Hepatitis B Vaccine Market Size & Trends:

The Hepatitis B Vaccine Market size was USD 8.27 billion in 2023 and is expected to reach USD 13.02 billion by 2032 and grow at a CAGR of 5.17% over the forecast period of 2024-2032. The report presents critical statistical insights and emerging trends shaping the industry. It covers healthcare facility loan distribution, highlighting how funding access influences vaccination programs and storage infrastructure across regions. The study includes technology adoption and equipment lifecycle data, detailing how modern cold chain systems impact vaccine efficacy and distribution efficiency. It further examines mergers and acquisitions in the medical financing sector, illustrating the strategic moves by companies to expand their market footprint. Additionally, it analyzes the rising demand for financing solutions, driven by increased government and private investments in immunization initiatives. The report also explores innovation and R&D by vaccine type in 2023, shedding light on advancements in recombinant DNA and combination vaccines. Collectively, these insights help stakeholders understand the financial, technological, and developmental dynamics influencing the Hepatitis B vaccine landscape.

Get More Information on Hepatitis B Vaccine Market - Request Sample Report

The United States held the largest market share in the hepatitis b vaccine market in 2023, primarily due to strong government-led immunization programs, advanced healthcare infrastructure, and a high level of public health awareness. With a market size of USD 2.43 billion in 2023 and projected growth to USD 3.93 billion by 2032 at a CAGR of 5.47%, the U.S. continues to lead due to its comprehensive vaccination coverage and stringent disease prevention policies enforced by agencies such as the CDC. The country's robust pharmaceutical industry, coupled with continuous investments in vaccine R&D and rapid adoption of next-generation recombinant and combination vaccines, further strengthens its market dominance. Additionally, a high prevalence of hepatitis B in certain high-risk populations and an aging demographic demanding increased immunization contribute to sustained demand across healthcare facilities nationwide.

Hepatitis B Vaccine Market Dynamics

Drivers

-

Rising global immunization initiatives and government vaccination programs propel the hepatitis b vaccine market growth.

The Hepatitis B Vaccine Market is experiencing significant growth due to extensive global immunization initiatives and aggressive national vaccination programs. Governments across both developed and developing countries are actively incorporating hepatitis B vaccination into their national immunization schedules, particularly for infants, healthcare workers, and high-risk populations. Organizations like WHO and UNICEF continue to support low- and middle-income countries with funding and vaccine procurement through alliances such as Gavi. For instance, the WHO’s Immunization Agenda 2030 aims to ensure equitable vaccine access worldwide, further boosting demand. Additionally, public health campaigns, increased awareness, and integration with maternal and child health programs have significantly improved vaccination coverage rates. These factors collectively enhance vaccine accessibility and uptake, leading to a robust and sustained expansion of the Hepatitis B Vaccine Market over the forecast period.

Restrain

-

High cost of advanced vaccines and cold chain logistics hampers the growth of the hepatitis b vaccine market.

Despite growing demand, the Hepatitis B Vaccine Market faces restraints primarily due to the high cost associated with advanced vaccine formulations and cold chain maintenance. Recombinant and combination hepatitis B vaccines, though more effective, are relatively expensive, which limits their affordability in low- and middle-income nations. Furthermore, the need for a reliable cold chain infrastructure from production to distribution adds to the overall logistics cost, especially in remote or underdeveloped regions with poor healthcare infrastructure. Breaks in cold storage can render vaccines ineffective, leading to wastage and increased operational costs. This creates financial challenges for governments and non-profit health organizations aiming to improve immunization rates. These economic and logistical burdens hinder universal access, thereby slowing down the full potential growth of the market, particularly in economically challenged regions across Africa and parts of Asia.

Opportunity

-

Development of innovative single-dose and combination vaccines presents lucrative opportunities in the hepatitis b vaccine market.

Emerging innovation in single-dose and combination vaccines is opening new avenues for growth in the Hepatitis B Vaccine Market. Manufacturers are increasingly investing in the development of vaccines that combine hepatitis B with other antigens (such as DTP or Hepatitis A), which not only reduce the number of required injections but also improve patient compliance and reduce costs. The introduction of thermostable and needle-free delivery systems further enhances the scope for widespread adoption, especially in remote areas with limited medical access. In 2023, several pharmaceutical companies advanced clinical trials for combination pediatric vaccines that could be game-changers in reducing immunization gaps. These innovations cater to the growing demand for simplified immunization schedules and can significantly enhance coverage rates in underserved regions, making them a vital opportunity for market players in the years ahead.

Challenge

-

Vaccine hesitancy and misinformation pose a significant challenge to the growth of the hepatitis b vaccine market.

One of the most pressing challenges facing the Hepatitis B Vaccine Market is vaccine hesitancy driven by misinformation and lack of awareness. Despite global scientific consensus on vaccine safety and efficacy, persistent myths and skepticism—especially circulating on social media—continue to deter sections of the population from receiving timely immunizations. This issue is particularly significant in high-income countries where individuals may delay or refuse vaccines due to personal beliefs or mistrust in pharmaceutical companies. Additionally, cultural stigma and low health literacy in certain regions contribute to the fear of side effects or doubt about vaccine necessity. The WHO has identified vaccine hesitancy as one of the top ten global health threats, underscoring its impact on public health initiatives. Overcoming this challenge requires coordinated education campaigns, healthcare professional training, and improved communication strategies to build public trust in vaccination.

Hepatitis B Vaccine Market Segmentation Analysis

By Type

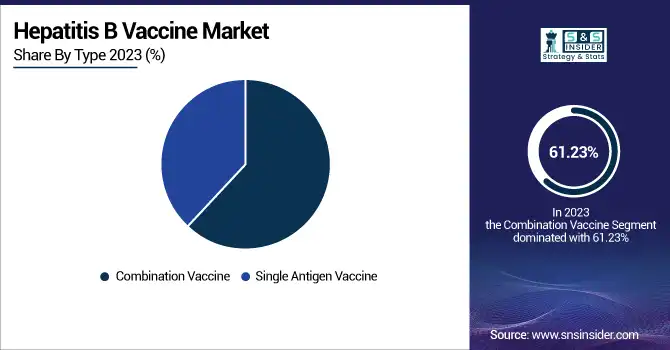

Combination Vaccine held the largest market share around 61.23%, in 2023. It owing to their ability to provide treatment for multiple diseases with a single shot, leading to a markedly improved immunization efficiency and patient compliance. The use of these combined vaccines, including the hexavalent vaccine in particular, allows national immunization programs a simpler task and alleviates the logistic burden of giving multiple separate vaccines. Furthermore, combination vaccines save costs in the future by decreasing storage, distribution, and administration expenses, which is particularly important for government-funded programs and initiatives associated with organizations such as Gavi and WHO. In developed and in emerging countries their adoption has been especially high where there is a need to simplify vaccination schedules for infants and young children. Such advantages have led to their massive adoption and eventual monopoly over the market.

By End-User Industry

Hospital held the largest market share at around 47% in 2023. It is owing to the vital role of hospitals in administering vaccinations for Hepatitis B during birth and during postnatal care and regular medical services. Hospitals, as the first service contact point for newborns, routinely administer hepatitis B birth dose as part of national immunization programs especially in countries with very high birth rates and good institutional delivery coverage. Likewise, hospitals have the facilities and staff to store and administer vaccines and monitor for any post-vaccination adverse events--and must abide by safety protocols set by the government. Increased awareness about nosocomial infections and preventive health care, in addition to adults and healthcare workers now choosing to be vaccinated for hepatitis B during routine hospital visits or pre-employment screenings. This coupled with greater patient confidence for hospital-based care have cemented hospitals as the preferred center to the distribution and administration thereby capturing the leading market share.

Hepatitis B Vaccine Market Regional Analysis

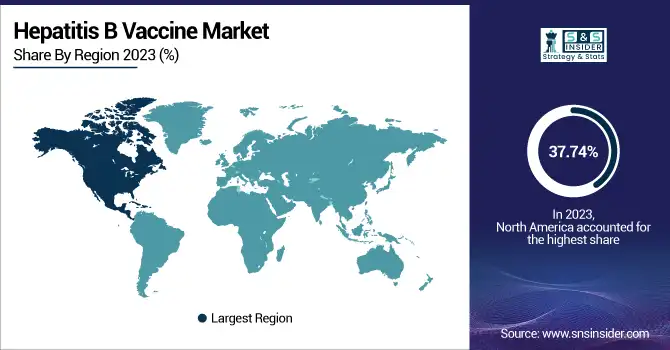

North America held the largest market share at around 37.74% in 2023. It is due to presence of established healthcare infrastructure, higher immunization awareness and presence of strong governmental led vaccination programs, the Hepatitis B Vaccine Market was acquired a major share in North America. In the U.S and Canada hepatitis B vaccination has been required for infants, health care workers, and high-risk individuals thus assuring a steady demand. Other reasons include strong funding support from public health agencies including the CDC and the Public Health Agency of Canada both of which are strong proponents of preventive vaccination vaccines to control the spread of disease. Also, the high per capita healthcare expenditure, presence of new vaccine technologies and collusion between major pharmaceutical companies facilitate wide availability and administration of hepatitis B vaccine. Additionally, increased political commitment to halt hepatitis B transmission and systematic adult immunization campaigns are further contributing to regional market leaders.

Asia Pacific held the significant market share. Its portfolio accounts for a larger population base and increasing birth rates and improved awareness regarding the need for immunization in emerging economies like China, India, and Southeast Asian countries. Mass vaccination campaign led by governments, especially within the national immunization programs has been a major resupplied on the demanded since the establishment of the demand. In countries such as China, vaccination against hepatitis B has been mandated for all newborns, and coverage has quickly become virtually complete. International health organizations, particularly WHO and Gavi, have been stepping up funding and technical assistance for the region. In addition to this, low-cost vaccine production centers, rising rural health reach, and a rapidly growing middle-class population supporting vaccine use trends are leading to peak vaccination rates in Asia Pacific and are translating as largest regional growth for the global hepatitis B vaccine market over the forecast period.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in the Hepatitis B Vaccine Market

-

GlaxoSmithKline (Engerix-B, Twinrix)

-

Gilead Science Inc. (Vemlidy, Viread)

-

Merck & Co., Inc. (Recombivax HB, Vaqta)

-

Shenzhen Kangtai Biological Products Co., Ltd. (HepBVac, KaiBiLi HepB)

-

Cyrus Poonawalla Group (Serum Institute of India Pvt.) (GeneVac-B, Hepavax-B)

-

Dynavax Technologies Corporation (HEPLISAV-B, SD-101)

-

Sanofi (Avaxim-HB, Shanvac-B)

-

VBI Vaccines Inc. (Sci-B-Vac, VBI-2601)

-

Meiji Group (KM Biologics) (Bimmugen, KM-B HepB)

-

LG Chem Ltd. (Euvax-B, HepB-12)

-

Indian Immunologicals Limited (Hepalert, Indivac-B)

-

Bharat Biotech (Revac-B, BioHep-B)

-

Zydus Lifesciences (Zyvac-B, Vax-B)

-

Panacea Biotec (EasyFour-HB, Enivac-HB)

-

Biological E. Limited (Bevac-B, ComBE Five)

-

Walvax Biotechnology (HepVax, WLV-B)

-

Sinovac Biotech (Healive, Sinovac-HepB)

-

Innovax Biotech (Innovax-HB, Reco-Hep)

-

Mitsubishi Tanabe Pharma (Tanabe-HepB, Entecavir Tanabe)

-

Crucell (Quinvaxem, HepB-Crucell)

Recent Developments:

-

In February 2024, Dynavax secured Marketing Authorization from the U.K.’s Medicines and Healthcare products Regulatory Agency (MHRA) for HEPLISAV B®, a two-dose hepatitis B vaccine for adults. This approval enables the active immunization of individuals aged 18 and above against hepatitis B virus infection.

-

In June 2023, VBI Vaccines strengthened its partnership with Brii Biosciences through expanded license and collaboration agreements valued at up to USD 437 million, along with potential royalty payments. The collaboration is focused on advancing both the prevention and treatment of hepatitis B.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD8.27 Billion |

| Market Size by 2032 | USD13.02 Billion |

| CAGR | CAGR of5.17 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single Antigen Vaccine, Combination Vaccine) • By End users (Hospital, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GlaxoSmithKline, Gilead Science Inc., Merck & Co., Inc., Shenzhen Kangtai Biological Products Co., Ltd., Cyrus Poonawalla Group (Serum Institute of India Pvt.), Dynavax Technologies Corporation, Sanofi, VBI Vaccines Inc., Meiji Group (KM Biologics), LG Chem Ltd., Indian Immunologicals Limited, Bharat Biotech, Zydus Lifesciences, Panacea Biotec, Biological E. Limited, Walvax Biotechnology, Sinovac Biotech, Innovax Biotech, Mitsubishi Tanabe Pharma, Crucell |