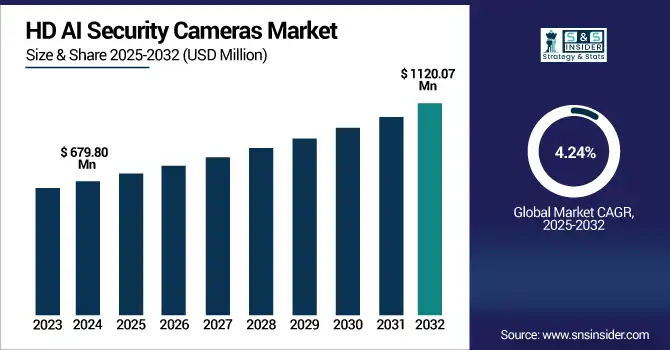

HD AI Security Cameras Market Size Analysis:

The HD AI Security Cameras Market size was valued at USD 679.80 Million in 2024 and is projected to reach USD 1120.07 Million by 2032, growing at a CAGR of 4.24% during 2025-2032. The demand for HD AI security camera is increasingly growing across residential, commercial, and marine markets boosting HD AI security camera market. Contributing series delivers high-definition video backed by a full suite of AI-powered applications, including motion detection, face detection, intrusion detection, and privacy masking, for all-encompassing, smart monitoring capabilities. Stronger low-light performance, image processing technologies for wide dynamic range and noise reduction, and onboard analytics reduce the load on cloud processing and improve real-time feedback.

To Get more information on HD AI Security Cameras Market - Request Free Sample Report

In addition to the growing security concerns and the demand for the systems to be accessible remotely from a mobile device or a web interface to monitor them and identify issues in day-to-day life, all this makes the justification for wide-spreading adoption. In addition, tough designs which serve hostile conditions like marine and industrial plants additionally contribute in the market growth as they have precise surveillance needs.

ACEL Power has launched the marine industry's first factory-integrated HD camera built into its electric outboards, offering real-time 1080p video, AI analytics, and low-light performance for enhanced visibility and safety. This compact, rugged camera features advanced imaging, motion detection, and remote access without extra hardware or setup.

The U.S HD AI Security Cameras Market size was valued at USD 172.53 Million in 2024 and is projected to reach USD 279.08 Million by 2032, growing at a CAGR of 6.26%during 2025-2032. Rising security concerns across residential, commercial and industrial sectors along with adoption of smart surveillance with real-time monitoring and advanced analytics capabilities will boost the growth of HD AI security cameras market.

HD AI Security Cameras Market trends include the integration of low-light and high-definition imaging for improved visibility, the use of edge computing to enable faster data processing on-device, and enhanced cloud connectivity for remote access and storage. Additionally, AI-driven features such as motion detection, facial recognition, and intrusion alerts are becoming standard, driving greater demand for HD AI security cameras.

HD AI Security Cameras Market Dynamics:

Drivers:

-

Increasing demand for intelligent AI-powered security solutions is driving rapid growth in the HD AI security camera market.

The increasing demand for smart security solutions, characterized by real-time threat detection and reduced false alarms, is the major factor driving the HD AI security camera market. Features Improved with AI Technology Understand AI feature details More Accurate Comprehensive AI Functionality Intelligent Scene Analysis Automatized Risk Assessment Customizable Monitoring Zones Wiser in Every Way Enhanced sensors and quality equipment work hand-in-hand with AI technology. Moreover, increasing adoption of cloud storage in conjunction with several other tracking modules including good quality imaging, and multitude of connectivity options, has become important factor for market growth. These developments enable adaptable, dependable, and scalable surveillance networks for residential and commercial applications, catering to the demand for effective security monitoring in diverse settings.

The Ulticam IQ security camera is an AI-powered smart camera using Gemini AI on Google Cloud that brings real-time scene analysis and risk assessment, an ultra high definition viewing experience with 4K Ultra HD recording, and free 7-day cloud recording. It has edge AI, dual storage, customizable zones, and weather-resistant durability to help you keep an eye on things in a smarter, more secure way whether they are easily connected to the smart cameras indoors or outdoors.

Restraints:

-

High Costs, Privacy Concerns, and Integration Challenges Restrain HD AI Security Camera Market Growth

Despite rapid growth, the HD AI security camera market faces several challenges that restrain its expansion. High costs associated with advanced AI-powered cameras and cloud storage services limit adoption, especially among small businesses and residential users. Privacy concerns and strict data protection regulations create barriers to deployment and use, as consumers and organizations worry about misuse of personal data. Additionally, integration complexities with existing security infrastructure and the need for reliable internet connectivity hinder seamless operation, particularly in remote or low-bandwidth areas. These factors collectively slow market growth by restricting widespread acceptance and implementation of HD AI security camera technologies.

Opportunities:

-

Rising Demand for Smarter Security Solutions Drives Growth in the HD AI Security Camera Market

The HD AI security camera market offers significant growth opportunities as consumers increasingly seek smarter and more efficient home security solutions. AI-based technologies such as facial recognition, motion detection, and real-time threat analysis improve the accuracy and effectiveness of surveillance systems and expand opportunities, which pushes the demand for the surveillance system. Furthermore, increasing adoption of smart home as well as growing demand for remote monitoring are other significant factors driving the growth of the market. Cloud storage, high-resolution imaging, and custom alert functions for comprehensive user experience are handling user-changed preferences. In addition, an increasing commercial and industrial application is generating new streams of revenues. With technology evolving, the opportunities for innovation in the AI-Powered Security Camera market are expected to accelerate, making this a lucrative segment within the overall security market.

Swann announced new AI-based video doorbells and security cameras that will welcome visitors and scare off intruders. The IoT products enables safe home with sophisticated AI features for real time monitoring and threat finding.

Challenges:

-

Cybersecurity Risks and Reliability Issues Slow Growth of the HD AI Security Camera Market

The HD AI security camera market faces challenges such as cybersecurity risks, including potential hacking and data breaches, which raise concerns about system safety. Additionally, limited AI accuracy in complex environments can lead to false positives or missed detections, reducing reliability. The need for continuous software updates and technical support increases operational complexity for users. Furthermore, power consumption and hardware durability issues in harsh conditions can affect performance and longevity. These challenges collectively hinder broader adoption and slow the overall growth of the HD AI security camera market.

HD AI Security Cameras Market Segmentation Analysis:

By Type

In 2024, the Dome Cameras segment accounted for approximately 32% of the HD AI Security Camera Market share, This strong presence is attributed to their compact design, wide-angle coverage, and suitability for both indoor and outdoor surveillance. Dome cameras are favored for their vandal-resistant features and discreet appearance, making them popular across commercial, residential, and public safety applications. Their growing adoption is driven by advancements in AI integration, enabling enhanced motion detection and facial recognition capabilities, which further boost market demand.

The PTZ (Pan-Tilt-Zoom) Cameras segment is expected to experience the fastest growth HD AI Security Camera Market over 2025-2032 with a CAGR of 7.47%, This growth is driven by their advanced maneuverability, allowing comprehensive area coverage and precise zoom capabilities, which enhance surveillance effectiveness across large commercial and industrial spaces.

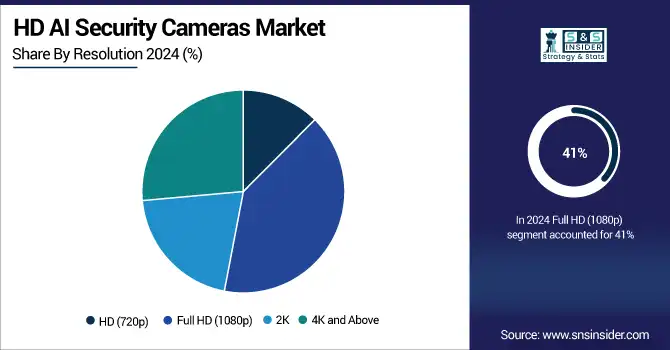

By Resolution

In 2024, the Full HD (1080p) segment accounted for approximately 41% of the HD AI Security Camera Market share, owing to its optimal balance between video quality, storage efficiency, and cost. Widely adopted across residential and commercial applications, 1080p cameras deliver clear imagery suitable for AI analytics without requiring high bandwidth or excessive storage.

The 4K and Above segment is expected to experience the fastest growth HD AI Security Camera Market over 2025-2032 with a CAGR, as it provides a perfect compromise between video quality, storage space requirements and price. 1080p cameras; This resolution is the most common and it provides clear imagery for AI analytics without high bandwidth or significant storage requirements, making it ideal for most residential and commercial uses.

By End-Use Industry

In 2024, the Commercial (Offices, Malls, Hotels) segment accounted for approximately 29% of the HD AI Security Camera Market share, This strong demand is fueled by the growing need for advanced surveillance in high-traffic areas to ensure safety, deter theft, and enhance operational efficiency. AI-driven features like facial recognition, behavior analysis, and real-time alerts make these cameras ideal for monitoring commercial premises with large public interaction and complex security needs.

The Transportation & Infrastructure segment is expected to experience the fastest growth HD AI Security Camera Market over 2025-2032 with a CAGR, owing to the growing investment in smart city projects, public safety, and intelligent traffic management. In view of the aggressive adoption of advanced AI features such as license plate recognition, crowd monitoring, and even real-time and at-source threat detection, airports, railways, and other roadways with sensitive or high-risk operations are using AI for security, operations, and response management.

By Distribution Channel

In 2024, the Online (e-Commerce platforms, Brand websites) segment accounted for approximately 37% of the HD AI Security Camera market share. This dominance is attributed to the growing preference for digital shopping, wide product availability, competitive pricing, and ease of comparison across brands. Consumers are increasingly purchasing security solutions online due to convenience, access to detailed specifications, user reviews, and direct-to-door delivery. Online platforms also offer frequent discounts and bundled deals, boosting overall sales volume.

The Offline (Retail stores, System integrators, Distributors)segment is expected to experience the fastest growth HD AI Security Camera Market over 2025-2032 with a CAGR, due the personalized customer experience, product demonstration, and expert installation services are easy to provide via physical channels. The offline purchase helps businesses and end-use with the need for customized security solutions prefer on-ground solutions for dependability, immediate assistance, and smooth support in post-sales especially for commercial and institutional deployments.

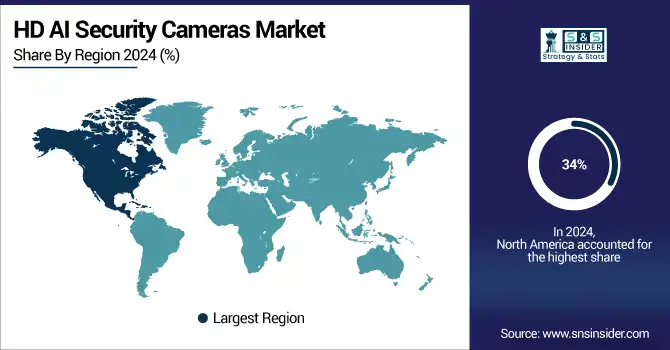

HD AI Security Cameras Market Regional Overview:

In 2024, North America dominated the HD AI Security Camera Market and accounted for 34% of revenue share, This strong presence is driven by high adoption of advanced surveillance technologies, increasing concerns over security threats, and widespread use across residential, commercial, and critical infrastructure sectors. Strong technology infrastructure, favorable regulatory frameworks, and demand for AI-based analytics continue to support market growth in the region.

Asia-Pacific is expected to witness the fastest growth in the HD AI Security Camera Market over 2025-2032, with a projected CAGR of 7.01% This is attributed to rising smart infrastructure investment, growing urban population and accelerating advanced surveillance demand across transportation, government, and commercial sectors. Furthermore, favorable government regulation and swift integration of AI-based technologies are driving market growth in this region.

In 2024, Europe maintained a well-sustained HD AI Security Camera Market , supported by stringent security regulations, rising concerns over public safety, and growing adoption of smart surveillance systems. Increased deployment in transportation, government facilities, and urban infrastructure projects, along with advancements in AI analytics and data privacy compliance, contributed to stable market demand across major European countries such as Germany, the U.K., and France.

LATAM and MEA are experiencing steady growth in the HD AI Security Camera Market, governments and companies are embracing AI-driven surveillance for security. The aforementioned growing development in this emerging regions are also supported by expanding internet connectivity and gradual digital transformation which in turn spur the need for smart and high resolution security solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

HD AI Security Cameras Companies are:

The Key Players in HD AI Security Camera Market are Hikvision, Dahua, Axis Communications, Bosch, Hanwha Vision, Avigilon, Honeywell, Panasonic i-PRO, Vivotek, CP Plus, Uniview, FLIR, Pelco, Mobotix, GeoVision, Eagle Eye Networks, Arlo, Reolink, Lorex, EZVIZ. and Others.

Recent Developments:

-

In Dec 2024, Panasonic unveiled AI-powered surveillance solutions at IFSEC India 2024, including a High Zoom Bullet Camera and X-series Camera with on-site learning analytics. Designed for India’s security needs, the solutions offer advanced object detection, facial recognition, and long-range performance.

-

In March 2025, Hikvision has launched the Power X DVR, integrating AcuSense AI for smarter, faster, and more accurate video surveillance with enhanced search and perimeter protection features. The DVR is designed for diverse applications including industrial parks, warehouses, and retail stores.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 679.80 Million |

| Market Size by 2032 | USD 1120.07 Million |

| CAGR | CAGR of 6.50% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Dome Cameras, Bullet Cameras, PTZ (Pan-Tilt-Zoom) Cameras, Box Cameras and Others (Fisheye, Turret)) • By Resolution (HD (720p), Full HD (1080p), 2K and 4K and Above) • By End-Use Industry (Residential, Commercial (Offices, Malls, Hotels), Industrial (Warehouses, Factories), Government & Public Safety (Traffic, Airports, Police) and Transportation & Infrastructure) • By Distribution Channel (Online (e-Commerce platforms, Brand websites) and Offline (Retail stores, System integrators, Distributors)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Hikvision, Dahua, Axis Communications, Bosch, Hanwha Vision, Avigilon, Honeywell, Panasonic i-PRO, Vivotek, CP Plus, Uniview, FLIR, Pelco, Mobotix, GeoVision, Eagle Eye Networks, Arlo, Reolink, Lorex, and EZVIZ. |