Healthcare Multi-Cloud Management Market Size Analysis:

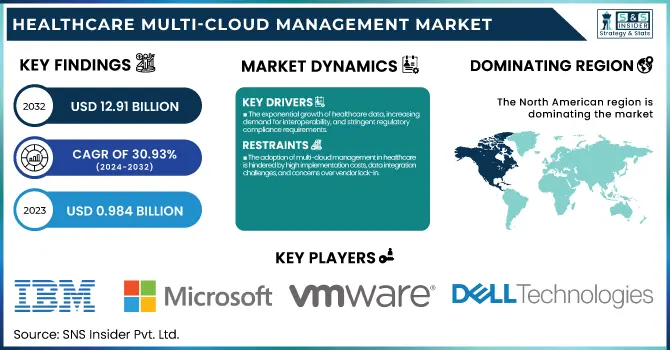

The Healthcare Multi-Cloud Management Market size was valued at USD 0.984 billion in 2023 and is expected to reach USD 12.91 billion by 2032, growing at a CAGR of 30.93% over the forecast period of 2024-2032. This report emphasizes cloud security and data governance trends, underscoring the mounting demand for strong cybersecurity frameworks and compliance-driven data protection practices. The research delves into AI and machine learning uptake in multi-cloud infrastructures, where automation is improving operational efficiency, workload optimization, and predictive analytics for healthcare use cases.

To Get more information on Healthcare Multi-Cloud Management Market - Request Free Sample Report

Moreover, it considers market share by cloud service providers, which represents competition as the big players enhance their portfolios to accommodate healthcare-specific needs. IT expenditure in multi-cloud management is also studied with increasing investments in hybrid cloud infrastructure and interoperability tools for facilitating healthcare data exchange. In addition, new technologies like edge computing and blockchain are redesigning multi-cloud healthcare environments for better data protection, real-time processing, and integration. The regulatory and compliance trends also shape the market because changing healthcare policy necessitates staying compliant with HIPAA, GDPR, and other international data protection standards.

The U.S. Healthcare Multi-Cloud Management Market was valued at USD 0.29 billion in 2023 and is expected to reach USD 3.44 billion by 2032, growing at a CAGR of 31.63% over the forecast period of 2024-2032. In the United States, the market for healthcare multi-cloud management is growing strongly as a result of expanded federal funding for digital transformation, heightened cybersecurity risks, and the increasing use of AI-based cloud solutions to boost patient data management and interoperability.

Healthcare Multi-Cloud Management Market Dynamics

Drivers

-

The exponential growth of healthcare data, increasing demand for interoperability, and stringent regulatory compliance requirements.

With healthcare data expected to expand by 36% per annum, driven mainly by medical imaging, electronic health records (EHRs), and genomics, healthcare providers and hospitals are increasingly embracing multi-cloud platforms in storing, managing, and analyzing big data cost-effectively. Medical imaging alone accounts for close to 90% of the data in healthcare, which calls for scalable cloud storage and high-speed processing. Furthermore, the requirement for interoperability among various healthcare systems has motivated organizations to embrace hybrid and multi-cloud models to facilitate smooth data exchange among providers, payers, and regulatory agencies. HIPAA (U.S.), GDPR (Europe), and HITECH Act are some of the regulatory mandates that require robust data security, which has further boosted cloud adoption. Additionally, the growth of AI-driven analytics in healthcare, such as predictive diagnosis and customized treatment plans, demands strong cloud infrastructure to support intricate calculations. Technology giants such as Microsoft, AWS, and Google Cloud are collaborating with healthcare providers to provide customized multi-cloud solutions that improve operational efficiency and patient outcomes. These aspects in combination drive the fast growth of the healthcare multi-cloud market, providing better security, scalability, and cost efficiency in healthcare IT infrastructure.

Restraints

-

The adoption of multi-cloud management in healthcare is hindered by high implementation costs, data integration challenges, and concerns over vendor lock-in.

Initial migration costs for healthcare organizations may be 30-50% more than on-premises infrastructure and hence may be out of reach for small and medium-sized hospitals. Also, intricate legacy systems that pervasively exist in healthcare institutions pose a substantial challenge in terms of integration with contemporary cloud offerings. Most hospitals continue to use on-premises PACS (Picture Archiving and Communication Systems) for the storage of medical images, thus slowing down the adoption of the cloud. Vendor lock-in, in which healthcare organizations become heavily reliant on one cloud vendor, reducing flexibility and enhancing long-term operational risks, is another significant constraint. Operating multi-cloud environments also demands expert IT skills, which most healthcare institutions do not possess, causing greater dependence on external consultants. In addition, sovereignty laws for data differ geographically, presenting more compliance obstacles to working with patient data across various cloud providers. Large healthcare organizations may be able to make ends meet working with these issues, but smaller hospitals and clinics find it expensive and technically challenging to implement a fully integrated multi-cloud environment, hence hindering market penetration.

Opportunities

-

The increasing adoption of AI, big data analytics, and edge computing in healthcare presents immense opportunities for multi-cloud management solutions.

AI-based diagnostic software, especially in pathology, radiology, and genomics, demands immense computational capabilities, necessitating multi-cloud infrastructures for high-speed data processing and instantaneous insights. Cloud-based medical imaging platforms are increasingly popular, enabling radiologists to remotely store, access, and analyze imaging information, decreasing turnaround times and enhancing patient outcomes. Another significant opportunity is in healthcare cybersecurity, with cyber-attacks in the industry having increased by 45% year-on-year, leading healthcare providers to invest in multi-cloud security tools such as zero-trust architecture, AI-powered threat detection, and blockchain for secure data exchange. Telehealth and remote patient monitoring solutions, which grew at a fast pace during the pandemic, are also creating demand for scalable cloud-based platforms that enable the real-time exchange of patient data. Government programs supporting digital healthcare changeover, like FHIR-based interoperability systems, also facilitate cloud uptake. Additionally, the increasing popularity of edge computing in healthcare allows for real-time processing of data near the patient, which lessens latency in time-sensitive applications like ICU monitoring and robotic surgeries. These trends provide substantial opportunities for cloud providers, healthcare IT vendors, and AI-based cloud management platforms to grow their business and meet the changing demands of the healthcare sector.

Challenges

-

The Healthcare Multi-Cloud Management Market faces severe infrastructure, security, and compliance challenges, particularly concerning medical imaging and high-volume healthcare data storage.

Medical imaging information alone will exceed 2,314 exabytes by 2025, taxing current cloud storage and necessitating sophisticated data compression and management techniques. Latency and bandwidth constraints are one of the primary challenges, since high-definition imaging and real-time diagnostics need ultra-high data transfer rates that most healthcare IT infrastructures cannot handle. Moreover, multi-cloud-based cybersecurity threats are on the rise, with 25% of all the ransomware attacks in 2023 targeting the healthcare sector. Multi-cloud security entails persistent monitoring, encryption, and identity management, making healthcare IT operations more complex. Multi-jurisdictional regulation compliance is another challenge, with multiple countries having different data residency and protection regulations, complicating data exchange between nations. Additionally, the absence of talented IT professionals in cloud management of healthcare is hindering adoption since hospitals and clinics are having difficulty hiring cybersecurity specialists and cloud architects. Finally, cost predictability is still a problem since multi-cloud environments are accompanied by unforeseen expenses concerning data egress fees, cloud resource scaling, and long-term storage costs, which makes budgeting for healthcare organizations challenging.

Healthcare Multi-Cloud Management Market Segmentation Analysis

By Component

Solutions led the market in 2023, with about 65% of the total share, fueled by the growing need for cloud-based data management, interoperability, and security solutions in healthcare. The increasing complexity of healthcare IT infrastructure, the growing use of AI-powered analytics, and regulatory compliance with standards like HIPAA and GDPR have driven the need for multi-cloud solutions. Big hospitals and healthcare organizations favor cloud-based solutions for handling electronic health records (EHRs), imaging information, and real-time analytics, which is driving the segment's leadership.

Services were the fastest-growing segment, led by the growing demand for cloud migration, integration, and managed services. Healthcare organizations are increasingly turning to multi-cloud deployment, security management, and compliance assistance from third-party vendors, driving the fast growth of the services market. The absence of in-house cloud skills also drove a shift toward outsourced cloud consulting and managed services.

By Deployment Mode

The private cloud led the market in 2023, with 57% of the overall share, since it is still the top pick for large healthcare organizations and government agencies because of improved security, adherence to data protection regulations, and support for mission-critical applications. Private cloud infrastructure is the first choice for most healthcare providers because they want to retain control over sensitive patient information, adhere to stringent regulatory requirements, and merge legacy IT systems securely. Private cloud solutions are also demanded by hospitals and research centers that process huge amounts of medical imaging, genomic information, and AI-driven diagnostics. Private cloud adoption is slower, with high costs and limited scalability.

The hybrid cloud is the fastest-growing deployment model as healthcare organizations seek a balance between security, scalability, and cost-effectiveness. Hybrid cloud architectures enable hospitals to keep confidential patient information on private clouds and use the elasticity of public cloud offerings for complex analytics, telemedicine, and AI-based applications. Increasing interoperability requirements between multiple cloud platforms and cost optimization capabilities are driving hybrid cloud deployment. The hybrid model is especially gaining momentum in telehealth, medical imaging, and AI-based diagnostics because it can manage high-data workloads effectively. Sovereign cloud is picking up speed in countries with stringent data residency regulations, like the EU under GDPR and Middle Eastern nations. They guarantee that patient data stays within the country, aligning with local healthcare laws. Sovereign cloud implementation is still relatively contained due to increased expense and infrastructure limitations, but it is a niche and increasing market.

By Application

Non-clinical information systems (NCIS) dominated the market in 2023 with a 58.9% market share, as healthcare organizations and hospitals spent on multi-cloud platforms to achieve administrative, financial, and operational efficiency. Cloud-based revenue cycle management (RCM), supply chain management, and patient engagement platforms have driven the growth of the segment, lowering operational expenses and improving overall healthcare delivery.

In Clinical Information Systems (CIS), Electronic Health Records (EHR) was the most rapidly growing segment, fueled by rising movement towards cloud-based storage of patient data and interoperability. With more than 90% of developed region hospitals now embracing EHRs, the need for multi-cloud EHR solutions that can enable easy access to data across various healthcare providers is on the rise. Governments across the globe are promoting EHR standardization and interoperability, accelerating cloud adoption in this sector. Medical imaging is also a significant driver of cloud adoption in the healthcare industry since it accounts for almost 90% of the volume of healthcare data. The transition to cloud-based Picture Archiving and Communication Systems (PACS) allows hospitals and radiologists to store, retrieve, and analyze imaging data at low costs while enhancing diagnostic precision.

By End User

Healthcare Providers led the market in 2023 with almost 70% of the share, as hospitals, clinics, and research centers increasingly embraced multi-cloud solutions for storing patient records, imaging data, and AI-based diagnostics. The movement toward value-based care, precision medicine, and telemedicine has substantially boosted the dependence on cloud technology in this category. High-volume hospitals with more patients and data-intensive applications are pushing demand for secure, scalable, and compliant cloud platforms.

Healthcare payers are the most rapidly expanding category, as insurance firms and healthcare financing groups use multi-cloud platforms for claim processing, fraud detection, and predictive analysis. The growing deployment of AI-powered risk assessment technologies, automated claims verification, and real-time exchange of patient information is driving payers to use the cloud more and more, increasing efficiency and cutting costs. Cloud analytics platforms are also assisting payers in increasing customer satisfaction, making claim settlements faster, and reducing fraudulent activity.

Healthcare Multi-Cloud Management Market Regional Insights

North America led the Healthcare Multi-Cloud Management Market in 2023 with the highest share based on a combination of stringent regulatory environments, strong healthcare IT expenditures, and sophisticated cloud infrastructure. In this region, comprehensive regulations like HIPAA and HITECH impose stringent data security and privacy measures, forcing hospitals, clinics, and healthcare organizations to implement advanced hybrid and multi-cloud environments. The United States, as the major North American market, enjoys a robust healthcare system with high levels of technological proficiency in which major cloud providers like AWS, Microsoft Azure, and Google Cloud offer customized solutions to achieve operational effectiveness as well as safety for patient information. Technology vendor collaborations with hospitals also spur advancements in secure clouds, supporting multi-cloud leadership across North America.

Asia-Pacific region is the most rapidly expanding, stimulated by growing healthcare IT infrastructure investments, government-sponsored digital health programs, and growing demand for cloud-based artificial intelligence and data analysis solutions. China, Japan, and South Korea are driving healthcare cloud transformation, and India's Ayushman Bharat Digital Mission (ABDM) is speeding up the adoption of the cloud across public and private healthcare centers. With a thriving healthcare industry and cloud-supportive legislation, APAC is becoming a prime destination for international cloud service providers seeking to establish their presence in healthcare multi-cloud offerings.

Get Customized Report as per Your Business Requirement - Enquiry Now

Healthcare Multi-Cloud Management Market Key Players

-

Microsoft Corporation

-

VMware Inc.

-

Cloudticity

-

Veeva Systems

-

athenahealth, Inc.

-

Rackspace Technology

-

Accenture

-

BMC Software

-

Oracle Corporation

Recent Developments in the Healthcare Multi-Cloud Management Market

In June 2024, Oracle and Google Cloud announced a strategic multicloud partnership to simplify cloud migration and management. The collaboration enables Oracle Cloud Infrastructure (OCI) database services on Google Cloud, with high-speed interconnectivity across 11 global regions and no cross-cloud data transfer fees. Later this year, Oracle Database@Google Cloud will launch, offering top-tier Oracle Database performance with feature and pricing parity to OCI.

In Nov 2023, Sentara Health achieved USD 5.8 million in annual savings by migrating to the cloud, reducing data center costs by 30% through lower labor expenses, software maintenance, and infrastructure costs. The transition also enhanced disaster recovery capabilities, improving overall operational efficiency.

In March 2023, Dr. Lal PathLabs, a leading pathology diagnostics provider in India, partnered with Kyndryl to enhance its IT infrastructure management. The collaboration includes overseeing both on-premises and multi-cloud environments across multiple hyperscaler cloud providers, ensuring seamless and efficient cloud operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.984 billion |

| Market Size by 2032 | USD 12.91 billion |

| CAGR | CAGR of 30.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component [Solutions (Cloud Migration & Integration, Security & Risk Management, Compliance & Policy Management, Monitoring & Analytics, Cost Management & Optimization, Disaster Recovery & Backup), Services (Managed Services, Professional Services)] • By Deployment Mode [Public Cloud, Private Cloud, Hybrid Cloud] • By Application [Clinical Information Systems (CIS) (Radiology & Imaging Solutions {Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), Artificial Intelligence (AI) in Medical Imaging, Teleradiology Solutions, Cloud-based Imaging Storage & Retrieval}, Electronic Health Records (EHR), Telemedicine & Remote Patient Monitoring, Laboratory Information Systems (LIS), Surgical Information Systems, Others), Non-clinical Information Systems (NCIS) (Revenue Cycle Management (RCM), Supply Chain Management, Workforce Management, Others) • By End User [Healthcare Payers, Healthcare Providers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, VMware Inc., Dell Technologies Inc., Cloudticity, Veeva Systems, athenahealth Inc., Rackspace Technology, Accenture, BMC Software, and Oracle Corporation. |