Ultra-low-power Microcontroller Market Size:

Get more information on Ultra-low-power Microcontroller Market - Request Sample Report

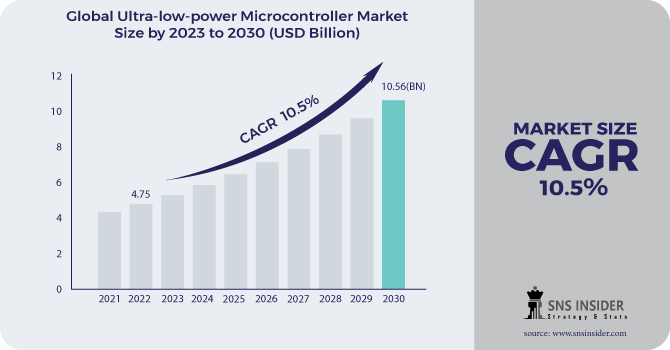

The Ultra-low-power Microcontroller Market Size was valued at USD 5.07 Billion in 2023 and is expected to reach USD 11.23 Billion by 2032 and grow at a CAGR of 9.27% over the forecast period 2024-2032.

The ultra-low-power (ULP) microcontroller market has experienced remarkable growth in recent years, driven by the surging demand for energy-efficient devices across industries such as IoT, consumer electronics, and industrial automation. With over 18.8 billion IoT-connected smart devices globally and more than 400 active IoT platforms in 2024, the proliferation of IoT and 5G technologies has intensified the need for electronic components that deliver reliable performance in energy-constrained environments. ULP microcontrollers are at the forefront of this shift, offering advanced power management features like sleep modes, power gating, and efficient clock systems to minimize power consumption without compromising functionality. This makes them indispensable for a wide range of applications, especially in the IoT sector. From smart home appliances to industrial IoT sensors, these microcontrollers enable efficient data processing and communication, ensuring prolonged operation on minimal energy sources.

The IoT market growth further underscores the importance of ULP microcontrollers. Many IoT deployments are in remote locations where regular maintenance is impractical, and the extended battery life enabled by ULP microcontrollers addresses this challenge effectively. Moreover, their seamless integration with low-power wireless protocols such as Bluetooth Low Energy (BLE), Zigbee, and LoRa enhances their role in building interconnected ecosystems, supporting the adoption of smart cities, wearable devices, and environmental monitoring solutions. As the push for sustainability and energy conservation gains momentum, the demand for ULP microcontrollers will continue to rise, solidifying their position as a key enabler of the IoT revolution and low-power electronics innovation.

Ultra-low-power Microcontroller Market Dynamics

Drivers

-

The proliferation of the Internet of Things (IoT) has dramatically influenced the ultra-low-power microcontroller market.

IoT devices, ranging from smart household gadgets to industrial sensors, depend significantly on microcontrollers for data processing and command execution. These devices are frequently utilized in remote or battery-operated settings, requiring energy efficiency to extend their operational life. Ultra-low-power microcontrollers meet this need by functioning at very low power levels while delivering excellent performance. For instance, in intelligent farming, sensors enabled by IoT track soil moisture, temperature, and plant health. These sensors must operate continuously for extended durations without needing frequent battery changes, rendering ultra-low-power microcontrollers essential. In the same way, wearable gadgets such as fitness trackers and health monitors emphasize energy efficiency to guarantee extended usage between charges. With the growing adoption of IoT in different industries, the need for these microcontrollers will keep increasing.

-

The increasing popularity of wearable and portable devices has significantly contributed to the ultra-low-power microcontroller market.

Wearables, including fitness bands, smartwatches, and medical monitoring devices, require microcontrollers that can operate continuously for extended periods on small batteries. Ultra-low-power microcontrollers address this need by offering minimal power consumption without sacrificing computational capabilities. Medical devices like glucose monitors, pacemakers, and hearing aids also leverage these microcontrollers to enhance patient convenience and reliability. For instance, glucose monitoring systems that use ultra-low-power microcontrollers can transmit real-time data to smartphones, enabling seamless health management. As the demand for wearable and portable technology grows, so does the necessity for microcontrollers designed to support these applications.

Restraints

-

The intricate design and manufacturing processes of ultra-low-power microcontrollers present a major challenge for manufacturers.

Achieving low power consumption without compromising performance requires advanced engineering expertise and precision. Additionally, integrating features such as wireless connectivity, data encryption, and sensor interfacing further complicates the design process. Manufacturing these microcontrollers demands state-of-the-art fabrication facilities, which may not be accessible to all companies. The reliance on specialized materials and components also increases production complexity and cost. These factors make it difficult for manufacturers to scale production efficiently, potentially hindering market expansion.

Ultra-low-power Microcontroller Market Segmentation

by Peripheral Device

The analog devices segment dominated with a 58% market share in 2023, as these are widely utilized due to their superior energy efficiency and low power consumption, which make them suitable for applications in battery-powered devices, wearables, and IoT products. These microcontrollers typically integrate analog features like sensors, amplifiers, and voltage regulators, which are critical for precise control in environments that demand minimal energy usage. Analog Devices, for example, offers products like the ADuCM4050 microcontroller, which is used in industrial, medical, and sensing applications requiring minimal power for extended periods.

The digital devices segment is projected to become the fastest-growing in the ultra-low-power microcontroller market due to their broad capabilities in processing digital signals and handling complex tasks while maintaining low-power usage. These microcontrollers are particularly popular in the development of smart home devices, communication systems, and consumer electronics where data exchange, user interaction, and connectivity are central. Companies like Texas Instruments and NXP Semiconductors provide microcontrollers, such as the MSP430 and LPC series, that are integral to smart meters, wearables, and home automation systems.

by Packaging Type

The 16-bit segment led the ultra-low-power microcontroller Market, with a 45% market share in 2023, attributed to the versatility and efficiency of 16-bit microcontrollers, which strike a balance between performance and power consumption. Their moderate processing power and energy efficiency make them ideal for devices that need to operate continuously for long durations without frequent battery recharges. Companies like Microchip Technology and STMicroelectronics manufacture 16-bit microcontrollers, which are used in applications such as sensor networks, medical devices, smart home systems, and automotive control systems.

The 32-bit segment is expected to be the fastest-growing in the ultra-low-power microcontroller market during the 2024-2032 period, driven by the increasing demand for more powerful microcontrollers that can handle complex tasks while maintaining energy efficiency. 32-bit microcontrollers provide higher processing power and a larger addressable memory space compared to 8-bit and 16-bit counterparts, making them suitable for more advanced applications such as IoT, wearables, and automotive electronics. Companies like NXP Semiconductors and Texas Instruments produce 32-bit microcontrollers for applications such as smart grids, industrial automation, robotics, and medical monitoring devices.

Ultra-low-power Microcontroller Market Regional Analysis

Asia-Pacific region dominated the ultra-low-power microcontroller market in 2023, holding a 38% market share due to its robust electronics and semiconductor manufacturing infrastructure. APAC's dominance is driven by high demand from industries such as consumer electronics, automotive, and industrial automation, particularly in countries like China, Japan, and South Korea. These nations are home to major players like Renesas Electronics, Panasonic, and Toshiba, which develop energy-efficient microcontrollers for smart devices, electric vehicles, and IoT applications. Companies such as NXP Semiconductors and STMicroelectronics leverage this demand, supplying ULP MCUs for medical devices, wearable technology, and home automation systems.

North America is projected to be the fastest-growing region in the ultra-low-power microcontroller market from 2024 to 2032, driven by advancements in IoT, AI integration, and the proliferation of wearable healthcare devices. The U.S., with its strong emphasis on R&D and innovation, leads the region. Companies like Texas Instruments, Microchip Technology, and Silicon Labs provide ultra-low-power solutions for energy-critical applications, including smart meters, remote sensing, and healthcare monitoring. The region also benefits from increased investments in renewable energy, where ULP MCUs optimize power consumption in grid management systems.

.png)

Get a Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the Ultra-low-power Microcontroller Market are:

-

Texas Instruments (MSP430FR6989, MSP430FR5994)

-

Microchip Technology (PIC16LF1823, ATtiny814)

-

STMicroelectronics (STM32L4, STM32L0)

-

NXP Semiconductors (LPC800, Kinetis K64)

-

Infineon Technologies (XMC1100, XMC1300)

-

Renesas Electronics (RL78/G13, RX231)

-

Analog Devices (ADuCM360, ADuCM3029)

-

Silicon Labs (EFR32BG21, EFR32MG21)

-

Arm Holdings (Cortex-M0, Cortex-M3)

-

Qualcomm (QCC5100, QCC3026)

-

Broadcom (BCM2837, BCM2835)

-

Cypress Semiconductor (now part of Infineon) (PSoC 4, PSoC 5LP)

-

Maxim Integrated (MAX32630, MAX32660)

-

Microsemi (now part of Microchip) (SmartFusion2, IGLOO2)

-

ON Semiconductor (EFM32WG, EFM32LG)

-

Nordic Semiconductor (nRF52840, nRF52832)

-

Espressif Systems (ESP32, ESP8266)

-

Atmel (now part of Microchip) (ATmega328P, ATtiny85)

-

Seeed Studio (Wio Terminal, XIAO nRF52840)

-

Lattice Semiconductor (iCE40 UltraLite, ECP5)

Recent Development

-

April 2024: STMicroelectronics introduced the STM32U0 series, a new range of microcontrollers aimed at improving energy efficiency in electronic devices. The latest series asserts it can decrease energy usage by as much as 50% compared to earlier models, possibly resulting in fewer battery changes and a lower ecological footprint from thrown-away batteries.

-

May 2024: Renesas Electronics Corporation, a leading provider of cutting-edge semiconductor technologies, revealed the introduction of its new microcontroller series, the RA0E1 MCUs. Created to cater to the requirements of various general-purpose applications, the RA0E1 series guarantees outstanding performance with extremely low power consumption, making it a perfect option for energy-efficient designs.

-

November 2023: Infineon Technologies AG unveiled the PSoC 4000T series of microcontrollers (MCUs). This new MCU series offers a top-tier low-power capacitive sensing solution featuring outstanding signal-to-noise ratio, liquid resistance, and multi-sense functions, along with superior reliability and durability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.07 Billion |

| Market Size by 2032 | USD 11.23 Billion |

| CAGR | CAGR of 9.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Peripheral Device (Analog Devices, Digital Devices) • By Packaging Type (8-bit, 16-bit, 32-bit) • By Application (Aerospace & Defense, Servers and Data Centers, Telecommunications, Media and Entertainment, Automotive, Consumer Electronics, Healthcare, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Texas Instruments, Microchip Technology, STMicroelectronics, NXP Semiconductors, Infineon Technologies, Renesas Electronics, Analog Devices, Silicon Labs, Arm Holdings, Qualcomm, Broadcom, Cypress Semiconductor, Maxim Integrated, Microsemi, ON Semiconductor, Nordic Semiconductor, Espressif Systems, Atmel, Seeed Studio, Lattice Semiconductor |

| Key Drivers | • The proliferation of the Internet of Things (IoT) has dramatically influenced the ultra-low-power microcontroller market. • The increasing popularity of wearable and portable devices has significantly contributed to the ultra-low-power microcontroller market. |

| RESTRAINTS | • The intricate design and manufacturing processes of ultra-low-power microcontrollers present a major challenge for manufacturers. |