Head and Neck Cancer Therapeutics Market Overview:

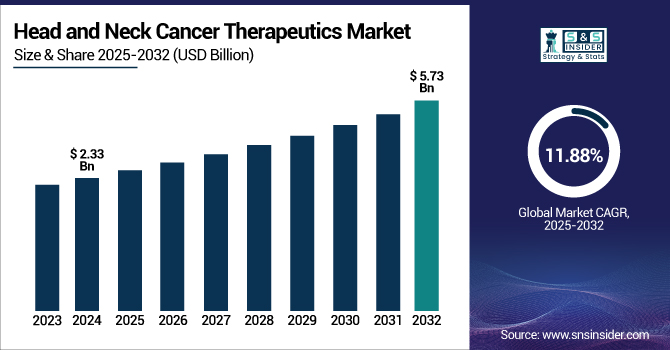

The Head and Neck Cancer Therapeutics Market size was valued at USD 2.33 billion in 2024 and is expected to reach USD 5.73 billion by 2032, growing at a CAGR of 11.88% over the forecast period of 2025-2032.

To Get more information on Head and Neck Cancer Therapeutics Market - Request Free Sample Report

The head and neck cancer therapeutics market is facing tremendous progress fueled by rising incidence, changing treatment protocols, and major investments in R&D. Early detection remains a crucial factor in the enhancement of patients with head and neck cancer. Patients diagnosed early have much-improved survival rates compared to patients with advanced disease. The 5-year survival rate is roughly 86.6% in localized disease, 69.1% in locally advanced disease, and sharply declines to 39.3% in metastatic disease, as reported in a Journal of Clinical Medicine study.

For instance, head and neck cancer in its early stages, like squamous cell carcinoma, may have 5-year survival rates between 70% and 90%, while survival is reduced significantly in the late stages of diagnosis. Such data highlight the immediate need for prompt diagnosis and treatment.

The therapeutic context in the head and neck oncology market is changing swiftly with the onset of targeted therapy for head and neck cancer and immunotherapy. Of specific interest, chemoradiotherapy has been useful in making the tumor operable from unresectable, as research has noted a 47% success rate in doing the same. PD-1/PD-L1 inhibitors, i.e., drugs like pembrolizumab, are replacing the previous standards, as do targeted therapies such as cetuximab. Its healthy pipeline of fresh therapies mirrors the potential of the market, which has more than 1,000 active global clinical trials in place. Regulatory clearances and this investment are opening up opportunities for new treatment strategies. However, the direct medical costs and out-of-pocket expenditures in certain regions limit access to expensive therapies.

In May 2024, Calliditas Therapeutics disclosed positive topline results from its Phase 2 trial of setanaxib, a NOX inhibitor, in combination with pembrolizumab in head and neck squamous cell carcinoma.

In January 2025, Eli Lilly announced that it would acquire Scorpion Therapeutics' mutant-selective PI3Kα inhibitor program for up to USD 2.5 billion. The deal will enable Lilly to expand its pipeline in oncology, particularly targeted cancer therapies.

Head and Neck Cancer Therapeutics Market Dynamics

Drivers

-

Increased Demand, Innovation, and Favorable Regulatory Environment Drive Market Growth

The head and neck cancer therapeutics market growth is led mainly by the growing incidence of HPV-related oropharyngeal cancers and the increased consumption of tobacco and alcohol worldwide. New developments in immunotherapy for head and neck cancer and targeted therapies, including PD-1 inhibitors such as nivolumab and pembrolizumab, have revolutionized the treatment.

For instance, pembrolizumab was granted faster FDA approval for recurrent/metastatic HNSCC due to its proven survival benefits. Growing R&D spending, over USD 1.5 billion worldwide in 2023 for biotech players with a focus on oncology, is driving the market.

Head and neck cancer treatment trends towards mRNA vaccine technology and precision oncology platforms have attracted heavyweights like Merck and AstraZeneca. Regulatory backing from organizations such as the FDA and EMA via orphan drug designations and fast-track approvals is also fueling the strong market. Additionally, the continued ADC development, including tisotumab vedotin, is a burgeoning pipeline with significant commercial interest. Increased awareness campaigns and improved diagnostic technology are driving early detection rates, impacting treatment initiation and therapeutic adoption directly.

Restraints

-

High Costs, Access Gaps, and Clinical Barriers Constrain Market Growth

The market is impeded by several factors that limit its full potential. High costs of treatment are still a major hurdle, with treatment per patient costing more than USD 90,000 for immunotherapies, making access in low- and middle-income groups difficult. Stringent reimbursement strategies for new drugs, especially in uninsured areas, also adversely affect the head and neck cancer therapeutics market. Moreover, treatment-associated toxicity and impaired quality of life during chemoradiation discourage patient compliance and long-term prognosis.

According to a study in 2023 by the American Society of Clinical Oncology, more than 37% of HNSCC patients reported cost-related financial toxicity, which compromised both the continuation of therapy and psychological well-being.

Further, the broken clinical trial landscape, where fewer than 30% of registered worldwide trials in 2023 achieved recruitment, holds up new drug approvals and delays market entry. Disruptions to supply chains and low penetration of biosimilars further inhibit the availability of affordable alternatives, inhibiting the market. The complexity of approval processes for combination therapies and next-generation modalities, including CAR-T or ADCs, also prolongs approval periods. These limitations highlight the need for policy reforms, payor interactions, and fair-priced models to fuel long-term head and neck cancer therapeutics market trends.

Head and Neck Cancer Therapeutics Market Segmentation Analysis

By Type

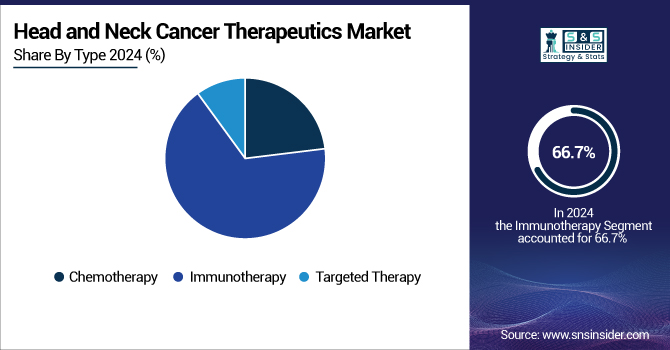

In 2024, immunotherapy was the leading treatment category, with 66.7% of the global head and neck cancer therapeutics market share. Its universal application is, in large part, a result of the therapeutic success of checkpoint inhibitors like pembrolizumab and nivolumab, which have shown a better survival advantage compared to conventional chemotherapy in recurrent or metastatic head and neck cancers.

Immunotherapy has revolutionized the therapeutic landscape, helping the market greatly and boosting its global growth. Additionally, this segment will also be the fastest-growing segment, led by continuing clinical trials and emerging next-generation immunotherapeutic combinations such as vaccines and T-cell therapies, which are anticipated to help boost the head and neck cancer therapeutics market analysis further over the coming years.

By Route of Administration

From the route of administration, injectables dominated the market in 2024, driven by intravenous administration of key immunotherapies and targeted therapies. Injectable medications accounted for the largest share of the head and neck cancer therapeutics market share due to their quick systemic absorption and better bioavailability in aggressive disease treatment.

On the other hand, the oral segment is expected to grow at the fastest rate due to growing patient preference for home-based treatment options, growing availability of oral kinase inhibitors, and attempts to enhance quality of life during long-term treatment. The growing development of oral targeted therapy is also expected to increase the market and provide diversified administration alternatives for patients and physicians.

By Distribution Channel

In distribution channels, retail and specialty pharmacies were the market leaders, with 60.6% of the market share in 2024, taking advantage of increasing outpatient prescriptions and convenient access to high-cost biologics through specialty programs. These pharmacies are being increasingly integrated into oncology models of care, contributing significantly to growing the market and ensuring better patient compliance.

Further, retail & specialty pharmacies are also expected to be the growth-leading segment, based on solid payer partnerships, increased logistics for cold-chain dispensing, and growing needs for tailored dispensing services. The growth tendency aligns with the general market expansion, given stakeholders' interests in convenience, ease of access, and reduced intermediary therapeutic dispensing pathways.

Head and Neck Cancer Therapeutics Market Regional Insight

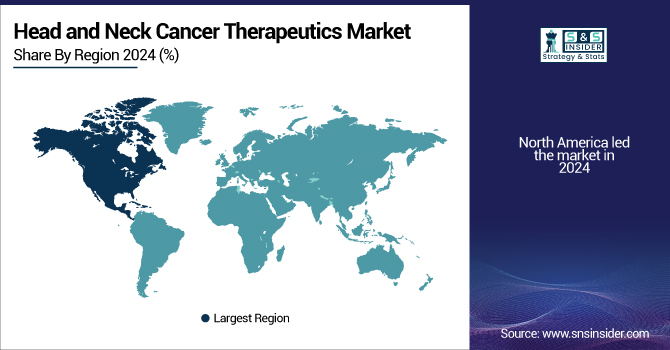

North America led the market during 2024, driven by robust clinical trial ecosystems, advanced oncology treatment, and high therapeutic uptake. The U.S. head and neck cancer therapeutics market was valued at USD 0.83 billion in 2024 and is expected to reach USD 1.91 billion by 2032, growing at a CAGR of 11.06% over the forecast period of 2025-2032.

In the U.S., it is estimated that by 2024, there will be about 71,110 new head and neck cancer cases, representing close to 4% of all cancer diagnoses, with an estimated 16,110 cancer-related deaths, based on the National Foundation for Cancer Research (NFCR).

The FDA approvals in the United States, including Keytruda (pembrolizumab) for recurrent/metastatic head and neck squamous cell carcinoma (HNSCC), have significantly contributed to the head and neck cancer drugs market size. Also, NIH-sponsored trials, like the NCT03993353 trial assessing nivolumab and other therapies, have widened therapeutic options. The U.S. further spends more on oncology R&D, at over USD 90 billion in 2023, led by industry giants like Bristol-Myers Squibb and Merck.

In Canada, the CADTH reimbursement recommendation for cetuximab facilitated access to targeted therapy, whereas Mexico is expanding biosimilar use and engaging in international networks of trials.

Europe is the second-largest area of the global market, with far-reaching national health programs and a growing emphasis on early diagnosis. Germany is in the lead due to high diagnosis levels and uptake of immunotherapy; for example, Bavarian Nordic's therapeutic vaccines clinical trials in HPV-related cancer favor innovation. In Europe, hospitals such as Gustave Roussy have been at the forefront of PD-1 inhibitor research for HNSCC, while NICE in the UK approved pembrolizumab in recurrent/metastatic disease, making it more accessible for treatment. The European Medicines Agency (EMA) also sped up approvals for head and neck cancer treatments such as cemiplimab, contributing to market momentum. Pan-European clinical projects, including HEADSpAcE, still fuel the head and neck cancer therapeutics market growth and maintain regional leadership in clinical innovation and joint R&D.

Asia Pacific is the fastest-growing market, underpinned by high patient volumes and increasing healthcare spending. In China, regulatory approval and local production of PD-1 inhibitors like tislelizumab (BeiGene) and toripalimab (Junshi Biosciences) have improved the availability and affordability of immunotherapies. With the Healthy China 2030 policy, the government has focused on cancer control, and therefore, treatment adoption has witnessed strong growth. India, with a rising head and neck cancer burden attributed to tobacco consumption, has witnessed progress through initiatives such as the National Cancer Grid and the domestic production of biosimilars and oral tyrosine kinase inhibitors. Japan's National Cancer Center has facilitated precision medicine trials, such as the application of nivolumab in platinum-refractory HNSCC, which has demonstrated better survival rates.

The LAMEA region is experiencing consistent but enhanced traction in the market size, primarily owing to increased awareness and strategic alliances. In Brazil, government healthcare programs and ANVISA approvals of treatments such as cetuximab have enhanced coverage of treatments. Brazil also takes part in global trials such as the KEYNOTE trials, which add to clinical visibility. Saudi Arabia has opened precision oncology centers and is incorporating checkpoint inhibitors such as nivolumab into national guidelines. The UAE Ministry of Health has invested in cancer research centers and accelerated access to oncology drugs under the Vision 2031 health transformation strategy. South Africa, meanwhile, continues to combat HPV-related cancers through expanded vaccination and early screening, although restricted access to biologics remains a challenge.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Head and Neck Cancer Therapeutics Market

Head and Neck Cancer Therapeutics Companies are Eli Lilly and Company, Sanofi S.A., Merck & Co., Inc., Cumberland Pharmaceuticals, Inc., Bristol-Myers Squibb, AstraZeneca plc, Takeda Pharmaceutical Co., Ltd., Teva Pharmaceutical Industries Ltd., Pfizer Inc., and F. Hoffmann-La Roche AG.

Recent Developments

-

In January 2025, GORTEC announced positive results from its new clinical trial evaluating an innovative treatment approach for head and neck cancer. The study demonstrated significant improvements in patient outcomes, highlighting the potential of novel therapeutic combinations in enhancing treatment efficacy and survival rates.

-

In May 2024, Petosemtamab, developed by Kura Oncology, received FDA Breakthrough Therapy Designation for the treatment of pretreated head and neck squamous cell carcinoma (HNSCC). This designation highlights the drug's potential to offer significant improvements over existing therapies for patients with advanced-stage HNSCC who have not responded to prior treatments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.33 Billion |

| Market Size by 2032 | USD 5.73 Billion |

| CAGR | CAGR of 11.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Chemotherapy, Immunotherapy, Targeted Therapy] • By Route of Administration [Injectable, Oral] • By Distribution Channel [Retail and Specialty Pharmacies, Hospital Pharmacies, Online Pharmacies] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Eli Lilly and Company, Sanofi S.A., Merck & Co., Inc., Cumberland Pharmaceuticals, Inc., Bristol-Myers Squibb, AstraZeneca plc, Takeda Pharmaceutical Co., Ltd., Teva Pharmaceutical Industries Ltd., Pfizer Inc., and F. Hoffmann-La Roche AG. |