Healthcare Process Mining Software Market Size:

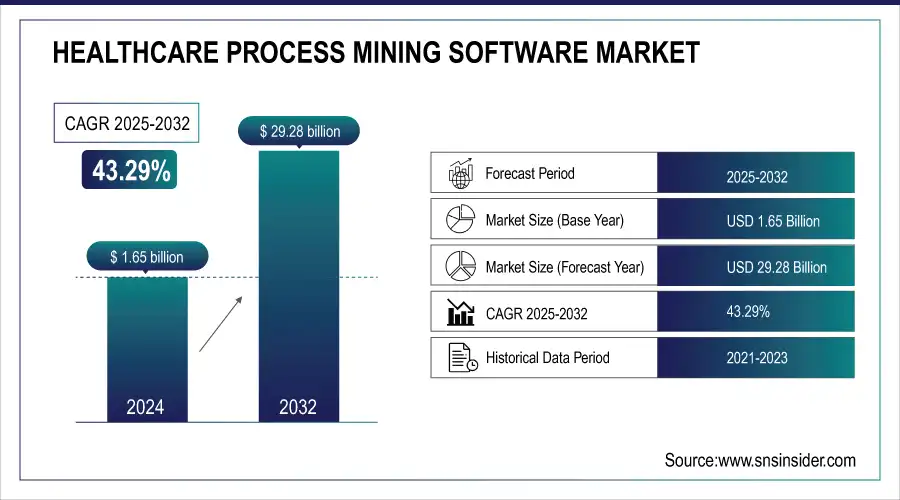

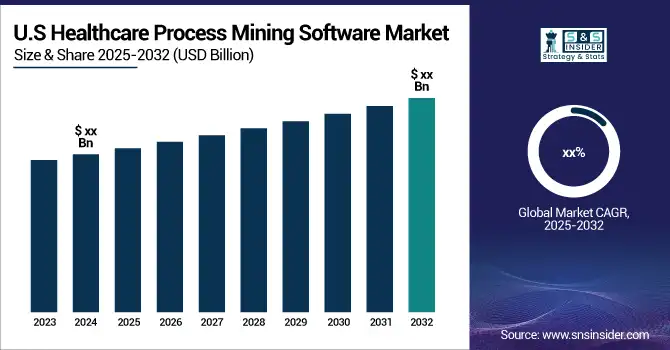

The Healthcare Process Mining Software Market was valued at USD 1.65 billion in 2024 and is expected to reach USD 29.28 billion by 2032, growing at a CAGR of 43.29% from 2025-2032.

Get More Information on Healthcare Process Mining Software Market - Request Sample Report

The Healthcare Process Mining Software Market is growing rapidly as organizations adopt digital solutions to enhance efficiency, transparency, and compliance. By analyzing event log data, process mining identifies inefficiencies, optimizes workflows, and improves productivity. Integration with AI and ML enables predictive analytics, real-time insights, and process optimization before issues arise. Companies like Celonis and SAP are expanding capabilities through collaborations and acquisitions, driving innovation. Cloud-based adoption, regulatory adherence, and automation further fuel demand. Process mining empowers healthcare organizations to reduce operational costs, enhance agility, and improve patient care while fostering data-driven decision-making.

Healthcare Process Mining Software Market Size and Forecast

-

Healthcare Process Mining Software Market Size in 2024: USD 1.65 Billion

-

Healthcare Process Mining Software Market Size by 2032: USD 29.28 Billion

-

CAGR: 43.29% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Healthcare Process Mining Software Market Trends

-

Rising need to optimize clinical and administrative workflows is driving healthcare process mining software adoption.

-

Integration with AI and analytics is enhancing operational efficiency, patient care, and resource utilization.

-

Growing focus on reducing healthcare costs and improving compliance is boosting market growth.

-

Adoption of EHRs and digital health platforms is facilitating real-time process analysis and insights.

-

Increasing demand for predictive modeling and performance benchmarking is shaping software usage.

-

Expansion of hospitals, clinics, and telemedicine services is fueling adoption globally.

-

Collaborations between software providers, healthcare institutions, and consulting firms are accelerating innovation and implementation.

Healthcare Process Mining Software Market Growth Drivers:

-

Increasing Demand for Enhanced Performance and Decreased Expenses in the Healthcare Industry

-

Rising utilization of digital health solutions and data analytics.

The healthcare sector consistently faces the challenge of improving operational efficiency and cutting costs, especially in light of increasing healthcare expenses and regulatory requirements. Process mining tools offer healthcare providers valuable information about bottlenecks, inefficiencies, and redundancies in various processes like patient flow, billing, and supply chain management. Process mining assists healthcare organizations in enhancing efficiencies, enhancing patient results, and lowering operational expenses by providing a thorough overview of workflows.

For instance, process mining can enhance the patient experience by pinpointing bottlenecks in appointments or diagnostic tests, ultimately decreasing patient wait times and enhancing service delivery. Additionally, it assists hospitals and clinics in cutting unnecessary expenses by pinpointing inefficiencies in resource allocation or procurement procedures. As of 2023, 35% of healthcare providers in developed markets have implemented process mining software, with an expected adoption rate of 50% by 2026.

As per a report from 2023, the use of process mining tools in the healthcare sector is predicted to increase by 43% annually from 2023 to 2030, with a rising number of healthcare providers opting for data-driven solutions to improve productivity and cut down on expenses

The move towards digital health services, particularly the use of EHRs, telemedicine, and other digital health tools, has led to a high need for process mining software. Healthcare institutions utilizing process mining have observed a decrease of up to 20% in operational expenses through the streamlining of workflows and removal of inefficiencies. Process mining tools are becoming increasingly crucial for analyzing healthcare operations in real time due to the large volumes of data being produced by these systems.

Healthcare Process Mining Software Market Restraints:

-

Concerns regarding the privacy and security of data

One considerable limitation in the healthcare process mining software market is increased concern over the privacy and security of data. Healthcare entities oversee the sensitive information of patients, which must comply with regulations like HIPAA in the U.S., GDPR in Europe, and local laws. Process mining software will have to analyze huge patient data fetched from all electronic health records (EHRs) clinical workflows and other healthcare systems. All this calls for the following concerns regarding potential data breaches, unauthorized access, and non-compliance with regulatory requirements.

Healthcare organizations are not willing to introduce third-party process mining solutions into the existing setups because that would mean more susceptibility to victimize patients' data. Hence, unwillingness to adopt process mining solutions without enough security measures is the main obstacle to the growth of the healthcare sector market.

Healthcare Process Mining Software Market Segmentation Analysis

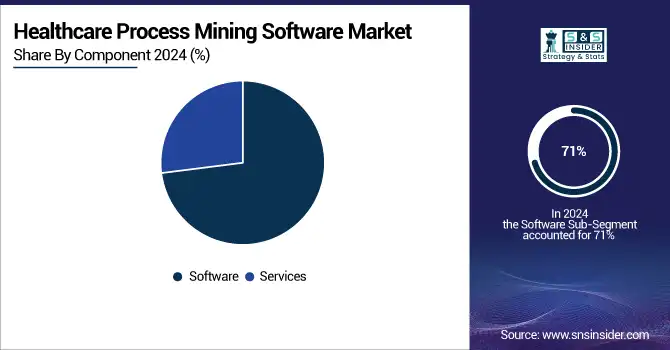

By Component, Software dominates the Healthcare Process Mining Software market, Services are expected to grow fastest.

The healthcare process mining software market is segmented into software and services based on its components. The market was mostly controlled by the software industry, generated more than 71% of the revenue in 2024, and is expected to continue leading in the future. This is due to the growing need for tools that can extract detailed data from business systems to understand and visualize workflow processes.

The service segment is projected to grow at a CAGR of 41% during the forecast period. The adoption of cloud-based software solutions and regular updates to ensure secure and smooth operation are anticipated to drive the demand for process mining services.

By Deployment, Cloud solutions dominate and are growing fastest, On-premise is slower-growing.

Regarding deployment, the market is categorized into on-premise and cloud solutions. The cloud sector held the largest market share at over 41% in 2024 and is projected to continue leading during the forecast period at a CAGR of 52%. The growing interest from businesses of all sizes in cloud-based process mining software that provides flexibility, scalability, visibility over every process, and cost-effectiveness is the reason for this trend.

On-premise experiencing slower growth as organizations shift towards cloud solutions. Only 30% of enterprises are expected to maintain on-premise solutions by 2025, emphasizing the trend towards cloud adoption.

By Application, Transactional Procurement dominates the market, Category Management is expected to grow fastest.

The area of transactional procurement had the highest revenue share, exceeding 29% in 2024, and is expected to stay in the lead during the forecasted period. The growth of this sector is due to the rising need for improved procurement solutions and services by businesses because of the challenges linked to transactional procurement processes.

It is anticipated that the category management sector will experience the highest compound annual growth rate of 49% during the predicted timeframe. The primary reason for the growth of this sector is the increasing need from businesses for external marketplace analysis, category planning & strategy, and spend data management and analytics.

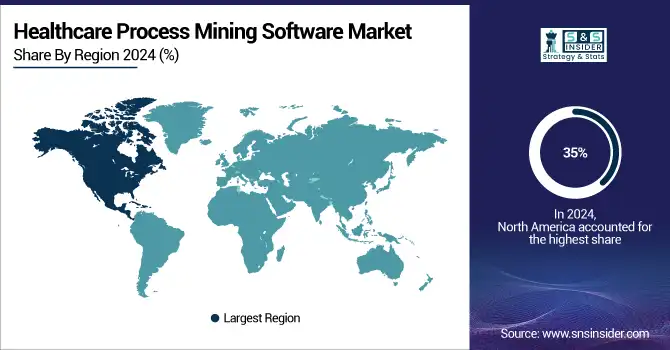

Healthcare Process Mining Software Market Regional Analysis

North America Healthcare Process Mining Software Market Insights

North America led in this process mining software market by 35% due to its advancement in technology infrastructure, significant adoption of digital transformation, and key players present in that region. The United States and Canada have led the implementations among various industries, such as finance, healthcare, and manufacturing, for process mining technology. Celonis and Software AG have emerged as prominent companies through continuous innovation, strategic partnerships, and capabilities. Fresh development ensures this top ranking, and the most recent example comes last August 2024, as Celonis has confirmed its highest-ever extended footprint in North America than ever and will improve the level of support for the companies expanding in the region.

Need Any Customization Research On Healthcare Process Mining Software Market - Inquiry Now

Asia Pacific Healthcare Process Mining Software Market Insights

Healthy economies in the Asia-Pacific region, more digital transformation projects, and rising interest in operations optimization turn it into the fastest-growing market for process mining software. It will grow at a CAGR of 45% by 2032. China, India, and Japan are key industries that drive growth within this region due to its large and diversified industries. Firms in these countries are also increasingly adopting process mining to further increase efficiency and gain a competitive advantage. Infosys, the Indian provider of IT services, is likely to boost its services during July 2024 by acquiring advanced process mining capabilities due to immense demand and growth prospects in this region, according to recent estimates.

Europe Healthcare Process Mining Software Market Insights

In 2024, Europe holds a significant position in the Healthcare Process Mining Software Market, driven by advanced healthcare infrastructure, strong adoption of digital solutions, and regulatory compliance requirements. Countries like Germany, the UK, and France are leading in implementing process mining to optimize hospital workflows, enhance patient care, and improve operational efficiency. Investments in AI integration and cloud-based solutions further strengthen market growth across the region.

Middle East & Africa and Latin America Healthcare Process Mining Software Market Insights

The Middle East & Africa and Latin America Healthcare Process Mining Software Markets are witnessing steady growth, driven by increasing healthcare digitization, rising demand for operational efficiency, and adoption of cloud-based solutions. Government initiatives to improve healthcare services, growing investments in hospital IT infrastructure, and the need for regulatory compliance are fueling market expansion, creating opportunities for software providers to optimize processes and enhance patient care in these regions.

Healthcare Process Mining Software Market Competitive Landscape:

Celonis GmbH

Celonis GmbH is a leading player in the Healthcare Process Mining Software Market, offering advanced process intelligence solutions to optimize operational workflows, enhance efficiency, and support compliance. Its software enables healthcare organizations to identify bottlenecks, improve patient care, and streamline processes through real-time analytics and AI integration. Continuous innovations and strategic partnerships strengthen Celonis’ position, driving adoption across hospitals and healthcare providers globally.

-

2025 – Celonis GmbH: Invested in Bloomfilter to enhance process intelligence capabilities, strengthening market position and expanding healthcare workflow optimization solutions.

-

2024 – Celonis GmbH: Partnered with five NHS trusts in the UK to optimize healthcare workflows, improving efficiency and patient care outcomes.

SAP SE

SAP SE in Healthcare Process Mining Software Market leverages SAP Signavio Process Intelligence and SAP HANA to provide advanced process mining solutions. The company enables healthcare organizations to optimize workflows, improve compliance, and enhance operational efficiency. SAP’s solutions integrate real-time analytics, AI, and automation, supporting data-driven decision-making and predictive insights. By combining cloud-based platforms with robust process intelligence, SAP helps healthcare providers streamline operations, reduce costs, and improve patient outcomes.

-

2024 – SAP SE: Finalized acquisition of WalkMe to enhance digital adoption, simplify complex workflows, and improve user guidance in healthcare processes.

Healthcare Process Mining Software Market Key Players

-

Celonis GmbH (Celonis EMS, Celonis Process Mining)

-

SAP SE (SAP Signavio Process Intelligence, SAP HANA)

-

Software AG (ARIS Process Mining, TrendMiner)

-

UiPath (UiPath Process Mining, UiPath Healthcare Automation)

-

IBM Corporation (IBM Process Mining, IBM Watson Health)

-

ABBYY (ABBYY Timeline, ABBYY FlexiCapture)

-

Microsoft Corporation (Microsoft Power Automate, Process Advisor)

-

Apromore (Apromore Enterprise Edition, Apromore Cloud)

-

Fluxicon (Disco, Process Mining Academy)

-

QPR Software (QPR ProcessAnalyzer, QPR EnterpriseArchitect)

-

Minit (acquired by Microsoft) (Minit Process Mining, Minit Dashboard)

-

Kofax (Kofax Process Intelligence, Kofax TotalAgility)

-

Nintex (Nintex Promapp, Nintex Workflow Cloud)

-

Signavio (acquired by SAP) (Signavio Process Intelligence,Signavio Collaboration Hub)

-

ProcessGold (acquired by UiPath) (ProcessGold Studio, ProcessGold Insights)

-

Lana Labs (acquired by Appian) (Lana Process Mining, Lana Analytics)

-

Everflow (Everflow Process Mining, Everflow Cloud)

-

Process Street (Process Street Workflow Automation, Process Street Process Mapping)

-

Icaro Tech (SMARTPERFORMANC, SMARTCARE)

-

Epicor (Epicor for Healthcare, Epicor Process Mining)

Key suppliers

-

Amazon Web Services (AWS)

-

Google Cloud Platform (GCP)Microsoft Azure

-

Palantir Technologies

-

Tableau (a Salesforce Company)

-

Qlik

-

Snowflake

-

Integromat (Make)

-

ServiceNow

-

Alteryx

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 1.65 Billion |

| Market Size by 2032 | US$ 29.28 Billion |

| CAGR | CAGR of 43.29% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (software, services) •By Deployment (on-premise, cloud) •by Application (Strategic Sourcing, Contract Management, Category Management, Transactional Procurement, Supplier Management) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Celonis GmbH, SAP SE, Software AG, UiPath, IBM Corporation, ABBYY, Microsoft Corporation, Apromore, Fluxion, QPR Software, Signavio, ProcessGold, Lana Labs, Process Street, Icaro Tech, Epicor. |