consists of an in-depth analysis of the Hazardous Area Equipment Market, covering industry deployment trends, technological advancements, manufacturing capacity, and supply chain dynamics. Various industries, including oil & gas, chemicals, and mining, are increasingly deploying hazardous area equipment to ensure safety in high-risk environments. Advancements in explosion-proof technologies, such as wireless communication and smart sensors, are enhancing operational efficiency. Manufacturing capacity utilization remains high due to the growing demand for ATEX and IECEx-certified equipment. Additionally, supply chain and distribution trends indicate a shift toward digital platforms and partnerships for streamlined global supply. The report also explores market growth drivers, regulatory impact, and emerging innovations.

To Get more information on Hazardous Area Equipment Market - Request Free Sample Report

The US Hazardous Area Equipment Market was valued at USD 1.6 billion in 2023 and is expected to reach USD 3.0 billion by 2032, growing at a CAGR of 7.32% from 2024-2032. driven by stringent workplace safety regulations, increasing adoption of explosion-proof devices in industries like oil & gas and chemicals, and advancements in IoT-enabled hazardous area equipment. The rise in industrial automation and demand for intrinsically safe equipment is further propelling market expansion. Looking ahead, the U.S. market is expected to witness steady growth, supported by continuous investments in infrastructure safety, technological innovations, and the integration of wireless communication in hazardous environments. The market is forecasted to expand at a significant CAGR, with increasing adoption across manufacturing, mining, and energy sectors ensuring long-term growth.

Hazardous Area Equipment Market Dynamics

Drivers

-

Stringent safety regulations by OSHA, ATEX, and IECEx are driving the demand for hazardous area equipment across industries.

Due to increasing enforcement of stringent safety regulations in various industries by governments and regulatory bodies like Occupational Safety and Health Administration, ATEX, IECEx, etc, the demand for hazardous area equipment will increase. Industrials like oil & gas, chemicals, mining, and pharmaceuticals need to follow explosion-proof and intrinsically safe equipment types to keep their workplaces stored and protected. An increasing number of incidents of industrial accidents and fire hazards has amplified compliance requirements. At the same time, innovations in hazardous area equipment, such as IoT connectivity and wireless communication, are driving improved safety and operational effectiveness. All of these factors together indicate a rising uptake of hazardous area equipment in various sectors in the global market.

Restraints

-

The high investment cost and complex installation process limit the adoption of hazardous area equipment, especially for SMEs.

One of the key challenges in the hazardous area equipment market is the high initial investment required for explosion-proof and intrinsically safe equipment. The complex installation process, requiring specialized expertise and adherence to regulatory standards, further adds to the overall costs. Small and medium-sized enterprises (SMEs) often face budget constraints in adopting advanced hazardous area equipment. Additionally, maintenance and periodic testing of these devices add to operational expenses. These cost-related factors can slow market adoption, especially in price-sensitive regions where companies may seek alternative safety solutions instead of investing in high-end hazardous area equipment.

Opportunities

-

IoT-enabled monitoring and wireless hazardous area equipment are creating new opportunities for enhanced safety and efficiency.

The increasing adoption of IoT and wireless communication in hazardous area equipment is creating new market opportunities. Smart sensors, real-time monitoring solutions, and AI-powered predictive maintenance are transforming workplace safety by providing advanced risk assessment and preventive measures. Wireless hazardous area equipment reduces the need for complex cabling, lowering installation costs and improving flexibility in industrial operations. Industries are increasingly investing in automation and real-time data analytics to enhance efficiency and minimize risks. As companies focus on digital transformation, the demand for intelligent hazardous area equipment is expected to grow, driving innovation and expansion in the market.

Challenges

-

Global supply chain disruptions and raw material shortages are impacting the availability and production of hazardous area equipment.

The hazardous area equipment market finds itself hampered by supply chain disruptions due to global trade barriers, scarcity of raw materials, and geopolitical tensions. Explosion-proof equipment is produced using certified components that meet strict regulations, and delays in component availability can slow manufacturing timelines. Market uncertainties extend to volatile raw material prices and transportation constraints. Hence, manufacturers are prioritising to de-risk their supply chains and invest in regional production bases. Nonetheless, supply chain volatility remains a key threat to market growth in the short run.

Hazardous Area Equipment Industry Segmentation Analysis

By Product

Cable glands and accessories dominated the market and accounted for 28% of the revenue share in 2023, as they play an important role in securing electrical connections made in a hazardous environment. These products are used extensively in industries ranging from oil & gas to chemicals to mining to prevent sparks and explosions from electrical failures. The growing standards for industrial safety and the increasing manufacturing and energy sectors will continue to uphold demand.

Control panel products are projected to be the fastest-growing, with the increasing adoption of automation and smart control systems in hazardous areas. Therefore, industries are using more explosion-proof control panels for better efficiency of the production process. Market growth is driven by the integration of IoT and real-time monitoring solutions into these panels.

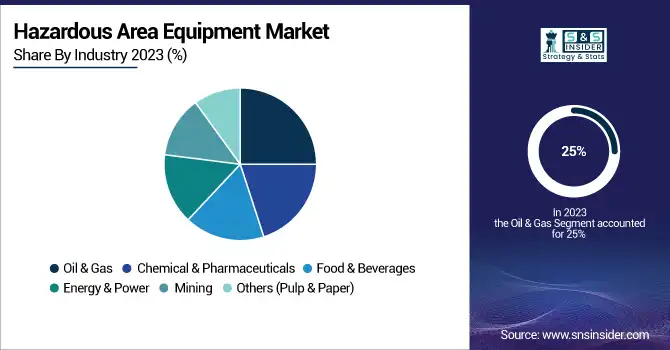

By Industry

Oil & gas dominated the market and accounted for 25% of revenue share in 2023, As the most hazardous and critical sector in terms of risk of explosion and fire. The demand for well-protected electrical and monitoring devices is due to stringent safety regulations such as ATEX and IECEx certifications. The continued growth of the industry, with new drilling projects and upgrades to refineries, increasingly drives the demand for hazardous area equipment.

The food & beverage industry is expected to register the fastest CAGR during the forecast period, with rising regulatory emphasis on explosion-proof equipment for processing facilities where vapors, dust, and combustible materials pose hazards. Demand for electrical components is rising due to the increase in automation in food production and beverage bottling plants. Moreover, the growth of dairy, grain processing, and brewing industries across the globe is also supporting the market growth.

Hazardous Area Equipment Market Regional Analysis

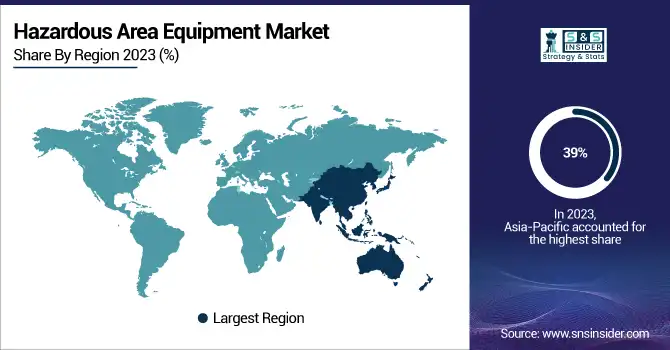

Asia-Pacific dominated the market and accounted for 39% of revenue share, where the industrial sector, especially oil & gas, chemicals, and mining, is expanding at a high rate. In countries such as China and India, substantial investments are also being allocated to refining, petrochemical, and power generation industries, creating a need for explosion-proof equipment. The market is also driven by government regulations to promote workplace safety and the increasing adoption of industrial automation.

North America is projected to witness the fastest CAGR on account of increasing spending in the development of current industrial infrastructure and stringent safety guidelines by OSHA & NFPA. Another significant growth driver is the rising adoption of IoT-enabled hazardous area equipment for real-time monitoring and predictive maintenance. Moreover, the growing offshore drilling activities, in addition to the expanding refineries in the U.S. and Canada, will demand it further.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Hazardous Area Equipment Market are:

-

Eaton – Crouse-Hinds Series Explosion-Proof Lighting

-

ABB – Flameproof Motors

-

Siemens – SIMATIC HMI Panels for Hazardous Areas

-

Rockwell Automation – Allen-Bradley Explosion-Protected Switches

-

Schneider Electric – Telemecanique Sensors for Hazardous Areas

-

Honeywell – Sensepoint XCD Gas Detector

-

Emerson Electric – Rosemount 628 Universal Gas Sensor

-

General Electric – EX-Proof LED Lighting Fixtures

-

R. Stahl – Explosion-Proof Control Stations

-

BARTEC – PIXA Explosion-Protected Smartphones

-

Pepperl+Fuchs – Purge and Pressurization Systems

-

Hubbell – Killark Explosion-Proof Enclosures

-

WEG – W22X Explosion-Proof Motors

-

Thuba – Flameproof Junction Boxes

-

Intertek – ATEX and IECEx Certification Services

Recent Developments

-

In November 2024, Honeywell International announced plans to sell its personal protective equipment (PPE) business to Protective Industrial Products for $1.33 billion in cash. This divestiture aligns with Honeywell's strategy to focus on core areas such as automation, aviation, and energy transition.

-

In December 2024, ABB Ltd unveiled a new range of low-voltage flameproof motors designed for industrial plants. These motors offer increased reliability and reduced maintenance requirements, catering to industries like oil & gas and food & beverages.

-

In January 2025, Siemens AG introduced an advanced communication system for hazardous areas, integrating real-time data analytics to enhance operational safety and efficiency.

-

In January 2025, Avon Technologies secured an $18 million contract from the U.S. military to supply combat helmets through its subsidiary, Team Wendy. This order is part of the U.S. Army’s next-generation head protection program.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 11.9 Billion |

|

Market Size by 2032 |

USD 20.9 Billion |

|

CAGR |

CAGR of 6.48% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Cable Glands and Accessories, Measurement Devices, Control Panel Products, Alarm Systems, Gas Detector, Fire Detector, Motors, Lighting Products) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Eaton, ABB, Siemens, Rockwell Automation, Schneider Electric, Honeywell, Emerson Electric, General Electric, R. Stahl, BARTEC, Pepperl+Fuchs, Hubbell, WEG, Thuba, Intertek. |