Infection Control Market Overview:

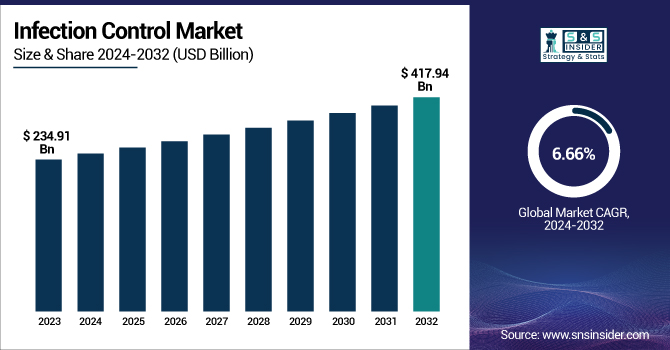

The Infection Control Market was valued at USD 234.91 billion in 2023 and is expected to reach USD 417.94 billion by 2032, growing at a CAGR of 6.66% from 2024-2032.

To Get more information on Infection Control Market - Request Free Sample Report

This report provides a distinctive view of the Infection Control Market by including extremely specific and actionable statistical data. It examines healthcare-associated infection (HAI) rates by facility type, giving a detailed view of risk exposure. The report also shows regional patterns of disinfectant use and sterilization technology, and monitors the installation of automated disinfection systems in countries. It further analyzes compliance with global infection control standards by facility size and identifies average infection control spending per hospital bed by region. These proprietary data-driven insights allow stakeholders to evaluate implementation gaps and regional readiness in infection prevention.

U.S. Infection Control Market Trends

The U.S. Infection Control Market was valued at USD 59.62 billion in 2023 and is expected to reach USD 103.13 billion by 2032, growing at a CAGR of 6.32% from 2024-2032. The U.S. dominates in the North American infection control market due to its sophisticated healthcare infrastructure, rigorous regulatory standards, and high levels of awareness for hospital-acquired infections (HAIs). The country also boasts critical market players and is at the forefront in using sterilization technology and infection control measures across healthcare facilities.

Market Dynamics

Drivers

-

The Rising Burden of Healthcare-Associated Infections (HAIs) is driving the market to grow.

The rising number of HAIs is a major growth driver pushing demand in the Infection Control Market. Based on the CDC, nearly 1 in 31 patients in the U.S. has at least one healthcare-associated infection each day. The infections not only threaten patient safety but also inflate the cost of healthcare because they require longer stays in the hospital, readmissions, and increased treatment. This increasing challenge has pushed healthcare facilities globally to implement rigorous sterilization and disinfection practices. In response, businesses are broadening their product lines, like Advanced Sterilization Products (ASP), which introduced BIOTRACE Readers and Biological Indicators in October 2023 to enhance sterilization monitoring processes. Such innovations are a testament to the industry's emphasis on reducing infection risks, enhancing patient outcomes, and adhering to global health regulations.

-

Growing Surgical Procedures and Medical Device Usage are propelling the market growth.

A rise in surgical procedures and the extensive use of invasive medical devices are contributing greatly to infection control needs throughout healthcare environments. Due to a rise in chronic illnesses such as cardiovascular and orthopedic diseases, surgical volume remains high around the world. These settings require excellence in asepsis to avoid infections both during and after procedures. Infection control practices like instrument sterilization, antimicrobial drapes, and operating room disinfection are essential. Players such as STERIS and Getinge have diversified their sterilization and washer-disinfection offerings to meet increasing demand. In addition, the November 2023 joint venture between Belimed AG and Steelco by Metall Zug and Miele illustrates the sector's dedication to expanding infection control solutions, making sure that there is efficient and safe surgery globally.

Restraints

-

One of the major constraints in the Infection Control Market is the expense involved in sophisticated sterilization and disinfection technologies.

Most contemporary infection control products—such as washer-disinfectors, low-temperature sterilizers, and high-level disinfectants—demand heavy capital outlay, not just for purchase but also for maintenance and training of personnel. This economic load can prove burdensome to small to medium-sized healthcare centers and institutions in low- and middle-income countries that may not be able to find the budget flexibility to embrace and maintain such technology. The additional burden of keeping up with continually changing regulatory compliance further compounds the cost burden. Consequently, clinicians in cost-sensitive areas tend to utilize basic or second-best practices, which would deprive infection control programs of their full potential and inhibit global best-in-class practice adoption at scale.

Opportunities

-

The increasing outpatient care and home healthcare services trend offers a major opportunity for the Infection Control Market.

As inpatient hospital stays decline, there is increasing demand for successful infection prevention measures outside of conventional clinical settings. This consists of mobile sterilization units, disposable disinfecting wipes, and easy-to-use disinfection solutions designed for use at home. Moreover, since home healthcare professionals deal with a range of medical equipment, like catheters, wound dressings, and respiratory therapy devices, the threat of healthcare-associated infections (HAIs) is always a serious issue. Industry players can ride this trend by providing portable, user-friendly, and affordable infection control products suitable for non-hospital settings. Increased awareness and caregiver and patient training programs will further drive adoption in these new care models.

Challenges

One of the major challenges to companies in the Infection Control Market is handling the intricate and frequently changing nature of the regulations in various nations. Infection control is, of course, a universal concern, but regulation of sterilization processes, chemical composition, and reprocessing of medical devices diverges considerably between regions. For example, what might be cleared for use in the United States by the FDA may need significant adaptation to comply with European CE Marking standards or Asia-Pacific regulatory processes. This discrepancy makes it more difficult to develop products, extends time-to-market, and adds compliance testing and documentation costs. Small businesses frequently have a hard time expanding internationally because of these regulatory challenges. Aligning these standards or creating more distinct channels for global clearances would help manufacturers and encourage wider use of infection control technology.

Infection Control Market Segmentation Analysis

By Type

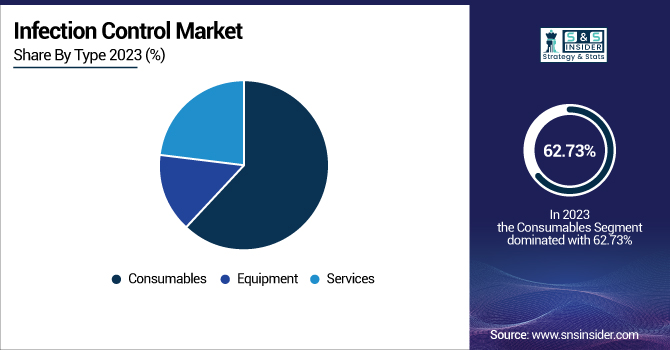

The Consumables segment dominated the Infection Control Market with 62.73% market share in 2023 because of the regular and recurring demand for products like disinfectants, sterilization wraps, biological indicators, face masks, gloves, and surface wipes in healthcare facilities. These are very important in the daily infection prevention practices and are consumed in huge quantities, particularly in operating rooms, ICUs, and outpatient centers. The COVID-19 pandemic also highlighted the necessity of high-volume consumption of consumables to ensure hygiene and manage cross-contamination. Moreover, the short shelf-life of most of these products results in repeated buying, which significantly contributes to the segment's recurring revenue stream and market leadership.

The Services segment is anticipated to experience the fastest growth with 7.09% CAGR throughout the forecast period based on growing demand for infection control activities to be outsourced, particularly within hospitals and long-term care facilities. As more regulations are being complied with, healthcare organizations are increasingly relying on professional services firms to undertake such activities as sterilization management, disinfection audits, and training of personnel. The intricacy of infection control measures, coupled with the lack of trained in-house staff, is fueling demand for specialized services to provide compliance with hygiene requirements. In addition, as healthcare agencies look forward to undertaking core medical activities, outsourcing infection prevention services is a cost-efficient and economic option, boosting the growth of this market segment.

By End Use

The Hospitals segment dominated the infection control market with a 52.16% market share in 2023, based on high patient turnover, complex procedures, and the risk of HAIs. Hospitals demand stringent infection control procedures such as sterilization of surgical equipment, disinfection of surfaces, and disposal of waste to avoid cross-contamination. The availability of intensive care units (ICUs), operating theaters, and emergency wards—where infection risk is much higher—also fuels demand for total infection prevention solutions. Additionally, hospitals are subject to strict regulatory oversight and are compelled to have strict hygiene standards, prompting ongoing investment in the latest infection control devices, consumables, and services. Their significant volume and extensive patient care mission position hospitals as the major consumers of infection control products and services, establishing their leadership role in the market.

Infection Control Market Regional Insights

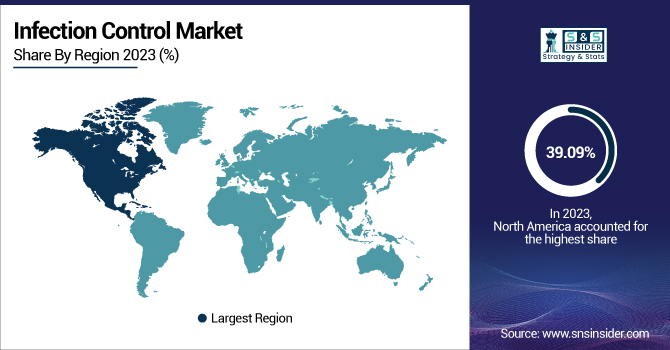

North America dominated the infection control market with a 39.09% market share in 2023 on account of the region's state-of-the-art healthcare facilities, high take-up of emerging cutting-edge sterilization and disinfecting technology, and regulatory practices with strong compliance to patient care and prevention against infection. Strong industry participation is present within this region of giant industry participants, 3M Company, STERIS plc, and Ecolab Inc., which also invests in innovation and R&D in its products. Besides that, the escalating rate of healthcare-associated infections (HAIs), strong awareness drives, and the government efforts focused on enhancing standards of hygiene across hospitals and operating centers also complement market demand further. The U.S., above all, drives the region due to high expenditures on healthcare, along with stringent infection control policies led by institutions like the CDC and FDA.

Asia Pacific is expected to be the fastest-growing region in the infection control market with 7.27% CAGR due to growing healthcare investments, expanding hospital networks, and increasing awareness regarding infection avoidance in developing countries. China, India, and Southeast Asian countries are experiencing an escalation in medical tourism, surgical operations, and hospital-acquired infections, each boosting the adoption of infection control products and services. Government programs encouraging sanitation, combined with the arrival of international players and increasing partnerships with local producers, are driving product availability and adoption. In addition, the continued modernization of healthcare facilities and focus on patient safety are likely to make significant contributions to the growth of the region over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Infection Control Market

-

3M Company (Steri-Drape Surgical Drapes, Avagard Hand Antiseptic)

-

STERIS plc (V-PRO Low Temperature Sterilizers, Revital-Ox Resert High-Level Disinfectant)

-

Getinge AB (GSS Steam Sterilizers, ED-Flow Washer Disinfectors)

-

Belimed AG (WD 290 IQ Washer-Disinfector, MST-H Sterilizer)

-

Advanced Sterilization Products (ASP) (STERRAD Sterilization Systems, Cidex OPA Solution)

-

Ecolab Inc. (OxyCide Daily Disinfectant Cleaner, A-456 II Disinfectant)

-

Cantel Medical Corp. (Advantage Plus Endoscope Reprocessor, Rapicide PA High-Level Disinfectant)

-

Metrex Research, LLC (CaviCide Surface Disinfectant, EmPower Dual-Enzymatic Detergent)

-

Tuttnauer Ltd. (Elara 11 Autoclave, Tiva 10 Washer Disinfectors)

-

MMM Group (Unotherm Sterilizers, Selectomat PL Steam Sterilizer)

-

Steelco S.p.A. (VS L Series Sterilizers, DS 610 Washer Disinfectors)

-

Contec Inc. (Sporicidin Disinfectant Solution, PeridoxRTU Surface Disinfectant)

-

Schülke & Mayr GmbH (mikrozid Universal Wipes, gigasept FF New Disinfectant)

-

Reckitt Benckiser Group plc (Dettol Antiseptic Liquid, Lysol Disinfectant Spray)

-

Diversey Holdings Ltd. (Oxivir TB Wipes, Virex II 256 Disinfectant Cleaner)

-

Pal International Ltd. (Pal TX Surface Wipes, Pal Hygiene Workwear)

-

Sotera Health Company (Sterigenics Gamma Irradiation, Nelson Labs Sterility Testing)

-

Skytron LLC (Sterile Processing Workstations, UV-C Disinfection Robots)

-

Matachana Group (S1000 Steam Sterilizers, MIEC Washer Disinfectors)

-

Case Medical, Inc. (SuperNova Cleaner, Case Solutions Instrument Lubricant)

Suppliers (These suppliers provide essential raw materials and specialty chemicals, such as disinfectant actives, antimicrobial agents, surfactants, and polymer compounds, which are crucial for manufacturing sterilizers, surface cleaners, and high-level disinfectants used across infection control products). In the Infection Control Market

-

BASF SE

-

DuPont de Nemours, Inc.

-

LANXESS AG

-

Lonza Group AG

-

Milliken & Company

-

Solvay SA

-

Eastman Chemical Company

-

Croda International Plc

-

Stepan Company

-

Ashland Global Holdings Inc.

Recent Developments

-

October 2023: Advanced Sterilization Products (ASP) broadened its sterilization monitoring portfolio with the introduction of new steam monitoring solutions, such as BIOTRACE Readers and Biological Indicators. These new additions are designed to improve workflow efficiency and promote greater compliance in sterile processing departments.

-

November 2023: Belimed AG's parent company, Metall Zug, entered into a deal with Miele to create a joint venture through the merger of Belimed and Steelco. The strategic acquisition is aimed at enhancing their combined strength in infection control and life science solutions.

Infection Control Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 234.91 Billion Market Size by 2032 US$ 417.94 Billion CAGR CAGR of 6.66 % From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Type (Equipment, Services, Consumables)

• By End Use (Hospitals, Medical Device Companies, Clinical Laboratories, Pharmaceutical Laboratories, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles 3M Company, STERIS plc, Getinge AB, Belimed AG, Advanced Sterilization Products (ASP), Ecolab Inc., Cantel Medical Corp., Metrex Research, LLC, Tuttnauer Ltd., MMM Group, Steelco S.p.A., Contec Inc., Schülke & Mayr GmbH, Reckitt Benckiser Group plc, Diversey Holdings Ltd., Pal International Ltd., Sotera Health Company, Skytron LLC, Matachana Group, Case Medical, Inc., and other players.