HIV Diagnostics Market Size:

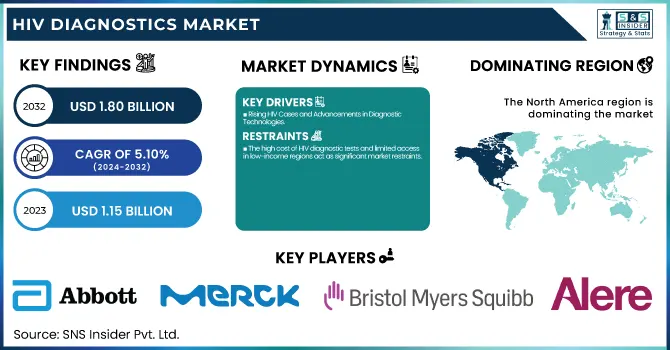

The HIV Diagnostics Market Size was valued at USD 1.15 billion in 2023 and is expected to reach USD 1.80 billion by 2032 and grow at a CAGR of 5.10% over the forecast period 2024-2032. This report emphasizes the increasing prevalence and incidence of HIV, coupled with geographical differences in testing and diagnosis levels that affect market demand. The research analyzes the number of HIV diagnostic tests by region, which demonstrates the effects of healthcare accessibility and awareness drives. It also investigates healthcare expenditure on HIV diagnostics, divided by government expenditure, commercial investment, private contributions, and out-of-pocket spending. The report also evaluates the uptake of cutting-edge HIV diagnostic technologies, including rapid point-of-care testing and molecular diagnostics, and their contribution to enhanced early detection and disease management. In addition, it examines regulatory approvals and policy reforms, highlighting their impact on market growth, innovation, and global access to HIV diagnostic solutions.

To Get more information on HIV Diagnostics Market - Request Free Sample Report

HIV Diagnostics Market Dynamics

Drivers

-

Rising HIV Cases and Advancements in Diagnostic Technologies

The rising worldwide incidence of HIV continues to fuel the market for sophisticated diagnostic platforms. UNAIDS estimates that there were about 39 million individuals living with HIV in 2023, with more than 1.3 million new infections being reported. Early diagnosis continues to be key to stemming transmission and enhancing treatment success, and this has fueled a growth in HIV testing programs. Governments and international bodies, such as the WHO and Global Fund, are aggressively promoting large-scale screening programs, driving market growth further. Advances in technology, including rapid point-of-care (POC) tests and self-testing kits, have transformed HIV diagnostics by increasing accessibility and decreasing turnaround time. Abbott and OraSure Technologies are at the forefront of innovation with highly sensitive and easy-to-use diagnostic kits. Additionally, increasing the use of multiplex testing, allowing for the simultaneous identification of multiple infections, is enhancing efficiency and precision. Higher R&D investments also promote the creation of next-generation diagnostic technologies, including AI-based testing products. Combinations of digital health platforms for remote monitoring and telemedicine-based HIV consultations even enhance market growth. Since an increase in consciousness and newer machines being more in reach, the HIV diagnostics market has been anticipated to grow immensely fulfilling the pressing necessity for early accurate detection globally.

Restraints

-

The high cost of HIV diagnostic tests and limited access in low-income regions act as significant market restraints.

Most advanced diagnostic technologies, including nucleic acid amplification tests (NAATs), are still costly, and their broad implementation is hindered in resource-limited environments. For instance, while high-income nations can sustain sophisticated HIV testing platforms, low-income settings find themselves using conventional serological assays, whose sensitivity in identifying infection in early stages may be poor. Furthermore, the cost of upkeep of laboratory facilities and highly trained staff further taxes the healthcare system, especially in developing countries. WHO reports that fewer than 70% of those infected with HIV in poor nations know their status, mostly because they have little access to low-cost testing. Another essential constraint is HIV-testing stigma, which discourages individuals from going for early diagnosis. Most individuals, particularly in conservative communities, fear discrimination and exclusion, and as a result, have low rates of screening. In addition, regulatory issues and long approval processes for new diagnostic products are preventing market growth. Harsh compliance measures and delays in approvals have the potential to limit the introduction of innovative testing solutions into the market. Until cost-effective substitutes and enhanced funding programs are initiated, affordability and accessibility will be major obstacles to global HIV diagnosis efforts.

Opportunities

-

The increasing acceptance of self-testing kits and the integration of digital health solutions present significant growth opportunities for the HIV diagnostics market.

The WHO has supported HIV self-testing as a primary approach to increase early detection, particularly among vulnerable groups. Self-testing kits like the OraQuick In-Home HIV Test are becoming popular because they are convenient, private, and easy to use. UNAIDS states that self-testing grew more than 60% from 2020 to 2023 due to awareness initiatives and availability online. Such a trend is especially helpful in areas where stigma is a hindrance to standard testing approaches. In addition, growths in digital health, such as mobile applications and telemedicine platforms, are facilitating diagnostic service access. Diagnostic analytics powered by AI and cloud sharing of data are optimizing patient tracking and result interpretation. Firms such as Abbott and QIAGEN are investigating digital connectivity technologies for connecting HIV diagnostics with electronic health records (EHRs). Furthermore, government efforts towards decentralized testing and public-private collaborations are further accelerating market growth. For instance, the U.S. government's "Ending the HIV Epidemic" program features enhanced self-testing programs. With ongoing advancements in technology, the combination of self-testing, digital platforms, and remote healthcare solutions is likely to revolutionize HIV diagnostics, making it more accessible and efficient.

Challenges

-

Supply chain disruptions and concerns over test accuracy pose major challenges in the HIV diagnostics market.

The COVID-19 pandemic revealed a weakness in the global supply chain, and this created shortages in diagnostic kits, reagents, and testing equipment. Delays in manufacturing and transport restrictions also severely affected the availability of HIV tests, especially in developing countries. Even in recovery from the pandemic, geopolitical tensions, trade restrictions, and volatility in raw material prices persistently interfere with production and supply networks. Also, accuracy issues remain a concern, especially for rapid and self-testing kits. Although these tests are convenient, false positives or false negatives may result in misdiagnosis, postponing timely intervention. A study in The Lancet indicated that certain self-test kits had variations in sensitivity, which raised issues of reliability. Additionally, varying regulatory standards among countries introduce variability in test quality and approval procedures. Maintaining quality control and standardization is a challenge for manufacturers, especially when increasing production for global distribution. The absence of proper post-test counseling and care linkage also makes the market situation more complex, as positive individuals might find it difficult to receive immediate medical advice. Overcoming these issues demands investment in strong supply chain management, enhanced quality assurance practices, and improved healthcare infrastructure to provide accurate and timely HIV diagnosis globally.

HIV Diagnostics Market Segmentation Analysis

By Product

The consumables segment led the HIV diagnostics market, with a share of 45.5% of overall revenue in 2023. The leadership owes to the steady demand for test kits, reagents, and assay consumables, which are used to detect HIV, monitor viral loads, and conduct confirmatory tests. The high usage of consumables is also driven by the repeated consumption of consumables in diagnostic labs, hospitals, and point-of-care facilities. Moreover, increased incidence of HIV and government-sponsored screening programs have witnessed sharply higher levels of HIV tests being performed worldwide, boosting demand for consumables even more. The growth of the segment is also being driven by improvements in test accuracy and sensitivity, especially for rapid diagnostic tests (RDTs), that have increased access in low-resource settings.

The software & services segment is anticipated to witness the highest growth in the coming years. This is owing to the expanding use of digital technologies in HIV diagnostics, such as cloud-based data management solutions, telemedicine services, and automated laboratory products. The expanded use of electronic health records (EHR) and artificial intelligence (AI) in diagnostic work increases efficiency while allowing remote monitoring of patients. With healthcare providers and laboratories moving increasingly towards digital solutions, the software & services segment is on the verge of massive growth.

By Mode

The laboratory-based testing category maintained its dominant 90.9% revenue position in 2023, as it remains the most trusted method of HIV diagnosis. The reason for such dominance is the high precision, stability, and universal accessibility of laboratory-based HIV tests. Centralized laboratories are responsible for the majority of HIV testing, including confirmatory assays like nucleic acid testing (NAT), CD4 count testing, and viral load testing. Government-sponsored HIV screening programs and global health agencies still use laboratory-based testing for mass-scale HIV detection and surveillance. The availability of qualified experts, sophisticated infrastructure, and high-quality control protocols further support the prevalence of laboratory-based diagnostics. Moreover, testing at hospitals continues to play an important role in the accurate and timely diagnosis of HIV, especially in high-epidemic areas.

The self-testing segment is also expected to develop at the highest rate owing to growing consumer demand for privacy, convenience, and accessibility. Self-test kits enable users to test their HIV status at home, free from the stigma of visiting clinics. Government campaigns for at-home testing, particularly in high-prevalence areas, are driving adoption levels. In addition, rapid test technology improvements have increased the affordability and accuracy of self-testing kits, making them more accessible. As awareness increases and better regulatory environments facilitate their distribution, self-testing will transform the HIV diagnostics market.

By Test type

The antibody test segment led the test category in 2023 with a 53.6% share of revenue. Antibody tests are the preferred HIV screening option because they are cost-effective, easy to administer, and produce quick results. They are regularly used in hospitals, clinics, and community facilities, and as such, play a central role in HIV testing programs worldwide. Rapid diagnostic tests (RDTs), as a subgroup, have gained popularity because they can provide results within minutes without the use of laboratory equipment. The antibody tests are also very important for large-scale screening programs and are used as the first step of detection for HIV before confirmatory tests. The fact that there are numerous testing formats available, such as oral fluid and blood tests, has also facilitated the use of antibody testing.

The segment of antibody testing is also predicted to expand at the highest growth rate, led by the growing demand for early detection of HIV and the rise of point-of-care testing. Development in the sensitivity and specificity of antibody tests are enhancing their diagnostic accuracy, thereby finding more takers. Rising awareness, HIV screening campaigns launched by the government, and the affordability of antibody testing are also further driving their popularity and market expansion.

By End Use

The diagnostic labs segment was the largest in terms of market share, and they generated 50.4% of revenue in 2023. This segment leads because laboratory testing plays an essential role in conducting confirmatory HIV testing, viral load measurement, and CD4 count monitoring. Highly specific and sensitive diagnostic tests are provided by diagnostic labs, so these are the ones that clinicians reach for to determine HIV. Governments and healthcare agencies persistently invest in lab-based test infrastructure to facilitate enhanced disease detection and effective control of HIV. Moreover, high-tech molecular diagnostic methods like PCR and NAT are mostly undertaken in equipped labs, strengthening the position of their necessity in the market. More importantly, enormous government screening efforts, hospital cooperation, and ever-constant innovations also underpin the rise of the segment.

The home settings segment is expected to experience the fastest growth, driven by the rise in the uptake of self-testing kits and rising demand for private, convenient HIV testing. Thanks to the provision of simple rapid test kits, people can now test their HIV status without a visit to a healthcare facility, lowering stigma and enhancing early diagnosis rates. Governments and NGOs are actively advocating self-testing as an integral part of their HIV prevention and control programs, especially in high-prevalence areas. In addition, the growth of e-commerce and online health platforms has popularized self-testing kits among a larger pool of population. With growing awareness and lowering costs, home testing will gain considerable momentum in the coming years.

HIV Diagnostics Market Regional Insights

North America dominated the HIV diagnostics market in 2023 owing to its established healthcare infrastructure, high awareness rates of the disease, and easy adoption of complex diagnostic technologies. The dominance of key players in the market, robust reimbursement norms, and excellent government support accentuate its status. Large-scale screening programs as well as policies for early diagnosis add to the growth of the market in this region.

Europe comes next as a prime market, backed by heightened HIV testing programs, positive healthcare policies, and advances in diagnostic technology. Germany, France, and the UK are leading the pack, reaping the rewards of high expenditure on healthcare and wide-ranging national screening programs. Government initiatives for encouraging early detection and prevention fuel further market expansion in this market.

The Asia-Pacific region is experiencing the most rapid expansion in the HIV diagnostics market, fueled by increasing HIV prevalence, increased awareness, and aggressive government-sponsored screening programs. China, India, and Thailand are heavily investing in increasing access to rapid HIV testing and self-test kits, enhancing early detection rates. Governments, NGOs, and international health organizations are also working together to increase the accessibility and affordability of diagnostic solutions. With improved healthcare infrastructure and awareness levels, Asia-Pacific is likely to emerge as a major regional contributor to the global HIV diagnostics market soon.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the HIV Diagnostics Market

-

Alere Inc.: Determine HIV-1/2 Ag/Ab Combo

-

Abbott: ARCHITECT HIV Ag/Ab Combo Assay

-

Bristol-Myers Squibb Company: Sustiva (efavirenz)

-

Janssen Global Services, LLC: Prezista (darunavir)

-

Gilead Sciences, Inc.: Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide), Sunlenca (lenacapavir)

-

Merck & Co., Inc.: Isentress (raltegravir)

-

ViiV Healthcare: Tivicay (dolutegravir), Triumeq (abacavir/dolutegravir/lamivudine)

-

BD (Becton, Dickinson and Company): BD FACSPresto System

-

Beckman Coulter, Inc.: Access HIV Combo Assay

-

PointCare: PointCare NOW System

-

F. Hoffmann-La Roche Ltd.: COBAS AmpliPrep/COBAS TaqMan HIV-1 Test

-

Siemens Healthcare GmbH: ADVIA Centaur HIV Ag/Ab Combo Assay

-

QIAGEN: artus HIV-1 QS-RGQ Kit

-

OraSure Technologies: OraQuick In-Home HIV Test

-

DiaSorin: LIAISON XL murex HIV Ab/Ag

Recent Developments

In Nov 2024, Egypt and the Global Fund signed a Framework Agreement to strengthen health systems, focusing on HIV and tuberculosis response while addressing COVID-19’s impact. UNDP will coordinate efforts with the Ministry of Health and civil society to enhance prevention and diagnostic services.

In April 2024, Cepheid's Xpert HIV-1 Qual XC received WHO prequalification, meeting global standards for performance, quality, and safety. This point-of-care diagnostic test enables early detection of HIV infections in infants using dried blood spots and whole blood samples, enhancing accessibility and accuracy in HIV diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.15 billion |

| Market Size by 2032 | USD 1.80 billion |

| CAGR | CAGR of 5.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Cancer, Infectious diseases, Osteoporosis, Pregnancy & fertility, Prenatal] • By End-Use [Hospitals, Laboratory, Home care, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd., Hologic, Inc., Quest Diagnostics Incorporated, Abbott, BD (Becton, Dickinson and Company), GE Healthcare, Koninklijke Philips N.V., Aspira Women's Health, Thermo Fisher Scientific Inc., Cardinal Health, Inc., Siemens AG, PerkinElmer Inc. |