HbA1c Testing Devices Market Size & Overview:

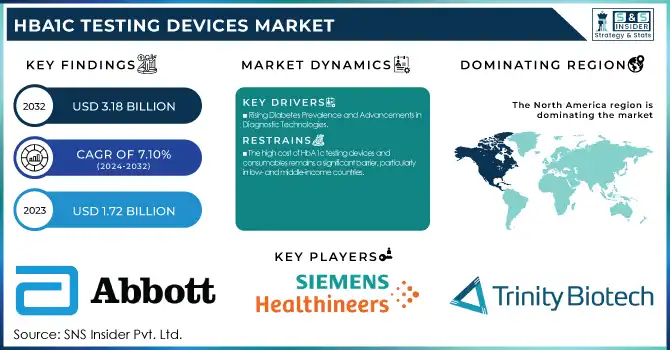

The HbA1c Testing Devices Market was valued at USD 1.72 billion in 2023 and is expected to reach USD 3.18 billion by 2032 with a growing CAGR of 7.10% during the forecast period of 2024-2032.

This report underscores the increasing prevalence and incidence of diabetes, fueling demand for HbA1c testing as a key measure for assessing long-term blood glucose control. The study discusses regulatory and reimbursement trends, looking at how government policy, insurance coverage, and healthcare funding influence market accessibility and adoption. Further, it discusses technological progress in HbA1c testing instruments, such as a transition towards point-of-care and continuous glucose monitoring for enhanced convenience to patients. The report further analyzes healthcare expenditures on diabetes control and HbA1c testing in various regions, accounting for the government, commercial, private, and out-of-pocket expenditures in dictating market expansion.

To get more information on HbA1c Testing Devices Market - Request Free Sample Report

HbA1c Testing Devices Market Dynamics

Drivers

-

Rising Diabetes Prevalence and Advancements in Diagnostic Technologies

The increasing number of people suffering from diabetes is one of the major drivers for the HbA1c testing devices market, with more than 537 million adults suffering from the disease in 2021, which is estimated to increase to 783 million by 2045 (IDF). The growing diabetes burden has increased the need for HbA1c testing as a vital means to track long-term glycemic control. Technological innovations, including point-of-care (POC) devices and continuous glucose monitoring (CGM) devices, have transformed diabetes care, enabling HbA1c testing to become more convenient and streamlined. Also, rising healthcare expenditure, favorable government initiatives, and increasing health consciousness regarding early detection and disease prevention are additionally fueling market growth. The combination of AI-based diagnostic equipment and point-of-care testing solutions is also increasing patient convenience, fueling adoption levels among healthcare organizations as well as homecare environments.

Restraints

-

The high cost of HbA1c testing devices and consumables remains a significant barrier, particularly in low- and middle-income countries.

The cost of an HbA1c test can be as low as USD 5 to as high as USD 30 and is thus prohibitive for many patients without insurance benefits. Additionally, strict regulatory approvals, like those required by the U.S. FDA and European CE marking, tend to prolong product releases and market entry for new devices. Adherence to different international standards raises manufacturers' costs and makes cheap testing solutions scarce. Also, laboratory-based HbA1c testing is done by trained personnel and sophisticated facilities, limiting access in rural and underserved areas.

Opportunities

-

Expansion of Point-of-Care Testing and Telehealth Integration

The growing trend toward point-of-care (POC) testing represents a significant opportunity for growth, as these systems provide quick results and increased availability outside of clinical laboratory settings. The growing interest in POC HbA1c testing is fueled by its convenience, allowing for quicker diagnosis and the ability to change treatment more promptly. The expansion of telehealth and digital health solutions is also changing diabetes care by allowing patients to be remotely monitored and consulted. Businesses are investing in smart HbA1c analyzers with cloud connectivity, enabling real-time data sharing with healthcare professionals, and enhancing disease monitoring and patient outcomes. Collaborations between diagnostic companies and government initiatives, including the World Health Organization's Global Diabetes Compact, are also increasing market penetration, enhancing diabetes management in underserved areas. Further, growth economies offer a latent opportunity with more healthcare investments being made and local production enhancing affordability and accessibility of HbA1c testing solutions.

Challenges

-

A key challenge in the HbA1c testing devices market is the lack of awareness among patients and healthcare providers, particularly in developing regions.

Most people are not aware of the significance of HbA1c testing in the management of diabetes, and thus these tests are underutilized. Moreover, differences in test performance between different devices are a concern for clinicians. Although the gold standard is high-performance liquid chromatography (HPLC), other tests like immunoassays and boronate affinity chromatography can provide variable results, affecting diagnosis and treatment. Standardization attempts are being made, yet consistent accuracy on all platforms of testing is still a challenge. Additionally, supply shortages and cost barriers in remote markets impede broad adoption even further.

HbA1c Testing Devices Market Segmentation Insights

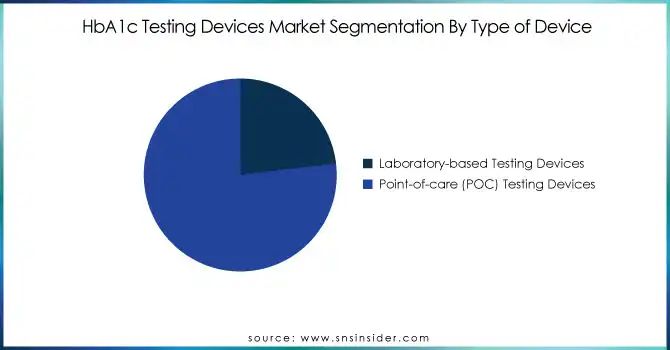

By Type of Device

In 2023, the point-of-care (POC) testing devices category led the HbA1c testing devices market with a high market share of 76.5%. The rising trend for rapid and more convenient test solutions has been a primary factor for the same, with POC devices facilitating real-time monitoring, instantaneous results, and increased patient compliance. The increasing incidence of diabetes, along with the demand for affordable and convenient testing options, has promoted the use of these devices in both home care and clinical environments. Further, advances in miniaturized and digital POC devices have improved accuracy and ease of use, promoting further demand. During the forecast period, the POC segment is likely to experience the fastest growth, backed by an increasing trend toward self-monitoring and decentralized healthcare. At the same time, laboratory-based testing devices are expected to expand at a profitable rate because they are more accurate and still in demand in hospitals and diagnostic labs. Although POC testing is becoming popular for its convenience, laboratory-based devices are still important for confirmatory and detailed diagnostics. The use of both types of testing ensures a holistic approach to diabetes management, addressing different patient needs in various healthcare settings.

By Technology

The immunoassays category dominated the technology segment in 2023, with a market share of 36.4%. Immunoassay-based HbA1c testing devices have emerged as the market leader because of their affordability, simplicity, and capability to give rapid and accurate results in both laboratory and point-of-care settings. The ubiquitous presence of immunoassay kits and automated analyzers has rendered this technology a first-choice option for everyday diabetes monitoring. Moreover, its adoption into current laboratory procedures and suitability with high-throughput diagnostic devices have further supported its market base. Nevertheless, high-performance liquid chromatography (HPLC) is projected to experience the most rapid expansion during the forecast period. HPLC is commonly accepted as the gold standard for HbA1c testing because it is highly precise, and accurate, and can detect hemoglobin variants that may compromise other testing approaches. With laboratories looking for more consistent and reliable testing options, demand for HPLC-based equipment is likely to increase significantly. Growing investment in sophisticated diagnostic technologies and clinical laboratory infrastructure development, especially in developing markets, will further drive the growth of the HPLC segment over the coming years.

By End-use

Hospitals & clinics led the end-use market in 2023 with a share of 41.4%, as they are still the main facilities for diabetes diagnosis, treatment, and management. The availability of experienced healthcare professionals, access to sophisticated diagnostic equipment, and the capability to perform thorough patient assessments are factors that make them market leaders. Furthermore, hospitals are usually the first point of contact for newly diagnosed diabetes patients, thus playing an important role in HbA1c testing and management of the disease over the long term. Government programs encouraging diabetes screening campaigns and hospital-based healthcare have also contributed further towards market growth in this segment. Even though hospitals dominate the market, the segment of homecare settings is expected to experience the highest rate of growth during the forecast period. The growing need for home monitoring solutions, in combination with the increased use of convenient, user-friendly portable HbA1c testing devices, is fueling this trend. Growing patient affinity for self-testing, increased consciousness regarding diabetes control, and development in digital health integration are simplifying and facilitating home-based testing. The growth of telehealth services and direct-to-consumer testing platforms is likely to further drive the adoption of HbA1c testing equipment in homecare environments, providing enhanced diabetes management and patient empowerment.

HbA1c Testing Devices Market Regional Analysis

North America led the market in 2023, driven by the widespread incidence of diabetes, well-developed healthcare establishments, and extensive usage of advanced diagnostic technologies. In addition, the concentration of major market players and favorable reimbursement policies enhance market growth within this region.

Europe followed closely, with strong demand for HbA1c testing driven by growing awareness of diabetes, government healthcare programs, and a growing population of elderly citizens. These nations include Germany, the UK, and France, which are significant contributors to a highly developed diagnostic ecosystem.

The Asia-Pacific region is anticipated to experience the highest growth, fueled by the prevalence of diabetes, growing healthcare expenditures, and the expanding use of point-of-care testing solutions. Urbanization, lifestyle modifications, and government programs aimed at enhancing diabetes screening are driving market demand, especially in Japan, China, and India. The increased presence of domestic manufacturers with cheaper testing solutions also improves accessibility.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their HbA1c Testing Devices

-

Bio-Rad Laboratories, Inc. – D-10 System, VARIANT II TURBO, VARIANTnxt

-

Abbott – Afinion 2 Analyzer, Architect c8000

-

F. Hoffmann-La Roche Ltd – Cobas b 101, Cobas Integra 800

-

Siemens Healthineers AG – DCA Vantage Analyzer, Atellica CH Analyzer

-

HUMAN – HumaNex A1c

-

Trinity Biotech – Premier Hb9210, PDQ Analyzer

-

Menarini Diagnostics s.r.l – HA-8180V, HA-8180T

-

SAKAE CO. LTD. – HbA1c Analyzer GA09

-

Ceragem Medisys Inc. – CM HbA1c Analyzer

-

SEKISUI MEDICAL CO., LTD. – SK HbA1c Analyzer

-

GC Medical Science Corp. – GCHbA1c Analyzer

-

Osang Healthcare Co., Ltd. – OHC HbA1c Analyzer

-

EKF Diagnostics Holdings – Quo-Lab HbA1c, Quo-Test HbA1c

-

Boditech Med Inc. – iChroma HbA1c

-

Eurolyser Diagnostica GmbH – CUBE-S HbA1c

-

Bayer AG – A1CNow+ System

Recent Developments

In April 2023, FIND partnered with Abbott, i-SENS Inc., and Siemens Healthineers to enhance access to affordable point-of-care HbA1c testing in low- and middle-income countries (LMICs). This initiative, following an open call in 2021, aims to align test kit prices with target affordability benchmarks, improving diabetes diagnosis and management in resource-limited settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.72 Billion |

| Market Size by 2032 | USD 3.18 Billion |

| CAGR | CAGR of 7.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Device [Laboratory-based Testing Devices, Point-of-care (POC) Testing Devices] • By Technology [Immunoassays, Chromatography, Enzymatic Assays, Boronate Affinity Chromatography, High-Performance Liquid Chromatography, Others] • By End-use [Hospitals & Clinics, Diagnostic Laboratories, Homecare Settings] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bio-Rad Laboratories, Inc., Abbott, F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, HUMAN, Trinity Biotech, Menarini Diagnostics s.r.l, SAKAE CO. LTD., Ceragem Medisys Inc., SEKISUI MEDICAL CO., LTD., GC Medical Science Corp., Osang Healthcare Co., Ltd., EKF Diagnostics Holdings, Boditech Med Inc., Eurolyser Diagnostica GmbH, and Bayer AG. |