Home Audio Equipment Market Report Scope & Overview:

Get More Information on Home Audio Equipment Market - Request Sample Report

The Home Audio Equipment Market was valued at USD 1.50 Billion in 2023 and is expected to reach USD 2.35 Billion by 2032, growing at a CAGR of 5.15% over the forecast period 2024-2032.

In recent years, the home audio equipment market has experienced notable growth, fueled by the rising demand from consumers for top-notch sound experiences in their homes. With changing lifestyles and advancements in technology, people are looking for better audio solutions that enhance their entertainment experiences and blend well in their homes. This shift has increased to multiple audio devices such as soundbars, wireless speakers, home theater systems, and multi-room audio installations. The increasing demand for streaming services is a key driver of the growth of the home audio equipment market. By 2024, the U.S. market for home audio systems is expected to reach around USD 4.3 billion, showing a decrease in both volume and value compared to previous years. This shift is due to changing consumer preferences and a move towards streaming services and portable audio devices. With platforms such as Spotify, Apple Music, and Netflix becoming more popular, consumers are now looking for audio options that offer top-quality sound reproduction for music, movies, and other content. Consequently, producers are developing new products that improve audio quality and offer connectivity choices for convenient streaming from devices. Wireless technology like Bluetooth and Wi-Fi is now a common feature, allowing users to listen to music and other audio content from different sources wirelessly.

Additionally, this factor has highly influenced the home audio equipment market due to rising customer’s inclination towards smart home incorporation. With the rise of smart home tech featuring more prominently across households, folks are after audio solutions which can be voice-controlled or integrated into their existing home automation capabilities. This saw manufacturers create smart speakers that had voice assistants built in them, so you could talk to your audio devices and control other smart things in your house with your Voice. Combining audio technology with smart home applications is driving new growth potential for the market, thereby attracting key players in the audio equipment manufacturing industry to invest more in research and development.

Home Audio Equipment Market Dynamics

Drivers

-

Consumer demand for superior audio quality drives growth in the home audio equipment market.

The growing consumer inclination towards superior audio quality is one of the key factors fueling the home audio equipment market. The rise of streaming services like Spotify, Apple Music, and Tidal means consumers don't have to put up with subpar sound quality. With high-res audio files gaining lots of ground, audiophiles are looking for home audio equipment that can deliver the best sound reproduction it can. The proliferation of formats such as FLAC (Free Lossless Audio Codec) and MQA (Master Quality Authenticated has in turn created a demand for audio equipment capable of reproducing these formats gimmick-free. Hi-fi audio systems are slowly becoming a must-have for both audiophiles and casual listeners due to the advances in technology. Manufacturers are fighting this trend by coming out with gear that employs modern technology like digital signal processing (DSP) and fancier speaker drivers to improve sound clarity, power, and overall depth. In addition, the question of whether consumers can wirelessly connect their devices to home audio systems via technologies like Bluetooth and Wi-Fi is a great support for listening at the high quality that they've become accustomed to. An increased focus on listening quality has also helped popularize the move toward multi-room audio systems, enabling users to manage multiple speakers throughout their homes.

-

Rising demand for home audio equipment driven by streaming services and enhanced consumer experiences.

The rapid expansion of cable and satellite networks coupled with increasing disposable incomes in countries such as China, India, and Brazil have been the influential factors in raising a number of audiences on televisions thereby influencing positively the Home Audio Equipment Market. With the increase in subscription platforms like Netflix, YouTube, and multiple music streaming services occupying more consumers, there has been a rise in demand for quality audio equipment. Streaming services frequently offer curated playlists, high-definition audio tiers, and exclusive recordings to incentivize users towards greater investment in speakers who can play those streaming options to their fullest. Consumers desire an engaging and exciting live music experience at home instead of listening to audio systems already commercialized. The rise of binges has also pushed consumers to make their home audio setups a priority. Soundbars and surround sound systems are basic for the living room, thereby ensuring an enriched audio experience by providing rich, natural-sounding reproduction that complements the auditory part of visual content.

Restraints

-

Challenges of high premium prices in the home audio equipment market.

High prices of premium audio systems are one of the main constraints for the Home Audio Equipment Market. Though the consumer appetite for elevated audio experiences is increasing, it does not mean all consumers are buying the newest and best equipment. The cost of manufacturing (not to mention, the superior materials, technology, and craftsmanship) means that premium audio brands tend to be some of the most expensive. This is a disincentive to value-conscious consumers and therefore caps the market. The notion that a high-fidelity system is a luxury product can also be a hurdle for people wanting to get into the hobby. Additionally, maintaining and updating audio systems becomes quite a costly endeavor which is another reason the listener may feel wary in investing their money into this equipment. A good example is high-end speakers that you need to purchase with compatible amplifiers or audio receivers in order to sound its best – resulting in more costs.

Home Audio Equipment Market Segmentation Overview

By Type

Home Audio Speakers and Systems held a 37% market share in 2023 and led the market in the Home Audio Equipment Market. This section offers a variety of products, such as individual speakers and advanced multi-channel systems, that enable customization and flexibility in audio configurations. Manufacturers are constantly innovating to meet the demands for top-notch audio from both audiophiles and casual listeners. Bose and Sonos are at the forefront of this category with their high-quality speakers that provide excellent sound, frequently incorporating smart features for voice command and easy streaming.

The Home Theater in-a-Box (HTIB) category is experiencing the most rapid growth in the Home Audio Equipment Market during 2024-2032. HTIB systems are popular because they are easy to use and budget-friendly, allowing consumers to enjoy a cinematic experience without the hassle of setting up separate components. Sony and Samsung have launched cutting-edge HTIB systems with wireless connectivity and advanced surround sound technologies to meet the increasing need for top-notch audio in compact packages.

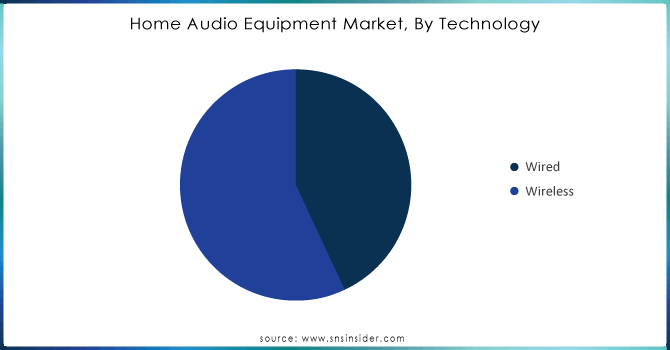

By Technology

The wireless sector led the market with a 55% market share in 2023, fueled by the growing use of smart home technology and consumers' desire for ease of use and mobility. Wireless audio systems remove the necessity for cords, enabling individuals to easily play music from different gadgets using Bluetooth, Wi-Fi, or other wireless technologies. Amazon and Apple have taken advantage of the trend by creating easy-to-use wireless speakers that connect with other smart home gadgets, such as Echo and HomePod.

The wired sector is accounted to have a faster growth rate during 2024-2032, due to factors like the rising need for top-notch audio and the dependability of wired connections. Audiophiles and professionals tend to favor wired audio systems for their excellent sound quality and low latency, whether for home studios or personal use. Sonos and Bose are at the forefront, providing wired sound systems that easily blend in with current home configurations.

Need any customization research on Home Audio Equipment Market - Enquiry Now

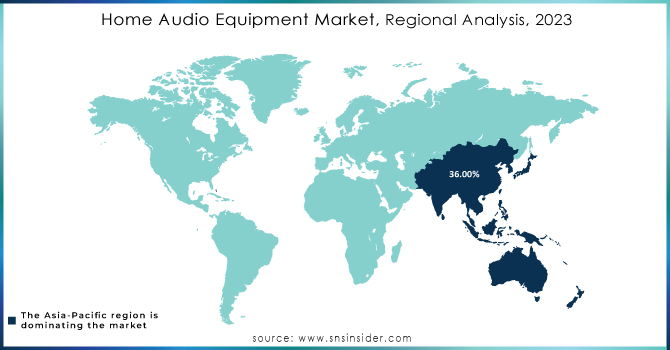

Home Audio Equipment Market Regional Analysis

The Asia-Pacific region dominated the market with a 36% market share in 2023, primarily due to rapid urbanization, rising middle class, and increasing internet penetration across countries like China, India, and Japan. This growth is fueled by a surge in demand for advanced audio solutions, such as Bluetooth speakers and soundbars, as consumers seek high-quality audio for various applications, from gaming to home theaters. Companies like Samsung and Sony have established a strong presence in the region, offering cutting-edge audio products tailored to local preferences.

North America is the fastest-growing and expected to have an 11.35% CAGR during 2024-2032 in the Home Audio Equipment Market, driven by technological advancements and increasing consumer demand for high-quality audio experiences. The rise in disposable income and a trend toward smart home technologies have led to greater investments in home entertainment systems. Companies like Sonos and Bose are at the forefront, offering innovative wireless speakers and smart audio solutions that cater to tech-savvy consumers.

Key Players in Home Audio Equipment Market

The major key players in the Home Audio Equipment Market are:

-

Sonos (Sonos One, Sonos Arc)

-

Bose (Bose SoundLink Revolve, Bose Home Speaker 500)

-

Sony (Sony HT-X8500, Sony SRS-XB43)

-

Yamaha (Yamaha RX-V6A, Yamaha MusicCast 20)

-

Bang & Olufsen (Beoplay A9, Beosound Stage)

-

JBL (JBL Charge 5, JBL Bar 9.1)

-

Audioengine (Audioengine A5+, Audioengine B1)

-

Klipsch (Klipsch R-41M, Klipsch RP-600M)

-

Denon (Denon AVR-S960H, Denon HEOS 5)

-

Marantz (Marantz SR5015, Marantz PM7000N)

-

Pioneer (Pioneer VSX-LX504, Pioneer XW-SMA1)

-

Samsung (Samsung HW-Q950A, Samsung Sound Tower)

-

LG (LG XBOOM Go PN1, LG SN11RG)

-

Focal (Focal Aria 906, Focal Chora 826)

-

Sennheiser (Sennheiser HD 560S, Sennheiser Ambeo Soundbar)

-

Devialet (Devialet Phantom I, Devialet Dione)

-

Onkyo (Onkyo TX-NR6100, Onkyo SKS-HT540)

-

Cambridge Audio (Cambridge Audio CXA81, Cambridge Audio Melomania 1)

-

Edifier (Edifier R980T, Edifier S350DB)

-

Monitor Audio (Monitor Audio Bronze 100, Monitor Audio Silver 300)

Recent Development

-

September 2024: Sony introduced a new range of BRAVIA Theater home audio products designed to enhance the cinematic experience at home. Key features include support for Dolby Atmos and DTS, as well as compatibility with the new Voice Zoom 3 feature on BRAVIA TVs. The lineup includes models like the BRAVIA Theater Bar 9 and Bar 8.

-

March 2023: Sonos launched two new speakers, the Era 100 and Era 300, which support multi-room audio, Bluetooth, and USB-C line-in. The Era 300 features Dolby Atmos Spatial Audio, while the Era 100 serves as a replacement for the popular Sonos One.

-

January 2023: The second-generation HomePod was released, adding support for spatial audio and Dolby Atmos. While it retains the lack of an aux input, it aims to provide enhanced sound quality and Siri integration for smart home control.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 33.00 Billion |

| Market Size by 2032 | USD 83.24 Billion |

| CAGR | CAGR of 10.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Home Theater in-a-box, Home Audio Speakers and Systems, Home Radios, Others) • By Technology (Wired, Wireless) • By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sonos, Bose, Sony, Yamaha, Bang & Olufsen, JBL, Audioengine, Klipsch, Denon, Marantz, Pioneer, Samsung, LG, Focal, Sennheiser, Devialet, Onkyo, Cambridge Audio, Edifier, Monitor Audio |

| Key Drivers | • Consumer demand for superior audio quality drives growth in the home audio equipment market. • Rising demand for home audio equipment driven by streaming services and enhanced consumer experiences. |

| RESTRAINTS | • Challenges of high premium prices in the home audio equipment market. |