Cryogenic Fuels Market Report Scope & Overview:

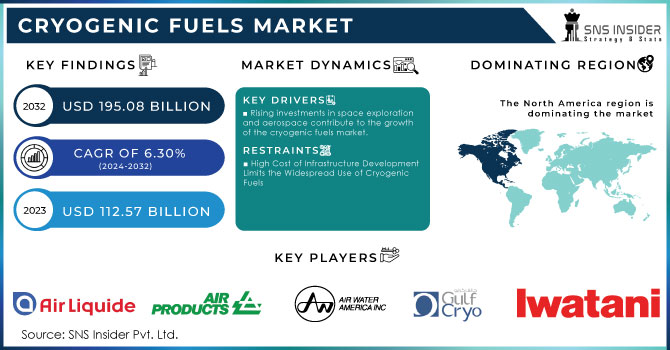

The Cryogenic Fuels Market Size was valued at USD 112.57 billion in 2023 and is expected to reach USD 195.08 billion by 2032 and grow at a CAGR of 6.30% over the forecast period 2024-2032.

Get more information on Cryogenic Fuels Market - Request Sample Report

The demand for cleaner and energy-efficient sources has driven growth in the Cryogenic Fuels Market. Owing to its significant development in aerospace, defense, and energy industries, there is a higher requirement for handling and storing these fuels at very low temperatures. Cryogenic fuels, in the form of liquid hydrogen or liquefied natural gas (LNG), appropriate for use in applications such as space missions and rocket launches, have changed the market dynamics. Innovations in fuel storage and transfer technologies exert greatly on the market. For instance, NASA, in August 2024, focused on enhancing fuel transfer and long-term storage solutions by developing low-leakage cryogenic disconnects, a critical technology that ensures safe and efficient fuel transfers in space environments. These innovations directly align with the industry's increasing need for more sustainable and reliable cryogenic fuel systems for space exploration.

Market dynamics are heavily influenced by growing government investments in space and defense programs, coupled with a rise in commercial partnerships with private entities. Defense organizations have also played a key role in fueling the demand for cryogenic fuels. At Eglin Air Force Base, in December 2023, U.S. Air Force cryogenics airmen successfully provided critical cryogenic fuel for munitions testing, an activity critically attesting to the strategic role cryogenic fuels play in military operations. From the defense perspective, cryogenics supports advanced design that evolves weaponry and increases the logistical efficiency of storing and transporting fuels on the ground under adverse environmental conditions. This growing military reliance is bolstering the cryogenic fuel market’s expansion.

Collaboration between academic institutions and major corporations is also propelling the growth of cryogenic propulsion technologies. In September 2024, Cal Poly collaborated with Boeing to pioneer advancements in cryogenic propulsion systems for space applications. This partnership will help explore a much more efficient method for storing and transferring cryogenic fuels, pushing the involvement of academia to advance the technology further. These partnerships are essential for the long-term sustainability of the market as they catalyze breakthroughs that improve the performance and safety of cryogenic fuels, particularly for aeronautical applications.

Recent technological advancements and investments made around the globe in space research and defense have contributed to exponential growth in this cryogenic fuel market. The strong focus on research, such as NASA’s push for advanced cryogenic storage solutions, the U.S. military’s use of cryogenics for defense testing, and Boeing’s partnership with academic institutions, demonstrates the broad scope of cryogenic applications across industries. The market is poised to evolve rapidly as these developments address critical challenges in fuel efficiency, storage, and transfer, positioning cryogenic fuels as a key component in future energy systems.

Cryogenic Fuels Market Dynamics

KEY DRIVERS:

-

Rising investments in space exploration and aerospace contribute to the growth of the cryogenic fuels market.

The increasing investments of governments and private sectors in space exploration and aerospace enterprises are pushing up the demand for cryogenic fuels. Recent improvements in satellite launches and deep-space missions have accelerated the need for high-performance, efficient fuels for rocket propulsion and other space applications. Among these cryogenic fuels, liquid hydrogen and liquefied natural gas (LNG) hold preference owing to their high energy density and the capacity to perform at highly low temperatures. Companies such as SpaceX and NASA are operating towards this technological advancement, directly impacting the market for cryogenic fuels. The rising propensity to minimize carbon footprints has also driven the adoption of cryogenic fuels as a greener alternative to traditional aviation in aerospace since they exhibit lower levels of pollutants as compared to traditional fuels. In consequence, this is pushing the progress of related fuel storage and transfer technologies at considerable rates and is contributing to good market growth.

-

Rising Global Demand for Clean Energy Sources Accelerates the Adoption of Cryogenic Fuels

Advances in the global transition toward more clean energy resources have supported market growth for the cryogenic fuels market. More countries, needing to reduce their carbon footprint and align with the international climate agreements, are increasingly paying attention to these cryogenic fuels, namely LNG and liquid hydrogen, as they emit much less than traditional fossil fuels. LNG is widely used for power generation, transportation, and processes of industry, while liquid hydrogen has been promisingly explored for potential use in fuel cells for electric vehicles and renewable energy storage. The demand is further increased by governmental encouragement through programs that help in the adoption of clean energy and several growing firms invested in the field of sustainable technology. Due to their inherent nature of intermittency, cryogenic fuels end up being an efficient way to store and transport energy at the same time as adding to their role in the global energy transition.

RESTRAIN:

-

High Cost of Infrastructure Development Limits the Widespread Use of Cryogenic Fuels

Highly capitalized development of storage, transport, and handling infrastructure remains one of the major handicaps for the cryogenic fuels market. High-capital expenditure storage tanks and transport vessels are required to ensure that cryogenic fuels could be sustained at very low temperatures, infusing a lot of capital. Additionally, maintenance of integrity with zero leakage prevents safe operations and adds to costs. Preliminary investment in infrastructure by companies and industries to switch from conventional fuels to cryogenic alternatives would act as a barrier, especially in the case of regions where prior systems do not exist. This would reduce the adoption of cryogenic fuels, especially for developing economies where large-scale investments based on financial resources might not be possible. For this reason, although they have various advantages, the market growth of the innovation is somehow limited by the requirement for significant investment at the front end.

OPPORTUNITY:

-

Growing Research in Hydrogen-Based Technologies Presents Significant Opportunities for the Cryogenic Fuels Market

New research and development in hydrogen-based technologies are opening new avenues for growth in the cryogenic fuels market. With growing global decarbonization ambitions, hydrogen is poised to emerge as an important means in this direction through applications in fuel cells, storage of renewable energy, and emission-free vehicles. Liquid hydrogen is a significant cryogenic fuel used in many of these technologies due to its high energy content and low environmental impact. Hydrogen infrastructure and innovation are areas of significant investment by the governments and private sectors of all countries involved. Some have developed hydrogen roadmaps in support of its implementation. Cryogenic fuel manufacturers stand to benefit from this development as they become an integral part of the supply chain that deals with the production, storage, and distribution of hydrogen. In the forecast period, as hydrogen-based technologies progress, cryogenic fuels will find increased popularity across both industrial and consumer markets.

CHALLENGES:

-

Developing Efficient Cryogenic Fuel Storage Systems for Long-Term Applications Creates Challenges in the Cryogenic Fuels Market

Developing efficient storage systems to maintain extremely low temperatures over long durations without losing any significant amount of fuel, is viewed as a key challenge for the market of cryogenic fuels. Liquid hydrogen and LNG are considered cryogenic fuels that have a high volatility rate and require constant cooling to avoid major evaporation and leakage issues. Current technologies cannot minimize the boil-off loss when stored for long periods, especially in space missions and large-scale industrial operations where fuel must be stored for an extended period. Lastly, the need to monitor closely and utilize effective insulation makes this system quite expensive and complicated. Overcoming the specific technical challenges is integral to the widespread adoption of cryogenic fuels in aerospace, energy, and other transportation industries where long-term storage is paramount.

Cryogenic Fuels Market Segments

By Type

Liquefied Natural Gas (LNG) dominated the cryogenic fuels market with an estimated market share of around 40% in 2023. It has been one of the more highly alternative fuels because of its low carbon emissions, which it emits compared to fossil fuels. This alternative fuel source is being used by industries to bring about widespread decarbonization around the globe. Its wide use in power generation, transportation, and other industrial applications marked its dominance. For example, most shipping lines opted for LNG-powered ships as part of their push to comply with demanding environmental regulations mainly in Europe and North America. Additionally, rising demands for LNG across Asia-Pacific as fuel for energy systems and increasingly as a new alternative fuel for transport fuels spur the existing leadership in the market of this cryogenic fuel. Its versatility, nonetheless, together with rising investments in LNG infrastructure, strengthens its leadership in the market for cryogenic fuels.

By Application

In 2023, the Aerospace & Space Exploration segment dominated the cryogenic fuels market, holding an estimated market share of around 35%. This can be attributed to the rise in space missions, satellite launches, and investment in space exploration from both governmental agencies and private companies such as SpaceX and Blue Origin. High-specific-impulse cryogenic fuels, liquid hydrogen, and liquid oxygen are primarily integral to a rocket propulsion system since they make it possible for extremely high energy efficiency and operations at extremely low temperatures. Increases in lunar and Mars exploration and improvements in reusable rockets have augmented the demand for cryogenic fuels in this segment to a great extent. Apart from this, the industry is rapidly shifting to cleaner and more efficient fuel sources with lower carbon emissions which further strengthens the position of this application.

By End-user

The Energy & Power segment dominated the cryogenic fuels market and accounted for about 38% market share in 2023. This is primarily on account of growth in global demand for cleaner energy alternatives worldwide, especially liquefied natural gas and liquid hydrogen. As the country switches to renewable sources of energy due to a decrease in carbon, cryogenic fuels are being used more and more for storage, transportation, and power generation. For example, LNG is increasingly replacing coal in gasified power plants because of its eco-friendly nature; liquid hydrogen usage is growing in the field of renewable energy storage for hydrogen fuel cells to generate electricity. The LNG infrastructure is rapidly growing in Asia-Pacific and Europe, which is further strengthening the position of the energy and power sector as the leader in the cryogenic fuels market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Cryogenic Fuels Market Regional Analysis

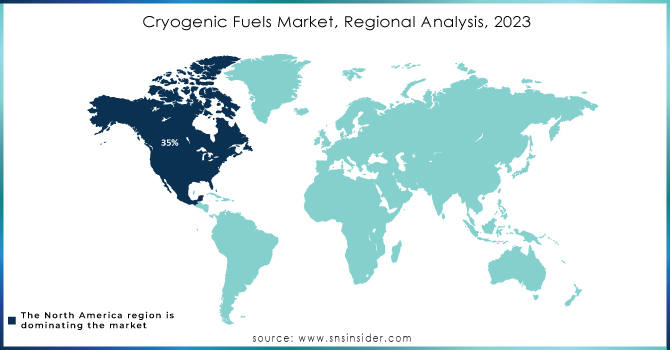

In 2023, North America dominated and accounted for the greatest share in the cryogenic fuels market, with around 35% market share. This can be associated with its advanced infrastructure in space exploration and energy production, not to mention that the trends of LNG consumption in power generation and transport are on the rise. There is heavy investment in the United States through government agencies like NASA and private enterprises like SpaceX, which rely on cryogenic fuels including liquid hydrogen and oxygen for propulsion purposes. In addition, with an already established infrastructure and growing exports, the LNG region has more potently made North America a market leader for the cryogenic fuels market.

Moreover, the Asia-Pacific region emerged as the fastest-growing region in the cryogenic fuels market, with an estimated 7.5% CAGR in 2023. China, India, and South Korea have been placed alternatively as being among the fastest-urbanizing and fast-industrializing economies, and their combined push for LNG as a relatively clean fuel source for power generation and transportation continues to fuel demand. Asia-Pacific is gaining impetus over renewable energy and hydrogen technology as well. That development in cryogenic fuels, especially in automotive and energy storage, increases the trend. Governments are encouraging alternative fuels of hydrogen, and LNG infrastructure expansion in this region supports a very strong growth momentum. For instance, China has recently launched an ambitious roadmap for hydrogen energy, whereas Japan has led in the related hydrogen fuel technology.

Key Players

-

Air Liquide (Cryocap, Nexelia)

-

Air Products & Chemicals (Liquefied Natural Gas (LNG) Equipment, Hydrogen Liquefaction Systems)

-

Air Water, Inc. (Cryogenic Storage Tanks, Liquid Hydrogen)

-

Chart Industries, Inc. (Brazed Aluminum Heat Exchangers, Cryogenic Storage Systems)

-

Gulf Cryo (Liquid Nitrogen, Liquid Argon)

-

Iwatani Corporation (Hydrogen Refueling Stations, Cryogenic Equipment)

-

Linde Plc (Praxair Technology, Inc.) (LNG Solutions, Hydrogen Refueling Systems)

-

Maine Oxy (Cryogenic Gases, Welding Gases)

-

Messer Group GmbH (Cryogenic Supply Systems, Liquid Oxygen)

-

Mitsubishi Chemical Holdings (Taiyo Nippon Sanso) (Hydrogen Generators, Cryogenic Pumps)

-

Narco Inc. (Cryogenic Tanks, Liquid Oxygen)

-

Nikkiso Co., Ltd. (Cryogenic Pumps, Vaporizers)

-

SOL Group (Cryogenic Tanks, Liquid Nitrogen)

-

Shell Global (LNG, Hydrogen Fuel)

-

TechnipFMC (LNG Liquefaction Plants, Cryogenic Equipment)

-

The Hydrogen Company (Electrolyzers, Hydrogen Storage Systems)

-

TNSC (Taiyo Nippon Sanso) (Hydrogen Refueling Stations, Cryogenic Storage Systems)

-

TotalEnergies (LNG, Hydrogen Solutions)

-

WestAir Gases & Equipment, Inc. (Cryogenic Liquids, Industrial Gases)

-

Woodside Energy (LNG, Hydrogen Solutions)

RECENT DEVELOPMENTS

- May 2024: ISRO developed a semi-cryogenic engine that utilizes liquid oxygen and kerosene, which is an attempt to increase payload capacity for the satellite. Here, the cost of payload for the satellite is reduced, but better thrust and performance are retained as compared to current technological platforms.

- April 2023: Linde signed a green hydrogen supply agreement with Evonik in Singapore. It will design, build, own, and operate the nine-megawatt alkaline electrolyzer to produce green hydrogen for Evonik's methionine additive used in animal feed at Jurong Island.

- March 2023: Air Products and Chemicals, Inc. signed an agreement with Shaanxi LNG Reserves & Logistics Company to supply proprietary LNG process technology and equipment for the Xi'An LNG Emergency Reserve & Peak Regulation Project, located in Shaanxi Province, China, which would be supplied by Technip Energies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 112.57 Billion |

| Market Size by 2032 | US$ 195.08 Billion |

| CAGR | CAGR of 6.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Liquid Nitrogen, Liquid Air, Liquid Helium, Liquid Neon, Liquid Hydrogen, Liquefied Natural Gas (LNG)) • By Application (Aerospace & Space Exploration, Power Generation, Automotive, Marine, Others) • By End-Use Industry (Energy & Power, Aerospace & Defense, Transportation, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Air Liquide, SOL Group, Air Products & Chemicals, Linde Plc (Praxair Technology, Inc.), Air Water, Inc., Gulf Cryo, Narco Inc., Mitsubishi Chemical Holdings (Taiyo Nippon Sanso), Maine Oxy, Messer Group Gmbh and other key players |

| Drivers | • Rising investments in space exploration and aerospace contribute to the growth of the cryogenic fuels market • Rising Global Demand for Clean Energy Sources Accelerates the Adoption of Cryogenic Fuels |

| Restraints | • High Cost of Infrastructure Development Limits the Widespread Use of Cryogenic Fuels |