eClinical Solutions Market Size & Overview:

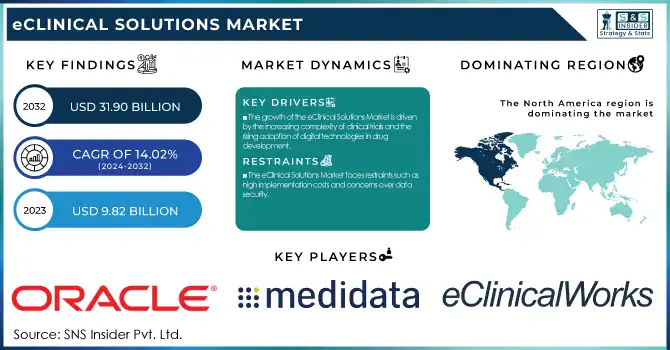

The Global eClinical Solutions Market was valued at USD 9.82 Billion in 2023 and is projected to reach USD 31.90 Billion by 2032, growing at a 14.02% CAGR over the forecast period 2024-2032.

Get more information on eClinical Solutions Market - Request Free Sample Report

This report emphasizes the growth in the adoption of eClinical solutions in regions due to the requirement for efficient clinical trial management and regulatory compliance. The research analyzes the growing number of clinical trials leveraging eClinical technologies, with an emphasis on regional differences and how digital transformation in clinical research is influencing this. The report also discusses the growth in investment and funding, with stakeholders acknowledging the efficiency and cost-effectiveness of such solutions. The study also explores pharmaceutical and healthcare expenditures on eClinical solutions, capturing the increasing focus on data-driven decision-making, remote monitoring, and AI-powered analytics in clinical trials.

eClinical Solutions Market Dynamics

Drivers

-

The growth of the eClinical Solutions Market is driven by the increasing complexity of clinical trials and the rising adoption of digital technologies in drug development.

The growth of decentralized and hybrid clinical trials has driven the demand for electronic data capture (EDC), remote patient monitoring, and eCOA solutions. Regulatory agencies like the FDA and EMA are actively encouraging the use of electronic systems to improve data integrity and trial efficiency. Moreover, the rise in R&D expenditure by biotech and pharma companies, which amounted to more than USD 230 billion across the world in 2023, has pushed the demand for strong clinical trial management solutions further. The inclusion of AI and machine learning into eClinical platforms is also enhancing patient recruitment, trial monitoring, and risk-based monitoring strategies. In addition, collaborations between CROs and eClinical solution providers, like the one between Medidata and Labcorp, have improved operational efficiencies in clinical research. The increasing amount of clinical trial data has also created a need for advanced analytics platforms, further driving the market.

Restraints

-

The eClinical Solutions Market faces restraints such as high implementation costs and concerns over data security.

The upfront cost involved in implementing advanced eClinical solutions, such as EDC and CTMS, can be high, constraining adoption among small and mid-tier pharmaceutical companies and academic research institutions. Regulatory compliance issues across regions also make adoption of uniform eClinical platforms complex. Cybersecurity threats are another major obstacle, with healthcare data breaches increasing more than 50% in 2023, raising fears regarding patient confidentiality and data integrity. A significant constraint is also resistance to change among established clinical research organizations where paper-based environments continue to operate due to familiarity and perceived stability. Inadequate interoperability between various eClinical platforms and legacy systems further impedes integrated data handling. Furthermore, the lack of highly qualified professionals skilled enough to operate complex eClinical software solutions creates an operational burden for most research organizations.

Opportunities

-

The eClinical Solutions Market presents significant opportunities with the increasing shift towards artificial intelligence (AI) and big data analytics in clinical research.

AI-powered eClinical systems are enhancing patient recruitment effectiveness through the analysis of large datasets to determine suitable candidates, lowering dropout rates in trials. Moreover, the increasing use of blockchain technology in clinical trials provides better data security, transparency, and tamper-proof documentation, which caters to the needs of regulatory bodies. Expansion of eClinical solutions in developing markets is also a significant opportunity, as clinical trial activity is increasing in such markets due to reduced operational costs and heterogeneous patient populations. Increased adoption of wearable devices and remote monitoring instruments in clinical trials also offers a profitable avenue for eClinical solution providers, enabling real-time data capture and enhanced patient compliance. In addition, regulatory bodies are promoting digitalization, with the FDA's Real-World Evidence (RWE) Program urging increased application of digital solutions in clinical research. The growth in cloud-based eClinical solutions, which had more than 90% of deployments in 2023, also offers scalability and affordable alternatives for research organizations. Strategic partnerships between technology companies and CROs, including the Veeva Systems tie-up with several pharmaceutical majors, are likely to unlock more opportunities in this segment.

Challenges

-

The eClinical Solutions Market faces challenges in achieving widespread interoperability and standardization across clinical research organizations.

Most eClinical platforms use various architectures, which does not allow integration of the data seamlessly, creating inefficiencies in trial management. Regulatory compliance is also not the same in all regions, and companies need to keep updating their platforms to comply with emerging requirements, which raises operating expenses. Another major challenge is excessive dependence on internet connectivity for cloud-based solutions, especially in geographically remote regions where clinical trials are now being implemented. Legacy system data migration to contemporary eClinical solutions is also a complicated task, tending to result in data loss or inconsistencies if not properly handled. Additionally, patient participation in digital trials is still a challenge since not all patients are willing to use technology-based solutions like ePRO and eConsent, resulting in potential data gaps. The absence of harmonized AI regulations for clinical trials also raises uncertainty about how much decision-making by AI can be adopted. Moreover, pushback from clinical trial professionals who are not accustomed to AI and big data analytics hinders uptake. The market further grapples with escalating cybersecurity risks, with cyberattacks in the healthcare sector increasing by 40% in 2023, which calls for more robust data protection practices for eClinical platforms.

eClinical Solutions Market Segmentation Insights

By Product

The Clinical Trial Management Systems (CTMS) segment led the eClinical Solutions Market in 2023 with a 22.2% share of the total revenue. The leadership of CTMS is due to its pivotal position in managing clinical trial operations, enhancing study efficiency, and maintaining regulatory compliance. The increasing volume of complex multi-site trials and the need for real-time tracking of trials have also fueled the use of CTMS solutions.

The Electronic Clinical Outcome Assessment (eCOA) market is expected to be the fastest-growing during the forecast period. The reasons behind this are rising interest in patient-centric trials, demand for real-world evidence, and favorable regulations towards digital health technologies. Decentralized and hybrid trials have also created an additional momentum in demand for eCOA solutions, as these solutions drive greater patient engagement and data accuracy.

By Delivery Mode

The Web and Cloud-based business segment led the market with a strong 93.3% revenue share in 2023. The sheer popularity of cloud-based solutions lies in their flexibility, affordability, and capacity for remote clinical trials. Furthermore, the need for smooth data consolidation and real-time access to trial data has accelerated the adoption of web-based eClinical platforms.

The On-Premise segment, though having a smaller market share, is anticipated to be the highest-growing segment over the forecast period. This is primarily because of data security and compliance issues in highly regulated industries, which make some organizations prefer on-premise solutions for more control over clinical trial data.

By Development Phases

The Phase III segment occupied the maximum share of 51.3% in 2023, due to the complexity and high costs involved in conducting late-stage clinical trials. Phase III trials include large patient groups and extensive data collection, and hence eClinical solution adoption becomes critical for achieving maximum trial efficiency and for regulatory submission purposes. The growth in drug approvals and biopharmaceutical R&D spend have also enhanced the demand for eClinical solutions in the Phase III segment.

The Phase I segment is anticipated to be the fastest-growing during the forecast period. This is spurred by the growth in early-stage clinical trials, the adoption of adaptive trial designs, and the growing focus on AI-based patient recruitment strategies. The need for data-driven decision-making in early-phase trials is driving the adoption of eClinical solutions in this segment.

By End-use

The Contract Research Organizations (CROs) segment was the market leader, with 37.5% of the overall revenue in 2023. The trend of outsourcing clinical trials to CROs has been a key driver of this leadership. CROs are utilizing eClinical solutions to increase trial efficiency, improve regulatory compliance, and shorten drug development timelines for pharmaceutical and biotechnology firms. The complexity of clinical trials is also driving demand for technology-enabled CRO services.

The Pharma and Biotech Organizations segment is projected to experience major growth over the coming years. The escalation in R&D expenditures, biopharmaceutical pipelines expansion, and implementation of digital technologies to be used for clinical development are significant drivers propelling the segment growth. Further, the need to implement decentralized clinical trials and analytics through artificial intelligence is expanding pharmaceutical and biotech companies' requirements for cutting-edge eClinical solutions.

eClinical Solutions Market Regional Analysis

North America held the largest share in the eClinical Solutions Market in 2023, holding 48.5% of the overall revenue share. Its leadership is propelled by the predominant presence of pharma and biotech firms, widespread use of cutting-edge clinical trial technologies, and favorable regulatory environments. The U.S., in turn, is a leading contributor with high R&D spending, rising numbers of clinical trials, and rising demands for decentralized trial solutions. Also, the availability of key players and regular strategic partnerships among technology providers, CROs, and pharmaceutical firms further enhance North America's leadership. The heavy adoption of cloud-based eClinical solutions, combined with government efforts to develop clinical research infrastructure, has continued to drive market growth in the region.

Asia-Pacific is expected to be the most rapidly growing region during the forecast period. The growing number of clinical trials, greater investments from international pharmaceutical organizations, and cost benefits in trial conduct in countries such as China, India, and Japan are major drivers of growth. Further, the region is also experiencing quick digitalization of healthcare, as well as regulatory reforms that favor the implementation of eClinical solutions. The growing emphasis on precision medicine and analytics driven by artificial intelligence is also fueling market growth in Asia-Pacific, making it a leading growth center for the eClinical solutions market.

Need any customization research on eClinical Solutions Market - Enquiry Now

Key eClinical Solutions Companies

-

Fountayn (formerly Datatrak International, Inc.) – Unified eClinical Platform

-

Oracle – Oracle Health Sciences Clinical One

-

Calyx (formerly part of Parexel International Corporation) – Calyx CTMS, Calyx EDC, Calyx IRT

-

Medidata (Dassault Systèmes) – Medidata Rave EDC, Medidata Rave CTMS, Medidata eCOA, Medidata RTSM

-

CRF Health (Signant Health) – Signant SmartSignals eCOA, Signant SmartSignals EDC

-

Clario (ERT and Bioclinica) – Clario eCOA, Clario EDC, Clario CTMS, Clario RTSM

-

eClinicalWorks – eClinicalWorks EHR & PM Solutions (includes clinical trial management features)

-

Merative (IBM Watson Health) – Merative Clinical Development

-

Anju Software – Anju eClinical Suite, Anju CTMS, Anju EDC

-

eClinical Solutions – elluminate Clinical Data Cloud

-

MaxisIT – MaxisIT Integrated Clinical Trial Data Platform

-

IQVIA – IQVIA Orchestrated Clinical Trials Suite, IQVIA EDC, IQVIA CTMS

-

Castor – Castor EDC, Castor eConsent, Castor ePRO

-

Veeva Systems – Veeva Vault EDC, Veeva Vault CTMS, Veeva Vault eTMF

Recent Developments

In Feb 2025, eClinical Solutions LLC strengthened its market position in 2024, adding 20 new clients, including three CROs, and serving 16 of the top 50 pharmaceutical companies. To enhance clinical trial efficiency, the company introduced AI-driven innovations, including a GenAI-powered chatbot and Clean Progress Tracking, aimed at reducing cycle times and improving operational performance.

In Dec 2024, eClinical Solutions partnered with Snowflake to integrate its elluminate Clinical Data Cloud with the Snowflake AI Data Cloud, enabling life sciences organizations to optimize clinical data management. This collaboration enhances AI-driven analytics and streamlines data architecture for improved healthcare outcomes.

| Report Attributes | Details |

| Market Size in 2023 | USD 9.82 billion |

| Market Size by 2032 | USD 31.90 billion |

| CAGR | CAGR of 14.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Electronic Data Capture (EDC) and Clinical Data Management Systems (CDMS), Clinical Trial Management Systems (CTMS), Clinical Analytics Platforms, Randomization and Trial Supply Management (RTSM), Clinical Data Integration Platforms, Electronic Clinical Outcome Assessment (eCOA), Safety Solutions, Electronic Trial Master File (eTMF), Electronic Consent (eConsent)] • By Delivery Mode [Web and Cloud based, On- Premise] • By Development Phases [Phase I, Phase II, Phase III, Phase IV] • By End-use [Hospitals/Healthcare providers, CROs, Academic Institutes, Pharma & Biotech Organizations, Medical Device Manufacturers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fountayn, Oracle, Calyx, Medidata, CRF Health, Clario, eClinicalWorks, Merative, Anju Software, eClinical Solutions, MaxisIT, IQVIA, Castor, Veeva Systems. |