High Voltage MOSFET Market Size & Growth:

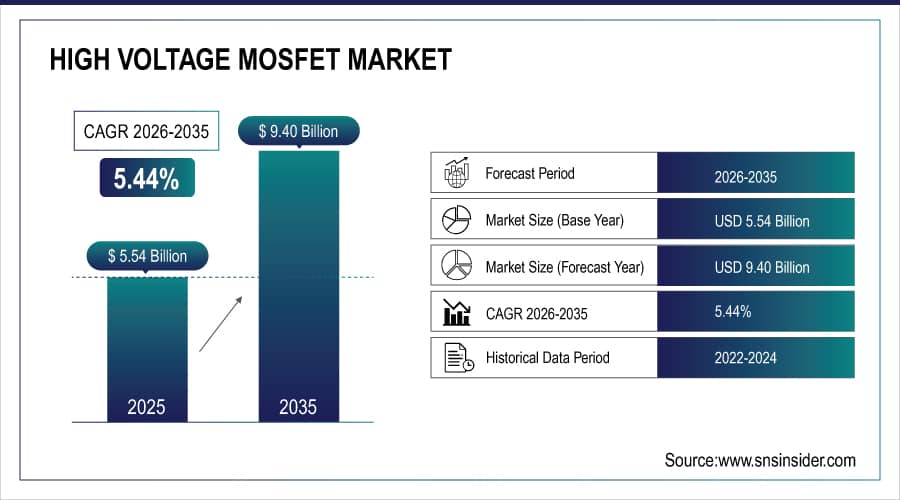

The High-voltage MOSFET Market size was valued at USD 5.54 Billion in 2025 and is projected to reach USD 9.40 Billion by 2035, growing at a CAGR of 5.44% during 2026-2035.

Rising electric vehicle adoption, energy-efficient power systems demand, industrial automation and renewable energy integration are key factors driving the High Voltage MOSFET Market growth. Silicon carbide (SiC) technology advancements and compact power designs, further spurred the market growth of this various key regions.

The High Voltage MOSFET Market growth is mainly attributed to rising demand for miniaturized and high-performance electronic devices in consumer and industrial applications. Increasing investments in smart grid infrastructure and expansion of data centers drives demand for dependable power management solutions. In addition, the growing strict government regulation for energy efficiency and emission reduction, promoting adoption of advanced semiconductor components. Innovations in packaging technologies and their integration with auxiliary devices also improve MOSFET performance, benefiting the growth of MOSFET in hugely adopted applications like telecommunications, aerospace, and defense.

The U.S. Department of Energy announced a historic USD 3.5 billion investment to enhance the resilience of the electric grid, supporting 58 projects aimed at improving grid reliability and integrating renewable energy sources.

High-voltage MOSFET Market Size and Forecast:

-

Market Size in 2025 USD 5.54 Billion

-

Market Size by 2035 USD 9.40 Billion

-

CAGR 5.44% from 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026–2035

-

Historical Data 2022–2024

To Get more information On High Voltage MOSFET Market - Request Free Sample Report

High-voltage MOSFET Market Highlights:

-

Increasing demand in electric vehicles and renewable energy applications is driving market growth.

-

Rising adoption in industrial automation and power management systems boosts high-voltage MOSFET deployment.

-

Technological advancements in silicon carbide (SiC) and gallium nitride (GaN) MOSFETs enhance efficiency and performance.

-

Asia-Pacific leads the market due to high manufacturing capacity and growing electronics industry.

-

Major players focus on strategic collaborations, mergers, and product innovations to expand market presence.

-

Growing need for energy-efficient and compact power devices in consumer electronics and telecom sectors supports market expansion.

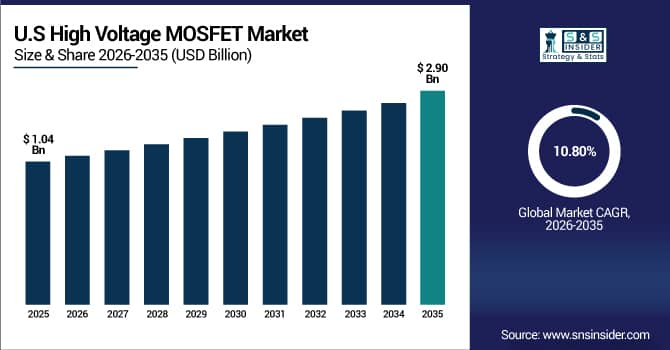

The U.S. High Voltage MOSFET Market size is estimated to be valued at USD 1.04 billion in 2025 and is projected to grow at a CAGR of 10.80%, reaching USD 2.90 billion by 2035. Advances in wide-bandgap semiconductors, combined with government support in the form of the CHIPS Act and a rising number of renewable energy projects that typically demand efficient power conversion systems, drive growth in the U.S. High Voltage MOSFET Market trends.

High-voltage MOSFET Market Drivers:

-

High Voltage MOSFET Market Booms with AR Advancements in 5G Expansion and Rising Demand for Immersive Tech

The global market for high-voltage MOSFETs is driven largely by the need for efficient power management and high-performance semiconductor devices. The growing uptake of renewables like solar and wind energy also increases demand for dependable power conversion devices, further fueling MOSFET growth. Moreover, growing industrial automation and smart grid infrastructure across the globe is having a substantial impact on the growth of the market. The rising stringent governmental regulations regarding the energy efficiency and emission reduction also accelerate the adoption of advanced high-voltage MOSFETs having the potential to help in multiple sectors for sustainability.

The U.S. Department of Energy's Grid Resilience Innovative Partnership (GRIP) Program, Supported by USD 10.5 billion in funding, this program focuses on grid modernization and cybersecurity, reflecting mature market priorities.

High-voltage MOSFET Market Restraints:

-

High-voltage MOSFET Face Challenges from Privacy Battery Limits Software Compatibility and User Comfort Issues

The major restraint in the High Voltage MOSFET Market is the tedious manufacturing process of the wide-bandgap semiconductor devices including SiC- and GaN-based MOSFETs. Although those are extremely efficient when made, they face the challenges of how to grow them as crystals, quality of the wafer and packaging the device. As a result, making these types of devices compatible for existing circuit designs requires a specialized expertise, and design modifications, prohibiting their widespread integration in legacy systems. Moreover, transitioning from legacy silicon-based devices to alternative technology requires significant R&D and validation, further hindering the market penetration.

High-voltage MOSFET Market Opportunities:

-

High-voltage MOSFET Unlock Growth with Better Design Healthcare Use and Expanding Tech Ready Global Markets

The key growth-related opportunities in the market is associated with the ongoing advancements in wide-bandgap semiconductor materials, such as silicon carbide (SiC) and gallium nitride (GaN), which feature better thermal performance and efficiency. New growth opportunities arise from new applications in aerospace, telecommunications, and data centers. In addition, the rising investments for improving power infrastructure in underdeveloped areas offers market growth opportunities. Furthermore, this opens new horizons for national and international entrepreneurs as MOSFETs are also used in the next generation of small compact low-power electronic appliances as well.

In October 2023, Infineon Technologies AG acquired GaN Systems Inc. for $830 million, enhancing its position in the GaN power semiconductor market and accelerating its GaN roadmap.

High-voltage MOSFET Market Segment Analysis:

By Product Type

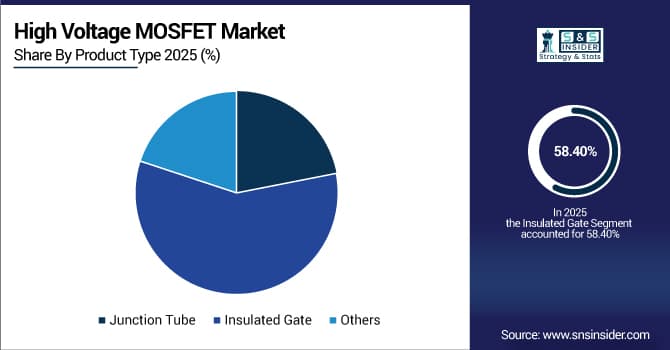

The market share of Insulated Gate MOSFETs reached 58.4% in 2025, and it is expected to witness the fastest CAGR over 2026-2035 due to their higher switching speed, higher efficiency, and superior thermal stability, they are rapidly becoming the dominant solution in many applications including automotive, consumer electronics, and industrial power systems. Moreover, the rising need for low-power and small-form-factor power devices will also accelerate insulated gate MOSFETs adoption across the globe.

Nonetheless, trickier mass production approaches and measuring it with the expertise currently available come with its own hurdles. Continued development of high-voltage and high-temperature reliability is also needed. Nevertheless, continued progress in semiconductor technology and increased energy investment in the renewable energy and smart grid are considerable short term growth drivers. The insulated gate MOSFET segment is ease poised to take advantage of these trends, propelling the overall market growth during the forecast period.

By Application

In 2025, Automotive Electronics accounted for the largest share of the High Voltage MOSFET Market share at 37.7%, caused by the increasing uptake of electric vehicles (EVs) as well as advanced driver-assistance systems (ADAS). Essential characteristics of power management and components of semiconductor parts are demanded in high volumes to manage the power flow of EV powertrains, cracked battery management systems, and in-vehicle infotainment systems. Also, strict emission regulations and a transition toward sustainable transportation are driving high-voltage MOSFET industry adoption in automotive applications, further strengthening the top share of the segment.

During 2026-2035, the highest CAGR is anticipated for Consumer Electronics, driven by the increasing need for small-sized and energy-efficient devices, including smartphones, wearables, and smart home appliances. Anecdotal evidence from compact low-power electronic components and increasing consumer awareness of energy conservation further push this growth. With rapidly evolving technology trends, the consumer electronics segments will gradually integrate high voltage MOSFETs to offer improved performance and efficiency as well as enhancing device battery life will open up the high voltage MOSFET global market.

High-voltage MOSFET Market Regional Analysis:

Asia-Pacific High-voltage MOSFET Market Trends:

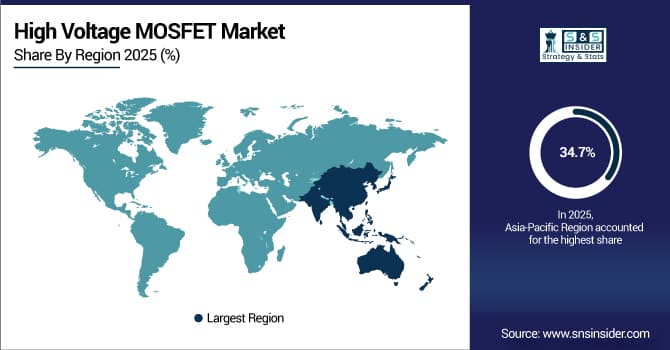

Asia Pacific led the high voltage MOSFET market with a 34.7% share in 2025 and is also expected to register the fastest CAGR over 2026-2035. Rapid industrialization, growing automotive, and consumer electronics industries, and rising investment across renewable energy and smart grid infrastructure is benefitting this region. Increasing acceptance of electric vehicles and the increasing number of data centers, among others, are increasing the demand for effective power management solutions, deepening the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Moreover, the emphasis on technological innovation and friendly government policies in the region also promotes advanced semiconductor devices design and implementation. Additionally, the growing urbanization and growing disposable income of the population, with increasing consumption of electronic devices, provides a significant opportunity for high-voltage MOSFET manufacturers. The Asia Pacific market is expected to continue to maintain its top position globally during the forecast period due to continued infrastructure development and the use of industrial automation and telecom applications.

Due to a strong electronics manufacturing ecosystem, rapid adoption of electric vehicles, growing renewable energy projects and robust government support for domestic semiconductor innovation, China was the largest market for high-voltage MOSFETs in the Asia Pacific region.

North America High-voltage MOSFET Market Trends:

North America paces the High Voltage MOSFET Market on account of strong technological advancements and early adoption wave for power-efficient semiconductor solutions. Smart investments in data centers, industrial automation and electric mobility are further boosting the region. Stakeholders in the construction, HVAC, and energy industries are investing in building energy-efficient infrastructure and expanding renewable energy projects and smart grid developments, which drives the market. Moreover, several semiconductor giants are already established in these regions, which in conjunction with consistent R&D initiatives, make the region a major player in the evolution of next-gen power electronics technologies.

Powered by extensive R&D capabilities, major semiconductor companies' presence, rapid data center expansion, and rising electric vehicles and renewable energy penetration, North America accounted for the largest share of the High Voltage MOSFET Market in the U.S.

Europe High-voltage MOSFET Market Trends:

High-voltage MOSFET also occupy a sizeable market in Europe owing to a solid regulatory framework aimed at energy efficiency and emission reductions. Stringent government regulations, high adoption of electric vehicle and industrial automation as well as renewable energy systems in the region are among the key growth drivers. Further, increasing developments in smart grid infrastructure and growing emphasis on sustainable power management solutions are expected to drive the demand for regulated power supply more in future. Some of the other factors driving continuous growth for power electronics in the region are increasing investments in advanced semiconductor technologies, and strong automotive and industrial ecosystem.

Latin America and Middle East & Africa High-voltage MOSFET Market Trends:

Latin America and the Middle East & Africa (MEA) are potential emerging markets area for high-voltage MOSFET due to growth of energy infrastructure development post COVID and surge in industrial automation. Both those areas are driving increased demand for efficient power management solutions to address renewable energy projects. Long-term market potential in these regions is also supported by government initiatives moving forward with electrification and digital transformation, and low-teens CAGR growth in the automotive and broader consumer electronics sectors.

High-voltage MOSFET Market Competitive Landscape:

Infineon Technologies, founded in 1999 and headquartered in Neubiberg, Germany, is a global leader in semiconductor solutions, specializing in power semiconductors, automotive chips, security ICs, and high-voltage MOSFETs, serving industries from automotive and industrial electronics to renewable energy and consumer applications worldwide.

-

In March 2024, Infineon introduced the CoolSiC™ 2000 V MOSFETs in the TO-247PLUS-4-HCC package, marking the first discrete silicon carbide device with a 2000 V breakdown voltage. These MOSFETs are designed for high-power applications, such as solar inverters and EV charging.

Wolfspeed, founded in 1987 and headquartered in Durham, North Carolina, USA, is a leading innovator in wide bandgap semiconductors, specializing in silicon carbide (SiC) and gallium nitride (GaN) power devices, including high-voltage MOSFETs, serving electric vehicles, renewable energy, industrial power, and telecom markets globally.

-

In January 2025, Wolfspeed launched its Gen 4 MOSFET technology platform, supporting 750 V, 1200 V, and 2300 V classes, designed to improve system efficiency, reduce development time, and enhance durability for high-power applications.

High-voltage MOSFET Market Key Players:

-

Infineon Technologies

-

ON Semiconductor

-

STMicroelectronics

-

Texas Instruments

-

Toshiba Corporation

-

Renesas Electronics

-

Mitsubishi Electric Corporation

-

Nexperia

-

ROHM Semiconductor

-

Vishay Intertechnology Inc

-

Fuji Electric Co., Ltd

-

Fairchild Semiconductor (now part of ON Semiconductor)

-

Maxim Integrated (acquired by Analog Devices)

-

Analog Devices, Inc

-

Microchip Technology

-

Diodes Incorporated

-

International Rectifier (acquired by Infineon)

-

Semikron

-

UnitedSiC

-

Cree, Inc. (Wolfspeed)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.54 Billion |

| Market Size by 2035 | USD 9.40 Billion |

| CAGR | CAGR of 5.44% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Junction Tube, Insulated Gate, and Others) • By Application (Consumer Electronics, Automotive Electronics, Power Systems, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Infineon Technologies, ON Semiconductor, STMicroelectronics, Texas Instruments, Toshiba Corporation, Renesas Electronics, Mitsubishi Electric Corporation, Nexperia, ROHM Semiconductor, Vishay Intertechnology Inc, Fuji Electric Co., Ltd, Fairchild Semiconductor (now part of ON Semiconductor), Maxim Integrated (acquired by Analog Devices), Analog Devices, Inc, Microchip Technology, Diodes Incorporated, International Rectifier (acquired by Infineon), Semikron, UnitedSiC, Cree, Inc. (Wolfspeed) |