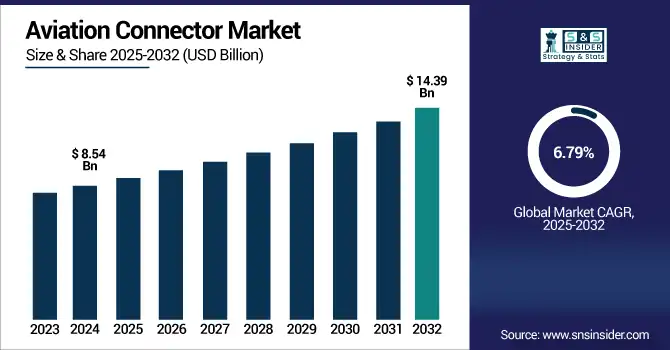

Aviation Connector Market Size Analysis:

The Aviation Connector Market Size was valued at USD 8.54 billion in 2024 and is expected to reach USD 14.39 billion by 2032 and grow at a CAGR of 6.79% over the forecast period 2025-2032.

To Get more information on Aviation Connector Market - Request Free Sample Report

Global market is segmented based on region, application, product type and end-user, market size, share and key growth drivers. Aviation connectors are crucial in ensuring safety, switching, and communications between systems within the aircraft. The increasing production of aircraft, higher defense budgets and fast pace technological advancements in avionics and electronic systems are driving the demand, leading to high adoption across global commercial aviation and military applications. Aviation Connector Market analysis highlights rising demand for robust, lightweight, and high-speed connectors across all major aircraft systems.

For instance, over 60% of active military aircraft globally are being upgraded with digital avionics systems that require high-reliability connector integration.

The U.S. Aviation Connector Market size was USD 2.29 billion in 2024 and is expected to reach USD 3.77 billion by 2032, growing at a CAGR of 6.49% over the forecast period of 2025–2032.

The U.S. market is propelled by the presence of major market aerospace manufacturers, rising defense expenditure, and continuous aircraft modernization programs. Advanced avionics and electronic systems have been embraced by the nation, which is a driving factor for high performance aviation connectors. This increase can be seen in both commercial and military aviation, with the U.S. being an important driver for the overall North American market. Recent Aviation Connector Market trends indicate growing demand for rugged, high-speed connectors in both legacy and next-gen aircraft.

For instance, modern U.S. aircraft typically feature over 50 electronic control units, each interfacing with multiple connector systems to manage operations.

Aviation Connector Market Dynamics:

Key Drivers:

-

Rising Aircraft Production and Fleet Expansion are Significantly Driving the Demand for High-Performance Aviation Connectors Across the Globe

A global boom in airline travel has pushed aircraft makers globally to ramp up production to meet airline need, especially in Asia and the Mideast. An indicator of this explosive growth can be seen in the growing fleet size with an increasing number of aircrafts requiring greater electronic systems on-board, particularly for the navigation, power distribution and in-flight entertainment systems that will require highly robust connectors. When airliners demand the efficiency of fuel and turnaround time, connectors that allow for modularity, maintenance, and ruggedness are growing increasingly relevant and function as one of the driving forces of modern aerospace.

For instance, more than 85% of new commercial aircraft are now delivered with in-flight entertainment (IFE) systems, significantly increasing the need for high-speed, durable connectors.

Restraints:

-

High Cost of Advanced Aviation Connectors Limits Adoption Among Small Operators and Budget-Constrained Aviation Stakeholders

Aviation connectors have been designed for ruggedness, low weight, and large data capacity in modern times but therefore are also more expensive. High-end connectors are expensive, which keeps small regional airlines, maintenance firms and budget aircraft manufacturers away. To make matters worse, the cost of certification and integration only increases the resource outlay. Consequently, the overall adoption curve of advanced aviation connector technologies in some segments is worsened by price-sensitive markets which either delay or skip up-grading.

Opportunities:

-

Technological advancement in fiber optic and miniaturized connectors is unlocking new opportunities in high-speed aviation systems

There is a growing demand for lightweight, high-speed data transmission connectors as such data-intensive systems as real-time monitoring, satellite communications, and autonomous flight controls proliferate. Though fiber optic connectors especially have large-volume capacity and lossless features against the electromagnetic interference. At the same time, shrinking of components makes for space-saving designs, perfect for drones and future cockpits. As aircraft systems increasingly transition toward digitalization and automation, manufacturers who are investing in R&D to manufacture such advanced connectors would benefit considerably.

For instance, more than 70% of onboard avionics systems are sensitive to EMI, making shielding a mandatory feature in connector design for safe operation.

Challenges:

-

Complex Design and Customization Requirements Add Engineering Challenges and Lengthen the Product Development Cycle

Aviation connectors often need to be tailored to the aircraft model, environment, and functionality. They range from moisture sealing, EMI shielding, temperature tolerance to intricate form factors. These bespoke solutions must also comply with strict industry standards, thus requiring a considerable amount of engineering resources and testing time. There are also pressures to interoperate with legacy systems, which makes designs even harder. These challenges stymie innovation and create a difficult balancing act for manufacturers between compliance, performance, and adaptability.

Aviation Connector Market Segmentation Analysis:

By Application

In 2024, aircraft segment in the Aviation Connector Market dominated with 52.4% revenue share due to its wide usage in avionics, engines, cabin systems and flight control electronics. In modern aircraft, connectors are a vital component needed for both reliability and safety. TE Connectivity, for example, offers an extensive line of of connectors for aircraft in response to this growing demand, especially as many new aircraft have been designed with more electronic content per unit than ever before.

The aerospace defense segment is expected to grow at the highest CAGR of 7.37% during the forecast period from 2024 to 2032 due to global defense upgrades and UAV uptake. Countries are taking it top-order level in their focus on electronic warfare and advanced mission systems. For instance, Amphenol Corporation, provides high-reliability connectors used in military aircraft, drones, and secure communications platforms that help support the industry's transition to modern, digital defense aviation infrastructure.

By Product Type

In 2024, circular connectors held the largest Aviation Connector Market share of 46.3% and are expected to grow considerably due to their mechanical strength, compactness, and user-friendliness, making them suitable for demanding aerospace environments. Used in applications such as engines, fuselage wiring, and avionics these connectors ITT Inc., a provider of circular connector technologies — including MIL-spec and commercial-grade circular connectors found in virtually all commercial and military aircraft systems.

Fiber optic connectors will witness the highest CAGR of 8.54% over the forecast period 2023-2032, due to the growing demand for the high-bandwidth data, and EMI resistance features. As a leading supplier of fiber optic connectors, Radiall supports aerospace manufacturers with lightweight, high-speed solutions that deliver secure data transmissions withstanding the most demanding conditions of flight.

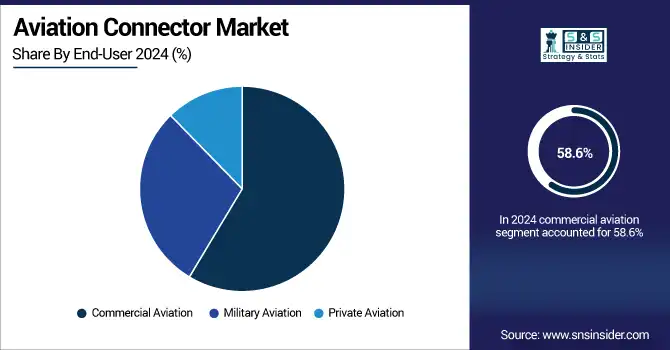

By End-User

In 2024, commercial aviation accounted for the largest share of 58.6%, which can be attributed to the growing production of aircraft, the increasing fleet of passenger aircraft, and the constantly evolving electronic systems fitted on aircraft. Connector replacement demand is also increased due to high-frequency maintenance. The global aviation connector segment is driven by the penetration of aviation grade connectors used in different commercial aircraft subsystems that are offered by solution providers such as Molex LLC, a leading supplier of electronic solutions.

Military aviation has been predicted to grow at a CAGR of 7.92% during the period of 2024 to 2032 due to increasing production of fighter jets, surveillance aircraft, and electronic warfare requirements. Reliable and resilient connectors are becoming paramount as governments bolster their defensive infrastructure. Smiths Interconnect enables this growth by providing mission critical military and aerospace high-reliability connector solutions globally compliant with the most stringent requirements.

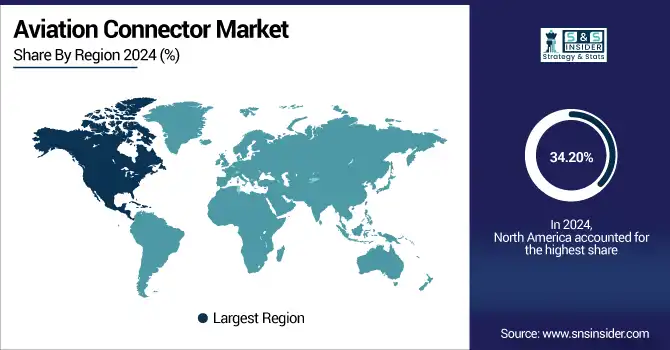

Aviation Connector Market Regional Outlook:

North America held the largest share of the global Aviation Connector Market in 2024 at 34.20%. The Aviation Connector Market growth in North America is attributed to the U.S. being a key supplier across aerospace manufacturing markets and military aviation. The presence of the key companies including Boeing and Lockheed Martin along with competitive R&D infrastructure and aftersales service network enable the maintainence of back to back demand for connectors from commercial, military and space applications.

-

The U.S. dominates the North American aviation connector market due to its strong aerospace manufacturing base, major defense programs, and presence of key players such as Boeing and Lockheed Martin, which drive continuous demand for advanced aviation connectors.

Asia Pacific is expected to grow at the highest CAGR of 7.97% for 2024–2032, owing to increasing commercial air traffic, production of commercial and regional aircraft, and modernization programs for defense forces in China, India, Japan, and other countries. The now-bursting adoption curve of aviation connectors on multiple aircraft types is compounded by the underlying drivers of expanding aviation infrastructure, low-cost carriers, and emerging aerospace supply chains in Southeast Asia.

-

China leads the Asia Pacific aviation connector market owing to rapid commercial aircraft production, expanding domestic airlines, and substantial government investments in both civil and military aviation infrastructure, making it a central hub for aerospace manufacturing and connector demand.

Europe is one of the most important shareholders in the Aviation Connector industry as it houses a strong aerospace industry led by giants such as Airbus. Strong R&D activities, regulatory compliance and growing adoption of advanced avionics characterize this region. The demand for connectors is further propelled by the growth of defense budgets and the modernization of commercial aircraft fleets in nations including Germany, France, and the U.K.

-

Germany dominates the European Aviation Connector Market due to its strong aerospace manufacturing base, advanced MRO infrastructure, and major role in Airbus programs. Companies such as Diehl Aerospace and Lufthansa Technik drive significant demand for high-performance connectors across civil and defense aviation.

The Middle East & Africa region is headed by the UAE, driven by its developing aviation infrastructure, presence of large MRO hubs, and growing investments in defense. Largely influenced by demands in the regional and commercial aviation segments, Brazil drove Latin America sales, powered in part by the locally produced Embraer aircraft range, military modernization efforts, and an expanding requirement for aerospace connector products.

Get Customized Report as per Your Business Requirement - Enquiry Now

Aviation Connector Companies are:

Major Key Players in Aviation Connector Market are TE Connectivity, Amphenol Corporation, ITT Inc., Molex LLC, Radiall, Smiths Interconnect, Carlisle Interconnect Technologies, Hirose Electric Co., Ltd., Glenair, Inc. and Eaton Corporation and others.

Recent Developments:

-

In March 2024, TE Connectivity introduced its NanoRF 75 Ω coax/optical hybrid modules designed for high-speed video capture in aerospace and defense systems, supporting up to 18 GHz and combining coaxial plus fiber‑optic interfaces in a compact, ruggedized form.

-

In May 2024, Amphenol acquired Carlisle Interconnect Technologies, significantly expanding its portfolio of rugged, aviation-grade connectors. This move deepened Amphenol’s footprint in commercial aerospace, defense, and industrial applications, strengthening its position in the aviation connector market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.54 Billion |

| Market Size by 2032 | USD 14.39 Billion |

| CAGR | CAGR of 6.79% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Aircraft, Ground Control Systems, Aerospace Defense) • By Product Type (Circular, Rectangular, D-Sub, Fiber Optic) • By End-User (Commercial Aviation, Military Aviation, Private Aviation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | TE Connectivity, Amphenol Corporation, ITT Inc., Molex LLC, Radiall, Smiths Interconnect, Carlisle Interconnect Technologies, Hirose Electric Co., Ltd., Glenair, Inc. and Eaton Corporation. |