Heavy Construction Equipment Market Report Scope & Overview:

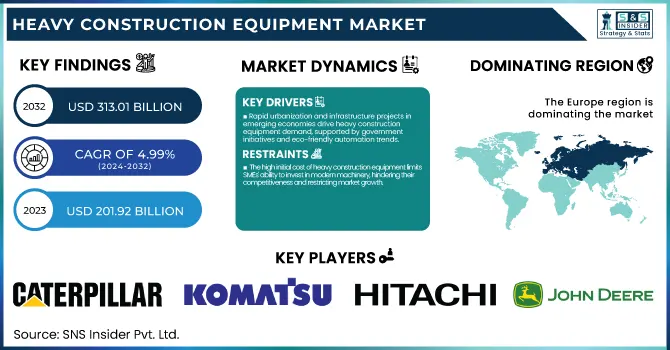

The Heavy Construction Equipment Market size was estimated at USD 201.92 billion in 2023 and is expected to reach USD 313.01 billion by 2032 at a CAGR of 4.99% during the forecast period of 2024-2032.

To Get more information on Heavy Construction Equipment Market - Request Free Sample Report

The heavy construction equipment market is experiencing significant growth, driven by increased infrastructure investments and technological advancements. Governments worldwide are prioritizing infrastructure development, leading to a surge in construction activities. This trend is particularly evident in emerging economies, where rapid urbanization and industrialization are creating a substantial demand for heavy machinery. Technological innovation is a key factor propelling market expansion. Manufacturers are integrating advanced technologies such as artificial intelligence (AI) and automation into their equipment, enhancing efficiency and safety. For instance, Komatsu Ltd. has introduced the Komatsu Frontrunner, an Autonomous Haulage System (AHS) truck, with over 700 units deployed by February 2024.

The market is also witnessing a shift towards fuel-efficient and environmentally friendly machinery. Companies are developing equipment that reduces fuel consumption and emissions, aligning with global sustainability goals. JCB, for example, is investing in hydrogen combustion engines for its equipment, positioning itself for future growth in the eco-conscious market segment. Rental services are becoming increasingly popular, offering cost-effective solutions for construction projects. This trend is particularly prevalent in regions with fluctuating construction activity, where renting equipment provides flexibility and reduces capital expenditure.

Heavy Construction Equipment Market Dynamics

DRIVERS

-

Rapid urbanization and large-scale infrastructure projects in emerging economies are driving heavy construction equipment demand, fueled by government initiatives and trends in automation, fuel efficiency, and eco-friendly equipment.

Rapid urbanization and large-scale infrastructure projects in emerging economies like India, China, and Southeast Asia are significantly driving the demand for heavy construction equipment. As urban populations rise, there is a pressing need for new infrastructure, including smart cities, highways, bridges, residential complexes, and commercial buildings. This surge in construction activities boosts the demand for machinery such as excavators, cranes, bulldozers, and loaders. Additionally, government-backed initiatives, like the development of smart cities and public transportation systems, are creating further opportunities for the construction equipment market. As these regions experience robust economic growth, the construction sector remains a major contributor to GDP, fueling the need for efficient and advanced machinery. The market is witnessing trends like automation, fuel efficiency, and the adoption of eco-friendly equipment, driving innovation and growth. These trends are expected to continue, contributing to the overall expansion of the heavy construction equipment market in the coming years.

RESTRAINT

-

The high initial cost of heavy construction equipment limits SMEs' ability to invest in modern machinery, hindering their competitiveness and restricting market growth.

The high initial cost of heavy construction equipment is a significant barrier for small and medium-sized enterprises (SMEs). These companies often face financial constraints, making it difficult to invest in expensive machinery required for large-scale construction projects. Purchasing new equipment requires a considerable upfront capital investment, which may not be feasible for many SMEs, particularly in regions where access to financing is limited. Even leasing equipment can involve high rental fees, adding to the financial burden. As a result, SMEs may opt for outdated or less efficient equipment, impacting their competitiveness in the market. This financial challenge can restrict market growth, as smaller players may struggle to keep up with larger firms that have more resources. Additionally, the inability to invest in advanced machinery can limit the adoption of newer, more efficient technologies, further hindering progress in the heavy construction equipment sector.

Heavy Construction Equipment Market Segmentation

By Propulsion

The Internal Combustion Engines (ICE) segment dominated with the market share over 62% in 2023, due to their high thrust capabilities, which are essential for the demanding power requirements of construction machinery. ICE engines provide the necessary power and performance for a wide range of equipment, from small machines to large, heavy-duty construction vehicles. Their ability to deliver consistent power output, especially in challenging environments, makes them a preferred choice for operators who require reliability and performance. Additionally, the infrastructure for fueling and servicing ICE-powered equipment is well-established, contributing to their continued dominance. Despite the rise of alternative power sources, ICE engines remain the go-to option for many industries due to their proven effectiveness, robustness, and the established ecosystem around them.

By Power Output

The <100 HP segment dominated with the market share over 38% in 2023, due to its versatility and suitability for urban environments. In cities where space is often limited, compact machinery is essential for efficient operation. These smaller machines are ideal for tasks like highway repair, maintenance, and smaller construction projects, where maneuverability in tight spaces is critical. They are easy to transport and operate in congested areas, making them highly effective for work on roads, bridges, and utility lines. Their lower power output doesn’t compromise their performance in these specific tasks, as they are designed to offer a balance of power and agility. This combination of factors makes the <100 HP segment particularly popular and widely used in urban construction projects.

By Engine Capacity

The 5-10L segment dominated with the market share over 42% in 2023, due to its optimal balance of power, fuel efficiency, and versatility. Machines in this category are widely used for large-scale infrastructure projects, urban development, and various construction applications that require a blend of performance and cost-effectiveness. The engine size is well-suited for equipment like excavators, loaders, and bulldozers, which need sufficient power to handle demanding tasks without excessive fuel consumption. As a result, this segment enjoys high sales and usage, driven by the demand for machines that can deliver robust performance in construction sites while keeping operational costs manageable. This makes it the preferred choice for both contractors and construction firms globally.

By End Use

The infrastructure segment dominated with the market share over 42% in 2023, largely driven by global investments in infrastructure development. With rapid urbanization, governments and private entities are focusing on constructing smart cities, upgrading transportation networks, and building essential public infrastructure like bridges, roads, and utilities. These projects require a wide range of heavy construction equipment, such as cranes, bulldozers, excavators, and loaders, to ensure efficiency and productivity. As urban populations grow and demand for modern infrastructure increases, the need for advanced construction machinery becomes even more critical. This sector's dominance reflects the essential role of heavy equipment in transforming and modernizing cities, driving economic growth, and improving living standards worldwide.

Heavy Construction Equipment Market Regional Analysis

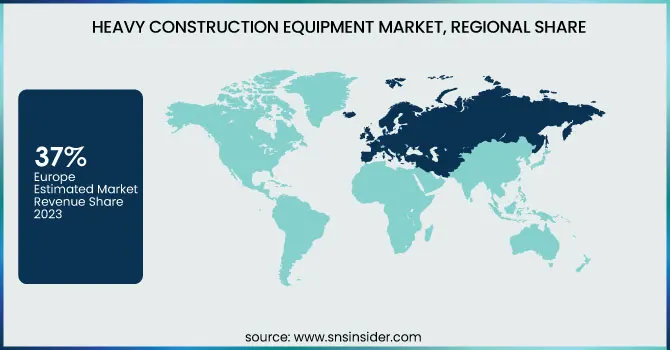

Europe region dominated with the market share over 37% in 2023, largely due to its well-established infrastructure and strong demand for construction projects. The region boasts a mature market with leading industry players, advanced technological innovations, and a high rate of investment in large-scale construction ventures. Key markets like Germany, France, and the UK drive the demand for heavy equipment due to ongoing urbanization, industrial development, and public sector projects. Additionally, Europe's focus on sustainability and smart city development is further pushing the need for advanced machinery. The presence of major construction companies and equipment manufacturers ensures a steady supply of innovative and reliable machinery, maintaining Europe's position as the leader in the global heavy construction equipment market.

Asia-Pacific is the fastest-growing region in the heavy construction equipment market, driven by rapid urbanization and the surge in infrastructure development. Countries like China, India, and Japan are experiencing substantial growth in large-scale construction projects, including residential, commercial, and transportation infrastructure. The increasing demand for modernized cities, smart urban planning, and extensive transportation networks has led to a surge in construction activities. This growth is further supported by government initiatives and investments in infrastructure to support economic expansion. The region's booming construction sector, coupled with rising industrialization and the need for advanced construction technologies, makes Asia-Pacific a key player in the global market for heavy construction equipment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Heavy Construction Equipment Market

-

Caterpillar (Excavators, Bulldozers, Loaders, Backhoe Loaders, Graders)

-

Komatsu Ltd. (Excavators, Dump Trucks, Wheel Loaders, Bulldozers, Motor Graders)

-

AB Volvo (Articulated Haulers, Wheel Loaders, Excavators, Road Machinery)

-

Hitachi Construction Machinery Co., Ltd. (Excavators, Wheel Loaders, Dump Trucks)

-

Deere & Company (Excavators, Backhoe Loaders, Dozers, Skid Steer Loaders)

-

CNH Industrial N.V. (Backhoe Loaders, Skid Steer Loaders, Excavators, Bulldozers)

-

LIEBHERR (Cranes, Excavators, Wheel Loaders, Dump Trucks)

-

Kobelco Construction Machinery Co., Ltd. (Excavators, Cranes, Mini Excavators)

-

SANY (Excavators, Cranes, Concrete Machinery, Road Machinery)

-

XCMG GROUP (Excavators, Cranes, Loaders, Bulldozers)

-

JCB (Backhoe Loaders, Excavators, Telehandlers, Skid Steer Loaders)

-

Doosan Infracore (Excavators, Wheel Loaders, Articulated Dump Trucks)

-

LiuGong (Excavators, Wheel Loaders, Motor Graders, Bulldozers)

-

Tadano Ltd. (Cranes, Rough Terrain Cranes, Truck Cranes)

-

CASE Construction Equipment (Excavators, Wheel Loaders, Bulldozers, Backhoe Loaders)

-

Mitsubishi Heavy Industries, Ltd. (Excavators, Bulldozers, Loaders)

-

Hyundai Construction Equipment (Excavators, Wheel Loaders, Skid Steer Loaders)

-

Terex Corporation (Cranes, Aerial Work Platforms, Dump Trucks)

-

Kubota Corporation (Mini Excavators, Skid Steer Loaders, Tractors)

-

Manitowoc Cranes (Cranes, Tower Cranes, Mobile Cranes)

Suppliers for (construction, mining, and industrial equipment., excavators, bulldozers, and loaders) on Heavy Construction Equipment Market

-

Liebherr Group (Germany)

-

Volvo Construction Equipment (Sweden)

-

Hitachi Construction Machinery Co., Ltd. (Japan)

-

CNH Industrial N.V. (UK)

-

John Deere (USA)

-

Komatsu Ltd. (Japan)

-

XCMG Group (China)

-

JCB (UK)

-

SANY Group (China)

-

Caterpillar Inc. (USA)

RECENT DEVELOPMENT

In June 2024, Volvo CE introduced the Volvo EC210, a 20-tonne category heavy excavator, under the campaign "Built for Bharat" and launched the "Karo Zyada ki Umeed" initiative. This addition to the company's diverse portfolio of construction equipment underscores its ongoing commitment to the Indian market by offering innovative, technologically advanced products in the construction industry.

In May 2024: Telestack, a leader in material handling solutions unveiled its groundbreaking TSR40 radial telescopic conveyor at Hillhead 2024, a prestigious exhibition dedicated to the construction, quarrying, and recycling industries.

In June 2024: The Roads and Transport Authority (RTA) introduced the new Dubai Commercial and Logistics Land Transport Strategy 2030, aimed at doubling the direct contribution of the logistics and land transport sector to the Emirate’s economy, reaching AED 16.8 billion (USD 4.5 billion).

In July 2023: HD Hyundai Infracore signed an MOU with Korean East-West Power to establish a mutual partnership for the development of Hydrogen Internal Combustion Engines (H2ICE) and to target the clean energy generation market.

In July 2023: Komatsu announced a national cooperative contract for construction equipment, including related attachments and technology, awarded through Sourcewell.

In March 2023: Teleo, a company specializing in autonomous technologies for heavy construction equipment, signed agreements with John Aarts Group, Teichert, and Tomahawk Construction for remote-operated wheel loaders, bulldozers, and dump trucks.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 201.92 billion |

|

Market Size by 2032 |

USD 313.01 billion |

|

CAGR |

CAGR of 4.99% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Machinery (Earthmoving Equipment, Material Handling Equipment, Heavy Construction Equipment, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Caterpillar, Komatsu Ltd., AB Volvo, Hitachi Construction Machinery Co., Ltd., Deere & Company, CNH Industrial N.V., LIEBHERR, Kobelco Construction Machinery Co., Ltd., SANY, XCMG GROUP, JCB, Doosan Infracore, LiuGong, Tadano Ltd., CASE Construction Equipment, Mitsubishi Heavy Industries, Ltd., Hyundai Construction Equipment, Terex Corporation, Kubota Corporation, Manitowoc Cranes. |

|

Key Drivers |

• Rapid urbanization and large-scale infrastructure projects in emerging economies are driving heavy construction equipment demand, fueled by government initiatives and trends in automation, fuel efficiency, and eco-friendly equipment. |

|

Restraints |

• The high initial cost of heavy construction equipment limits SMEs' ability to invest in modern machinery, hindering their competitiveness and restricting market growth. |