Global Healthcare Analytics Market Size & Overview:

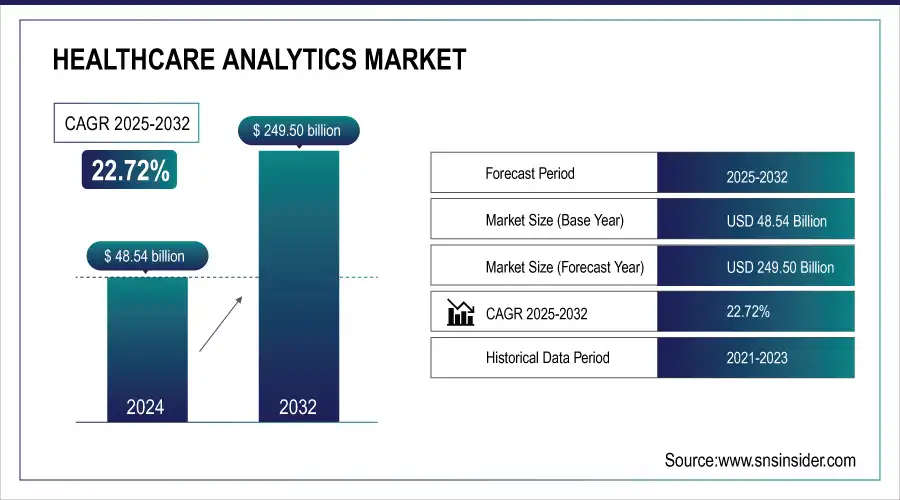

The Healthcare Analytics Market size was valued at USD 48.54 billion in 2024 and is projected to grow at a CAGR of 22.72% to reach USD 249.50 billion by 2032.

Get more information on Healthcare Analytics Market - Request Sample Report

The healthcare analytics market is experiencing remarkable growth, driven by the increasing availability of data and the need for data-driven decision-making in healthcare. This market encompasses the use of advanced tools and technologies to analyze various healthcare data, such as electronic health records (EHRs), medical imaging, clinical trial data, and patient outcomes.

The growing burden of chronic diseases further drives the market, with conditions such as diabetes and heart disease accounting for approximately 90% of the nation’s USD 3.8 trillion in annual healthcare expenditures. According to the Centers for Disease Control and Prevention, nearly 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 adults have two or more chronic diseases. Healthcare analytics tools enable healthcare providers to identify at-risk populations and offer personalized interventions. For example, the use of data analytics for chronic disease management has led to significant improvements in patient outcomes, as seen in programs that focus on reducing hospital admissions for diabetic patients by using real-time analytics to predict acute events. Additionally, the shift towards value-based care models is accelerating the demand for healthcare analytics. The U.S. Centers for Medicare & Medicaid Services reports that by 2023, over 50% of all Medicare beneficiaries were being treated under value-based care models, which emphasize improving patient outcomes while controlling costs. A 2021 report from the American Medical Association underscores that EHR adoption, along with analytics, supports clinicians in making data-informed decisions that improve patient care. This push toward efficiency is exemplified by the success of predictive analytics in identifying high-risk patients and reducing emergency room visits, which has been shown to reduce healthcare costs by 20-30%.

The cloud-based analytics platforms are also becoming essential, as they allow for scalable solutions and ease of data sharing across various healthcare entities. According to a 2021 study in the American Health Information Management Association Journal, cloud analytics platforms enable real-time access to healthcare data, improving collaboration among healthcare professionals and leading to better patient outcomes. Recent data from AHA suggests that nearly 70% of hospitals have adopted cloud-based healthcare technologies, further indicating the shift towards digital and scalable solutions. Furthermore, the U.S. Department of Health and Human Services (HHS) projects that federal strategies for data modernization (such as the Data Modernization Initiative) will enable more effective use of healthcare data to drive innovation in predictive analytics, population health management, and clinical research. In its latest updates, the CDC indicates that healthcare data modernization is expected to save billions in healthcare costs over the next decade by improving patient outcomes and reducing inefficiencies in care delivery.

Market Size and Forecast:

-

Market Size in 2024 USD 48.54 Billion

-

Market Size by 2032 USD 249.50 Billion

-

CAGR of 22.72% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Healthcare Analytics Market Trends:

-

Rising adoption of wearable devices is generating large volumes of real-time health data, driving demand for advanced analytics solutions.

-

Increasing focus on personalized medicine is promoting the use of analytics to tailor treatments based on genetic, lifestyle, and environmental factors.

-

Analytics is being leveraged to monitor treatment responses, accelerate drug development, and improve patient recovery times.

-

Growing emphasis on patient-centric healthcare is enhancing resource allocation and improving overall healthcare outcomes.

-

Stricter regulatory requirements for healthcare data management are encouraging investment in secure and efficient analytics technologies.

Healthcare Analytics Market Growth Drivers:

-

Healthcare Analytics Market Growth Driven by Wearable Devices, Personalized Medicine, and Regulatory Changes

The healthcare analytics market is experiencing rapid growth, driven by several transformative factors that are reshaping the industry. A major contributor to this expansion is the rising adoption of wearable devices. These devices, which provide real-time data on patient health, are enabling healthcare providers to make more informed decisions regarding prevention and treatment. Wearable health trackers are particularly effective in managing chronic conditions such as diabetes and heart disease, facilitating timely interventions that reduce the likelihood of emergencies. As both patients and healthcare providers increasingly embrace these devices, the volume of health data being generated grows, driving the demand for advanced analytics solutions to process and analyze this information. Another key factor is the growing emphasis on personalized medicine. As healthcare becomes more patient-centric, analytics plays a critical role in tailoring treatments based on individual genetic, lifestyle, and environmental factors. This trend is enhancing patient outcomes and ensuring better allocation of healthcare resources. Healthcare analytics also aids in monitoring treatment responses, accelerating drug development, and promoting faster recovery times. Additionally, tighter regulatory requirements surrounding healthcare data management are encouraging the adoption of robust analytics tools. Governments and regulatory bodies are implementing stricter standards for data protection, prompting healthcare organizations to invest in technologies that can securely and efficiently manage large datasets.

Healthcare Analytics Market Restraints:

-

Data Security, High Costs, Skill Shortages, and System Fragmentation

One of the primary concerns is the issue of data privacy and security. With the increasing digitization of healthcare data across various platforms and devices, the risk of data breaches grows significantly. Strict regulations like HIPAA in the U.S. and GDPR in Europe impose rigorous compliance requirements, making it difficult for healthcare organizations to safeguard sensitive data while leveraging advanced analytics technologies. This challenge often results in hesitation among providers to fully embrace analytics solutions.

Additionally, the high cost of implementing healthcare analytics, particularly those involving artificial intelligence and machine learning, remains a significant barrier. These technologies are expensive to develop, deploy, and maintain, which can be financially burdensome for smaller healthcare facilities, especially in developing regions. Furthermore, the shortage of skilled professionals in data science and analytics adds to the problem, as healthcare organizations struggle to find qualified personnel to manage and analyze complex datasets. These skills gap further slows the adoption of analytics tools. Finally, the fragmented nature of healthcare systems complicates data integration and interoperability, limiting the effectiveness of analytics tools across various platforms and environments.

Healthcare Analytics Market Segment Analysis:

By Type

Descriptive analysis was the dominant segment in the healthcare analytics market in 2024, accounting for a 37.8% market share. This type of analysis is focused on interpreting historical data to identify trends, patterns, and behaviors within healthcare systems. The reason for its dominance is that healthcare organizations mainly rely on descriptive analytics to track past performance, patient outcomes, and operational efficiency. It provides essential insights that guide healthcare management decisions and improve care delivery.

Predictive analysis is the fastest-growing segment over the forecast 2025-2032. This segment uses historical data to predict future outcomes, trends, and potential risks. As healthcare providers increasingly focus on improving patient outcomes, reducing costs, and optimizing resource utilization, predictive analytics is becoming a critical tool. Its ability to forecast disease progression, patient admissions, and treatment outcomes is driving its rapid adoption across healthcare systems.

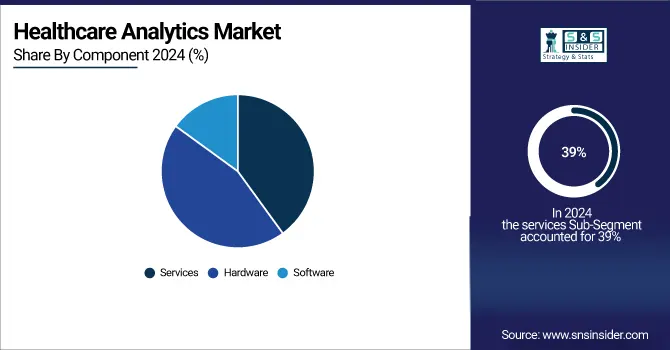

By Component

The services segment was the dominant component in healthcare analytics in 2024 with a 39% share. This segment has the largest share of the market due to the increasing demand for consulting, implementation, and support services. As healthcare organizations continue to adopt advanced analytics tools, they require expert services to help integrate, optimize, and maintain these solutions. The growing complexity of analytics platforms and the need for personalized, tailored solutions are driving the dominance of the services segment in the healthcare analytics market.

In addition to being the dominant segment, services also represent the fastest-growing segment throughout the forecast period. This growth is fueled by the rising need for professional services to support the deployment and optimization of complex analytics solutions. Healthcare organizations are increasingly turning to specialized service providers to help them navigate the complexities of advanced analytics tools, leading to rapid expansion in this segment.

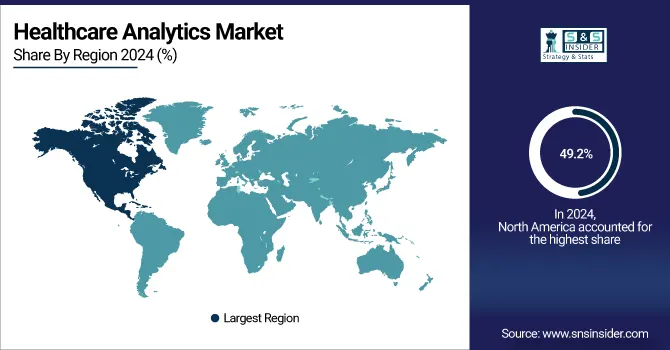

Healthcare Analytics Market Regional Analysis:

North America Healthcare Analytics Market Insights

In 2024, North America led the healthcare analytics market, holding a 49.2% share. The advanced healthcare infrastructure, high adoption rate of digital health technologies, and significant investments in healthcare IT drive the region's dominance. The United States, in particular, has witnessed substantial growth due to implementing policies supporting healthcare data interoperability, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act. Furthermore, the presence of key players and the demand for solutions focused on improving patient care and reducing healthcare costs are major factors contributing to North America's market leadership.

Need any customization research on Healthcare Analytics Market - Enquiry Now

Asia Pacific Healthcare Analytics Market Insights

The Asia Pacific region is the fastest-growing in the healthcare analytics market. This growth is primarily due to the rising adoption of digital health solutions, expanding healthcare infrastructure, and increasing investments in healthcare IT. Emerging economies such as China and India are rapidly adopting healthcare analytics to enhance healthcare services and improve patient care. Additionally, the increasing prevalence of chronic diseases and the need for data-driven decision-making are pushing the demand for healthcare analytics solutions across the region.

Europe Healthcare Analytics Market Insights

Europe’s healthcare analytics market is growing due to the adoption of electronic health records, advanced analytics technologies, and personalized medicine initiatives. Strong government support, stringent regulatory standards, and increasing investment in digital health infrastructure drive the demand for analytics solutions, improving patient outcomes, operational efficiency, and data-driven decision-making across healthcare systems.

Latin America (LATAM) and Middle East & Africa (MEA) Healthcare Analytics Market Insights

LATAM and MEA markets are expanding with rising digital healthcare adoption, growing chronic disease prevalence, and increasing government focus on healthcare modernization. Investment in analytics platforms helps optimize treatment, enhance patient care, and support decision-making. Limited infrastructure and evolving regulations are shaping the growth of healthcare analytics solutions in these regions.

Healthcare Analytics Market Key Players:

-

Merative – IBM Watson Health

-

Optum, Inc. – Optum Analytics, OptumIQ

-

SAS Institute Inc. – SAS Health Analytics, SAS Viya for Healthcare

-

Oracle – Oracle Health Sciences, Oracle Analytics Cloud

-

Citiustech Inc. – HealthCumulus, HealthBI

-

Inovalon – Inovalon ONE Platform

-

McKesson Corporation – McKesson Data Analytics Solutions

-

MedeAnalytics, Inc. – MedeAnalytics Platform

-

Cotiviti, Inc. – Cotiviti Analytics Platform

-

Exlservice Holdings, Inc. – EXL Health Analytics Solutions

-

Wipro – Wipro Health Analytics, Wipro HOLMES

-

Apixio – Apixio AI Platform

-

Komodo Health, Inc. – Komodo Healthcare Platform

-

Health Catalyst – Health Catalyst Data Operating System (DOS), Healthcare Analytics Platform

-

CVS Health – CVS Health Analytics Solutions

-

Veradigm – Veradigm Health Insights

-

Enlitic – Enlitic AI Analytics

-

HealthEC LLC – HealthEC Analytics Platform

-

IQVIA – IQVIA Analytics Solutions, IQVIA Technologies

-

Arcadia Solutions, LLC – Arcadia Analytics Platform

-

Evidation Health, Inc. – Evidation Analytics Platform

-

HealthCorum – HealthCorum Analytics

-

Aetion, Inc. – Aetion Evidence Platform

-

Tredence Inc. – Tredence Healthcare Analytics Solutions

-

Sisense Ltd. – Sisense for Healthcare

Competitive Landscape for Healthcare Analytics Market:

Forian Inc. is a healthtech company specializing in data science-driven information and analytics solutions for the healthcare and life sciences industries. It offers a suite of data management capabilities and proprietary information solutions to optimize and measure operational, clinical, and financial performance for customers.

-

In Dec 2024, Forian Inc. partnered with Databricks to expand access to its Chartis product, which maps physician and organization affiliations, through the Databricks Marketplace. This collaboration aims to provide healthcare organizations with enhanced visibility into Forian's data solutions, fostering innovation in healthcare research, drug development, and patient care.

Tuva Health is an open-source healthcare data transformation platform founded by former Health Catalyst and Strive Health executives. It empowers healthcare organizations to convert raw claims and EHR data into analytics-ready tables through a standardized data model. Tuva's tools include data quality testing, normalization, and enrichment, facilitating real-time analytics and AI-driven insights.

-

In Dec 2024, Tuva Health launched an open-source platform aimed at transforming the healthcare analytics industry. The company has emerged from stealth mode with USD 5 million in funding and has partnered with over 25 organizations to promote transparent and accessible data analytics.

| Report Attributes | Details |

| Market Size in 2024 | USD 48.54 Billion |

| Market Size by 2032 | USD 249.50 Billion |

| CAGR | CAGR of 22.72% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Descriptive Analysis, Predictive Analysis, Prescriptive Analysis) •By Component (Software, Hardware, Services) •By Delivery Mode (On-premises, Web-hosted, Cloud-based) •By Application (Clinical, Financial, Operational and Administrative) •By End-use (Healthcare Payers, Healthcare Providers, Life Science Companies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Merative, Optum, Inc., SAS Institute Inc., Oracle, Citiustech Inc., Inovalon, McKesson Corporation, MedeAnalytics, Inc., Cotiviti, Inc., Exlservice Holdings, Inc., Wipro, Apixio, Komodo Health, Inc., Health Catalyst, CVS Health, Veradigm, Enlitic, HealthEC LLC, IQVIA, Arcadia Solutions, LLC, Evidation Health, Inc., HealthCorum, Aetion, Inc., Tredence Inc., Sisense Ltd |