Nucleic Acid Amplification Testing Market Size:

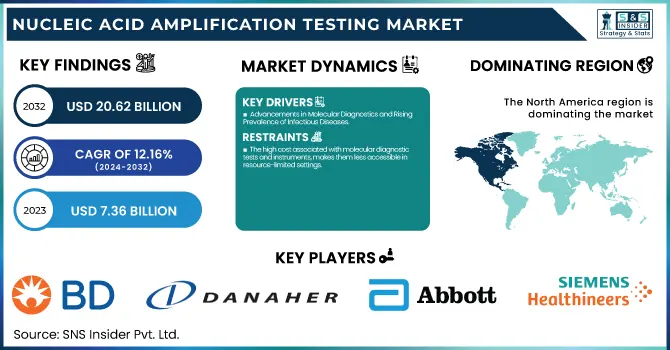

The Nucleic Acid Amplification Testing Market Size was valued at USD 7.36 Billion in 2023 and is projected to reach USD 20.62 Billion by 2032 and grow at a CAGR of 12.16% over the forecast period 2024-2032.

To Get more information on Nucleic Acid Amplification Testing Market - Request Free Sample Report

This report indicates the growing incidence and prevalence of target conditions necessitating NAAT, as well as the expanding demand for new diagnostic solutions. The report further analyzes regulatory forces and how this affects market growth, in addition to pricing direction and cost trends that shape accessibility and adoption into the market. The report goes further to cover the increasing shift towards point-of-care (POC) NAAT testing with a focus on its application for enhancing fast diagnostic and patient treatment. In addition, it examines research and innovation directions, highlighting innovations in NAAT technology that increase accuracy, efficiency, and usage in diverse healthcare environments.

Nucleic Acid Amplification Testing Market Dynamics

Drivers

-

Advancements in Molecular Diagnostics and Rising Prevalence of Infectious Diseases

The nucleic acid amplification testing (NAAT) market is fueled mainly by advances in molecular diagnostics and the growing infectious disease burden globally. NAAT is highly specific and sensitive in identifying pathogens, and it remains the first choice for diagnosing infections like HIV, tuberculosis, hepatitis, and COVID-19. As per the WHO, an estimated 296 million individuals had chronic hepatitis B in 2019, which highlights the requirement for sophisticated molecular testing. Furthermore, the increasing uptake of point-of-care (POC) NAAT solutions has driven market expansion by allowing quick and decentralized testing. The increasing demand for precision medicine and individualized healthcare solutions has also driven the uptake of NAAT in oncology and genetic testing. Additionally, ongoing innovations, including dPCR and isothermal amplification technologies, have improved the accuracy and efficiency of nucleic acid testing. Government support and increased funding for infectious disease control programs, especially in developing countries, are also significantly contributing to rising market demand. For instance, the U.S. government's PEPFAR program has greatly increased access to molecular diagnosis for HIV. The continuous R&D activities to enhance NAAT platforms and automate them are likely to further consolidate market growth in the future.

Restraints

-

The high cost associated with molecular diagnostic tests and instruments, makes them less accessible in resource-limited settings.

NAAT platforms like real-time PCR (qPCR) and digital PCR (dPCR) systems are costly, as they need costly reagents, advanced laboratory facilities, and skilled personnel to perform, thus elevating the cost of the overall test. Industry estimates put the cost of a single NAAT-based test at between USD 50 and USD 250, depending on the target disease and the testing platform. This cost element greatly constrains widespread adoption, especially in low- and middle-income nations (LMICs) where the budgets for healthcare are limited. In addition, the requirement of specialized laboratory equipment and cold chain logistics for reagent storage poses an adoption barrier in rural and distant places. Another issue is the absence of standardization and regulatory harmonization, making it difficult for emerging players to enter the market. Regulatory clearances differ across geographies, with tough requirements from regulators like the FDA, EMA, and PMDA (Japan) delaying launches of products. Further, reimbursement policies for molecular diagnostics are also inconsistent, with scarce insurance coverage for NAAT in most geographies. These factors together limit the universal deployment of nucleic acid amplification technologies, especially in cost-conscious markets.

Opportunities

-

The increasing adoption of point-of-care (POC) NAAT solutions presents a significant opportunity for market expansion, especially in decentralized healthcare settings.

Traditional laboratory-based NAAT methods often require several hours to days for result generation, whereas POC NAAT platforms provide rapid results in under an hour, enabling faster clinical decision-making. The global POC diagnostics market is witnessing substantial growth, with key players like Abbott, Cepheid (Danaher), and Roche investing in compact and portable NAAT devices. For instance, Abbott’s ID NOW system has been widely used for rapid COVID-19 detection, demonstrating the potential of POC NAAT in infectious disease management. Another major opportunity lies in the rising demand for personalized medicine and companion diagnostics, where NAAT is being increasingly used for cancer biomarker detection, pharmacogenomics, and hereditary disease screening. Advancements in next-generation sequencing (NGS) and CRISPR-based diagnostics are further enhancing the precision and scalability of NAAT. Additionally, growing government initiatives to improve molecular diagnostic accessibility—such as the Africa CDC’s efforts to expand genomic surveillance—are creating new growth avenues. With continuous innovation, automation, and cost-reduction strategies, the expansion of NAAT into home-based and telehealth-integrated diagnostics represents a promising future for the market.

Challenges

-

The NAAT market faces challenges related to regulatory complexities and quality assurance issues, which impact product approval and commercialization.

The strict requirements by regulatory agencies like the U.S. FDA, the European Medicines Agency (EMA), and China's NMPA lead to longer approval times and higher compliance expenses for manufacturers. For instance, FDA 510(k) clearance for a new NAAT platform may take 12 to 24 months, pushing market entry back. Moreover, regions have diverse regulatory environments for molecular diagnostics, posing obstacles to international market growth. The other key challenge is the potential for false positives and false negatives with NAAT-based testing, impacting clinical decision-making. Sample contamination, poor primer design, and reagent degradation are among the factors that lead to inconsistent test results. In the initial period of the COVID-19 outbreak, false-negative rates in RT-PCR ranged from 2% to 29%, which raised concerns about test reliability. In addition, the very high complexity of multiplex NAAT assays that identify more than one pathogen at a time raises the risk of cross-reactivity and results in misinterpretation. To overcome these issues, there must be ongoing enhancements in assay standardization, regulation simplification, and investment in quality control efforts to guarantee the consistency of NAAT-based testing.

Nucleic Acid Amplification Testing Market Segmentation Analysis

By Type

In 2023, the Polymerase Chain Reaction (PCR) tests segment held the largest share in the nucleic acid amplification testing (NAAT) market, generating 67.1% of the total revenue. PCR is still the gold standard for molecular diagnostics because it has high sensitivity and specificity and has a wide range of applications in infectious diseases, oncology, and genetic testing. Its capability to identify low levels of nucleic acids with great accuracy has led it to become the laboratory and clinical standard choice. Its adoption across COVID-19 diagnosis has further established its foothold in the market. Ongoing technological improvements, including real-time and digital PCR, have further enhanced efficiency and its use across different applications. However, the Isothermal Nucleic Acid Amplification Technology (INAAT) tests segment will be growing at the highest rate over the forecast period. The fact that INAAT amplifies nucleic acids at a fixed temperature without the requirement of sophisticated thermal cycling instruments ensures that it is a cheaper and quicker substitute for PCR. Its growing usage in point-of-care (POC) testing, especially for infectious diseases, is a major growth promoter. Furthermore, its ability to be tested and validated in decentralized settings with limited resources and increasing demand for fast, portable diagnostic tools are anticipated to drive its growth in the coming years.

By Application

The infectious disease testing application held the highest revenue share of 45.2% in 2023 due to the growing incidence of viral and bacterial infections across the globe. The need for timely and precise detection of diseases like COVID-19, influenza, tuberculosis, HIV, and hepatitis has prompted extensive use of NAAT in infectious disease testing. Government programs and public health initiatives for curbing infectious outbreaks have also increased market growth. Moreover, technological advances in molecular testing and the use of automation in testing have increased the efficiency and availability of infectious disease testing. Nonetheless, oncology testing will continue to expand with the highest growth rate in the future years. The increasing world cancer burden combined with liquid biopsy and genetic sequencing advances has powered the need for molecular oncology diagnostics. NAAT is especially important for its role in the detection of cancer in its early stage, treatment follow-up, as well as support for personalized medicine strategies. Accelerating investments in oncology research and increasing awareness about precision oncology is likely to spur the adoption of NAAT for oncology applications at a high growth rate, making it one of the most lucrative segments in the market.

By End-use

The Central and reference laboratories segment led the NAAT market in 2023 with a 42.2% revenue share. These labs are favored because they can process high volumes of tests, provide highly standardized and accurate results, and perform sophisticated molecular diagnostic processes. Their established infrastructure, automation integration, and experience in dealing with complicated cases make them the first choice for large-scale diagnostic testing. In addition, alliances between healthcare providers and diagnostic labs have reinforced the position of central laboratories in providing timely and accurate diagnostic solutions. Notwithstanding this, the hospital segment is expected to grow at the highest rate in the coming years. The demand for rapid on-site diagnostics, as well as the growing number of hospital admissions due to infectious diseases, cancer, and genetic disorders, is driving this growth. Hospitals are more likely to adopt molecular diagnostic functionality for quicker decision-making and enhanced patient outcomes. Besides, the growth of emergency care service offerings, more hospital-based use of point-of-care testing, and enhanced in-house lab equipment investment will lead to even quicker growth in this segment and it will remain the most promising space for expansion within the NAAT market.

Nucleic Acid Amplification Testing Market Regional Insights

In 2023, North America led the nucleic acid amplification testing (NAAT) market with the highest revenue share of 39.1%. The region's established healthcare infrastructure, high rate of adoption of advanced molecular diagnostics, and rising incidence of infectious diseases and genetic disorders are the reasons behind this leadership. The availability of major market players such as Abbott Laboratories, Danaher Corporation, Becton, Dickinson, and Company has also provided more fuel to the leadership of North America within the market. Also, robust government support for infectious disease surveillance programs, easy availability of reimbursement policies, and ongoing development in PCR and isothermal amplification technologies have contributed to market growth. The strong need for precision medicine and the early diagnosis of disease, along with expanded R&D spend, have continued to fuel NAAT's use in the region.

Europe is the second-largest market, led by increased government investment in molecular diagnostics, increasing early disease detection awareness, and rising incidence of chronic diseases. Germany, the U.K., and France have been leading countries in adopting NAAT, especially in infectious disease testing and cancer diagnostics.

The Asia-Pacific market is anticipated to expand at the highest growth rate, driven by rising healthcare spending, growing awareness of molecular diagnostics, and increasing prevalence of infectious diseases like tuberculosis and hepatitis. Growing laboratory infrastructure, increasing investments from overseas players, and government efforts to enhance diagnostic capacity are anticipated to fuel market growth in nations like China, India, and Japan.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Along with Their Related Products:

-

F. Hoffmann-La Roche Ltd – Cobas 6800/8800 Systems, Cobas Liat System, LightCycler Systems

-

Becton, Dickinson and Company – BD MAX System, BD Veritor Plus System

-

Danaher Corporation – Cepheid GeneXpert System, Beckman Coulter DxN VERIS Molecular System

-

Abbott Laboratories – Abbott RealTime PCR System, ID NOW Molecular Platform

-

Illumina, Inc. – NovaSeq Series, MiSeq Series, NextSeq Series (used for genetic analysis and sequencing-based amplification)

-

Siemens Healthineers AG – VERSANT kPCR Molecular System, FTD SARS-CoV-2 Assay

-

bioMérieux SA – BIOFIRE FilmArray, NucliSENS EasyQ System

-

Novartis AG – (Focuses more on pharmaceuticals, limited direct involvement in NAAT-based diagnostics)

-

Bio-Rad Laboratories, Inc. – CFX96 Touch Real-Time PCR System, QX200 Droplet Digital PCR System

-

Seegene Inc. – Allplex SARS-CoV-2 Assay, Anyplex II HPV28 Detection

-

QIAGEN N.V. – QIAsymphony RGQ, NeuMoDx Molecular Systems, QuantiFERON TB Gold Plus

Recent Development

In March 2023, BD (Becton, Dickinson, and Company) received FDA 510(k) clearance for the BD Vaginal Panel on the BD COR System, a high-throughput molecular diagnostic test for large laboratories. This test enables the direct detection of the three most common infectious causes of vaginitis, enhancing diagnostic accuracy and efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.36 billion |

| Market Size by 2032 | USD 20.62 billion |

| CAGR | CAGR of 12.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Polymerase Chain Reaction (PCR) tests, Isothermal Nucleic Acid Amplification Technology (INAAT) tests, Ligase Chain Reaction (LCR) tests] • By Application [Infectious disease testing (COVID-19 testing, Mosquito-borne disease testing, Influenza testing, Sexually transmitted infections testing, Hepatitis testing, Tuberculosis testing, Others), Oncology testing, Genetic & mitochondrial disease testing, Others] • By End-use [Hospitals, Central and reference laboratories, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd, Becton, Dickinson and Company, Danaher Corporation, Abbott Laboratories, Illumina, Inc., Siemens Healthineers AG, bioMérieux SA, Novartis AG, Bio-Rad Laboratories, Inc., Seegene Inc., and QIAGEN N.V. |