Nanocapsules Market Report Scope & Overview:

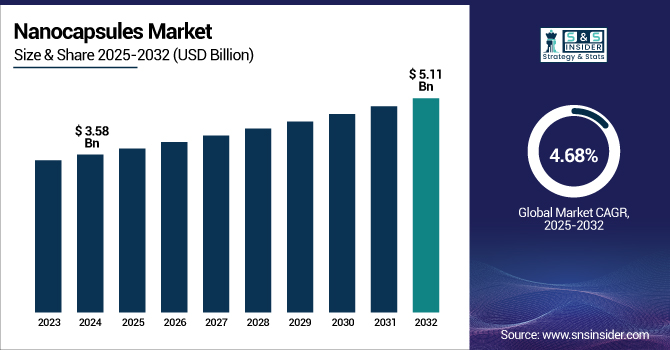

The Nanocapsules Market size was valued at USD 3.58 billion in 2024 and is expected to reach USD 5.11 billion by 2032, growing at a CAGR of 4.68% over the forecast period of 2025-2032.

To Get more information on Nanocapsules Market - Request Free Sample Report

Increased R&D spending, support from the government through legislation, and novel delivery techniques of pharmaceuticals are propelling the nanocapsules market to receive impetus. The U.S. and China are at the forefront of patent filings, with over 3,700 patents for drug delivery methods utilizing nanotechnology that were submitted by 2020. India emerged as a large investor by pouring ₹1,000 crores (~USD 140 million) in R&D into nanotech, predominantly in medicine, through programmes such as the NanoMission of the Department of Science and Technology. India launched a USD 12.05 billion fund in the budget of 2024 in long-term interest-free loans for the private sector's R&D.

As per recent statistics, the regulations have cleared around 80 nanomedicine products; 56% are lipid-based, 38% are protein-based, and 6% are metallic-based formulations. Even the FDA has released specific guidelines called "Drug Products, Including Biological Products, that Contain Nanomaterials," with detailed open policies for thoroughly reviewing the quality and standards of drug products containing nanomaterials. More pharmaceutical companies are investing in nanocapsule-based therapies due to this openness in regulation.

In addition, research and clinical nanocapsules market trends favor the fast growth of the nanocapsule market analysis. For instance, ClinicalTrials.gov listed 4486 clinical trials employing nanoparticle-based drug delivery technologies till 2021. There is tremendous momentum in oncology applications with at least 48 active clinical trials in cancer nanotechnology, many of which are currently Phase II. The National Cancer Institute (NCI) is spearheading the efforts. Furthermore, improving workforce development and creative capacity are recent industry-academic partnerships, such as the government fellowship program for nanotechnology projects at the University at Albany.

Product introductions are rising and show clear demand in all spheres of therapy. Nanocapsule-based delivery systems are poised to redefine the next generation of precision medicine and pharmaceutical innovation due to the growing interest of regulatory authorities, such as the FDA and EMA, which are further helping to create a more defined terrain.

For instance, Camurus received EMA approval in May 2024 for its acromegaly therapy nanocapsule formulation CAM2029. Likewise, SN Bioscience's polymer nanoparticle-based medicine SNB-101 gained EMA for small cell lung cancer in 2024 and orphan drug status from the FDA.

Market Dynamics:

Drivers:

-

Market Growth is Driven by Advancements in Drug Delivery and Innovation

The global nanocapsules market is witnessing robust growth in light of the increased demand for drug delivery systems with controlled release, improved therapeutic effectiveness, and growing application of nanotechnology in drug delivery. Greater use of biodegradable nanocapsules in cancer and long-term disease treatments is driving innovation through pharmaceutical pipelines. A prime instance is polymeric nanocapsules for brain-targeted delivery of chemotherapeutics, backed by research in a report (2023) showing a 65% increase in the rate of blood-brain barrier penetration. New regulations are facilitating nanocapsules market growth and the FDA's new guidelines on drug products containing nanomaterials (2022) clarify matters and hasten the process of product development.

Moreover, investments in R&D of medical nanocapsule formulations globally are increasing. China alone invested over USD 2.5 billion in nanopharmaceutical research in 2023. Lipid nanocapsules are gaining widespread acceptance in drug delivery nanocapsule due to their stability and high encapsulation efficiency, particularly in mRNA- and peptide-based therapy. The U.S. nanocapsules market is specifically booming due to its superior infrastructure and coordination between academia and nanocapsules companies. The emergence of personalized medicine and the increasing market for encapsulation technology identify the encouraging trend reflected in the growing proportion of the nanocapsules market and the continuation of clinical trials on nanocapsule-based drugs globally.

Restraints:

-

Manufacturing Complexity, Cost Barriers, and Scalability Issues Hamper Market Expansion

The accuracy needed in synthesizing biodegradable nanocapsules and reproducibility restricts mass-scale adoption. For instance, a 2023 report released pointed out that 41% of nanocapsule R&D projects get stuck at pilot-scale production due to cost escalation and material variability. Moreover, the high price of raw materials, such as chitosan, PLGA, and some phospholipids increases the overall cost of lipid-based nanocapsules. The industry players usually need government or VC finance to drive extended development cycles. Compliance with the regulatory aspects is also an issue. Although regulations are there, a deficit in harmonized global standards mostly delay cross-country commercialization. Unstable supply chains for polymers and lipids of high purity further detract from continuous production, limiting the market size for some areas of nanocapsules. In the emerging economies, insufficient awareness concerning controlled-release medication systems and the encapsulation technology market further limits penetration.

Nanocapsules Market Segmentation Insights:

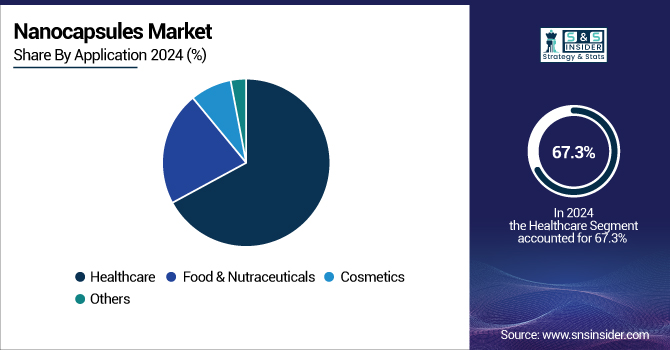

By Application

The healthcare segment led the nanocapsules market in 2024 with a commanding 67.3% share. The segment’s growth is propelled by the increasing acceptance of drug delivery nanocapsules in the treatment of chronic diseases and cancer treatment. Medical nanocapsule preparations are crucial in the delivery of medicine to the exact location since they enable controlled release of medication and enhance the body's ability to utilize it. Chemotherapeutic and biologic drug platforms are utilizing advanced lipid-based platforms to minimize systemic toxicity and maximize precision. Emphasizing the growing significance of nanotechnology in the delivery of drugs, this trend is bolstered by increasing clinical trials employing biodegradable materials in gene therapy and individualized medicine.

In February 2024, LivOn Labs continued to expand its distribution of Lypo-Spheric Vitamin C, a leading supplement utilizing nanocapsules to enhance absorption and immune function. This expansion is indicative of the prevalence of nanocapsule formats in medicine, specifically in the delivery of nutraceuticals.

The food and nutraceuticals segment is also a rapidly expanding application based on the growing customer demand for functional foods, enhanced bioavailability of nutrients, and extended product shelf life. A 2023 Food Hydrocolloids paper demonstrates that the application of lipid-based omega-3 fatty acids and vitamin D supplements enhances absorption levels by around 50%. In addition, being employed in nutraceuticals for scheduled medication delivery, controlled release drug systems are assisting in better preserving gut health and metabolic balance.

By Therapeutic Area

Oncology continued to be the predominant therapeutic segment with the highest nanocapsules market share in 2024 due to the critical need for targeted therapies for cancer and fewer side effects. The application of drug delivery, particularly of polymer type, is extremely effective in accommodating cancer drugs, such as paclitaxel and doxorubicin. These formulations of nanocapsules medication enable tumor-specific release, hence improving efficacy and lowering systemic toxicity. By 27%, biodegradable materials lower the likelihood of cancer recurrence in patients with metastatic breast cancer, therefore proving the real advantages of applying nanotechnology for medication delivery in cancer treatment.

Pain management segment is anticipated to be the fastest-growing therapeutic field, fueled by the growing burden of chronic pain and opioid challenges. To release pain relief drugs more safely and efficiently, scientists are employing controlled-release systems consisting of lipid-based systems. Recent advancements include designing cannabinoid-loaded nanocapsules that provide long-lasting relief with less medicine. In addition, such technologies are ideal for long-term therapy regimens as they reduce peak plasma levels, preventing drug addiction. Specifically in the case of neuropathic and inflammatory pain, the segment’s growth in the nanocapsules market is projected to accelerate significantly as increasing non-opioid nanomedicines are added to the pipeline.

Nanocapsules Market Regional Analysis:

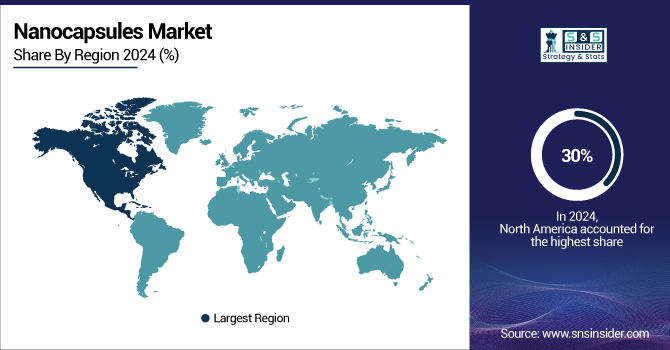

North America was the leading region in the market globally, with a substantial market share of 30% in 2024, primarily driven by its advanced healthcare infrastructure, significant R&D investments, and strong regulatory support.

The U.S. market size was valued at USD 0.81 billion in 2024 and is expected to reach USD 1.06 billion by 2032, growing at a CAGR of 3.58% over the forecast period of 2025-2032. The reason for this domination lies in the large base of a strong pharmaceutical sector and government encouragement of research in nanotechnology. The FDA has played an instrumental part in facilitating the clearance of nanocapsules for numerous drug delivery systems, particularly in oncology and pain relief, which fueled universal acceptance.

The U.S.-based companies, such as Johnson & Johnson and Pfizer, are at the forefront of drug delivery nanocapsule innovation, especially in liposomal and polymeric formulations that are central to targeted cancer therapies. The expanding emphasis on precision medicine, combined with the rising incidence of chronic diseases, has spurred significant investment in nanotechnology in drug delivery. Canada is also experiencing market growth, but the U.S. retains the dominant position in both market share and nanocapsule technology advancements.

Europe shares 20% of the global nanocapsules market in 2024 and is a key region as it possesses a developed pharmaceutical sector and major investments in nanotechnology research. Germany, France, and the U.K. are dominant markets led by their robust regulatory infrastructure and research-oriented pharmaceutical industries. Germany is a major center of polymeric nanocapsules applied to oncology and pain relief therapies. The European Medicines Agency (EMA) has facilitated the expansion of drug delivery with uniform approval mechanisms for nanomedicines, further driving market expansion.

Asia Pacific is the fastest-growing region within the market due to the tremendous innovation in nanotechnology and rising healthcare innovation. The major regions driving the growth of this market are China and India, more specifically in biodegradable and drug delivery nanocapsules. Strong emphasis by China on nanotechnology research has elevated the application of nanocapsules to treat cancer, and lipid-based delivery to deliver targeted drugs. Furthermore, the growth in chronic diseases and an aging population in South Korea and Japan is raising the need for controlled-release drug systems and medical formulations.

The LAMEA region is experiencing steady growth in the market, led by nations, such as Brazil, South Africa, and the UAE in the use of nanocapsules across different applications. Brazil has the highest market share in the region owing to a high focus on food & nutraceuticals and developments in biodegradable materials for vitamin and supplement delivery. The increased emphasis on the development of healthcare infrastructure, especially in emerging economies, has contributed to the rising demand for medical nanocapsule formulations. Also, South Africa is seeing more clinical trials related to nanotechnology-based drug delivery, especially in cancer.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major players operating in the market are BioDelivery Science International, Camurus AB, Carlina Technologies, Cerulean Pharma, Inc., Nano Green Sciences, LLC, NanoNutra Technologies, NanoSphere Health Sciences, Eos Biosciences, LLC, PolyMicrospheres Technologies, and GAT Food Essentials, Inc.

Recent Developments:

-

In March 2024, Pacira BioSciences revealed additional indications for Exparel, a controlled-release pain management system based on lipid-based nanocapsules, hence lowering opioid reliance following surgery.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.58 Billion |

| Market Size by 2032 | USD 5.11 Billion |

| CAGR | CAGR of 4.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Healthcare, Food & Nutraceuticals, Cosmetics, Others] • By Therapeutic Area [Oncology, Pain Management, Endocrinology, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BioDelivery Science International, Camurus AB, Carlina Technologies, Cerulean Pharma, Inc., Nano Green Sciences, LLC, NanoNutra Technologies, NanoSphere Health Sciences, Eos Biosciences, LLC, PolyMicrospheres Technologies, and GAT Food Essentials, Inc. |